This newsletter is 2,352 words a 10-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

Weekly Unemployment Claims Soothes Markets

Company News

Airbnb

Disney

Stats of the Week

Increase in Credit Card Delinquency

Mortgage Rates fall to 15-month low

$600 Million donation to HBCU Med Schools

Looking Ahead

Inflation Data released

Retails Sales

Last Few Earnings Calls

Sports I Love

Olympic Volleyball

Olympic Basketball

Extras

Kamala Harris's VP seems like a nice guy

Markets

I love the chaos we saw in the market last week. I hope we see more of this for the rest of the year. As a boring long-term mostly index fund investor, I don't get the same excitement other investors get. Because I do not have a dog in the fight, if stocks go up, I win cause my investment grows. If stocks go down, I win because I get to buy stocks on sale. The market having these massive rundowns is the only time I can get excited. I get to live vicariously through everyone else's panic or excitement like a neutral fan in a stadium.

The irony is after chaos on Monday, the market returned to the norm of going up. This is exactly why we never act based on our emotions. There will always be something that the world is losing its mind about. We have to remain calm in the sea of overreacting emotions.

Tale of the Tape

Economy

Weekly Unemployment claims fell this week from 250,000 to 233,000. Helping soothe US economic concerns temporarily.

🔎Details: After the nonfarm payroll numbers were released last week, there was panic that the economy was heading for a recession or is already in a recession (it isn't).

Most commentators believed the Fed had missed their chance by not cutting rates last week. There were calls for the Fed to have an emergency meeting and announce a rate cut to save the economy (what they really mean is the Stock Market).

🧐Reality Check: The Fed is not beholden to the Stock Market. Its mandate is to stabilize prices and have a healthy labor market. By all signs, the economy is relatively stable after inflation cooled down. There are signs of a weakening labor market but there is no recession.

😑Takeaway: After the weekly unemployment claims report was released on Thursday, the S&P 500 ran up 1.9%. The bond yield increased to 4%. All the losses from earlier in the week were wiped away.

👶🏾My Takeaway: Investors are children. They throw tantrums whenever they don't get what they want. The Fed has to remain the parent and not cave to the whims of children who only care about themselves and not the big picture.

Last week, the IRS hit Coca-Cola with a $6 Billion tax bill.

🔍Details: According to the IRS, Coke owes the government some money. The IRS said Coke intentionally hid income in low-tax countries to avoid paying taxes in the US. The IRS discovered this in 2015 (when they had financial support from Congress) and the case has been in court ever since.

Coke has lost pretty much every single court case since then. But continues filling more appeals. A judge in 2020 wrote that Coke reported astronomical profit levels from its subsidiaries in Brazil, Ireland, and Eswatini (low-tax countries). Those profits were almost double the profits of the US-based parent companies. Which to everyone and anyone would make absolutely no sense.

Coke says the IRS and every judge that has ever ruled on the case are misinterpreting regulations and it should not owe any money. However, Coke agreed to pay the $6 Billion fine and filed another appeal.

🤑Takeaway: This could be a massive hit to Coke's bottom line. If Coke loses this next appeal, it could owe up to $10 Billion in taxes as the IRS will collect its back taxes dating back to 2009. This would wipe out a year and a half of profits. So you know Coke gonna keep fighting.

However; this is a massive deal not only for Coke's cash flow. But also for every American business with an international side. A lot of these businesses have similar tax strategies as Coke. If the IRS wins, many of these businesses will also owe the US government a lot of money.

💲💸My Takeaway: Popular discourse on taxes is focused on individual taxes. I believe that is a complete mistake. Look at that number that Coke owes, $6 BILLION. The question is not about raising or cutting taxes on individuals. The question should be whether these companies pay their fair share while using more public resources. The same questions should be asked to individuals whose earnings and net worths are the size of nations.

The US is supposed to have a progressive tax system. However; for Ultra High Net Worth Individuals and Businesses, it is a regressive system. Capital is taxed at a much lower rate than labor, leaving labor to bear the load of carrying everything the country needs. I do not think it is fair. But then again as I was once told, "Fair is a place where pigs are judged. This is life."

Companies

📉Stock Move After Earnings: Stock dropped 14%. Because it is estimating lower night bookings.

🔢By The Numbers: Airbnb reported an increase of 11% in revenues going from $2.4 Billion last year to $2.75 Billion.

Profits fell 15% from $650 million last year to $555 million this year

On-app/site bookings increased 53% compared to last year.

$21 Billion worth of Bookings on the site an 11% increase from last year.

👀What to Watch: The profit hit was due to a one-time tax payment. However, Airbnb said they expect sales to slow down for the rest of the year.

In the Shareholder letter, Airbnb said, "During Q3 2024, we expect a sequential moderation in the year-over-year growth of Nights and Experiences Booked relative to Q2 2024. However, we are seeing shorter booking lead times globally and some signs of slowing demand from U.S. guests. Lastly, we expect ADR (Average Daily Rate) to increase modestly on a year-over year basis in Q3 2024"

Layman's Terms: People booking for far shorter stays and at cheaper rates.

Airbnb is another example of the pressure consumers are facing. Also, Work from Anywhere, which fueled a ton of the growth for Airbnb over the last two years, is dissipating as more companies require workers to be in the office for periods. How will Airbnb answer to both of these challenges?

🥺Personal Insight: I am an Airbnb host. I have noticed a slowdown in bookings this month. Typically, I get nights booked for the month at the beginning of the month but so far I have had none.

📉Stock Move After Earnings: Stock dropped 2%. Parks revenue missed expectations, although streaming is finally profitable.

🔢By The Numbers: Disney made $23 Billion in the quarter, a 4% growth from last quarter.

Parks and Experience Revenue grew by only 2% from last year to $8.4 Billion

Streaming revenue grew by 4% from last year to $10.5 Billion

Streaming reported its first quarter of profit. Going from losing $512 million last year to making $47 million this year

Subscriber growth for Disney+, Hulu+ was flat

🧐Takeaway: Like with Airbnb, consumers are not spending like last year. However, Disney's move over the last year to cut costs (aka firing workers) has helped with profitability. Operating income grew by 19% compared to last year.

💬In Their Words: Disney CFO Hugh Johnston said, “The portfolio is working well. Yes, there was softness in the domestic parks, but the entertainment division’s profit tripled in the quarter.”

👀What to Watch: Cutting Costs only helps so much. Disney has to grow its revenue to see permanent change. Disney is moving in the right direction with its streaming division finally becoming profitable. However, ESPN is a driving force of that growth. Without ESPN, the streaming division had a loss of $19 million.

With consumers pushing back on price raises (Disney raised prices again this month). The question is: can Disney find a way to make substantial cash flow from streaming? It will all depend on its ability to create great movies. I expect Inside Out 2 and Deadpool & Wolverine to drive subscribers to Disney+. The new bundles it has with Max should help as well.

Stats of the Week

The percentage of credit card balances that entered delinquent status. This is according to the latest data from the New York Federal Reserve.

🤔Uh Explain: Credit card delinquency is when a borrower has not paid the minimum payment on their balance for over 60 days.

😯Why It Matters: This is the highest level of credit card delinquencies since 2007. It shows that consumers are in a tight spot even as inflation has cooled. Mainly because shelter costs got so expensive. The highest delinquency rate was those ages 30-39.

According to Axios, "Researchers at the New York Fed offer a few reasons why this might be the case: They overextended themselves during the pandemic and they're more likely to be renters, so they're more exposed to rent price increases."

💢More Pain: Student loan payments are slowly entering the picture. It will be interesting to see how this affects consumers even more.

Warren Buffett’s Berkshire Hathaway has more cash on hand than the Market Cap of most companies in the US.

Mortgage Rates in the US dropped to the lowest point seen since May 2023. The lower rate is driven by the expectation for the Fed to cut rates in September. However, lower rates are not driving more activity in the housing market. 6 is still higher than 3 which is what most people have. There is a hope that rates could fall as low as 5.57%, which might drive more activity.

Michael Bloomberg announced a donation of $600 Million to 4 HBCU medical schools.

Howard University - $175 Million

Meharry Medical College - $175 Million

Morehouse College of Medicine - $175 Million

Charles R Drew University of Medicine - $75 Million

Bloomberg donated $100 million in 2020 to the same four schools.

Looking Ahead

👀 What to Watch

Last week was very relaxing for the markets, as seen by this newsletter being only ** words, while last week it was almost 3,000 words. However, just as school is back in session for all the children (can't believe kids go back to school so early). We business news junkies get a plethora of economic reports.

On Wednesday, CPI will be released. Expect a lot of OMG or Let's Go from your fellow econ or investing nerds. If inflation continues its slow descent towards the 2% target, expect a flurry of excitement from the stock market. If inflation seems stubborn in the same spot (which is what I believe it will be), expect volatility in the downward direction for stocks.

On Thursday, we get the July retail sales report. Every consumer discretionary company reported that consumers are pulling back. This report will confirm what CEOs have been saying on Earnings calls. Or it could show that consumers are back in business, I highly doubt that though.

On Friday, we get the consumer sentiment survey results. I have been ignoring this survey for the last year. Consumers keep saying they feel terrible about the economy but continue spending the same way. This makes me believe this survey has become more noise than useful information. However, now that inflation has cooled, I want to see how consumers feel now. Probably will be more of the same.

Company/Earnings

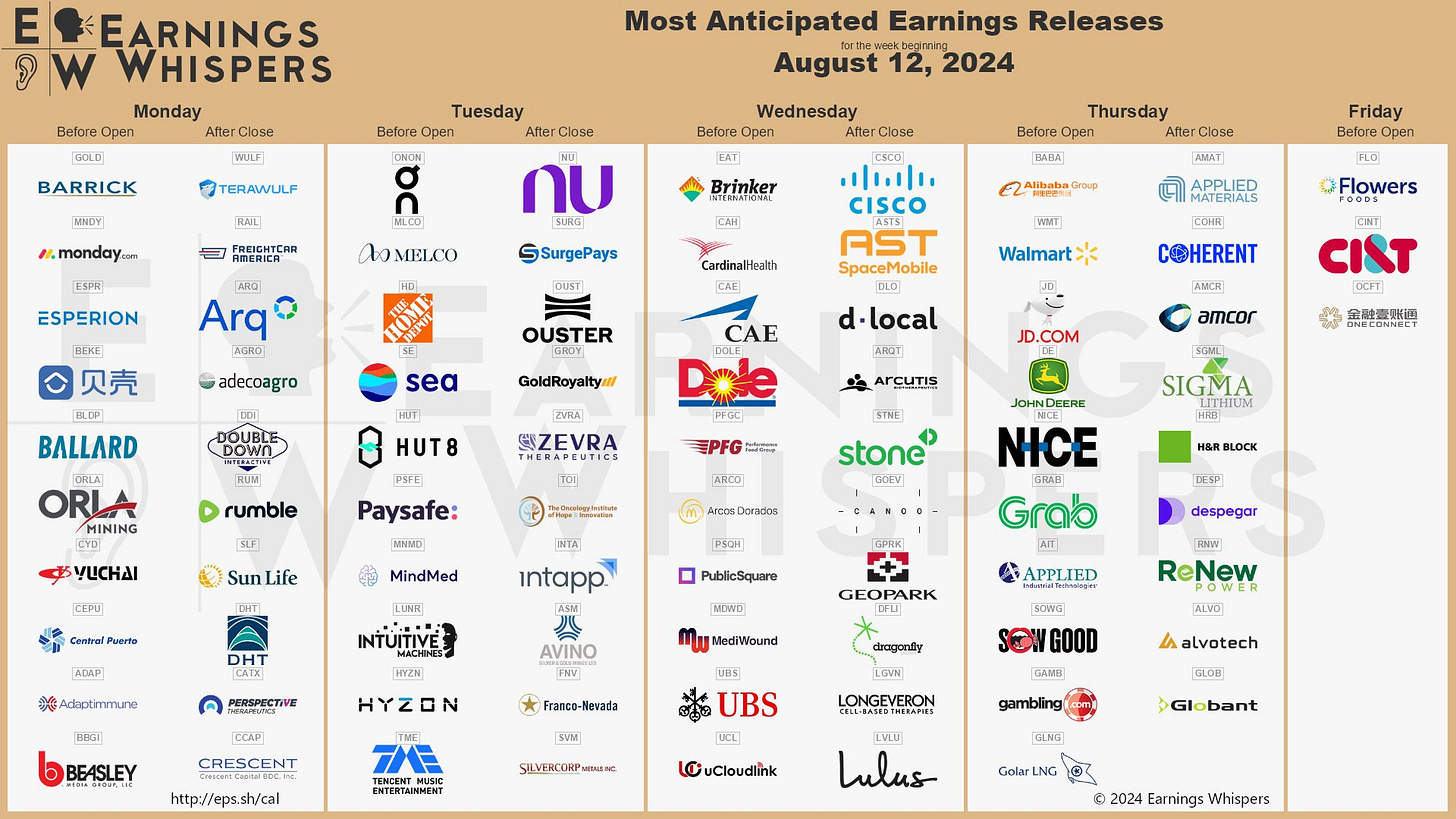

90% of the S&P 500 have reported earnings. There are not that many companies left. But some of the biggest retailers will be reporting this week, both have great insight into consumer spending:

Home Depot on Monday

Walmart on Thursday

Sports I Love

Olympics

I have found a new love for Volleyball. I watched the US men's and women's semi-finals. I was blown away. The game is so exciting! Plus I thought basketball players could jump.

NAH! These ladies and dudes FLY!!

USA Women unfortunately lost in the Finals. However, this was the first time in the history of USA Women Volleyball that they made it this far. USA Men won bronze.

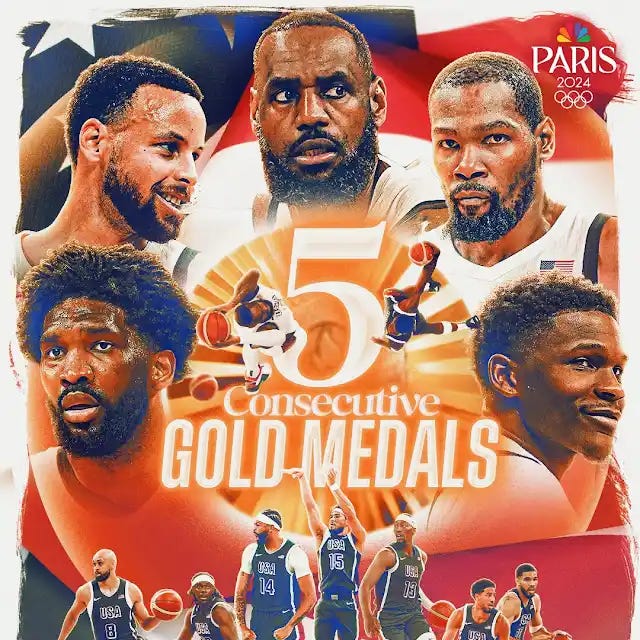

USA Men's and Women's Basketball won gold as well. The men's was a bit closer but they pulled it through. Steph is HIM!! That dude went OFF to close out the game. it was amazing to be reminded that He is a LEGEND!! This is the men's FIFTH gold in a row.

This is the women's EIGHTH gold in a row in the Olympics. Talk about DOMINANCE!

Extras

VP Kamala Harris selected Her VP, Tim Walz

I included this news article because I found something interesting and funny.

A lot of rhetoric I have been hearing is how radical and “dangerously liberal extremist" Tim Waltz is as governor of Minnesota. So, I wanted to learn more about some of his highlights as governor. This is per Morning Brew. I have not done extensive research yet; however, I think this is a good starting point:

Minnesota passed universal free school meals, tightened gun control, codified the right to abortion, and became a refuge state for gender-affirming care for minors.

He allocated state funds for public infrastructure, clean energy, affordable housing construction, and pro sports venues.

He also signed a bill granting family and medical leave, and his administration banned non-compete clauses in the state.

He also has not used his position as Senator or Governor to enrich himself. He owns no stocks or investment portfolios of any kind.

As a money nerd, I think it is extreme not to own any investments but he has a standard.

If this is the radical and dangerous extremism I can expect from a Harris Presidency. Bruh, I am so down!

Read this article to learn more about who this guy is. I like him. At least based on what I have read so far.