Gas Prices = Inflation - Market Update July 31 - Aug 4

the only number people care about when talking about inflation

“A lone amateur built the ark; a large group of professionals built the Titanic.”

-Unknown

You have an edge. Sometimes your edge is the fact that you know nothing about a topic which gives you the freedom to try things. Innovations hardly ever come from those within a particular field, it comes from outsiders looking at things from a slightly different perspective. Ignore the noise and do your thing.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Markets

A bit of reality returned to the Stock Market last week after months of rallying up and to the right. The biggest issue was a downgrading of the financial worthiness of US Credit (more on this below).

A slight change in titles moving forward for Market Update. The dates shall now reflect the prior week not the week ahead.

This newsletter is 1,781 words a 9 min read

Tale of the Tape

Economy

A new student loan payoff plan went into effect last Tuesday. You can click the link above and apply. It is called the Saving on a Valuable Education aka SAVE Plan. It is a revised version of the income-driven repayment option aka REPAYE (Revises Pay As You Earn Repayment Plan). This is the Biden Administration's way of helping federal student loan borrowers after the Supreme Court hit them with NOPE on the $10,000 Student Loan forgiveness that was pushed earlier this year.

What's In It?: The SAVE Plan raises the income limit for paying nothing from $22,000 to $32,805. This will allow about 1 million more Americans to qualify for $0 monthly payments.

Unpaid Interest does not accrue on the loan balance even if the monthly payment is $0 (THANK GOD!!)

Beginning in 2024, Loans of $12,000 or less will be canceled after 10 years of payment

Every $1000 above that would add another year to the cancellation

For example, a $20,000 would take 18 years to pay off

Years to Forgiveness = (Your Total Loan - $12000)/1000 + 10

Undergraduate loan payments will be limited to 5% of discretionary funds from 10%

Opposition: The SAVE Plan is estimated to cost between $138-$361 Billion over 10 years. However, we all know businesses do not like their money getting played with. Republican lawmakers especially do not like helping anyone that is not a corporation. 60 Republicans are already looking for ways to challenge this new plan in court. Fortunately, there are similar repayment plans that exist and they have never been challenged successfully. Let's hope that remains the case

Takeaway: It is wonderful to see the Biden Administration trying to find alternatives to their original loan forgiveness to help people struggling to make payments. As expensive as it may seem, this is actually great for the economy as a whole. We saw over the last three years how the economy gets a significant boost when people have excess cash to spend on things rather than on debt payments. It helps GDP grow and creates jobs. This repayment plan is also very targeted rather than a broad stroke.

My Takeaway: Really think about if you want to be on this plan. It is not for everyone and it is not a permanent solution. I see it as a temporary option for the hard times. I prefer for you to take destiny into your hands. Find ways to upskill yourself, make more money, and then pay off the loan faster and get started investing ASAP. However, you can use this option to your benefit to have flexibility while you are on your journey.

I do love the fact that interest no longer accrues. I have always argued against interest on student loans. The benefit for the government is in the much higher tax revenue they will generate from a richer society. You can put the interest rate to prompt people to pay their loans back but there should be workarounds for those who actually pay off their loans (i.e. the various tax loopholes that exist for real estate, stocks, businesses, etc.). Also, colleges need to be held liable for the loans they give out. If students cannot pay off the loan, colleges have to be held accountable as well.

Lots of People getting this message now

The Bureau of Labor Statistics released the JOLTS report for the month of June. It showed there are 9.6 million job openings in the economy. This is the lowest number of job openings we have seen since the start of the pandemic. That is the headline but the details are far more important and not nearly as rosy.

Details: The number of hires at the end of June decreased by 326,000 jobs.

The number of quits decreased by 295,000 jobs

The number of layoffs remained the same overall but increased for professional and business services aka white collar jobs by 112,000.

Manufacturing jobs continue to see a high demand for workers

In The Weeds: The Labor Department released the nonfarm payrolls from July and as expected the US economy added 187,000. Showing a cooling labor market.

The Labor Department also report a revision of 49,000 fewer jobs being added in May and June

Unemployment fell from 3.6% to 3.5%

Takeaway: This is great news for one Jerome Powell but horrible news for workers. The labor market is cooling. According to Jerome and the Feds, this will drive inflation to its 2% target.

Fitch, a business and country credit rating agency (what FICO is for you and I), downgraded the US Credit rating from AAA (the highest rating) to AA+.

In their words: "In Fitch's view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025. The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management. In addition, the government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process."

Explanation: US, get your S#!+ TOGETHER! The risk of the US defaulting on its loan is higher than normal due to the continued bickering of politicians.

Earnings

In case you forgot, Apple makes money like Messi dominates the MLS (literally making the entire MLS look like middle schoolers). Apple reported Q2 Earnings on Thursday and met all analysts’ expectations. Apple made $81 Billion, and $39.7 Billion was from iPhone sales. But more importantly, Apple services i.e. Apple Music, Apple TV+, etc. brought in $21 Billion a new record.

In Their Words: "Our June quarter year-over-year business performance improved from the March quarter, and our installed base of active devices reached an all-time high in every geographic segment," Apple CFO Luca Maestri said in a statement.

Details: Apple has a 45% gross profit margin which is insane for a none hardware company to have. The services unit is really driving all the profit growth for the company. Apple just crossed 1 Billion paying subscribers. This is why the company can do $24 Billion in share buybacks.

If you are wondering where all your money went, I think I found it. Amazon made $134 Billion in Q2, an 11% increase from last year. It is insane that a company this massive can still increase revenue by double digits. AWS, the most profitable part of the business, made $22 Billion in the quarter a 12% increase.

In Their Words: "To grow double digits on an $80 billion revenue run rate business [AWS], when ... every company in the world is trying to save as much money as they can [in] the last year ... means that we're acquiring a lot of new customers and a lot of new workloads," said Amazon CEO Andy Jassy

Details: Amazon made $8 Billion in Free Cash Flow. It is the first quarter since the pandemic that Amazon has been profitable enough to have excess cash. After spending the last three years investing in its infrastructure, Amazon is back to focusing on profitability.

Side Note: Amazon still sucks at physical stores but is still trying to compete with Walmart, Target, and Krogers.

Stats of the Week

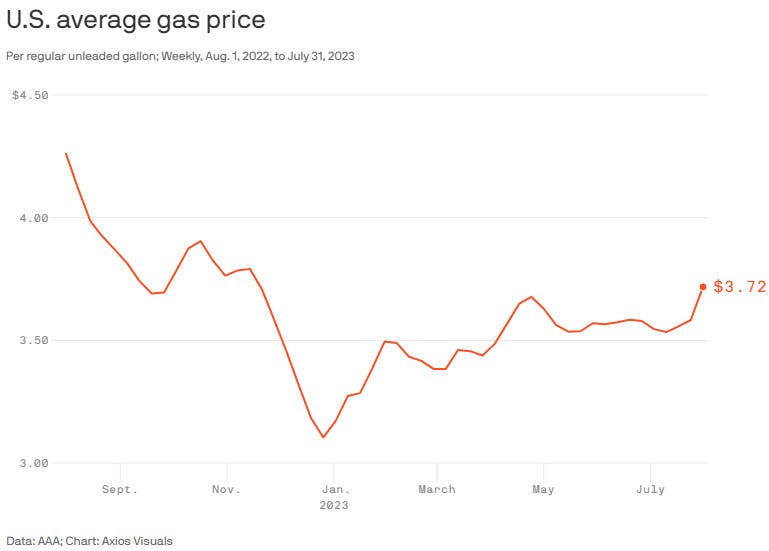

Once again we will be faced with a barrage of people complaining about inflation because gas prices are once again rising. Except for a whole lot of, pictures of gas with the caption "Thanks Biden".

First, No president has a say over the price of gas. No matter how much they try to take the victory for bringing it down.

Secondly, the price pressure is due to heat and storms. Due to how hot, it has been this summer refineries have not been able to operate at full capacity. Therefore less gas will be produced. Plus Saudi Arabia has been doing a great job of limiting production to keep prices high for their bottom sheet.

$1 Billion

Barbie really got that Girl Magic working.

After three weeks of showings, the blockbuster of the summer hit the $1 billion mark. Becoming the first solo woman-directed film to hit that threshold.

According to Bankrate (such an underrated site), the value of all the unused gift cards in the US is about $23 billion. Basically free money for so many stores across the US. Bankrate found that 47% of US adults have at least one unused gift card, voucher, or store credit just sitting in their wallets collecting dust. I know I am in that number cause I believe I have a Home Depot card I have not used.

Looking Ahead

Inflation

Gas is once again in the headlines so there will be a heavy focus on the inflation numbers for the month of July, which will be released on Thursday. Economists, who have been wrong about everything inflation, expect prices to have risen by 0.2% from June and for inflation to increase from 3% in June to 3.3% year-over-year.

Core inflation (removes food and energy prices) is expected to remain at 4.8%

Not So Magical

Disney* reports earnings on Wednesday. It has not been a good few years for Mickey and Company. Streaming has not been a money-maker for the company. The movie magic of Disney seems to have faded as more movies have been flops all year long. People are seemingly exhausted from all the superhero sequels. Plus there is the Writers and Actors Strike going on. So a lot of clouds on Bob Iger's head right now.

Other Companies Reporting

Sports I Love

T-5 Days

Extras

NO NO NO

Can we not!! Why?!! Why is this already here?!!

Can we relax?!! UGH!! Capitalism is annoying!!!

*I am a tiny shareholder in this company.