This newsletter is 3,122 words a 15-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

✋🏾Fed Says NO CHANGE

🎓💸Student Loans ARE BACK

😐Trade Deal is Made ... Sort Of

Company News

🪄Disney's Magic Returns

Stats of the Week

🎞️100% Tariffs on Movies. HUH?

💸-$140.5 Billion Increased Trade Deficit

🚙$2000 Increase in Ford Vehicles

Looking Ahead

🇺🇸🇨🇳 US-China Trade Meeting

🎈Inflation

🛍️Retail Sales Numbers

🏬Walmart Earnings

Sports I Love

💔Shattered Heart! (Real Madrid)

⚽Man U Stockholm Syndrome

Markets

We still don’t have even a semblance of a trade deal with our largest trading partner—China. In fact, relations remain as frosty as ever. No deal with Taiwan, India, South Korea, Japan, Vietnam, or the EU either. Canada’s Prime Minister stopped by the White House, but he left with nothing but a handshake and continued anti-American shade. And let’s not even talk about Mexico—still no new agreement there.

Yet, the market keeps going up. Why?

In my very humble, very basic understanding, there are a few reasons:

There's a trade deal with the UK in the works (more on that below). Investors see this as a promising sign of what's to come.

China and the U.S. are talking again

The AI hype cycle is back in full swing after last week’s earnings reports.

Does any of this make sense?

Not really. Because on the ground, businesses big and small are all saying the same thing: profits are drying up, and layoffs are quietly (and not-so-quietly) starting. Companies are cutting costs to protect their bottom lines. But investors? They've decided to throw on blinders and charge ahead like bulls at Pamplona.

What am I doing?

Absolutely nothing. My boring retirement investments are staying invested, and I continue making contributions every paycheck. Unless I lose my job, I’m staying the course. Why? Because over the long haul, the future tends to bend toward progress. I love the way Sam Ro puts it:

There’s basically three scenarios investors always have to consider: 1) Things improve from here, and the market goes up; 2) Things get worse before they get better, which means markets could fall before resuming a more firm rally; or 3) Things get worse and never get better.

If we’re facing scenario 3, then we may have bigger problems than stocks not recovering.

Stay Invested and Keep Investing!

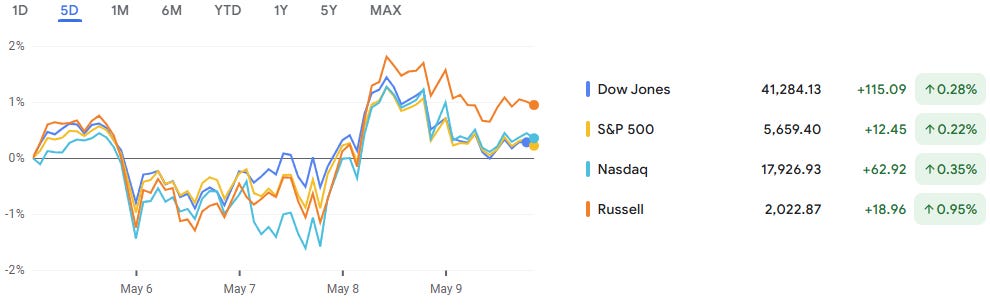

Weekly Returns

Tale of the Tape

Economy

Papa Powell took the mic on Wednesday following the Fed’s two-day FOMC meeting. One word stood out from his remarks: uncertainty—and he used it a lot. Let’s just say it got mentioned more times than Newark Airport had delays last week (okay, almost).

🔎Details: No rate cuts—for now. The Fed believes the economic picture is too unclear to justify a move in either direction. Better to stay put than risk overcorrecting and creating more instability. Inflation remains a concern, and there's growing unease around how tariffs could affect both prices and unemployment.

But here’s where it gets interesting:

On the surface, the economy still looks pretty healthy:

CPI is holding around 3%

Unemployment is steady at about 4%

GDP growth is still chugging along

But dig a little deeper, and some real-time indicators are flashing warning signs:

Shipping volumes are down more than 30%

Job openings continue to shrink

Weekly unemployment claims are on the rise

Consumer sentiment keeps dipping

💬In His Words: Papa Powell, "The risks of higher unemployment and higher inflation have increased, but they have not materialized."

In response to questions about a potential stagflationary environment, Papa Powell told reporters, "Let's just say this would be a complicated and challenging judgment that we would have to make. We haven't faced that question in a very long time."

🪨Takeaway: Right now, there’s not much the Fed can do. Rates are likely to stay high until something significant breaks. The reality is, monetary policy can’t fix issues rooted in poor fiscal or international policies.

As you might expect, Trump wasn’t happy with the announcement. He had this to say: “‘Too late.’ Jerome Powell is a fool who doesn’t have a clue.”

On Thursday, the US and UK announced the first trade deal of the Trump tariff era.

🔎Details: A 10% tariff on the UK will remain on all imports from the UK. The UK will reduce tariffs on US imports from 5.1% to 1.8%

What’s interesting is that the US has a trade surplus with the UK, around $12 billion, but trade volume between the two countries isn’t massive.

One notable exception: UK cars. While the US initially slapped a 25% tariff on all car imports, it’s now been "reduced" to 10%, with a limit of 100,000 vehicles allowed to enter.

In 2024, the US imported 102,000 cars from the UK.

Rolls-Royce engines (critical for planes) and Melrose Industries, an aerospace company specializing in jet engines, are completely exempt from tariffs.

However, there’s still no clarity on other key items like beef, pharmaceuticals, ethanol, poultry, and cereals (yes, animal feed—not your breakfast cereal).

💬In Their Words: A British Official told reporters after the deal, "The optics are out of the way. We've done the Oval Office. Now we've got more serious work to do."

I like the way University of Michigan economist Justin Wolfers put it: “It's a photo op, with little macroeconomic significance."

🔢By The Numbers: The UK isn’t one of the US’s largest trade partners. Last year, the UK exported $68 billion worth of goods to the US. For comparison:

India exported $87 billion

Taiwan $116 billion

South Korea $132 billion

Vietnam $137 billion

This is why the deal with the UK was a bit easier to hammer out—but don’t expect it to be a sign of things to come.

🍔Takeaway: Honestly, this deal feels like a bit of a nothing burger. It's all the bread, but without the meat to really sink your teeth into. The UK isn't a major trade partner with the US, and not much has really changed with these agreements. It’s reminiscent of when Trump tore up NAFTA and replaced it with the United States-Mexico-Canada Agreement (USMCA)—a change that ultimately didn’t shift much, just some minor tweaks with a limited implementation timeframe.

But, as always, both scenarios allowed Trump to do what he does best: be the star of the show and tout himself as the ultimate "Deal Maker."

🪙My Take: If there is one thing that I will give Trump credit for is for the way he has somehow gotten the countries to almost accept the baseline 10% tariff as a starting point. A few months ago, a 10% tariff was unheard of. Now it feels like countries are willing to accept that.

On Monday, the federal government began collecting student loan payments from defaulted accounts for the first time since 2020. Borrowers with loans in default will see payments deducted directly from their wages, tax refunds, and government benefits.

🧵Background: After the COVID-19 pandemic, federal student loan repayments were paused to help those affected by the crisis.

When Biden took office in 2021, he extended the pause and promised to forgive student loans. However, his efforts were blocked by the Supreme Court.

In 2023, the Biden administration introduced the SAVE plan and made adjustments to existing income-driven repayment plans to ease the burden on borrowers. In response, the Republican Congress filed a lawsuit, which has been ongoing in court.

As a result of the lawsuit, borrowers who had signed up for the SAVE plan were placed in forbearance.

Before leaving office, Biden extended the deferment on student loan payments for these borrowers.

In 2025, Trump took office and attempted to eliminate the SAVE plan, prompting another lawsuit. This led to further extensions of forbearance for affected borrowers.

Trump also announced that all student loans must be repaid, ending the pause on payments, and blocked new sign-ups for the SAVE plan.

This brings us to Monday, when collections finally began.

🔢By The Numbers: There are 42 million student loan borrowers in total. Of these, 5 million are in default, meaning they haven’t made a payment in over 270 days.

An additional 4 million borrowers are in late-stage delinquency, having missed payments for more than 90 days.

Only about one-third of borrowers have been making regular payments on their loans.

💢Headache: Being in default on your loans means they are sent to collections, and the government can directly garnish your paycheck. The default is also reported to the credit bureaus, potentially causing your credit score to drop by up to 171 points. This can severely damage your credit, making securing an apartment, a job, or any new loans difficult.

Takeaway: To everyone who signed up for the SAVE Plan, you're in good standing, as your missed payments won't count towards default. For those who didn't sign up, while the SAVE Plan is currently unavailable, other Income Driven Repayment plans can help you get back on track. The worst thing you can do right now is ignore the problem. If you're one of the 42 million people with student loans, check your loan status on StudentAid.gov.

🪙My Take: I really dislike this system. It feels like universities prey on young people who have no idea about how the system works. Before you say, "Well, they should learn!" my question is: how much does the average American know about money? Do most people even understand loan terms? This isn’t just an individual issue; it's a collective problem. Universities should be held accountable for the loans they hand out, just like a car dealership or mortgage broker.

I’m not a fan of total loan forgiveness, but I do believe in making sense of the system. There should be an easy path for students to pay back their loans without it costing them everything. Repayment should be automatic once someone graduates—like a part of the graduation process. We all had to go through the steps to earn our diplomas, so why not include details about our loans as part of that process?

I also believe the government shouldn’t be incentivizing private companies to profit off these loans. Yes, there should be interest rates, but let’s make it like mortgages—manageable and reasonable for everyone.

Companies

Bob Iger just reminded everyone that he is him and he does this.

📈Stock Move After Earnings: The stock levitated 11% on Tuesday after earnings. Unlike most companies that fear the tariff environment, Disney increased its revenue and profit expectations for the year.

🔢By The Numbers: Revenues increased by 7% to $23 billion from last year.

Net Income (Profits) increased more than 10x from $216 million last year to $3.4 billion this year.

Free Cash flow doubled from last year to $4.9 billion.

Disney+ and Hulu subscriptions added 2.5 million subscribers and now have 180 million subscribers

Disney+ has 126 million, an increase of 1.4 million subs

Revenue increased by 8% to $6.1 billion, but more importantly, operating income increased by almost 10x.

Sports division revenue increased by 5%. However, operating income decreased by 12%

Increased competition continues to drive operating costs higher and higher

But the biggest issue was a one-time write-off.

💬In Their Words: Bob Iger told investors on the call, "The significant improvement in our Entertainment segment demonstrates the effectiveness of the changes we've made and the strength of our content and platforms."

Kelechi's interpretation: I DO THIS!! How dare you doubt me?? I AM HIM!!

Takeaway: Bob Iger has right-sized Disney, which is why profits are flowing for the business. He has cut the fat for the business and is driving the business to greater success much faster than I expected. The streaming business that was loss center is now in full profit maximization mode, and the cash is flowing.

👀What to Watch: Disney announced that a new theme park will be opened in Abu Dhabi. It's first in the Middle East. Disney wants to get some of that oil money. We talk a lot about the content creation arm of Disney, but the real money maker is the parks. 60% of Disney's profit comes from the parks. Which is why it is also investing $30 billion to expand its parks in Orlando and California. The content is the entry point for Disney's real business.

The question is, can consumers continue spending if they feel horrible about their future? Disney ticket prices are already insane.

How will competition disrupt Disney? NBCUniversal is launching a new park called Epic Universe, which will attract some of the potential Disney customers.

How much room do they have to continue raising prices and expecting people to keep shrugging and paying up for the experience?

Can streaming growth continue as Disney has found its perfect Niche, not competing with Netflix on a plethora of content but targeted content for a specific population?

Can it keep competing with Big Tech giants in sports to drive ad growth? Iger said they will be launching a new Streaming offering to take the place of ESPN+ this year.

Biggest question of all, WHO WILL TAKE OVER FOR IGER?

Stats of the Week

🎞️100%

Trump slapped a tariff on movies produced outside the US, and, as he said on Truth Social, "The movie industry in America is DYING a very fast death. Other countries are offering all sorts of incentives to lure our filmmakers and studios away from the United States. This is a coordinated effort by other nations, and therefore, a national security threat. It’s also, on top of everything else, messaging and propaganda!"

What’s going on?: If you’re confused, you’re not alone. This makes zero sense and feels like yet another distraction from the real issues. Also, a trade war focused on intellectual property is one the US can’t win. The top export the US has is intellectual property, and the biggest companies here aren’t manufacturing giants—they’re massive service corporations.

🔢By The Numbers: A large portion of sales for movies come from outside the US. A few examples:

Inside Out made $1.7 billion, 62% of which was from outside the US

Barbie made $1.4 billion, 56% of which was from outside the US

Netflix makes 75% of its content outside the US

Proving my point of mass distraction: Trump also announced that he wants to reopen Alcatraz. in 1963, the government found the site too expensive to maintain, hence its shutdown. But hey the greatest businessman of our generation says he knows better.

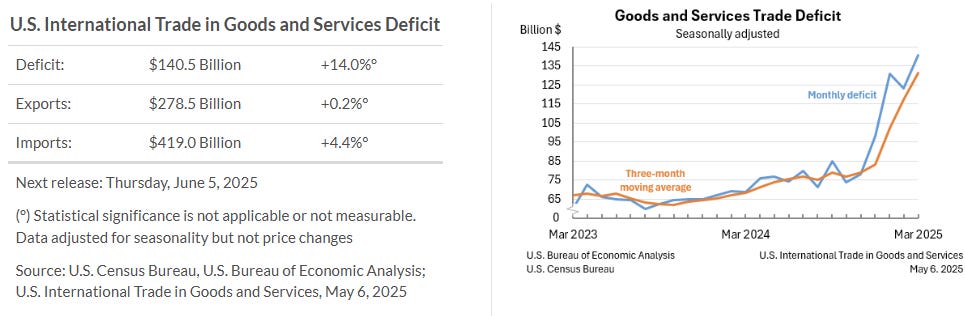

Exports from the US remained steady in March at $278.5 Billion. Imports more than doubled to $419 Billion. Setting a new record for monthly trade deficit.

Ford is the first US car manufacturer to increase prices due to Trump's tariffs. It announced on Wednesday that it will raise prices on three vehicle models: Mustang Mach-E, Maverick, and Bronco Sport. Although the cars are made in the US, Ford imports parts from elsewhere to assemble the cars in the US.

Looking Ahead

More Trade Deals?

The US is set to meet with China to discuss trade, and there’s a lot of buzz that a new agreement will come out of it, one that both sides will accept, potentially lifting those hefty 145% tariffs. But I have my doubts that anything significant will come from these talks.

Why? For a deal to happen, both sides need to feel like they’re winning. Right now, neither side can walk away feeling like they've come out on top. Trump wants to claim victory and tell everyone how he "broke" China and made them bend to his will. China, on the other hand, needs to save face with its citizens and show that it didn’t cave to the "Big Bad US."

But hey, maybe I’m wrong. Maybe there are enough level-headed folks in both administrations who can strike a deal that lets everyone walk away feeling like they’ve won.

Inflation

On Tuesday, we’ll get the CPI report for April. The Fed’s been keeping a close eye on inflation before making any moves on rate cuts. Until they see a print below 2%, don’t expect them to rush into any changes. Then on Thursday, Papa Powell will speak, and we might get some insight into how the Fed is feeling about inflation.

It’s expected that inflation could tick up as consumers rushed to import goods before tariffs kicked in.

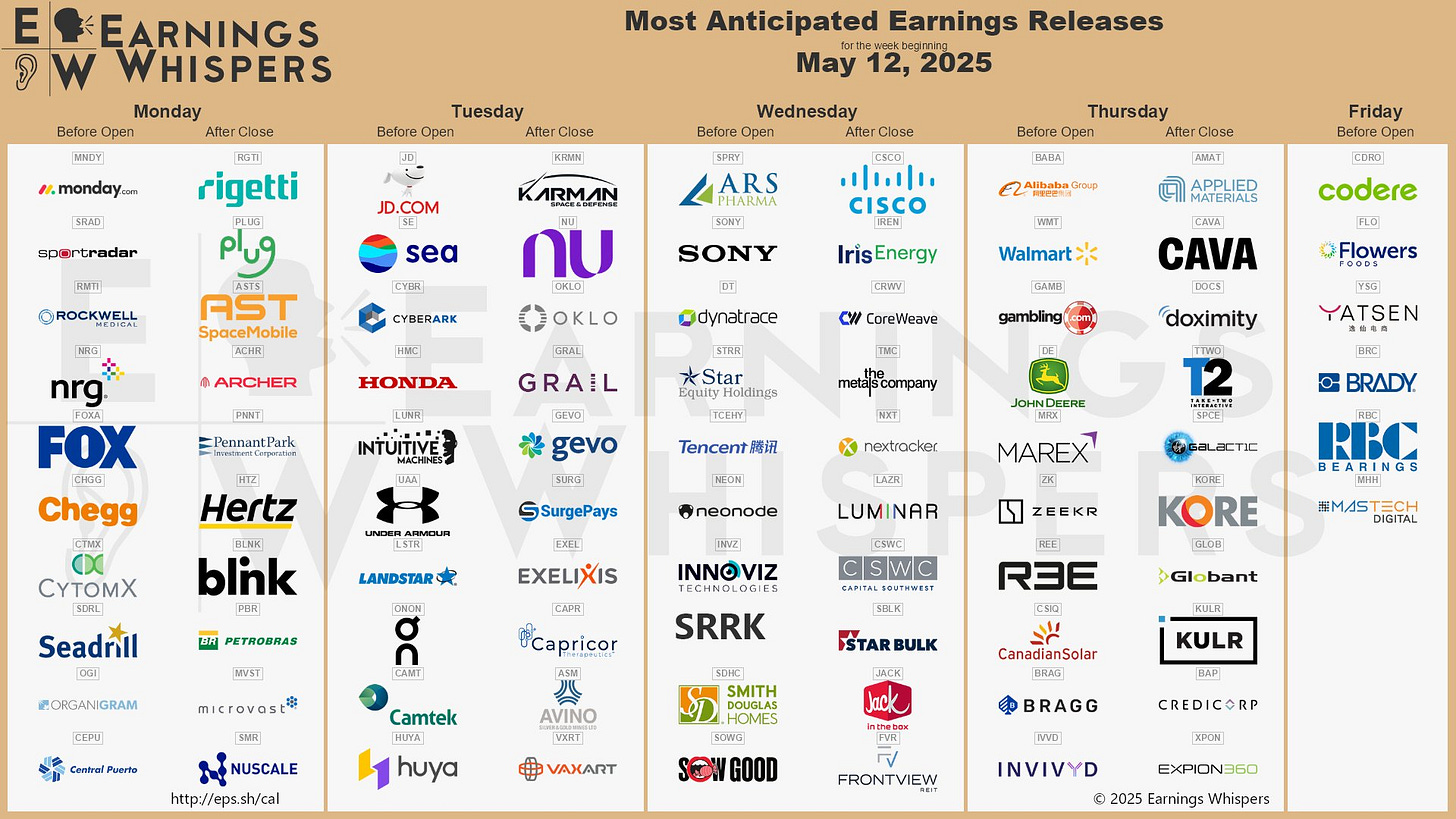

Company/Earnings

Walmart reports earnings on Thursday, and retail spending data will be released the same day. Both will give us a look into consumer trends. All surveys have pointed to consumer sentiment being at an all-time low, but if there’s one thing we know for sure, it’s that America’s spending power is our superpower.

👀 What to Watch

Sports I Love

💔Shattered Heart

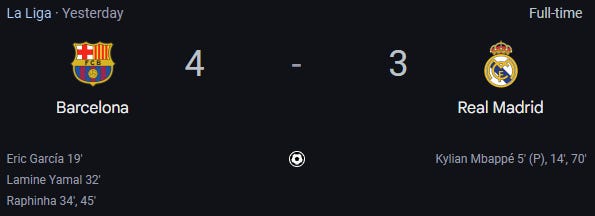

Oh, what's that sound? It's just my heart being broken into a million pieces as Real Madrid gifted Barcelona the La Liga title.

The score makes the game seem close but it was not. Nothing in this game was that different from all the other times Madrid played Barcelona this year. Madrid's defense might as well have been a piece of tissue paper. Over and over, Barcelona was able to do whatever they wanted on offense. Especially on the right side of the field. Lucas Vasquez might as well have been a cone, the way Barcelona went around him like he was not even there.

We gotta get that defense figured out in the off-season. We need some good signings in Center Back, Left & Right Back. Let's hope Florentino Perez does his magical thing and gets things back in order.

⚽Man U Stockholm Syndrome

I am in shock! Man U is going to play in the Europa League Final. I did not see that coming at all. I don't think the players saw it coming either, because they actively tried to blow a 4-0 lead. But thankfully, the team they played was just as bad.

I have no belief that Man U will actually win because my heart refuses to be betrayed again. However, this terrible season could be recovered from.

Yeah, I can't help myself. I have Stockholm syndrome when it comes to this team. 😔

*I am a tiny shareholder in this company.