This newsletter is 4,081 words a min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

❌Trump threatens Economic Stability

↩️And Just Like That, Things Have Changed

Company News

🚘Tesla Struggling to Sell

📈Google Reminds Doubters Of Its Greatness

Stats of the Week

🏛️$1 - Breakdown of How The Government Spends Taxes

✈️108 Million Travelers (Only Thing Atlanta Wins At)

🔚$8 Billion Worth of Clean Energy Projects Cancelled

🪙50% Rise in Trumpcoin

Looking Ahead

Economy - Q1 GDP & Labor Market

Earnings - 180 Companies Report

Sports I Love

Chaotic Madrid

Mediocrity Upon Mediocrity

Extras

🐦Canary is Singing

💧Water Sommelier

Markets

Don't think of Trump through the lens of an economist or a journalist trying to understand things. But rather as a psychologist trying to understand his psyche and temperament. This change will help you understand Trump’s actions.

Marc Fisher who wrote the book Trump Revealed, a biography about Trump, explains his mindset, "He is a very simple person. He is a guy who trusts his guy. Knows very little. Studies not at all. Adverse to taking advice from almost everyone. And wants to win on every occasion. Then you kind of understand his actions."

Trump wants to remain in the spotlight. He needs a drama to be the star of. What bigger drama is there than being the President of the US, where your every word is hung onto by the entire world?

Returns

Tale of the Tape

Economy

❌Trump Threatens Economic Stability

🕰️Background: Over the last two weeks, Trump has been attacking Federal Reserve Chairman Jerome Powell for not cutting interest rates after his tariffs plunged markets into a freefall. Thursday before Easter weekend, Trump said on Truth Social in one of his typical social media rants, "termination cannot come fast enough". Alluding to the fact that he might fire Papa Powell. Then it was shortly followed by his economic advisor, Kevin Hassett, telling reporters the White House was investigating whether it was possible to fire the Fed chair.

✅Result: The market fell 2% and has continued its downward trend since then. Trump continued pouring gas on the fire last week by calling Powell, "Mr. Too Late" and a "major loser" after demanding Papa Powell cut rates "NOW" and claimed there is “virtually No Inflation". The market is set for its worst April since 1932, which was during the Great Depression.

✏️Education: The goal of the Federal Reserve is to maintain price stability and ensure maximum employment. The Fed uses interest rates to achieve these two directives. Sometimes that means making hard and unpopular decisions like raising interest rates to kill inflation, which could make things harder in the short term, but over the long term, make life much better. This can be counter to the needs of a politicians who want to win easy favor with their citizens by encouraging spending through low borrowing costs.

🤔Why It Matters: The independence of the Fed has been one of the many reasons the US market is loved by investors around the world. Think of the Fed like the adult in the room during a party that sees when things are getting a bit too out of hand and removes the punch before it is too late. Anything that challenges that independence would spell disaster for the US economy and market over the long run.

We are already seeing some signs of this as interest rates for US treasuries have reversed course and are continuously climbing. Now sitting above 4.4%

The dollar continues to decline in strength compared to other currencies, as investors are choosing other currencies as safe havens.

📜History Lesson: In the early 1970s, during Nixon's presidency, there was an inflation spike due to the oil crisis. Nixon believed that if interest rates were high, he would lose the election. Similar to Trump, he attacked the Fed Chair of that time, Arthur Burns. Blaming him for the inflation of that era, calling on him to cut rates and keep them low. Burns caved to the pressure of Nixon.

It worked out for Nixon, who won the election of 1972 in a landslide but sucked for the American public. Inflation went out of control, and the economy was in a much worse state.

In 1979, Jimmy Carter replaced Burns with Paul Volcker, who had to raise interest rates to nearly 20% to quell inflation. He drove unemployment to nearly 11%.

Volcker, unlike Burns, did not cave to political pressure. Jimmy Carter, unlike Nixon, did not pressure Volcker to make his presidency easier.

By the mid-1980s, inflation was under control, and unemployment dropped back to single digits.

Takeaway: Removing the fact that firing Powell would spell economic disaster as investors pull their money out of every dollar-denominated investment option. It is also illegal for Trump to fire Powell, according to a Supreme Court precedent known as Humphreys Executor. Unfortunately, the current Supreme Court and Congress cannot be trusted to uphold laws as intended.

Even if Trump does not fire Powell, Powell's term as Fed Chair comes to an end next year. Every sign shows that whoever fills the position next year will be a puppet to do the bidding of Trump. Which will have the same reaction from the markets.

Pimco (a major bond investing brokerage) Libby Cantrill recently wrote, "It is still unlikely that Trump pulls the trigger and fires Powell: We don't think the legal fight or the market pain (particularly in the bond market) is worth it for the Administration. But even if Powell stays, Trump could be doing longer-term damage to the mere perception of the independence of the Fed, which may continue to make dollar-based investors more weary and wary."

🔥My Take: Play with fire and you will get burned.

And Just Like That, Things Have Changed

🌀The Change: On Monday, the CEOs of Target, Walmart, and Home Depot had a private meeting with Trump. They said if he kept doing what he was doing with tariffs, there would be major supply chain disruptions, increased prices, and empty shelves.

🗨️In Their Words: According to an administration official, "The big-box CEOs flat out told him [Trump] the prices aren't going up, they're steady right now, but they will go up. And this wasn't about food. But he was told that shelves will be empty."

Gene Seroka, executive director of the Port of Los Angeles, told Axios, "These are the most sweeping tariffs we've witnessed in our lifetime. I'm hearing directly from large retailers and manufacturers here in the United States that many have ceased all shipments from China. You're probably going to see two-thirds of normal cargo or less coming through the Port of Los Angeles in the weeks to come."

😬Reaction: Shortly after that meeting, Trump announced that tariffs will be nowhere as high as they are right now and that there will be talks with China. Then his Treasury Secretary, Scott Bessent, said there will be a de-escalation in the trade war with China.

Trump then told reporters that he had no intentions of firing Papa Powell, to quell the markets.

Bottom Line: This is chaotic. It also shows the only group of people that this administration cares to listen to, and it sure ain't the regular folk. If you are not a large conglomerate, you have no say in what the administration chooses to do. Last week, we saw Tim Cook get carve-outs for tech. This week, it is big box retailers. What is going to happen to the hundreds of thousands of small businesses that do not get an audience with Trump? What will happen to everyday people who just want to be able to take care of their families?

My Take: This newsletter is going to be 3,000 words every week if this continues. I don't like it. The goal is 1500 or less. I'm sorry, folks.

Companies

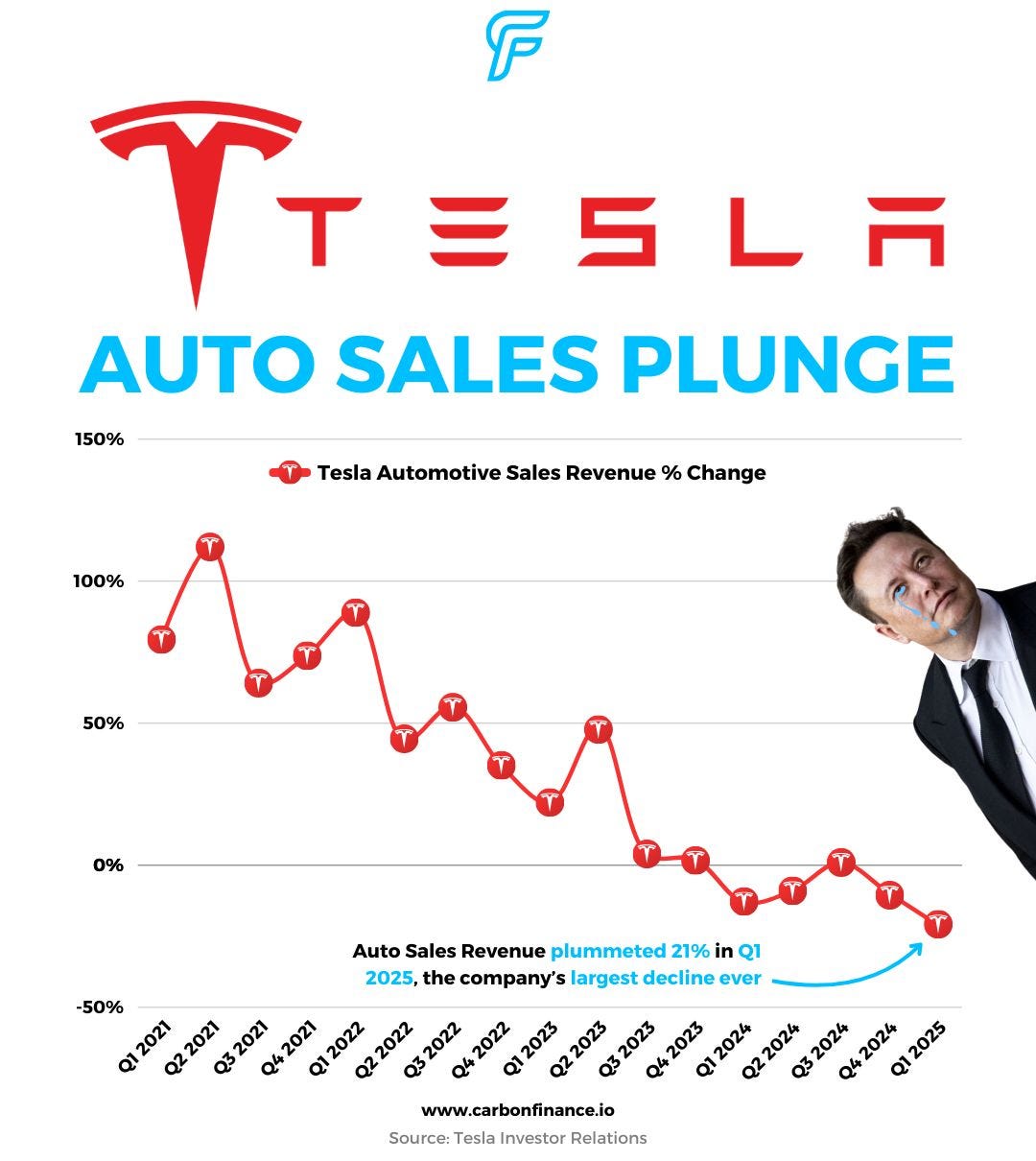

Tesla has continued producing far more cars than it can sell. Especially the Cybertruck, which has proven to be probably the worst vehicle for any sane person.

📈Stock Move After Earnings: Weirdly enough, the stock rose 7% after reporting, although it continues losing sales and profits.

🔢By The Numbers: Revenues were $19.3 billion, down 9% from last year and far behind its expectations of $21.3 billion

Profits were $409 million, down 71% from last year.

Car revenue dropped 20% from last year to $14 billion

Energy storage grew 67% to $2.73 billion in the quarter.

It is the only part of the business that generates a profit for Tesla

🗨️In Their Words: Tesla said during the earnings call, "Uncertainty in the automotive and energy markets continues to increase as rapidly evolving trade policy adversely impacts the global supply chain and cost structure of Tesla and our peers. This dynamic, along with changing political sentiment, could have a meaningful impact on demand for our products in the near-term."

🙂↔️Takeaway: Although the company looks more and more like a typical car company with its gross margins, the story of Tesla is not one of a typical car company. Elon Musk has been able to weave a beautiful story of Tesla being Waymo, NextEra, and OpenAI combined. This is why Tesla has been able to continuously avoid the scrutiny of the public markets, because there is always another rabbit to point to. This quarter, it was the promise of Full Self Driving combined with the growth of its Energy generation and storage business.

🏃🏾My Take: I thought the stock would plummet once the earnings were released because vehicle deliveries declined all of 2024. But this is why I do not touch Tesla. There is just so much love and faith in Elon that it is extremely hard for real numbers to be allocated to this business. This company continues to be in my "TOO HARD TO EVEN THINK ABOUT" pile of companies.

If everything you just read sounds familiar, that is because I wrote all of that during Tesla's Q4 2024 earnings call. Elon and Tesla have more Teflon than the US military. This company is impervious to bad news. The good thing about this company is that they have so much cash and so little debt that they can survive for a long time until other revenue streams take off. If you are a Tesla shareholder, Good LUCK!

👀What to Watch: If Tesla's cybercab gets on the road next month, as Elon promised during the call. I have my doubts, but what do I know?

Are Tesla's declining sales a temporary thing or a long-term issue?

Can the company win back favor now that Elon is leaving the White House?

Can Tesla take the Amazon effect, where it uses its Energy business to fund everything else?

For decades, AWS allowed Amazon to run every other part of its business at basically no profit and reinvest heavily.

The difference here is that Tesla is beginning to lose free cash flow, something that Amazon never had to deal with.

📈*Google Reminds Doubters Of Its Greatness

Since the release of OpenAI's ChatGPT, the belief has been that Google is done and it can no longer compete as people move away from using its search box to using chatbots like ChatGPT to answer questions. Also, the FTC and DOJ are suing Google for monopolistic practices. The belief is that Google would not be focused enough to answer the call from the competitors.

📈Stock Move After Earnings: After reporting earnings on Thursday, the stock climbed 4%. Reminding everyone that it may die one day, but that day is not today, and tomorrow ain't looking that great either.

📈By The Numbers: Revenues increased by 12% to $90 billion, beating investors' expectations of $89 billion.

Profits increased by 13% to $26 billion (discounting for the $8 billion in unrealized gain from a private investment).

Gross margin remained at 60% (INSANE!!)

Operating margin increased to 34% even as Google continues to invest heavily in its AI push.

Various parts of the business:

Search increased revenues by 10% to $50 billion

YouTube ads increased revenues by 10% to $9 billion

Google Subscriptions increased sales by 19% to $10 billion

Google now has 290 million paid subscribers

Google Cloud increased sales by 28% to $12.3 billion

Cloud's profitability is growing rapidly. Gross margin on this segment of business doubles from 9% last year to 18% this year.

Free Cash Flow increased by 13% to $19 billion from $16 billion last year.

This is while Google spent $17 billion on CapEx, a 43% increase from last year.

Google reaffirmed its expectation to spend $75 billion in CapEx this year.

🗨️In Their Words: Sundar Pichai, Google CEO, said, "This quarter was super exciting as we rolled out Gemini 2.5, our most intelligent AI model, which is achieving breakthroughs in performance and is an extraordinary foundation for our future innovation.”

😤Takeaway: Google is GOOGLE! It may not be growing like the weeds in my yard, but it continues to defy possibilities. As long as Google can continue to generate massive amounts of free cash flow, there is a long runway possible for this company.

👀What to Watch: While Tesla continues talking about releasing its autonomous taxi shortly with nothing to show for it, Google has Waymo on the roads giving rides right now. It has expanded to Atlanta, and I see them everywhere downtown. This is a key growth area for Google, and as long as Google does not let up the gas, it seems Google is running away with it.

Google cannot lose focus on investing in AI and competing actively with OpenAI. After dropping the ball early in the race, Google has recovered nicely, but it cannot let up. It no longer has the MOAT that it had when it ruled over search. It has to ensure that it has a competitive answer to OpenAI at every turn.

The biggest question for Google is what will happen with its lawsuit with the DOJ and FTC? It has been found guilty of monopolistic practice, and there is a possibility that it will be forced to divest Google Chrome. That will be a massive blow to Google if that happens. This will be a massive story to watch play out over the rest of this year.

🫡My Take: Last quarter was a great one for Google, but as we all know, when it comes to investing, it is all about the FUTURE. You do not get rewarded for what you have already done, but rather for what you will do. I believe Google will continue executing, which is why I have been buying the stock as the market has seen a decline. It is my largest single stock position.

Explaining Obscure Financial Terms

Free Cash Flow: The money a company gets to keep after paying all expenses, taxes, and capital investments. It is, in my opinion, the most important metric of any business because this is how a company can pay dividends, have cash reserves, buy back stock, or maybe make even better investments.

Operating income: This is the profit generated from a business's core operations. It is key to seeing how well a business manages its operations. The higher the number, the better it is for the business.

Stats of the Week

A breakdown of how the US government spends funds. I think it is important to understand that most of the money spent by the government is on its citizens. The largest being Social Security.

🗨️In Their Words: Zach Moller, director of Third Way's economic program, told Axios, "Most people think there's tons of waste in the budget, but that's often because the spending feels like a black box. Once you see that 60% of every dollar is spent on health care or direct payments, it flips a switch in how you think about what government does."

🏛️Takeaway: The US government generally does a great job with how it uses taxpayer dollars. Can it be improved? ABSOLUTELY! But like I love to say, when you see a spider in your house, you don't burn down the house. I do like their focus being brought to the total government budget.

The amount of agricultural products the US exports to China annually. Farmers are already complaining about the lost revenue due to the trade war. The largest of which are soybeans and pork.

Post-tariff implementation and China's reaction:

Soybean exports to China are down 50% week over week.

Pork exports are down 72% week over week.

Takeaway: In 2018, when Trump implemented tariffs, China imposed major tariffs on agricultural products. Farmers have never recovered from it and are still receiving subsidies from lost sales that never came back to the US. Whatever revenue was to be generated from those tariffs was pointless cause it had to be used to bail out farmers. The same thing will happen here.

16 clean energy projects that have been cancelled by the Trump administration. Pulling back on $8 billion worth of investment that had begun during the Biden Administration.

The largest of these projects is a $28 billion offshore wind project in New York that was scheduled to go into service next year and deliver 810 megawatts of power, enough power for 500,000 homes. The Trump administration stopped construction, citing a need to "re-review" all permits for the project.

Takeaway: Any slowdown will cause a chill across the industry. Investors will not want to put money behind anything that the government can just renege on a previous agreement.

My Take: I just do not understand. For an administration that calls itself Pro-Energy Growth. It continues to find ways to do the exact opposite of growing energy.

The amount that Trumpcoin rose after it was announced that the top 220 holders of the coin will be able to get a "special dinner" with the president on May 22, and the top 25 will get a "special VIP White House Tour."

My Take: At least Trump is upfront about the corruption, and it is no longer being called a "donation" as most politicians would call it.

Looking Ahead

Economy

It's gonna be a big week for Econ-nerds like myself. A ton of data about the current state of the economy will be released as April comes to a close. Just crazy that we are already in May. Feels like time is moving super fast and super slow all at the same time. The labor market will take center stage for the most part, but GDP will also be released.

⏳Timeline: Tuesday, the JOLTS (Jobs and Labor Turnover Survey) will be released.

On Wednesday, we get GDP (Gross Domestic Product) for Q1 2025.

Also on Wednesday, ADP will release its private payrolls reports.

Then on Friday, we get the big nonfarm payrolls report.

👀What to Watch: I will be paying attention to the layoff percentage and the quits rate from the JOLTs report. With the economic uncertainty, I expect to see a flat line in the economy as companies are not sure how to react to the Trump administration.

I expect GDP to be healthy as consumers have been pulling forward purchases to front run the tariffs. Remember two two-thirds of GDP is consumer spending.

I have no idea what to expect from ADP and Payrolls. Companies are saying they are pausing a lot of activity. I am not sure if that means hiring freezes, layoffs, or just carrying on as usual.

These numbers should at least give us some idea of what is happening.

However, government employment numbers will be the most interesting part of the report.

Company/Earnings

It’s a heavy week of stock earnings, as we enter into the thick of it this week. Around 180 companies within the S&P 500 will be reporting this week. Expect a ton of volatility as companies begin to position the markets for what is to come soon. I expect a lot of companies to pull guidance for the year ahead or give negative guidance due to tariff effects still being largely unknown.

👀 What to Watch

The Mag 7 will have great representation this week:

Microsoft and Meta report on Wednesday

Apple and Amazon report on Thursday

These companies represent a healthy portion of my single stock portfolio (and a large portion of all indices), so I will be paying attention to them, and you will hear all about it next week.

The rest reporting:

Sports I Love

Chaos at Madrid

There aren’t many seasons as a Madrid fan where we don’t get to celebrate a trophy. Unfortunately, this season looks like it will be one of those rare times.

On Saturday, Madrid faced Barcelona in the final of the Copa del Rey (Spanish Cup). It was a chaotic and entertaining match, but sadly, Madrid fell apart in the final moments. The same issues that have plagued the team all season (careless turnovers and poor defensive organization) showed up once again.

Madrid had their chance to win and were leading with just six minutes left, but a lapse in concentration cost them the match.

Takeaway: This is just not Madrid’s season. Trying to incorporate Mbappe was never going to be an easy task. Then, all the injuries the team had in defense throughout the season did not help either. The good news is Madrid has all the ingredients to stay great, but so does Barcelona.

My Take: El Clásico will be entertaining for years to come.

Mediocrity Upon Mediocrity

Nothing to see here but mediocre soccer being played by a trash team.

Extras

Capital One reported earnings last week and reported record revenues. But more importantly, they reported that credit card balances increased by 4% to $157.2 Billion in the first quarter of the year.

My Take: This is a sign of people not being able to pay off the credit card balance in full at the end of the month. Typically, signaling that finances are deteriorating for some people. It could be a potential sign of people beginning to feel some of the effects of the new administration's policies.

It is something to keep our eye on.

I swear we will make anything a luxury product with the right kind of story.

Details: There is an event called the Fine Water Summit. It is a festival where people gather to taste expensive, "luxurious" water. The event will be running from April 25-27.

🔢By The Numbers: A few examples of how much these bottles of water cost:

Socosani is melted snow filtered through volcanic rock in a remote part of Peru costs $64 for a pack of 6 of 16 fluid ounce bottles

ROI, a magnesium-rich water, costs $200 for a pack of 6

Svalbardi is iceberg water from rain 4,000 years ago, costs $6000 for a bottle

My Take: Wealth inequality is a problem

*I am a tiny shareholder in this company.