Better Retirement Option? - Market Update Oct. 21-25, 2024

Strike shines light on a retirement problem in the US

This newsletter is 2,691 words a 13-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Company News

✈Boeing Chaos: Pensions vs 401(k)

🚘😲Tesla Surprise Earnings

Stats of the Week

12% of the World Stock Market is 3 Companies

🗳20 million people have voted

👎🏾3% investing return over the next decade

😱$2 Billion spent on political ads

Looking Ahead

👷🏾♀️Economy: All about labor data

📈Company Earnings: Big Tech Earnings

Sports I Love

⚽😭My Soccer Heart Weeps: Real Madrid & Man U Lost

🏈Ravens Drop The Game (Literally)

Extras

🐔Chick-fil-A is a Streaming Company

Markets

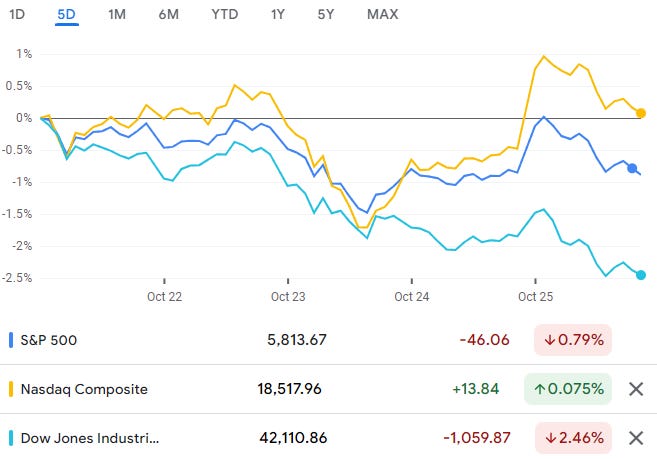

After six weeks of the Stock Market going in one direction, UP, the market decided to catch its breath for a bit as earnings season kicked off. This is not a bad thing; it should be expected for the market to have some volatility as companies report their Third-Quarter Earnings and give the best guidance for how the year will end for their businesses.

It doesn’t matter if the market goes up or down today or tomorrow. My time horizon is 30 years, so I play the long game of buying index funds and then buying some more and then buying more and then…. You get the point.

Tale of the Tape

Companies

Never have I seen a company in such dire straits.

🔄Background: After the grounding of the 737-Max following two horrific crashes due to a Boeing software issue, a door flying off a plane midflight, and multiple reports showing Boeing's selection of profits over safety; the FAA has had a very heavy-handed approach to reviewing Boeing's designs and inspecting their planes.

The thorough inspection and review of Boeing by the FAA reviewed many issues with the way Boeing was manufacturing materials with defects being found all over the place. The FAA refused to allow Boeing to release any new planes or meet the demand from prospective buyers.

Then Boeing suppliers have been facing issues with meeting material needs due to COVID-19 supply constraints. Further inhibiting Boeing from meeting customer needs.

Due to all this Boeing has had multiple rounds of layoffs and multiple CEOs have been fired.

🙃Now: Then six weeks ago, Boeing workers decided to strike to make demands for higher pay and in a surprise for 2024, a demand for the traditional pension retirement system to be brought back.

Boeing like much of its private company peers eliminated pensions in 2014.

🔢By the Numbers: In the 1980s, 46% of private companies had a pension. Today that number is closer to 18%.

The government still has a very nice pension system. One of the benefits of being underpaid is great health benefits and great pensions.

🧐Pensions v 401(k): Pensions are a guaranteed stream of income and put the responsibility and risk of retirement on companies. They were also a great benefit for companies to ensure employees stayed for the long haul. However, it comes with a few risks:

The company could go bankrupt

The income is not always tied to inflation which can eat away at the entire income

Companies can play around with the pension leading to situations like Enron where unnecessary risks are taken in these portfolios

Leading the government to institute much tighter restrictions on pensions

401(k)s shift the responsibility to individuals. Giving each person more control over their future and current lives (job hopping). However, it comes with its own set of risks:

Financial Literacy is very important for anyone to be able to manage their retirement properly.

The Stock Market is very volatile and not everyone can handle that properly.

Typically, Blue Collar jobs do not get these benefits leading to a larger disparity between the haves and have-nots.

😐Takeaway: I don't care about the Boeing situation. But I find it very fascinating that workers desire a return to a pension system. I can't say I disagree; the current system just isn't working for most people and might not work for much longer. I'm not the only one thinking this, BlackRock CEO, Larry Fink recently penned a letter to investors speaking about the same thing (now of course he wants a pension system it would mean more money for his company so take his word with all the grains of salt).

What are your thoughts on Pensions vs 401(k)s? Do you think we need them or are better off now? Or maybe a bit of both?

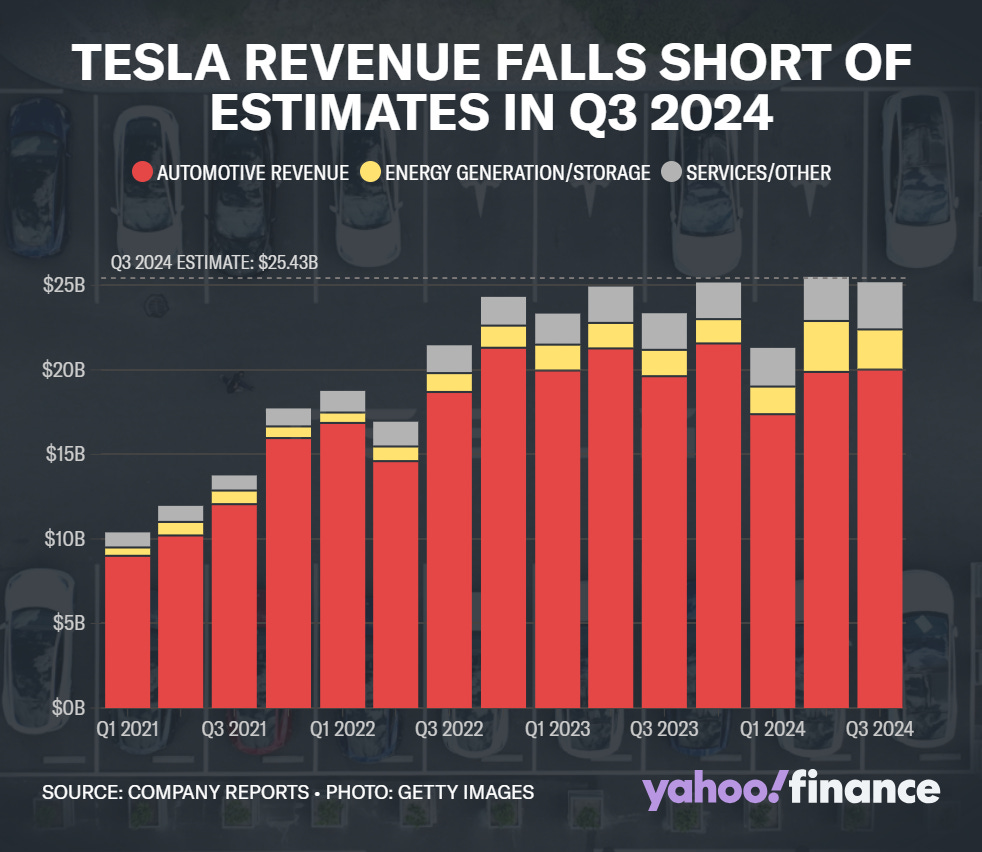

Well then, this is why I never bet against Elon and Tesla as much as I may not like the dude. He has created a product that people like.

📈Stock Move After Earnings: The stock flew 12% on Wednesday night after the announcement.

🔢By The Numbers: The report was a mixed bag, but it was good enough for investors to remain confident in the business of Tesla

Revenue for Q3 was $25.18 billion vs. $25.4 billion estimated. A 7 % increase from last year

Net income was $2.5 Billion

Free cash flow was $2.9 Billion

The gross margin was 19.8% a major increase from last year's 16%

This is the most important metric for investors. It is the reason Tesla gets a valuation bump.

Most car companies have single-digit margins, but Tesla has found a way to make more.

😤Takeaway: Stories are insanely powerful. This earnings report could have destroyed the stock after the meh "We-Robot" event. However, once again Elon pulled a rabbit out of his hat. He not only got investors to stay aboard. He got them excited about very mediocre growth for the company. But even more importantly he painted a vivid future of what is coming "soon" during the call. I thought investors were tired of his promises but apparently not.

😎My Takeaway: We need the confidence that Elon Musk has when he is actively BSing everyone.

👀What I'm Watching: When will these promises actually come true? According to Elon, the Robotaxis are already being tested in San Francisco and "would reach volume production in 2026, not just start production, and the company aims for 2 million Tesla Cybercabs per year."

Keep in mind that in 2023, Tesla made 1.85 million cars TOTAL.

Tesla also said they are still on track to release a sub $30,000 EV next year (the same thing they said last year and the year before that).

I'm just watching to see when investors get fed up with waiting for next year to come. But as of right now, Elon has everyone by the balls. No one wants to bet against the company. Not even myself.

If you're a Tesla investor, Good Luck!

Explaining Obscure Financial Terms

Gross Margins: % of revenue made that is profit

Net Income: Profit made by the company after all costs are accounted for.

Free Cashflow: the cash that is available for the business to use as they choose. This is what is used for investment in the business, paying dividends, or buying back stocks.

Stats of the Week

Microsoft, Apple, and Nvidia make up 12% of the World Stock Markets!

That is INSANE!!

The election is about a week away and over 20 million people have already voted. This is election might be the highest voter turnout in history, if people continue the trend.

😞3%

According to Goldman Sachs, over the next decade, the stock market is "on track" to return only 3%. Which is abysmal compared to the 13% that was returned over the last decade.

🤔Why: Goldman says the market is far too concentrated in the companies we talk too much about - Microsoft, Apple, Google, Facebook, Nvidia, Tesla, Amazon, and Berkshire Hathaway. Because of this concentration, if any of these companies have issues, the market is going down with them. Eventually, all good things must come to an end. They use past market cycles as examples of this phenomenon.

My Take: No one knows what will happen in the future. Every prediction is pretty much pointless because it can never be acted on promptly. Your best bet is to create a portfolio you are comfortable with. As you near retirement, get a Fiduciary Fee-Based Advisor to help look over things. Outside of that do nothing!

Since July, over $2 Billion has been spent on political campaign ads. That is so much freaking money!!

Looking Ahead

My slow and quiet fall news weeks come to an end this week. A combination of labor reports, inflation data, and big tech earnings is putting an end to my ability to ignore news articles. Yay for my ability to do my actual job this week 😓😖

Economy

👀 What I'm Watching

After a few weeks of quiet economic data, econ-nerds can once again rejoice. A deluge of government data will be made available for their analysis. This week is all about the Labor Market:

Tuesday, we get the Job Opening and Labor Turnover Survey (JOLTS). The JOLTS report tracks the number of job openings, hires, quits, layoffs, and other separations each month. The report gives us an idea of how strong the labor market is currently.

Prediction: The report will show that workers are quitting at a historically low clip as the labor market has softened recently as companies continue laying off workers.

Wednesday, ADP will give us private employer payroll report. Providing us actual numbers to the number of jobs added by private cooperations in the last month.

Prediction: Last month ADP reported 143,000 jobs being added in September. I expect a higher number as companies begin prepping for the holiday rush.

Thursday, we get the Personal Consumption Expenditures Price Index aka PCE which is the Federal Reserve's preferred inflation measurement.

Although inflation has cooled and is close to the Fed's target of 2% inflation, there are still some worrying signs due to various global crises. This can prompt the Fed to further delay cutting rates.

If there is any sign of a rebound of inflation expect chaos in the markets.

Prediction: Inflation will come in at a very nice level.

Friday, we get the most important economic data. The Nonfarm Payrolls from the Federal Government. This is the definitive labor report. As this number goes so goes the stock market. As inflation has become less of a concern, the labor market has become that much of a bigger concern for investors.

Company Earnings

But that's not all that's happening this week, we got Big Tech Earnings to watch. As these companies go so go the market:

Google reports on Tuesday.

Big focus will in two things:

Growth of Google Cloud.

How much is Google spending on its obsession to dominate AI aka Capital Expense? Investors are not exactly pleased with the ever-growing capital budget as Google tries to outduel OpenAI and Microsoft.

Microsoft reports on Wednesday.

No real questions. This company has been absolutely unstoppable with the growth of its Azure Cloud platform and now using CoPilot as a solid growth engine for Microsoft Office products.

Investors will just want to continue seeing the growth continue. If Microsoft shows a slowdown in growth, it might cause a mini panic in the stock.

If that happens and the stock falls heavily, I will be buying more of the stock for my portfolio. This is not financial advice. Just a random dude talking stocks 😉

Facebook also reports on Wednesday

I could come up with some BS about Facebook's AI growth and its dominance with VR.

But I honestly just don't care much for Facebook. Plus, the company is in a great position right now. The Apple Vision Pro was a complete dud, so Facebook has the entire VR segment basically to itself.

And LaMDA it's Large Language Model continues to be the Open Source of choice for anyone developing an AI asset of their own.

Apple reports on Thursday

There's only one thing investors care about with Apple, iPhone sales. This is because iPhone sales make up now than 50% of Apple's total revenue

There will be big questions about Apple's continued struggles in China which had made up a large part of iPhone sales.

But what I'm interested in is Apple's services growth. I believe this is Apple's growth engine. This is hands down the most profitable part of Apple's business.

Amazon reports on Thursday as well

The big question for Amazon surrounds Amazon Cloud Services (AWS). As Azure Cloud has been growing, AWS's market share has shrunk.

AWS remains the profit engine for Amazon any signs of AWS growth slowing will shake investors’ faith in the company.

The other question will face Amazon's push to become more efficient and return profits to shareholders. Has that push turned from talk to numbers meaning has gross margins improved for its core retail business?

As you can see, this week is gonna be A LOT!!

Sports I Love

My Soccer Heart Weeps

On Saturday, Real Madrid gave the most shambolic performance I have ever seen. I've been saying for the last couple of weeks that if Real don't get things together they would lose against a good team.

Guess what? They did

They looked good in the first half of the game, but they were making rookie mistakes. Missed so many chances and it came back to bite them in the second half. One change from Barca's coach Flick and boom the game completely changes.

Then on Sunday, I already had no hope about Man U actually winning the game but then they got my hopes up. They looked really good in the first half but as always. They fell asleep in the second half and gave up a stupid goal. Then Lady Luck smiled against them, and they lost.

My Football Heart Weeps

I cannot believe how this game went. Ravens had the game in their hands literally. With 1:22 seconds left to go in the game and the Ravens up 1 point, the Browns had the ball. But the QB threw a bad pass, and it looked like the Ravens would have a walk-off interception to win the game. Unfortunately, he dropped the ball. On the very next play, the Browns throw a 38-yard touchdown.

It was a painful sports weekend for me.

Extras

Chick-fil-A is a Streaming Company

Chick-fil-A just announced plans to release a new app not focused on food but rather on creating content.

In Their Words: Dustin Britt, the executive director of brand strategy, said in a press release, "Hospitality and fun have always been at the core of the Chick-fil-A family experience, whether inside our Restaurants and play areas, or through our Kids Meals. The Chick-fil-A Play App is a digital extension of that experience and another way we’re reimagining ‘Play’ for our Guests, in a unique way through entertainment that really encourages time together.”

Takeaway: We live in the attention economy, your eyeballs are the most valuable item to a company. Businesses are looking for ways to get into your wallet as efficiently as possible. This is Chick-fil-A's method of going directly to the kids. Not only when they see the Chicken sign but also when they open their phone to play.

My Takeaway: This could be a genius idea. Parents trust Chick-fil-A because they have proven to be one of the very few companies that uphold and stay true to their values. Also, their values are very family-friendly and inspire growth. It is something parents would not have to worry about their kids being on.

I WISH I COULD INVEST IN THIS COMPANY!! But I guess the fact that I can't is why they can do things like this. They have no pressure from shareholders.

*I am a tiny shareholder in this company.