This post is 1,254 words, a 6-minute read. Enjoy!

Have you ever driven at night when a thunderstorm is raging?

You have limited visibility, feel like your car is no longer in your control, and have a messed-up sense of distance.

It can be terrifying, especially when others are not taking the same precautions (Atlanta drivers, UGH!!).

It's the same feeling most of us have regarding our money. Most of us are constantly driving, not just in a thunderstorm but in a hurricane. We have no idea what is happening with our money. We do not know what is coming in or going out. The idea of trying to face our finances sends shivers down our spines. (But congratulations, if this is you and you are reading this, you have made progress.)

Ramit Sethi says

"To be CONFIDENT with your money

You have to be COMPETENT with your money."

Knowing your numbers provides a sense of control and stability. It doesn't matter if those numbers are good or bad. It provides a framework to begin making concrete decisions about your money.

Knowing your numbers takes two parts.

The first part is tracking your spending to understand where your money currently goes.

The second part is creating a plan of how you want to spend your money.

There are two ways you can track your spending:

First Way is Real Time Tracking (Slow Method because you do this over time about 1-3 months before making changes)

Pen and Paper or Using Notes App: Every time you swipe your card tap your phone or click your mouse. You write down what you spent money on and categorize it

Example: On Monday: I paid my power bill. I would write: $100 and put it into the Bills

On Tuesday: I stopped at Chick-fil-A for food. I would write $15 and put it in Earing Out

Excel or Google Sheets

This should be no more than 1 month and don't try to lie to yourself. You have to spend like you normally would spend.

Using an app: Monefy

Using an app that is connected to your banks: Monarch Money, CoPilot (Apple/Mac Specific), Simplifi, Every Dollar (meh.), Rocket Money (meh.)

This takes a while to categorize everything but would be the fastest method.

The second way is Review Tracking (a Fast Method because you can make changes immediately. I prefer this one)

You use the same tools and do the same thing.

But rather than waiting to see what your spending has been, you review your past spending.

You get old Statements from Banks, Credit Cards, etc.

Look over the last three months. That should give you a good enough idea of the variability in your spending.

I prefer this method because you can spend an hour or two right now and know exactly where you are. This way you get started much faster with the next stage

Please do not get bogged down on the tool. The most important thing is to get started with something. I started with pen and paper. Then Monefy app. Now I use Monarch Money. 99% of the time, the simplest solution is all you need to get started. I want you to get started FAST and rack up quick money wins up wins.

Now we have information on our spending but information on its own is useless. We have to turn that information into action.

Welcome to the next step, Creating a Spending Plan

Money is like water, without firm limitations and boundaries; it will find the path of least resistance and flow right out of your hand.

This means we have to do something a lot of us hate.

Planning Our Spending aka Budget.

Before we continue, I want to ask something. When you think of a budget what do you think?

Limiting, No, I cannot do... etc

These are the absolute wrong ways to think about a budget.

A budget is A YES Statement. It is how I tell myself YES so that I can do the things I WANT TO DO.

Do I want to spend money to visit my sister for her birthday? YES

A budget is how I make that happen

Do I want to have a massive wedding? YES

A budget is how I do that

Do I want to give more? YES

A budget is how I make room for that

Do I want to go to the World Cup? YES

A budget is how I plan for it

Do I want to travel more with my wife? YES

A budget is how I ensure this happens

Do I want to go on more date nights? YES

A budget is how it never becomes a hard decision

The point is by taking the time to plan out our finances, we get to say YES to more things.

Before making a plan for your money, I want us to ask ourselves this question:

What level of change do I want?

No Change

Small Change

Big Changes

Our answer to that question will determine if we are ready to make the necessary changes for our visions to come to life.

Here is a good guideline to use for your financial plan: 50-25-25

Spend no more than 50-60% of your take-home income on Your Needs

Things you need to survive aka bills

Mortgage, Rent, Power, Water, Garbage, Phone, Internet, Groceries (not eating out), Insurance, Debt Payment, Transportation (Car Note, Gas, Bus/Train Ticket)

No more than 20-30% of your take-home income on Your Wants

Eating Out, Traveling, Entertainment, Streaming, Shopping, Gifting, Giving

Whatever you do for fun

20-30% of your take-home income on Saving & Investing

Emergency Fund

Long Term Goals: New Car, New House, Wedding,

Retirement aka Financial Freedom

Former US President Dwight D. Eisenhower said, "Plans are useless but planning is indispensable"

I can pretty much tell you; that your plans are going to fail especially the first time you do it

But having the plan will provide a sense of confidence that you have never had before

With that being said I have two resources for you:

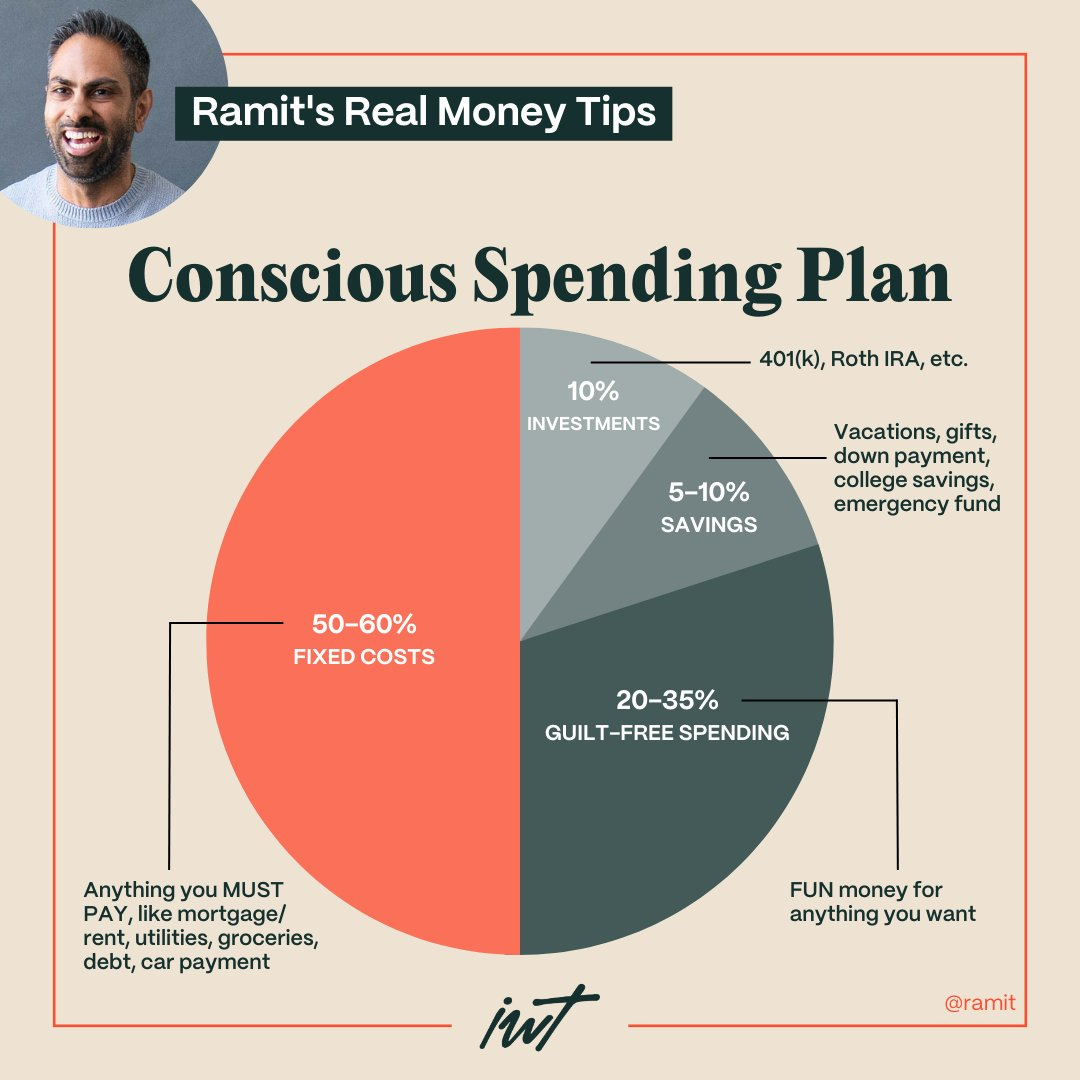

Ramit Sethi's Conscious Spending Plan

This is to help you set up a vision of what you want your money to do for you

It combines everything we have been talking about into one document.

It will help put into perspective where your money currently is and where it should be going.

Quote from the site: I believe in using my money to build a Rich Life TODAY, not make it smaller! And I want to show you how to do it, too.

What if you could make sure you were saving and investing enough money each month, and then use the rest of your money guilt-free for whatever you want?

Well, you can — with some work. This is what Conscious Spending is all about.

Humble Dollar's Two-Minute Check-Up

This gives you an idea of general basic goals to aim for

From the site: THE TWO-MINUTE Checkup is designed to give users a quick assessment of their finances based on just nine pieces of information, the sort of things most of us know off the top of our heads.

Enough driving in a hurricane. It is time for us to stop, reroute, and take a safer path.

Remember Generosity>greed

✌🏾

Recommendation Section

Ben Carlson in "What's a High Income?" Ben breaks down how incomes have grown over time and uses numbers to put into perspective comparative incomes from different decades.

Nick Maggiulli in The Things You Can't Buy, writes about all the ways we chase after money but miss out on the most important things in life. He also makes an awesome announcement.

Johnathan Clements in Advice For The Kids, gives some of the best financial advice for us youngins in bite-sized form that I've ever seen

Morgan Housel in A Few Little Ideas And Short Stories. Provides awesome stories to help us understand the world and think better.

Some of the best life questions to ask ourselves, are posed by Morgan Housel in I Have A Few Questions.

There are hidden costs in almost everything we choose to purchase. Doug and Heather Boneparth have a series covering many of them. The latest topic is on Holidays

🎙️Two podcasts I love:

50Fires. It is by Carl Richards, a recovering Financial Planner and Advisor. He could help other people with their finances but had a difficult time talking about money with his wife and children. It has quickly become one of my most anticipated podcasts to listen to every week.

Money For Couples by Ramit Sethi. Ramit is no one new to the world of money and personal finance. In his podcast, he talks with couples about their finances and helps them better enjoy their money or better get aligned. This is very important podcast for me as I enter a new stage of life.