This newsletter is 1,552 words an 8-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

Inflation continues to COOL Down

Company News

Big Banks Report Earnings

Stats of the Week

110 million AT&T customers hacked

$2.4 Billion spent on fireworks for July 4th

Used Car prices fell by 8.9%

$5 Increase to Costco Membership

5668 Passengers can fit in Royal Caribbean’s Newest Boat rather Island

$1 Billion in Taxes clawed back from 1,600 Wealthy households in the US

Looking Ahead

Heavy Earnings Week: More Banks & Netflix

Sports I Love

Spain Wins Euro 2024

Extras

ETHICS Act to force Congress to stop insider trading

Markets

Stocks have been having such a good time recently that even the Russell 2000, floundering for the entire year, had its best week of the year. It rose 5.5% for the week far ahead of the 0.76% from the S&P 500. But things might be shaken up this week after President Trump was shot at during a speech in Pennsylvania. The chaos of American politics just got a whole lot worse.

Tale of the Tape

Economy

Down Down Down

Inflation is giving everyone good vibes.

💬In Their Words: Jason Furman, who led the Council of Economic Advisers in the Obama administration, posted on Twitter, "No matter how you look at it inflation was basically non-existent during the month of June,"

🔎Details: Inflation in June fell from May by 0.1%. Yup, you are reading that correctly, overall prices for goods and services declined aka we had Deflation. Prices from last year rose by only 3.3%, the slowest rate we have seen since 2021.

🔢By The Numbers: Housing or shelter, as it is called in the CPI report has been the largest contributor to higher inflation. It finally regressed, growing only by 0.2% from May to June.

June saw a rare summer decline in gas prices, falling by 3.8%.

Food prices rose only 0.2%

🤔Takeaway: Typically, Deflation is not a good thing, it's even worse than inflation. However, this is like having rain on an insanely hot day. Sure, I don't like being wet but I hate the heat even more. Just like too much rain can quickly become a flood. Similarly continued deflation can make things much worse. Namely, a recession as businesses cut prices which leads to lower wages and job cuts. This leads to less demand which means more price cuts leading to less wages and on and on.

But a brief reprieve can be very helpful.

🛑My Takeaway: We the consumers are saying NO MAS to price increases.

PepsiCo CEO Ramon Laguarta told investors, "Some parts of the portfolio need value adjustments, [...] for particular consumers, we need some new entry price points."

In basic man terms: People ain't buying our stuff anymore because it is too expensive. We need to cut prices or at least make new items that have cheaper prices.

Delta CEO Ed Bastian told the Wall Street Journal that there is a race to the bottom on ticket prices and he is calling for significant corrective action on prices.

In basic man terms: People ain't buying our "luxury" priced tickets anymore. They flying basic economy or not at all.

This is a 180 from what companies had been saying the last two years, where they saw room to keep increasing prices because consumers were willing to swallow it. WELL NOT ANYMORE AND I LOVE IT!! Expect to hear more companies report these sentiments over the next few days as earnings reports start trickling in.

Companies

As with every Earnings Report Season, the Big Banks start things off. JP Morgan, Wells Fargo, and Citigroup reported Q2 2024 earnings on Friday before the markets.

📉Stock Move After Earnings: All three stocks fell after the report. JP Morgan fell 1.2%, Wells Fargo (the least loved banking stock for good reason) fell 6%, and Citigroup fell 1.8%

🔎Details: All banks reported less income from loans as they have all finally been forced to pay out interest to depositors. They all reported that customers have been taking money out of their banks and moving their deposits to higher-yielding bank accounts aka High Yield Savings Accounts.

JP Morgan and Citigroup reported higher income from investment banking deals that have picked up in the last year

With all the AI announcements, it has been a hot time for Mergers and Acquisitions. Which leads to more revenue for banks

My Takeaway: FINALLY!! For the last three years, every financially inclined person has been yelling from every hilltop and telling anyone who would listen to remove their savings from these trash banks and into banks that pay you interest. It finally happened!

👀What to Watch: More than likely interest rates will begin to decline soon. I expect these banks to drop the yield on savings accounts faster than an anvil falls from the sky.

Bank of America reports this week, it can give more detail into consumer spending pullback.

Stats of the Week

🐱💻110 Million

AT&T was hacked over 6 months. 110 Million customers’ phone records were stolen. The data stolen includes records of every phone number customers called or texted between May 1, 2022, and October 31, 2022. The hack was through a third-party data aggregation app called SnowFlake.

The amount spent on fireworks for all the various independence celebrations. We do love our explosions in 'Murica.

Prices of used cars have fallen almost 8.9% from last year. Continuing a trend of used cars falling after the crazy run up in 2021. Used car prices now cost an average of $17,934, according to Cox Automotive's Manheim Used Vehicle Value Index.

Electric vehicle prices are down 16.6%.

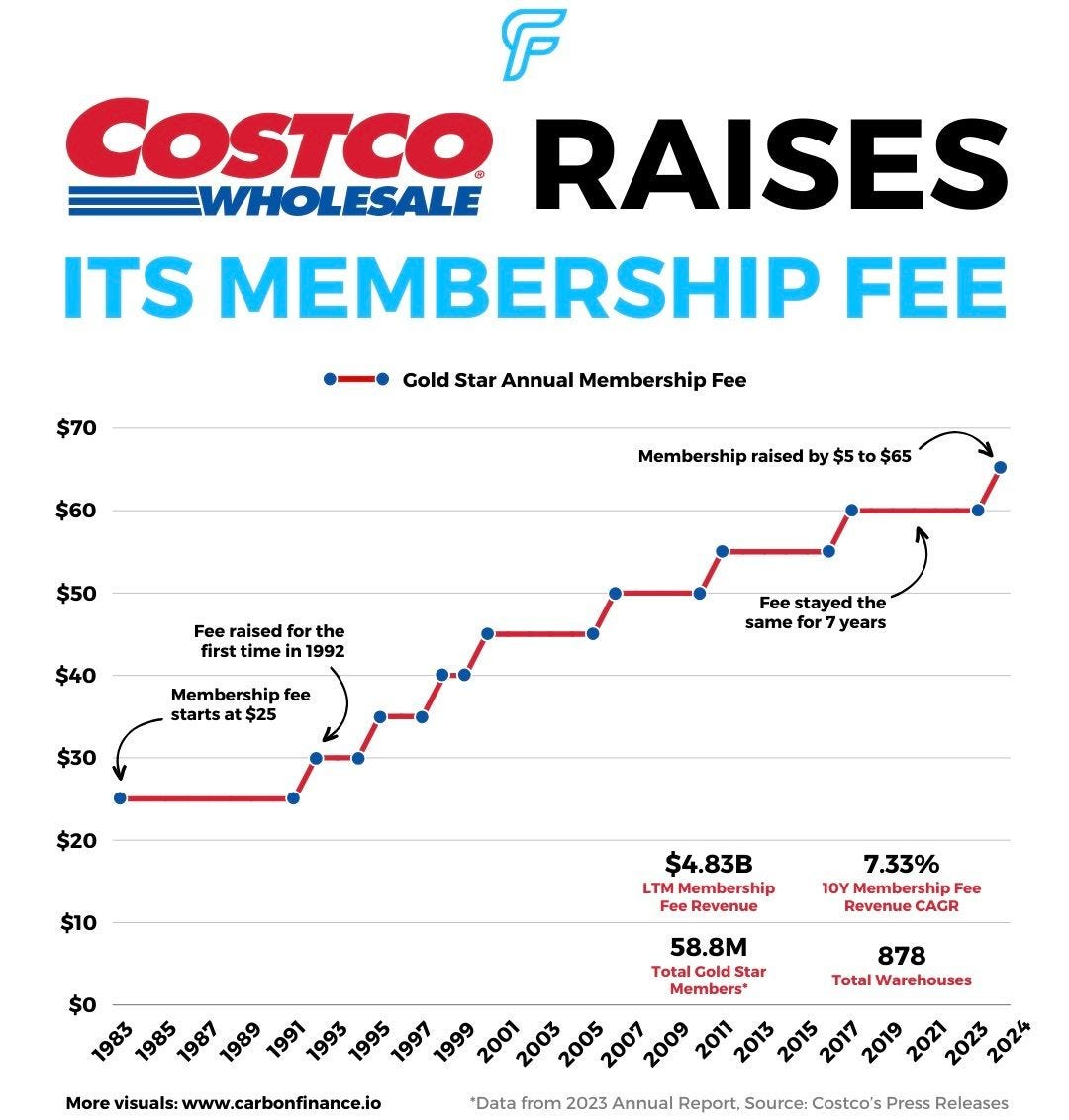

Costco is increasing the price of its annual membership fee from $60 to $65 for the first time in 7 years. The executive membership is increasing from $120 to $130. Not a crazy increase and is a price that I am willing to pay.

Takeaway: While Sam's Club is cutting its membership fee in half, Costco is raising its price. Tells you the crazy loyalty Costco has gained over the years.

Royal Caribbean just said, "HOLD MAH BEER." After debuting the largest cruise ship EVER, The Icon of the Seas, in January. Royal Caribbean just unveiled its newest ship called the Utopia of the Seas. It will be the second-largest cruise ship EVER!

It can hold 5,668 passengers, 21 restaurants, 5 pools, 2 casinos, and an ice-skating rink. This thing is a floating island.

The IRS collected over $1 Billion in unpaid taxes from 1,600 wealthy households that were withholding taxes until the IRS began sniffing around. The IRS says there is so much more to be collected from these wealthy households. This is all thanks to the funding they received from President Biden's Inflation Reduction Act of 2022 which added a lot of the financing for the IRS to grow the number of workers and it had.

Looking Ahead

Company/Earnings

Brace YOURSELVES

👀 What to Watch: These are the companies I am watching this week:

Bank of America to see how consumers are doing

Netflix to see if their subscribers are still growing, specifically the ad-tier of subscription.

Sports I Love

Spain 2 - 1 England

Now that was a fantastic game to watch. Spain and England played so well. This was a final between the luckiest team all tournament versus the most dominant team all tournament. I am glad the best team won.

Congrats to La Espana they deserved to win this tournament. They won every single game they played. 7-0. Not something you see regularly in tournament play. They were the best team in the tournament by a wide margin.

Extras

A bipartisan group of congressional lawmakers (4 Democrats and one Republican) created a legislation called the Ending Trading and Holdings in Congressional Stocks (ETHICS) Act. The act is designed to ban anyone associated with the government from trading stocks. Something that I'm shocked Congress is allowed to do (INSANE). Three main takeaways from the legislation:

Lawmakers would also be banned from trading for 90 days after the bill becomes law.

The penalty for breaking the law would be either a lawmaker’s monthly salary or 10% of the value of the asset in violation—whichever is bigger.

The act requires divestment of assets even if put in a blind trust.

The penalty is the big hitter because there was the Stop Trading on Congressional Knowledge (STOCK) Act of 2012. It was supposed to force Congress to disclose any trades they made within 40 days of the trade. However, the penalty was only a $200 fee.

Takeaway: The question is will this act pass? I have my doubts that it will. Why would Congress who has shown that they do things to serve themselves, ever take away the ability to make money based on inside information they get or from laws they know are going to be passed? As much as some acknowledge the way it negatively makes them look to the public, they just don't care.

Two attempts to put a stop to this have already failed. I doubt it will happen this time.