This newsletter is 1,903 words a 9-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

👎🏾Downgrading the US

🤦🏾♀️More Idiotic Government Policy

Stats of the Week

👴🏾👵🏾17 States Help With Retirement

🤑$2.5 million is the new middle-class income

🪙230 Years and no more

Looking Ahead

💻Nvidia Reports

🎈PCE Inflation

Sports I Love

😑Oh look, Man U Lost. I’m so surprised

Extras

Scorching Summer

Trump Administration Blocks Harvard Students

Markets

No matter what else you read in this newsletter, remember one number: $1.1 trillion.

That’s how much in tax breaks the Trump administration and Republican-led Congress just handed the wealthiest Americans—those making over $500,000 a year. A giveaway of historic proportions to the people who need it the least.

And how are they paying for it? By gutting the programs that support everyday Americans. Cuts to Medicaid, SNAP, public school funding, and the Affordable Care Act—programs that millions rely on just to survive. That $1.1 trillion isn't coming out of thin air. It’s being pulled directly from the hands of low-income families, the sick, the elderly, and children in underfunded schools.

Let that sink in.

My question is: What is the true purpose of government? Is it to serve those without a voice, or to serve the most powerful?

Returns

Tale of the Tape

Economy

Moody's last Friday announced that US Bonds will be downgraded from a AAA-rated status to AA-1.

🔎Details: Just like people have credit scores, countries and companies have credit ratings.

Three major agencies assign them: Standard & Poor’s, Fitch, and Moody’s.

2011, during the financial crisis, S&P downgraded the U.S. They said the government wasn’t serious about cutting debt and was too unpredictable.

In 2023, Fitch followed, citing the same issues—plus the constant political drama. Lawmakers kept pushing budget deals to the brink, threatening default, and treating the debt ceiling like a game. Fitch said enough was enough.

📆Today: Moody’s had been the last major holdout on downgrading the U.S. credit rating. But after the House advanced the latest budget bill, Moody’s decided it had seen enough. Just hours after the bill moved forward for a vote, the agency issued its downgrade on the United States.

💬In Their Words: Moody's explained in the report, "Successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs. We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration.”

Explanation: Last year, the U.S. spent over $1 trillion just on interest payments for its $35 trillion debt. That’s more than the entire military budget—and now the second largest monthly expense for the federal government behind Social Security payments.

The new budget bill advancing in the House would add another $5 trillion to that debt. Moody’s issued its downgrade warning that, under this plan, the U.S. won't generate enough revenue to cover either the existing debt or the new debt—thanks largely to the deep tax cuts also packed into the bill.

🤒🤧How It Affects You: Just as a low credit score leads to unfavorable loan terms for an individual, the same principle applies to a country. Each downgrade of the U.S. credit rating has historically resulted in higher interest rates for U.S. bonds. This recent downgrade followed the same pattern. Following the announcement, yields on U.S. 30-year Treasuries rose above 5%, and 10-year Treasuries exceeded 4.5%, remaining elevated since. This trend is significant because these Treasury rates serve as the benchmark for all other loans. For instance, mortgage rates have climbed back above 7% and continue to rise.

💬In Their Words II: Federal Reserve governor Christopher Waller said, "Everybody I have talked to in financial markets, they are staring at the [big, beautiful] bill and they thought it was going to be much more in terms of fiscal restraint. The markets are looking for a little more fiscal discipline. They are concerned."

Takeaway: There are no simple solutions for addressing the U.S. debt burden. However, the current budget bill isn't the answer. Republicans continue to advocate for cost-cutting measures, but often focus on programs benefiting the poorest Americans, see above. Democrats, on the other hand, push for increasing taxes on the wealthiest Americans and businesses.

The truth is, both approaches are necessary. As anyone who has successfully paid off debt can tell you, the solution involves both increasing revenue and cutting costs. While I disagree with cutting benefits for the most vulnerable in society, I do believe in capping benefits for the wealthiest Americans. I also support raising taxes, but this must be accompanied by the removal of all the loopholes that allow for tax avoidance.

However, I doubt either will happen until the Citizens United ruling, which has allowed money to become the dominant voice in elections, is eliminated.

🤦🏾♀️In Other Idiotic Goverment Policy News

The Senate passed Trump's "No Tax on Tips" Bill.

Details: The bill would create a federal income tax deduction of up to $25,000. Crucially, it's intended (key word) to apply only to workers who typically receive tips for services provided.

💬In Their Words: Senator Ted Cruz said, "no tax on tips is going to become law and give real relief to hard-working Americans.”

🪞Reality: This bill does not effectively help its intended beneficiaries. Currently, most workers who receive a significant portion of their income from tips already do not pay federal income tax due to their low earnings. Instead, this legislation primarily assists middle-to-high-income earners in finding new ways to claim additional tax deductions.

🤬My Take: If this STUPID bill becomes law, I'll ask my company to pay my annual bonus as 'tips.' After all, it's essentially a tip for a year of good work, just paid in a lump sum instead of over months. Why should I have to pay tax on it?

I can also guarantee that high-earning accountants are already salivating at the prospect of re-categorizing their wealthy employers' income as tips. This idea was foolish when Kamala Harris and Donald Trump suggested it on the campaign trail, and it's even more foolish now that both Democratic and Republican senators are pushing it through. What is wrong with these people?!

Stats of the Week

👴🏾👵🏾17 States

According to the Georgetown University Center for Retirement, 17 states have implemented auto-IRA enrollment since 2013. These auto-enrollments have resulted in over one million funded accounts, now collectively valued at over $1.7 billion.

🔢By The Numbers: 78% of workers do not have access to 401(k) accounts. So, if you work for an employer who doesn't offer a 401(k), it most likely means you are saving nothing for retirement.

Why a great retirement option has to be tied to employment, I will never know.

👍🏾Takeaway: These accounts belong to individuals who likely would never have opened a retirement account or saved independently. However, with states now requiring and simplifying the process for businesses to connect to these programs, it creates a pathway for more people to accumulate at least some savings as they approach retirement.

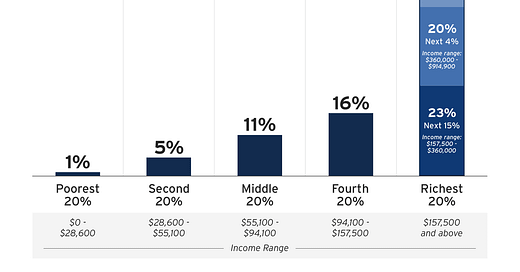

According to President Trump, an income of $1 million per year is 'modest.' He believes that an income is no longer considered 'middle class' only when it exceeds $2.5 million.

🪞Reality Check: If you earn $150,000 annually as an individual or $235,000 as a household, you are among the top 10% of all income earners in the United States. According to the Pew Research Center, the 'middle class' income ceiling is $188,400."

👎🏾On The Other Hand: The new budget bill passed by the Republican House expanded the child tax credit from $2,000 to $2,500. However, 20 million children will not benefit from this change because most of their families do not earn enough to claim the credit.

The bill also prevents an additional 4.5 million children from claiming the tax credit if a parent lacks a Social Security number. For example, if a parent is a lawful immigrant but not a citizen, their citizen children will be unable to claim the credit moving forward.

Why It Matters: Discussions about fairly increasing taxes are ongoing. If the president and other elected officials genuinely believe that individuals earning $1 million annually are 'working' or 'middle-class,' it explains why they consistently fail to enact policies that genuinely assist those in need. It also sheds light on why tax burdens disproportionately fall on the lower end of the income spectrum.

🛑My Take: We need to stop this nonsense. In the U.S., you can ask someone making $5 million a year and someone making $30,000 a year how they view themselves within America's social class, and both will answer 'middle class.' Everyone characterizes themselves as middle class. You have one side that refuses to acknowledge the reality of their struggle. The other side refuses to acknowledge the privilege they enjoy. Until we accept that we are not all the same, and that some of us have it much better than others, we will never implement policies that benefit all of society. We will perpetually work against our best interests as a community.

Get ready to say goodbye to a familiar coin! The U.S. Mint placed its last order for penny blanks this month. Once this final order is fulfilled, there won't be another. It seems the penny's time is coming to an end.

Why?: It seems our smallest coin just isn't pulling its weight anymore! It costs the U.S. 4 cents to make every 1-cent penny. Ditching the penny could save the U.S. about $56 million each year. But here's a little twist: those savings might just vanish into thin air if we have to crank out more nickels to fill the gap. Why? Because it costs the U.S. Mint a hefty 14 cents to produce every 5-cent nickel!

🎩My Take: The next time you see a penny, tip your hat to Ole' Abe Lincoln

Looking Ahead

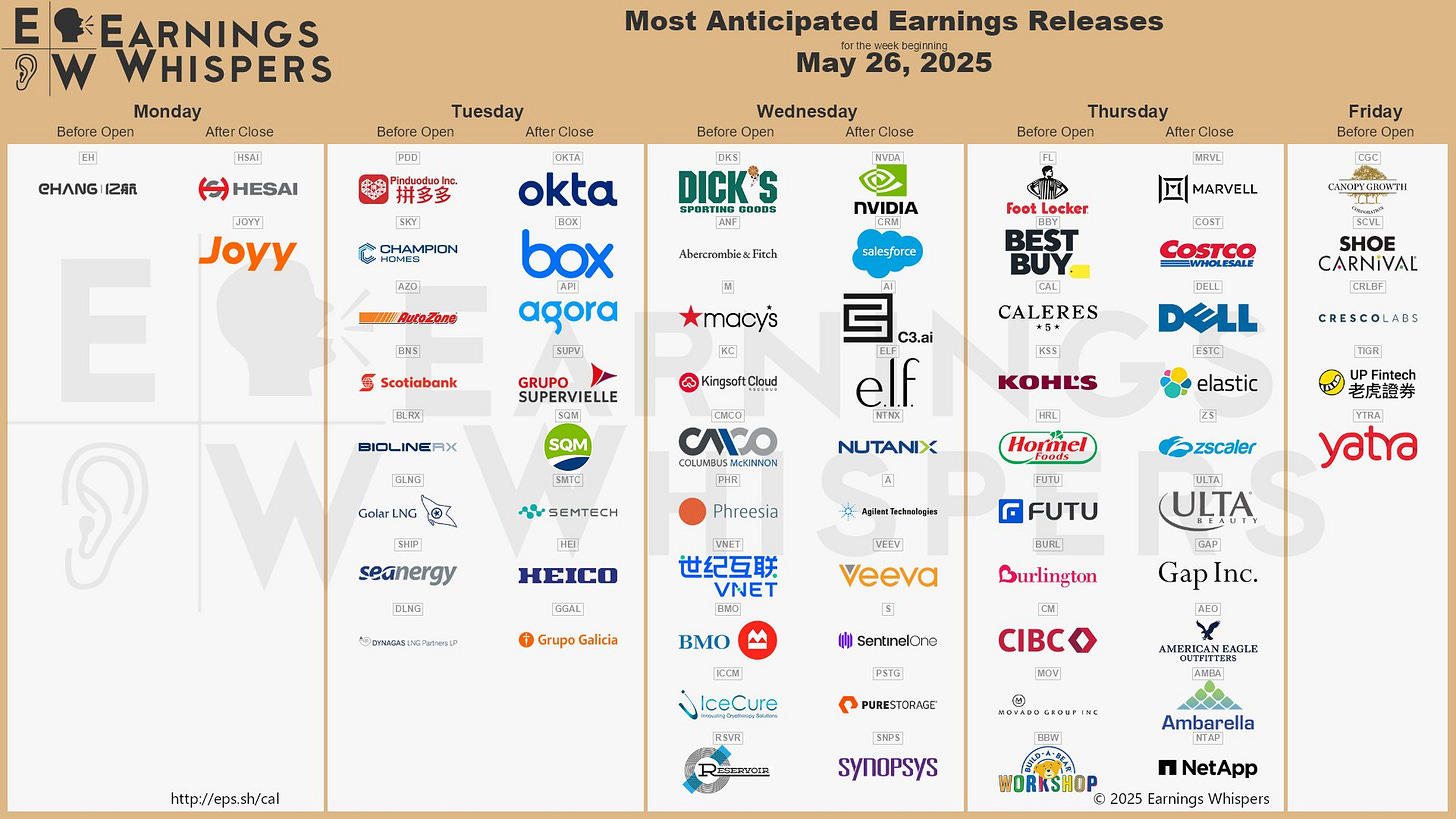

Company/Earnings

Nvidia reports on Wednesday, and everyone stops to listen.

Friday, the Fed's favorite inflation gauge, Personal Consumption Expenditure (PCE), will be released.

👀 What to Watch

Sports I Love

I am not surprised!

Extras

According to the National Oceanic and Atmospheric Administration, this summer will be "unusually warm".

It will also be an abnormally high hurricane season. Meaning we will have more Category 3 or higher hurricanes.

Trump Administration Blocks Harvard

This is getting crazy! The Department of Homeland Security said it is terminating Harvard's student and exchange visitor program certification. This is key to allowing universities enroll international students. Not only does this impede new students from enrolling, it puts in danger every student that is currently enrolled at Harvard.

The administration said it is "holding Harvard accountable for fostering violence, antisemitism, and coordinating with the Chinese Communist Party on its campus."

My Take: I smell something awful and I see a Bull. This administration is insane!

*I am a tiny shareholder in this company.