This newsletter is 1,952 words a 9-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

Biden’s Plan to Reduce Housing Costs

Company News

Bad Day for CrowdStrike and every IT professional

Google Copying Microsoft’s Playbook

Netflix Still Streaming King

Stats of the Week

$500,000-lifetime cost increase

$14 Billion Prime Day Record

70% of Wealth Owned by Your Elders

Looking Ahead

Advanced Look at GDP

PCE - Personal Consumption Expenditure

Earnings from Tesla, Google, Chipotle

Sports I Love

Olympics begin

Extras

Top Jobs according to Gen Z high schoolers

Markets

Like LeBron in the 2011 Finals, the Stock Market started the week hot but cooled off as the week progressed. The excitement of a potential rate cut was not powerful enough to keep the rally going. There is fear of potentially bad geopolitical decisions from both presidential candidates. As we enter the busy earnings season, expect more volatility in the markets. This is a great time to reaccess why you invested in certain companies so you make no rash decisions. Happy Investing!

Tale of the Tape

Economy

🧢Cap

Biden in a campaign event in Nevada, proposed implementing a 5% cap on rent increases over the next two years.

🔎Details: Biden proposed ending tax credits for corporate landlords, which are defined as anyone with 50+ units for rent, who increase rent by more than 5% a year over the next two years. One of the biggest advantages to real estate investing is the tax benefits investors get on the debt they use to build the properties

As we all know, housing costs over the last 4 years have been insane. We have seen the same amount of housing inflation in the last 4 years that was seen over the two decades combined.

This move would be a big win for renters and homeowners. Providing a potential break in the crazy increases in prices.

According to a study by Harvard University, more than 50% of renters are spending more than 30% of their income on rent and utilities. That eats into the ability of people to survive.

🧐Not So Fast My Friends: Economists do not like this idea at all. They believe this proposal from Biden would make the situation worse because it would disincentive developers from building more units.

They have a point, one of the biggest reasons housing is so expensive is because we are not building enough houses.

According to a Pew study, the US is short 4-7 million housing units. As we learned in Intro to Economics, Supply and Demand drive everything. Without enough supply and plenty of demand, prices will keep rising.

Takeaway: Biden needs a win. This proposal is a way to get as many voters in the short term as possible. 41% of Americans see inflation and cost of living as the most important problem they face. He also announced a $325 million grant that would fund home building in seven cities.

This does not fix the core issues that housing faces which are mostly local zoning laws that inhibit the ability of developers to build freely. Unless that issue is addressed as it was addressed in places like Austin and Minneapolis, we will run into the same problem over and over again.

My Takeaway: This would never fly in Congress. I do see some benefit to trying to hold prices in place until more housing is ready to enter the market. However, that comes with risks of causing investors not to be incentivized to build more. But I push back and say investors were already not that incentivized seeing as they are not building as many housing units as we need. They are more than comfortable with the situation to remain as is to keep making money by raising rents.

Companies

🐦CrowdStrike Just Became A House Name

That is not a good thing

🔎Details: On Thursday night, CrowdStrike* pushed out what should have been a routine maintenance update to their system. Unfortunately, something with the update went wrong and it caused issues with every Microsoft system that had both pieces of Software. All Workers minus IT guys celebrated as they got a nice 3-day weekend. While the IT dudes in your office probably had to work the entire weekend to bring systems back online. It caused a massive outage for almost every company on the planet. It will go down as the largest IT failure in history:

Airlines were grounded

Banks were disrupted, and some people could not get access to their money.

Hospitals could not input reports and other various administrative tasks.

Emergency services around the world were locked out of their systems.

It was not a good day for anyone who worked at CrowdStrike especially whoever was in charge of that update.

👩🏾💻Takeaway: It is pretty insane that one company can bring the world to its knees with one stroke of a keyboard. The fact that all our systems are so fragile is pretty scary to me.

📉Stock Market Reaction: The Stock fell about 10% on Friday. Which is not that bad considering the scale of the mess up. The reason is that CrowdStrike does not have a competitor that can do what it does. It is one of the reasons (as you all know) it is a big part of my stock portfolio.

I used the opportunity to buy more shares in the company.

👀What to Watch: How will this cost CrowdStrike? Will businesses seek reimbursement for their losses from the outage? If they do, it'll probably destroy the business. More than likely revenues will be surpressed for a short while as CrowdStrike begins damage control by offering some kind of compensation.

The largest acquisition ever made by Google's parent company, Alphabet. Alphabet is pulling a page out of Microsoft's playbook and trying to acquire its way to a stronger position in cloud services.

🔎Details: Alphabet has potentially agreed to buy cloud cybersecurity firm Wiz according to the Wall Street Journal. Wiz works with 40% of the Fortune 500 companies including Google Cloud competitors Microsoft and Amazon. This acquisition would make Google Cloud a more compelling option for large firms to do Cloud business with.

Alphabet's previous largest acquisition was Motorola in 2012 for $12.5 Billion. Yeah, we all tried to forget that ever happened.

🔢By The Numbers: Wiz's revenue in 2023 was about $350 million. It is estimated to bring in about $500 million this year.

In its most recent funding round, it was valued at about $12 billion. Google is willing to pay almost double.

We have not seen insane valuations like these since 2021, when companies were trigger-happy.

Takeaway: The keyword to pay attention to is "potentially". The FTC will have a lot to say about another Big Tech company swallowing up a small startup. Last year, the FTC blocked Adobe's acquisition of Figma and has had multiple anticompetition lawsuits against Google. Expect the same treatment for this acquisition by Google.

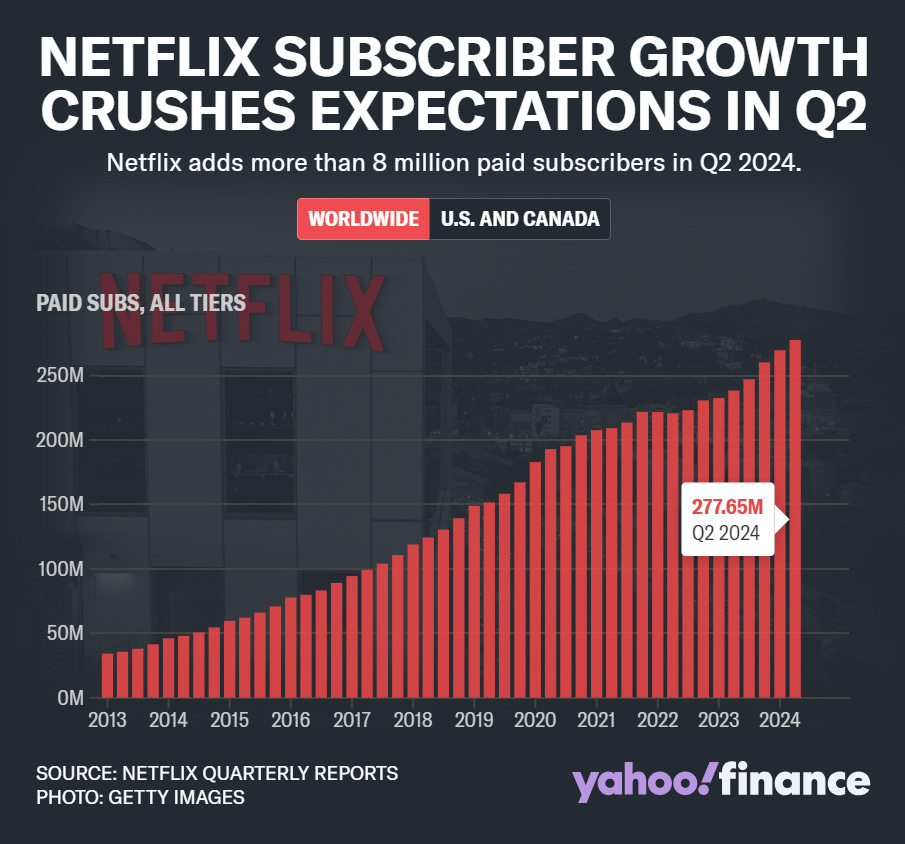

The King of Streaming continues its world-dominating march.

Details: Netflix reported earnings on Thursday, and it was far better than could have been expected.

Subscribers grew by 8 million when it was expected to grow by only 4 million subscribers.

The ad tier of subscribers grew by 34%. Surprisingly it was not the driver of the growth

The higher paying tiers grew with shows like Bridgerton driving subscribers back to the platform.

Revenue increased 17% from last year and Netflix expects revenue to grow 15% for the year

Profit increased

📉Stock Move After Earnings: Ironically the stock fell about 1% after reporting due to the global pressures.

👀What to Watch: How will the ad integration grow its revenue? The company stated in its report, "Given this sustained progress, we believe that we’re on track to achieve critical ad subscriber scale for advertisers in our ad countries in 2025, creating a strong base from which we can further increase our ad membership in 2026 and beyond."

It will be interesting to see how it drives growth as Netflix is beginning to enter the live TV game as well.

Stats of the Week

According to a recent study by Consumer Report, Americans should expect to pay an additional $500,000 over their lifetimes not because of inflation but because of the increasing cost of climate change. We should all expect to continue paying far more for insurance, energy, healthcare, food, fuel, etc.

If you think this is BS, here is some food for thought. We have consistently seen the record of average annual temperature rise constantly over the last three years.

Amazon is estimated to have made $14 Billion over the two-day Prime Day sales event. An increase of 10.5% from last year. This is a record for Amazon. Thank you to everyone who bought something, you pumped my Amazon stock. Buying shares in Amazon was my Prime Day shopping.

The amount of wealth owned by those 55 and up in the US. To all my grandpas, grandmas, uncles, aunts, and anyone older than me reading this newsletter. I got one question for y'all.

Can I hold $100?

Looking Ahead

Economy

On Thursday, we get an advanced look at Q2 GDP. Economists expect that US GDP grew by 1.9%. If it does come in around that number, it would be a good sign of things as it would be better than Q1 GDP.

Personal Consumption Expenditure (PCE) the Fed's preferred inflation index will be released on Friday. This will be a major determining factor of what the Fes does with interest rates moving forward. If it matches the downward move the CPI made last week, we might get an earlier cut than expected.

👀 What to Watch

The Heavy Weights just entered the newsletters. Some of the largest companies in the world are reporting earnings this week. Including:

Google*: Expect lots of questions about its need to acquire Wiz.

Tesla: Expect Elon to bloviate on the ability of the company to meet its deadlines on car production.

Chipotle: lots of questions about how it has addressed all the blowback on its bowl sizes. Also, how it is going to address the pushback on price increases?

The Rest

Sports I Love

2024 Olympics

Begins on Friday.

Team USA basketball is looking good. I wonder if they can win this tournament.

I was watching the highlights of the US v South Sudan game and realized most of my favorite players this will be their last Olympics. Players like LeBron, KD, and Steph are more than likely never playing in another Olympic tournament again.

I am now having another realization, I AM OLD!

Extras

According to a survey by the National Society of High School Scholars, government jobs and healthcare are the top spots for Gen Z high schoolers. They knocked off tech companies as the most desirable jobs.

The recent layoffs must be playing a major role in how that industry is being viewed by the younger crowd. Plus, there seems to be a greater desire for service. The top companies to work for are now: St. Jude Children's Research Hospital, Mayo Clinic, Health Care Services Corp, the FBI, and NASA.

Government positions provide job stability and healthcare is one of the few industries that has continued growing in work need.

*I am a tiny shareholder in this company.