This newsletter is 1,246 words a 6-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

🐂2 Year Bull Run

Company News

🦵🏾⚽Earnings Kicked Off By Big Banks

Stats of the Week

⬇️2.4% Inflation in September

🏚️$75 BIllion

💳$1.8 Trillion National Deficit

💍46% Lab Grown Diamonds

Looking Ahead

📈Earnings Onslaught

Sports I Love

Pain-Free Weekend

🦅Ravens Rule DMV

Markets

There is not a lot to talk about this week. It was a pretty silent week minus the hurricane. The election has sucked the air out of essentially every topic. And I am tired of all the election talk so I tuned down my news intake. But on the bright side, the stock market continues its no-hold bars mission for new highs every week. Which is another reason it has been quite boring recently. But you know what, BORING IS GOOD!

But Boring might be ending as companies begin reporting Q3 earnings.

Tale of the Tape

Economy

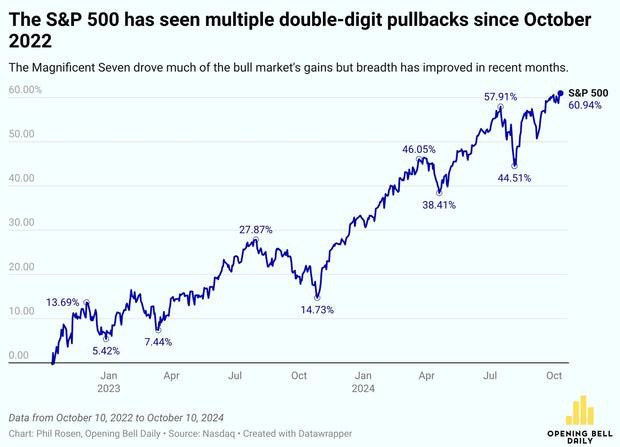

On Saturday, the Stock Market Bull Run turned 2 years old! The S&P 500 has returned 62% since bottoming on October 12, 2022.

It has not been an easy run by any means. There have been multiple major double-digit pullbacks during that time. There are multiple reasons to pull your money out of the market. However, if you held steady you have been handsomely rewarded by the stock market.

😏Takeaway: In the coming months, you will hear fear about hurricanes, the conflicts in the Middle East, elections, and so many other things. Use your experience to form your future direction. Do exactly what you have been doing, DO NOTHING!

Companies

The Big Banks kicked off Q3 earnings (as they always do). JP Morgan and Wells Fargo reported Q3 earnings Friday morning.

📈Stock Move After Earnings: JP Morgan stock popped 4% after reporting. Wells stock popped 5%.

🔎Takeaway: Investors were focused on one number from both banks, Net Interest Income. This is the difference between what the bank earns on loans and what they pay on deposits.

Unlike banks like Ally or SoFi which pay out a healthy 4% on your savings. The big banks on average pay about 0.1% while charging upwards of 6% on loans. This has been a healthy spread for banks to make money.

Investors loved it. Now that the Fed is cutting rates there is a fear that banks won't be able to squeeze as much profits from Net Interest Income (NII).

🔢By The Numbers: JP Morgan reported an increase in NII of 3% and increased its full-year profit target of NII from $91 Billion to $92 Billion.

Wells Fargo reported a decline of 11% in NII because unlike JP Morgan it was forced to raise its savings interest rate to attract more money.

Essentially people do not like or trust Wells Fargo, so they demand more incentive to bank with them.

You may be wondering why the stock went up after reporting a decline.

The answer is expectations. Investors expected things to be worse but when they were not as bad, the stock went up

Expectations are EVERYTHING in investing. But sometimes even expectations can lead to weird outcomes. See Tesla and its Cybercab announcement.

👀What to Watch: Both banks continued to speak to the strength of the consumers. However, both reported continued declines in loan activity in the last quarter. The expectation is that with rates coming down there will be more income to be made from those products.

More banks will report earnings next week and provide more details on the consumer. Especially Bank of America which gives the best insight into consumer spending.

Stats of the Week

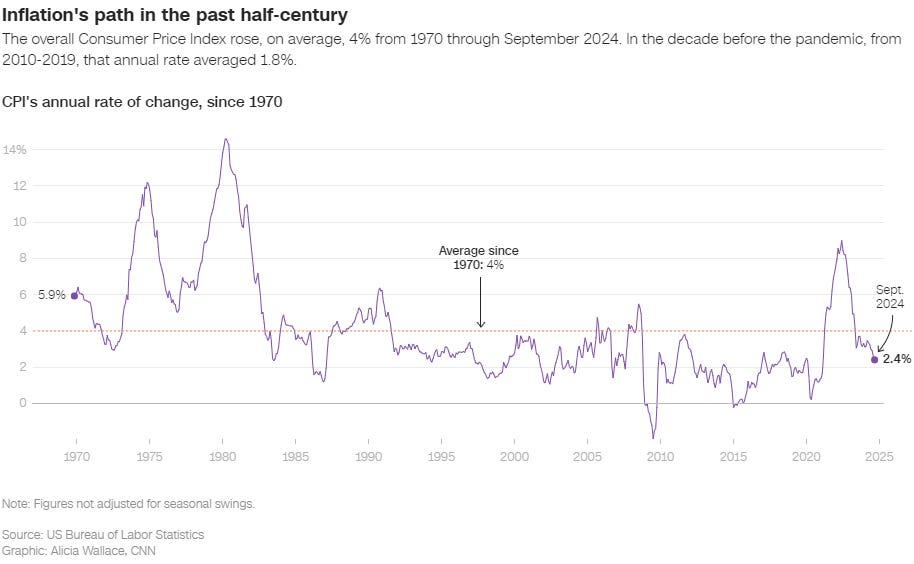

⬇️2.4%

Inflation remained subdued in the month of September. It is the lowest level in 3 years. Very interesting to me that no one is talking about gas prices anymore now that they are at unbelievably cheap levels. Average gas price is $3.20.

Unfortunately (here comes negative Kelechi), there are still price categories that remain stubbornly high.

Housing remains expensive

Most people are now more likely to rent than to buy due to how expensive buying a home has become. I am in this crowd. There is a part of me that regrets buying a house because of all the unstated costs.

Insurance prices have been terrible this year and seem to be moving in only one direction

Some food categories are going high due to uncontrollable things such as eggs with a bird flu outbreak

The amount of damage caused by Hurricane Milton. It was initially estimated that the hurricane would cause "only" $35 Billion worth of damage. After Hurricane Helene caused more than $47 Billion worth of damage. These storms are getting more powerful and more often.

3 million lost power after Hurricane Milton made landfall last week as a Category 3 storm.

10 People have been found dead so far.

The good news is it wasn't worse.

In 2023, $1.8 Trillion was added to the National Deficit. It is the largest annual deficit ever. The deficit was driven by greater spending on older Americans and higher interest payments. The US is now spending more on servicing debt than on any other part of the budget, $950 Billion last year an increase of 34%.

Takeaway: NO ONE IN GOVERNMENT CARES ABOUT THE DEBT. Anyone who is in Congress that says otherwise is lying. Typically, we see this kind of debt explosion after a pandemic, a war, or a recession. We had none of those last year.

💎46%

Lab-grown diamonds are on pace to outsell natural diamonds in the next few years. As of September 2024, 46% of diamonds sold in the US were lab-grown diamonds. After generations of Da Beers selling overpriced shiny rocks, people have wised up to not wanted to spend so much money on a ring. The biggest driver is a generational divide. Younger generations are more likely to buy a lab diamond while older generations still prefer their blood rocks. This is far more pronounced for Gen-Z

😤😟Hard Lesson Learned: Advice to anyone buying a ring for their future spouse. Bigger is Better. Ignore clarity, Ignore all the useless jargon they try to sell to you about a ring. Just buy the bigger diamond. Trust me just buy the biggest rock. If one ring costs $3000 and has 2 carats and another is "shinier" according to some scale of whatever has 1 carat and costs the same. BUY THE BIGGER ONE!

Thank me later

Looking Ahead

The Onslaught begins.

JPMorgan and Wells Fargo kicked things off and next week, the rest of the market joins in the action

👀 What to Watch

Netflix reports on Thursday. A big focus will be on how the ad-supported tier is growing.

Sports I Love

⚽International Break for Futbol

Thank Goodness! I don't have to watch the travesty known as Man U.

🦅Ravens Rule DMV

On Sunday, the Ravens beat Washington Commanders. This was the big game of the weekend. Lamar Jackson took on Jayden Daniels the rookie sensation of Washington. The game was as good as expected. But the Ravens took control early and held onto it. This was the first game the Ravens looked in complete control from beginning to end.