Everything to Know About Your Money (Improved): Part 4 - Simple Path to Wealth

My favorite money topic

This post is 1,199 words, a 5-minute read. Enjoy!

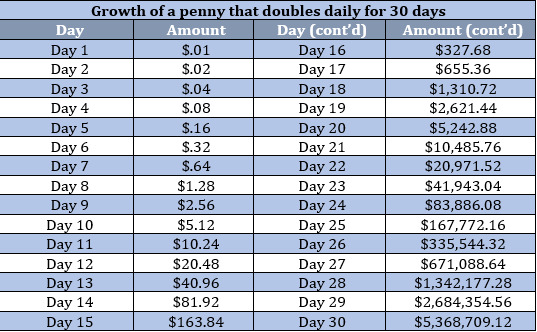

Before we begin, I have a question

And yes it is a trick question.

This is The Magic of compounding. It is believed that Einstein said, "Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn't pays it."

It is not just with money. Once you understand compounding, you will see it in every area of life. It is how we learned to talk, to walk, to read, to drive, to cook, etc. EVERYTHING COMPOUNDS! Whatever we do repetitively, will compound. So be very careful of what you choose to work on passively or actively.

The unfortunate reality is our minds do not work in this way. Our minds linearly think of things, one thing happens then the next thing then the next thing. The exponential factor of compounding is impossible for our heads to quickly calculate and think through.

This is why whenever we hear someone say something about saving for retirement, we completely check out. It does not resonate at all. Taking a small number to become a large number seems daunting and impossible. However, compounding is what makes the seemingly impossible, achievable.

Since none of us have a magic penny that doubles every day (if you do please let me know), here is a real example of what compounding looks like. Investing $600/month with an annual return of 10% (most savings accounts pay 3ish%) over 30 years.

Over 30 years, you would have contributed $216,000 but would have $815,639.12. Your investment portfolio made $600,000 with you doing absolutely nothing.

Caveat: Real investing looks nothing like that smooth line in the graph. It does not just go up and to the right. The 10% is the average return of the US Stock Market over the last 100 years.

Now that we understand the magic and beauty of compounding. There is a bigger question that we need to answer.

Why Do We Invest?

There is truly only one reason we invest our money. It is to preserve and grow capital, to enable us the ability to stop working with our brain or back when we either choose or are forced to aka retirement.

Retirement is still generally a new concept for humans. For most of human history, you worked until you died. However, that changed when the Industrial Revolution came about and most people were no longer farmers.

So then that leads to the next question

How much do we need for retirement?

There is something called The 4% Rule. It is based on a study that determined how much we could withdraw from our investment portfolios and never run out of money.

An example is if you had $1 Million, you could withdraw $40,000 every year and never run out of money.

With this rule, we can get an estimate of how much money we would need to retire comfortably. We can calculate our Retirement Number aka Freedom number aka Financial Independence number aka F U number.

For this number, you multiply 25 times the amount you spend annually. Here is an example:

If you spend $60,000/year, you would need $1.5 million invested.

Now we know how much we need for retirement. Four parts play into your investment returns:

Time - how long you are invested for. This is your greatest ally with compounding. Unfortunately, it is also your greatest enemy when you are playing catch-up.

Savings Rate - the percentage of your income you invest

Fees

Taxes

Of these four, you only control one part and that is the Savings Rate. Wanna have more money in retirement, put more money into investment.

What to invest in?

What have you noticed about the way I have been talking about investing so far?

The way I think about investing is not something that I get lucky with or something that I hope for. It is strategic and guarantees that I win as Monish Pabrai says, “Heads I win, tails I don’t lose.”

And It is EXTREMELY BORING! As Mohnish Pabrai says, “When you get excited by watching paint dry, then you are ready to build wealth.”

We all know investing is important to building wealth. However, we have been misguided as to what successful wealth-building looks like. Good investing is not what you hear about, or watch on TV or social media. It is the automatic thing that happens in the background.

Okay, enough teasing time for the details. Let’s start with the accounts you will need:

Company Sponsored 401(k)/403(B)/457/TSP

Free money shall never be left on the table

Also easiest to start with as this can be automatically deducted from your pay

Talk to your various HR people at work

Roth Individual Retirement Account

Vanguard is seen as the Crème De La Crème

However I use Fidelity, and I also like Charles Schwab

It doesn't matter who you choose just choose one that has no fees for opening and managing the account

HSA - Health Savings Account

This might not be open to everyone because it requires a specific type of Insurance

I will skip this one but share it so you can do your research on it

Note: Every account mentioned is tax-advantaged. Which can save you hundreds of thousands of dollars over your lifetime.

So now you have your various investment accounts. What do you invest in:

Low-cost index funds

Nothing over 0.1% in fees aka Expense Ratio

Depending on your risk tolerance and I assume you are around my age so your risk tolerance should be HIGH. Here are two types of funds you should have

Total Market Index

Total International Market Index Fund

If you are too lazy to think about either of those things.

Target Date Index Fund

Year to Select = 65 + Year of Birth

Increase the number if you want more risk

You should want more risk

For step-by-step instructions, check out this post from Personal Finance Club.

Notice the things I did not talk about

Single Stocks

Crypto

Real Estate

Gold

Silver

Oil

Farmland

Foreign Exchange (ForEx)

All those things are like the garnish on a fancy meal. They make the meal look all fancy and exciting but at the end of the day. It's the basic protein, carbs, and veggies that fill us up. Don't get distracted by the garnish, EAT YOUR MEAL!!

Recommendation Section

Ben Carlson in "There Goes My Hero", walks through the death of his brother and shares his story.

Ben Carlson in "Some Things I'm Thinking About", discusses the stuff that actually matters after losing his brother to cancer. Two of my favorite snippets are:

My lists are changing. The list of things I don’t care about is growing exponentially. There is a lot of bullshit in the world I’m more or less done caring about. The list of things I do care about is shrinking, but my feelings for the important things are growing stronger by the day.

Life is for living. Money is for spending.

Warren Buffett in the annual Berkshire Hathaway Shareholder Letter, brags about paying more income tax than any other business in the US

Morgan Housel in Minimum Levels of Stress, perfectly describes the current state of things in the US. Where things are great but yet everyone feels absolutely terrible.

Nick Maggiulli answers the question Is $1 Million still a lot of money?.

Johnathan Clements in Advice For The Kids, gives some of the best financial advice for us youngins in bite-sized form that I've ever seen

There are hidden costs in almost everything we choose to purchase. Doug and Heather Boneparth have a series covering many of them. The latest topic is on Holidays

🎙️Two podcasts I love:

50Fires. It is by Carl Richards, a recovering Financial Planner and Advisor. He could help other people with their finances but had a difficult time talking about money with his wife and children. It has quickly become one of my most anticipated podcasts to listen to every week.

Money For Couples by Ramit Sethi. Ramit is no one new to the world of money and personal finance. In his podcast, he talks with couples about their finances and helps them better enjoy their money or better get aligned. This is very important podcast for me as I enter a new stage of life.