This newsletter is 2,383 words an 11-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update. It has been a hot minute since I put out one of these. Things have been hectic to say the least in recent days but we finally back. Still busy with life stuff but newsletters should be back to some level of consistency. Money Mentality will return next week. Thank you all for your continued support.

Summary of Topics:

Economic News

Inflation Cooled Down in April

Company News

Return of Meme Stonks (Ended Badly)

Google vs OpenAI - Heavy AI Newsweek

Stats of the Week

8.9% - Increase in Credit Card Delinquency

25% to 100% - Tax on Chinese Goods

$11,600/year - Cost of Childcare

14% - Millennials Buying Homes with Friends

Looking Ahead

Nvidia and Retailers Report Earnings

Sports I Love

End of My Misery

NBA Playoffs

$850 to watch NFL games

Extras

Streaming devolves to cable

Markets

If you thought the party was over because we had a horrible month in April, well you were very wrong. The S&P 500 and Nasdaq hit a new all-time high last week. The Dow Jones hit 40,000 for the first time ever. Stock Market continues to rise despite all the fearful headlines from news reporters.

This is why I preach staying invested and surviving the short periods of volatility. You cannot get the great returns without the times of stocks going down. Always play the long game, especially for my young investors with 20+ years to ride out any craziness in the markets.

Tale of the Tape

Economy

Cool Breeze Blows Through The Economy

The Economy got some good news on Wednesday when inflation numbers were released. It showed the economy was drinking a nice ice-cold bottle of water. Bringing relief to everyone that inflation was not running away as had been the worry since it seemed to be inching higher in February and March.

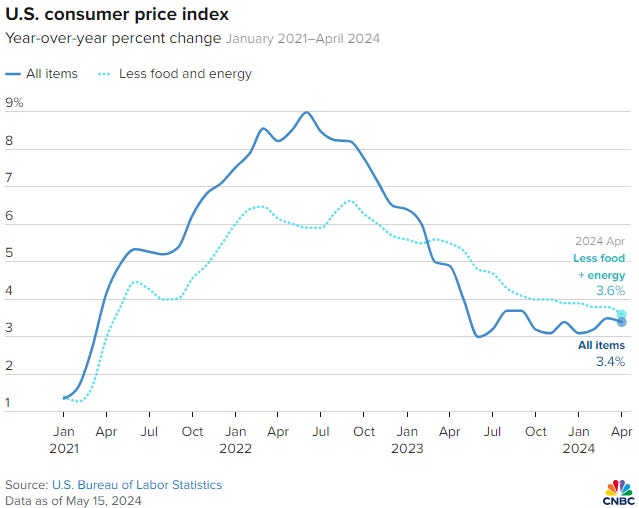

Details: April Consumer Price Index (CPI) aka Inflation showed inflation hit its lowest point since 2021.

Prices on average increased 3.4% from a year ago less than the 3.5% in March

Prices increased by 0.3% from the March.

Core CPI which removed food and energy prices increased 3.6% last month compared to 3.8% in March.

Although things are calming down, not all parts of the inflation report showed such a great picture. Car insurance, housing, healthcare, and energy prices increased in the last month.

In Their Words: EY-Parthenon senior economist Lydia Boussour said, "The weaker-than-expected retail sales report for April indicates that US consumers are acting with more prudence as labor market conditions soften and prices remain persistently high,"

My Takeaway: When we are stuck in traffic, we blame everyone and everything else for the traffic. We forget that the reason there is traffic is because we decided to go in the same direction, at the same time, as everyone else. In other words, we are the very reason for the traffic we are stuck in. It is the same thing with inflation. We complain about inflation but when we choose to continue paying for certain things as prices rise, prices will remain elevated. Of course, this is a simplistic view and there are multiple reasons people decide to make a purchase and my point remains.

The quote from Lydia Boussour sums up what caused inflation to cool. It was simple consumers decided to pull back on spending. The economy is 70% consumer spending, when we decide to not buy stuff businesses have to do things to incentivize you to buy which typically means lower prices. I hope this trend continues cause I don't wanna pay these prices anymore.

Companies

Are Y'All Serious?

Are we really doing this again? We ain't learned from 2021? We still wanna get burned?

Details: On Monday seemingly out of nowhere, the most popular meme stocks began ripping.

GameStop ripped up over 190%.

AMC joined in the madness and ripped 235%

*insert pic from Axios PM on 5/13/2024

There was no news from either company. Actually, both companies reported earnings a while ago and things were horrible for both companies. Both edging towards bankruptcy as their businesses continue to fall apart.

So What Happened?: One Tweet was the cause of all the uproar. A tweet by Roaring Kitty (real name Keith Gill), the original inspiration for the initial GameStop insane gain in 2021; tweeted a picture showing that he was returning after years of the platform. Roaring Kitty made over $50 million from his bet on GameStop in 2020. The stock rallied because retail investors believed, he was back to betting on the company that made him his fortune.

Takeaway: The question every is asking is "Will GameStop have another massive run-up?" NO. The Answer is a very resounding NO. No two snowflakes are the same and history hardly ever repeats itself in the exact same way. Despite GameStop and AMC being two of the most shorted companies in the Stock Market, there is no reason to believe that short sellers will allow the same short squeeze to happen again. Both stocks are down more than 50% from their dizzying high in 2021.

My Takeaway: Take THE MONEY AND RUN!! If you were a GME or AMC bag holder; Congratulations this is your chance to get out. Don't let greed blind you. Swallow your pride and get rid of this garbage stock. Take the loss and learn your lesson. Take your lucky break and run away.

But then again what do I know. This could make you rich just like Roaring Kitty. More than likely, it won't but it could, but IT DEFINITELY WON'T! Don't Play Yourself!

On Tuesday google held its developer conference, Google I/O. Everything shown off during the conference was AI driven. It either had something to do with the way Google was integrating AI into existing services or creating new services to sell you on the benefits of its AI platforms.

This was Google's first time having complete control over the way it presented its AI technology to the public its way since it faced massive backlash for being too woke with its release of Gemini earlier this year. Before the conference, OpenAI released a video showing off its latest version of ChatGPT which is able to have free flowing conversations with users. In an attempt to steal some hype from Google's event.

Takeaway: Google and OpenAI are in a war to be your default chatbot. OpenAI is using its partnership with Microsoft to continue improving without fear of making mistakes. Where Google continues to try to ensure it does not cause too much damage as it pushes the boundaries. More than likely there will be room for both, OpenAI might be the enterprise solution and Gemini the consumer solution, but it will be almost impossible for any other AI chatbot to compete with these two powerhouses.

My Takeaway: We are edging closer and closer to a really cool but also rather dystopian reality. Where we spend more time talking to our devices than to people in real life. Oh, wait we are already there. But I still love the technology being developed. I just hope we are mindful of the way; we use and implement it. However, I know we will not because that is not the way we choose to use technologies.

Stats of the Week

According to the New York Federal Reserve, the share of credit card balances that went into delinquency, meaning minimum payments were not made by the due date, increased to 8.9%. Credit card delinquency has not been this high since the Great Recession. Which is kinda weird because the economy is doing really well by all numbers from unemployment to wage increases. However, this might be a leading indicator.

This is a bad sign because it shows a growing problem for consumers. With an economy that is 70% based on consumer spending, it is never good to see consumers not able to service their debt. Inflation and interest rates might finally be really having a heavy effect on consumers. The average interest rate for a credit card is 21% and according to Bankrate almost 44% of credit card users carry a balance.

On Tuesday, President Biden announced new tariffs on a variety of Chinese imported goods. The goal of the tariffs is to protect the United States manufacturing industries from being affected by the extremely subsidized Chinese manufacturing sector. The tariffs are a short-term protection play for the industries being protected to build up their ability to compete against Chinese manufacturers.

Word Explanation: Tariffs are taxes placed on imported goods. It is a way to ensure key domestic industries thrive or counter unfair trade practices by other countries.

By The Numbers: These are the items that are on the list:

Lithium-ion Batteries increases from a 7.5% tariff to 25%

Semiconductors increase from 25% to 50%

Solar cells increase from 25% to 50%

Medical products like syringes and needles increase from 0% to 50%

Steel and Aluminum increase from 7.5% to 25%

Takeaway: These tariffs can be helpful in protecting and maybe even helping restore the manufacturing industry here in the US as the US tries to onshore more things. However, tariffs sometimes come with the side effect of higher consumer prices.

The cost of a childcare per year, according to research from the nonprofit Child Care Aware of America. It was found that childcare for two children now costs more than housing for every state in the US. Affordable childcare continues to be a headwind for the economy's ability to grow in the future. If less people choose not to have children because of cost, productivity declines which will eventually cause issues for the economy.

According to BankRate, 14% of Millennials are buying houses with friends. This has essentially never been a thing for other generations but is becoming normalized as the housing market continues to feel impossible to be a part of.

If you're thinking of doing this, my advice is DON'T. If you choose to ignore that advice, then you need to have a tight legal agreement drafted on the requirements of everyone involved in the purchase.

Looking Ahead

Company/Earnings

Nvidia will be releasing its Q1 earnings on Wednesday. It is expected to be another massive revenue growth number for the company. As the AI story continues to remain captured in the headlines.

Retailers such as Lowe’s, Ross, Macy’s will also release earnings this week. These companies can provide a view into how consumers are spending or not spending, as the seems to be the case.

Sports I Love

Finally Out of My Misery

The Premier League season ended on Sunday and my misery was finally brought to an end. I no longer have to watch the steaming pile of dung known as Manchester United. Literally cannot believe how bad they were this season; the coach is definitely gone. But even then, there is so many systematic problems with the team starting with the ownership that it does not even matter. All I see is dark days ahead for Man U. Great players come to Man U and are total trash but as soon as they leave, they return to their great form.

To make things worse, Arsenal could not do me any favors and win the league. Rather as they tend to do, they choked in the last few games and Man City as they tend to do came storming back and WON the league. EFFFF

I guess there is always next year, and Real Madrid will always make me proud.

That is what it will cost you to have access to every NFL game this season. On Wednesday, Netflix announced that it has agreed to air Christmas games for the NFL for the next 3 years. It paid $150 million for the privilege. The NFL has multiple agreement with multiple streaming companies for various games in the upcoming season including Peacock, Amazon Prime, ESPN+, Paramount+, and YouTube. The whole set up is looking more and more like cable. Check out the Extra Story below on how cable has returned just dressed in a different outfit.

NBA Playoffs

These playoffs have been fun to watch. These new kids are really doing their things. I cannot believe the Timberwolves beat the Nuggets. An old rivalry was reborn between the Pacers and the Knicks. Luka and Kyrie put on a show, but SGA is gonna be a problem for years to come. Celtics are Celtics and continue handling business in a methodical manner.

I picked Denver to win it all and I was wrong. The best team left are the Celtics but can Tatum and Brown finally get over the hump to win a title? Most people believe Timberwolves will win it all because everyone believes Anthony Edwards is the second coming of Micheal Jordan. I do not see the comparison, nor do I agree with it. I think we are far too in a rush to crown folks.

I will take the Celtics to win it all.

Extras

We all saw this coming. Comcast announced on Tuesday a new streaming bundle that will include Netflix, Peacock, and Apple TV+. Two weeks ago, Disney announced a streaming bundle that will include Disney+, Hulu, and Max.

We have gone full circle, streaming disrupted Cable just to become Cable. It makes sense because these steaming services have just gotten so expensive, and people are not subscribing at the same rate. This is an attempt for these companies to survive for the long run. Now we have no prices for any of these bundles so we will have to wait and see if it is actually a worthwhile deal.

*I am a tiny shareholder in this company.