This post is 1,562 words, a 8-minute read. Enjoy!

One of my favorite writers is Nick Magguilli, I love the way he uses data to talk about finances. His blog ofdollaranddata is a weekly read for me. If you get to the recommendation section of the Wednesday Money Mentality, he is a regular feature.

I read his latest blog (as of writing this post) called What is Coast FIRE? The Ultimate Guide to Semi-Retirement

Quick aside: Coast F.I.R.E (Financial Independence Retire Early) is when you have invested enough money that with only the investment returns you can retire by a certain age of your choosing without adding another dollar your investment account. It's my preferred version of the FIRE Movement. Because it means I can front load my savings before various life events happen (i.e. getting married, having kids, aging parents, etc.). That might require me to redirect funds.

This has been my focus with saving and investing for a long time. I always said to myself I will work super hard now, make all the necessary sacrifices so that when those life events happen, I don't have to stress.

It has always been hard trying to balance not sacrificing so much of my life that I miss out on great memories today. But also, not sacrificing the future for what I would look back on as "trivial" moments. It's the balance of "Am I being cheap?" Vs "I'm being frugal."

Which can be hard to manage when you aren't making a ton of money.

Although I knew about Coast FIRE in passing from listening to podcasts. I have never really done any major calculations on it. I have always based my calculations on a previous post from Nick Magguilli (one of my absolute favorites) called Go Big, Then Stop. That post opened my eyes to the idea that I could front load my savings and come out ahead later in life (it also got me extremely focused on compounding in all areas of life). I read that post for the first time in 2022.

So, when I saw the title of this blog on Coast FIRE from Nick, I got excited. I believed that I was about to read how awesome I've been doing and how far ahead I am. But most importantly I expected to read that I could begin slowing down with my savings and investing.

Because I have no idea what my expenses will be in the future. See above for various life events that haven't happened yet. I like to estimate that I'll be spending about $100,000/year in the future which is about 2x what I current spend on myself alone. This includes various savings and income taxes that would go away when I retire. It also includes things like a mortgage that would more than likely be gone because I should own my house outright by then. However, I also assume health expense will go up and might take the place of those expenses.

So, in my head $100,000/year seems to be a good number. For anyone who is far savvier than I, please reply or comment on what I'm missing in my expense assumptions above.

I also estimate that I will retire probably around 67 which is the retirement age in the US. Of course, if I can retire earlier, I will. Maybe I'll have the opportunity to switch to something else and keep bringing in an income.

This means in retirement I would need about $2.5 Million in a portfolio that I can draw on indefinitely and never run out of money. According to the Trinity Study, which is known today as the 4% rule.

Armed with my understanding of compounding and the ever faithful, compound interest calculator on investor.gov. I've always felt pretty decent about where things were and how things were progressing.

But somewhere in my mind, I have always had a feeling that I was not doing enough. I always felt like I was behind and needed to do better.

Well, reading this post was like being hit in the face by Mike Tyson. Cause it caused all my anxieties around money to flare up like a woman going through menopause in the heat (too much?)

The first thing that hit me reading the post was the number Nick used for his rate of return and what he said about the number I used.

The second piece of information is an assumption we make based on market history. While the U.S. stock market has returned about 7% after inflation going back a century, I believe 7% is too high of a return assumption for a diversified portfolio. I prefer to use 4% (after inflation) which is a conservative long-term return that most diversified portfolios should be able to achieve.

This hit like a ton of bricks because almost immediately I knew all my back of the napkin calculations were DEAD!

I kept reading and got to the calculation example of a 35 who wanted to retire at 65 and be able to draw $100,000 from his portfolio. I saw he would need $700,000 at age 35 to be Coast FIRE. At which point, I totally FREAKED OUT!

My thoughts at the time were as follows:

$700,000 ARE EFFING KIDDING ME. I AM NO WHERE NEAR THAT. At this point, I will never reach Coast FI.

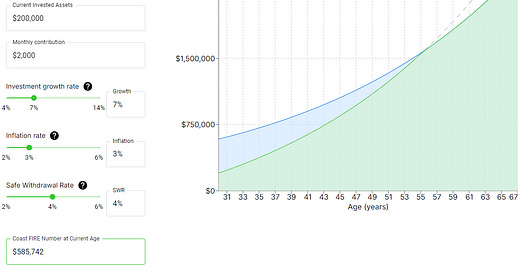

I went to the website and ran my own calculations for where I am and how long it'll take to get to my Coast FI number. It said 26 years.

Coast FIRE Calculator - Coasting to FIRE | WalletBurst

All of a sudden, I felt a feeling that I had never felt before.

DESPAIR

Yes, I had been anxious around money and had fears of the future. But this was different.

Even with my anxieties and fears, I always felt that I could make a change. I could exert more effort more ability.

I felt in control.

For the first time, I felt defeated.

Seeing 26 years was almost laughable. All I could think was:

Well what the hell's the point? If it's gonna take me that long, why the EFF am I doing all this for? Why pursue Financial Independence? Why try so hard? It's all effing pointless!

A cynical nihilist Kelechi began to creep up and take over my mind. I was embracing the darkness that was slowly taking over my mind. I could feel my heart racing faster and faster. My mind running from thought to thought with no exact point. I could feel sweat on my forehead and my palms.

But most of all I felt ALONE, ASHAMED, and POINTLESS!

Then another thought (definitely not mine) came into my mind,

Take It To HIM.

Then another thought,

At least you have options.

Then another,

Bruh Relax.

Then another,

You ain't even factoring in the pension from work.

Then another,

What about social security?

Then another, START WRITING!

As I write this, that feeling of despair and nihilism is still very much front of mind. I'm literally writing this in the middle of my gym

Because I don't want to let this moment go to waste. I want to remember how I felt for all the next times I feel this way. I want to remind myself not to listen to my inner nihilist. Rather choose to listen to voice of hope and truth!

This is the first time I could finally relate to others in a different financial situation than me who have always said "Bruh I don't even know. It just feels impossible." Which I always responded flippantly with "Well what other choice you got?"

Now I have to tell myself the same thing. Truth is truth. It just sucks that truth can be so painful.

Truth is to be able to get to my Coast FI number faster, I need to make some uncomfortable choices. Am I willing to make those choices? Am I willing to pay those costs?

The answer is more than likely NO! If I was, I would have done it and been doing it.

There's a saying, "Knowledge can be a curse." But it only brings a curse when we give it the power to be a curse. It can also be freeing.

I'm choosing for this knowledge to free me from the pressure I've placed on myself to meet an ideal that was always impossible based on the choices I am making.

I am choosing to go to HIM even in my despair.

I am choosing to Enjoy Today and TOMORROW.

I am choosing to believe that regardless of what I may face to rest in HIM, and trust in HIS promises.

If you are where I was and sometimes still am, I want you to write down what is causing those emotions. Then I want you to write down next to it. It is time for a new STORY! Then I want you to write the story you want to tell.

Then beginning each day, do something that moves you towards that new story. This does not have to be just with your finances. Do this for any and every part of your life that brings you despair. I want us to take control over our thoughts and direct our path.

IT IS TIME FOR A NEW STORY!

Remember Generosity is greater than greed.

God Bless You!

✌🏾

Recommendation Section

Nick Maggiulli in Getting Paid to Not Understand It, talks about how Meta plays a role in people getting scammed and a bit about paying attention to the incentives of people.

Ben Carlson in 10 Money Revelations in my 40s, talks through 10 things he has learned about money.

Morgan Housel in A Few Little Ideas And Short Stories. Provides awesome stories to help us understand the world and think better.

There are hidden costs in almost everything we choose to purchase. Doug and Heather Boneparth have a series covering many of them. I have loved learning and reading about them:

A new podcast I am loving is called 50Fires. It is by Carl Richards, a recovering Financial Planner and Advisor. He could help other people with their finances but had a difficult time talking about money with his wife and children. It has quickly become one of my most anticipated podcast to listen to every week.

Katie Gatti Tassin in We're Having Fun Right?, exposes me to a plight I have become more aware of since dating my now fiancee. Being a female in the American capitalist society is a scam. Everything from the pink tax to the ever-growing attack to make women more aware of their imperfections. It disgusts me!

Jack Raines in The Cost of Apathy discusses how the modern world can rob us of our ability to live a fulfilling life because of the comforts that we have. He challenges us to choose a life path and TRULY LIVE.