GDP 🔼 Inflation 🔽 - Market Update July 22-26, 2024

All Economic Signals are Looking Good but there is a catch

This newsletter is 2,282 words a 10-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

Economy is Looking Good - Inflation and GDP numbers show

Company News

Google Great Earnings - Didn’t matter

Tesla Sad Earnings

Other Companies - Spotify

Stats of the Week

$5.4 Billion lost by Fortune 500 Companies due to CrowdStrike Outage

$10 Uber Eats Gift card

$80.5 Million made by Twisters - Sequels are everything

$81 Million - Women Run The World

$923 Million - Nuclear Fusion Investment

1000 Spies at the Olympics

Looking Ahead

All About Jobs, Jobs, Jobs

JOLTS report released Tuesday (Big Deal for FOMC)

Nonfarm Payroll released on Friday

Fed Meet on Tuesday and Wednesday for FOMC Meeting

Big Tech Enters Stage Center:

Microsoft on Tuesday

Facebook on Wednesday

Apple & Amazon on Thursday

Sports I Love

NBA Bidding War or Lawsuit

Markets

71 Companies in the S&P 500 reported earnings last week, which was reflected in the volatility we saw in the stock market last week. Expect more of the same this week because another 70 companies will be reporting this week. However, the markets are driven by the Big Tech stocks. Last week those stocks began declining and the market followed their lead. With Apple, Microsoft, Apple, and Facebook, reporting this week expect whatever direction they go, so will the market.

Breathe my friends. Breathe! As always, we stay invested regardless of what is happening. Remember the best decision you can make when investing for the long term (5+ years) is JUST KEEP BUYING!

Tale of the Tape

Economy

All signs are pointing to a very healthy economy right now. GDP and PCE numbers released last week showed great signs.

🔎Details: Economists had been expecting a slowing growth rate for the United States economy as inflation and higher interest rates had eaten into consumer spending. However; GDP numbers released on Thursday, showed strong economic growth.

GDP showed the US economy grew by 2.8% after a slow 1.4% growth in the first quarter. Economists expected growth of only 1.9%

Capital spending was a main driver as businesses seemed looser with the dollars in their pocket. Spending increased by 5.2%

PCE (Personal Consumption Expenditures), the Fed's preferred inflation metric, showed inflation increased by only 0.1% between May and June and prices increased by only 2.5% from last year.

⏸Pause: Before we get all excited about these numbers. The GDP numbers are preliminary numbers for Q2. We will not get full numbers until later in the Quarter. Similar excitement existed with Q1 GDP but that number was revised downward when final data was acquired.

Layoffs are beginning to tick up with over 112,000 layoffs across the country in July. This brings the total number of layoffs this year to 1.65 million. Although not that crazy, it is a canary in the coal mine. We need to listen to that canary.

🎉Takeaway: Celebrate the temporary victory. Investors and home buyers should be very excited because this means the Fed will likely cut interest rates this year. It might even be more than once.

🤔My Takeaway: Anytime I mention layoffs, I am contractually obligated (to myself) to ask, “DO YOU HAVE YOUR EMERGENCY FUND?!” Life comes at us fast and things change faster than we expect. As they say, “Stay Ready and You Ain’t Got To Get Ready.”

Companies

First Big Tech Company to report Q2 Earnings and it was great. However, investors said,

📉Stock Move After Earnings: The company beat on top and bottom numbers. But still, the stock declined 5% after announcing.

🔢By The Numbers: Revenues increased 14% to $84 Billion (just insane how much money this company makes)

Profit increased by 29% to $23.6 Billion from $18.4 Billion last year.

Cloud Revenue continues to grow at a very healthy rate.

It brought in $10 Billion for the quarter

For the first quarter ever, it made more than $1 Billion in profit.

Cloud will play a massive role in Google's continued growth

Even with competition from Instagram and TikTok, YouTube continues to grow.

YouTube made $8.6 Billion in ad revenue a little lower than expected ($8.93 Billion).

Even Waymo (Google's self-driving unit) is bringing in revenue for Google

Right now, it's pocket change, bringing in $365 million. However, initial reactions have been very positive

I used a Waymo when I visited my brother in San Fran and it was amazing.

👀What to Watch: Investors overreacted to one announcement Google made. Google announced an additional $5 Billion investment into Waymo to expand into other cities. Investors are not interested in capital investments right now. They only want to hear about cash returning to them. However, these investments position Google to remain dominant for years to come.

In Their Words: Sundar Pichai said on the earnings call, "Our strong performance this quarter highlights ongoing strength in Search and momentum in Cloud. We are innovating at every layer of the AI stack. Our longstanding infrastructure leadership and in-house research teams position us well as technology evolves and as we pursue the many opportunities ahead.”

As a small shareholder, I was very pleased with the company.

😯Suprise: Not as much mention of AI during this earnings report. Probably because they are not making any money from their investment in the unit.

📉Stock Move After Earnings: Tesla's report was bad. The top line looked good but as they say, the devil is in the details. Those details are ugly. The Stock fell 11% after the earnings release.

🔢By The Numbers: Overall revenue increased by 2% to $25 Billion due to an increase from its energy and storage division.

Car revenue declined by 7% to $20 billion from $21.6 Billion last year.

Gross margins have been declining since hitting a peak in 2021 of 21%, it is now 14%.

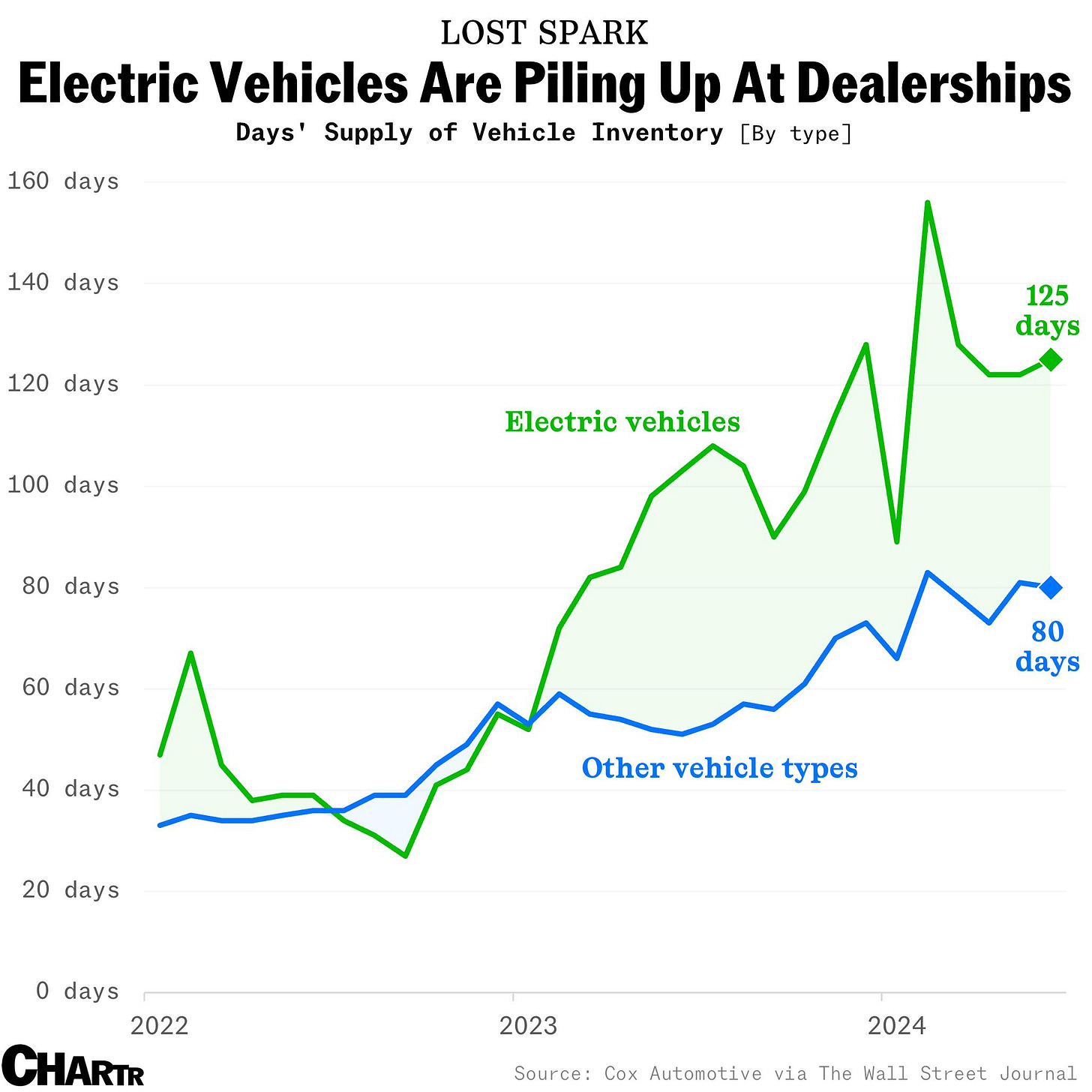

Takeaway: Tesla is in a bad spot. No matter how much people try to ignore it, Tesla is a car company. It has the same profit margin as other car manufacturers. Even worse, Tesla is the king of EVs and in the current climate, no one wants to buy a $30,000-$50,000 car, which is the cost of most electric vehicles—putting Tesla in a bad position.

👀What to Watch: Promise of Robotaxis by Elong Musk is supposed to be the savior of Tesla. Elon Musk on the call said, "I would be shocked if we cannot do it next year." In response to questions about when Tesla will release its robotaxi update to cars.

Here's the thing, I just mentioned Google's Waymo which is already on the roads and is already making money for the company with its robotaxi.

Elon and Tesla have been promising robotaxi for years now, which is the reason the market cap of the company is larger than every other car manufacturer combined.

However, those promises have always been one year away with nothing to show.

So, it is hard to believe the words coming out of Elon's mouth. Tesla is a company I will continue to avoid. It’s all smoke no substance.

Other Companies

The winds are changing for this company. After major restructuring aka layoffs, Spotify is finally turning the company profitable. It reported a revenue increase of 20% and an income increase of 30%.

Stats of the Week

The estimated amount the CrowdStrike outage cost Fortune 500 companies. Healthcare saw the greatest losses at about $1.9 Billion and Airlines lost about $860 million (with Delta having the highest losses and still struggling to get back online).

Twisters, the sequel to the popular Twister movie, made $80.5 million in the US and Canada box office over the weekend. This summer, unlike last year, sequels are dominating in theaters.

Inside Out 2 (the movie of the year in my opinion) has made $1.4 billion since its release in June.

Despicable Me 4 has made $574 million since its release 3 weeks ago.

With Deadpool & Wolverine releasing this Friday (already made over $50 million as of Friday) and sequels like Gladiator 2, Joker 2, and Beetlejuice 2 (I don't get why people like this one) coming out later this year. It seems this will be a great year for movie theaters.

The amount Kamala Harris's campaign fundraised, one day after Biden announced he was stepping down as the Democratic candidate. This is the single-day record for a presidential campaign. Another $150 million was raised by the Democratic super PAC Future Forward.

The donations have been led by WOMEN! Both White and Black.

There is a lot of excitement for Kamala Harris to be the next president. Most Democratic House Representatives (186 of 212) and Democratic Senators (41 of 47) have voiced and voted their support for Kamala. Ensuring she’ll be the Democratic candidate. It was a 180 from a few weeks ago when Biden looked a mess during the debate

Takeaway: The World is about to see the reality that WOMEN run things. For those who have not been paying attention, Women are on track to earn more than men in the US. There are far more college-graduated women who earn more than men.

In Politics, MONEY TALKS. Women hold the money and those Dollars are SHOUTING! I love to see it.

Nuclear fusion is having a moment. In the last year, almost $1 Billion has been invested in the nuclear fusion industry. The key change came last year, when a fusion reactor was able to generate more power than was used in the process. This has invigorated the space and opened the wallets of investors.

French Officials said they booted 1,000 suspected spies from the Paris Olympics on Tuesday.

💬In Their Words: The French Interior Minister told reporters, "We're here to make sure ... that sport isn't used for spying, for cyberattacks or to criticize and sometimes even lie about France and the French."

Some 4,000 other individuals were removed from Paris as well. Officials said these individuals were flagged for political extremism.

Looking Ahead

Busy Week for Nerds Like Me

Tuesday, the JOLTS (Job Labor and Turnover Survey) report will be released. It will give us insight into the Labor market is going. If it shows layoffs continue to rise, it might be a sign of an oncoming recession.

Wednesday, Papa Powell and his Fed buddies aka governors will meet to decide on interest rates. The hope is for the Fed to cut interest rates, but the expectation is for the Fed to set the table for rate cuts during the next FOMC meeting in September. The JOLTS report might play a role in the decision by the Fed.

On Friday, we get nonfarm payrolls. The Federal Reserve has two mandates. Ensure stable prices, aka inflation, are not out of control. The second is to ensure that there is a healthy job market. Unemployment continues creeping upwards since its fifty-year low of 3%. Currently, it sits at 4.1%. If it goes any higher, it might spook the Fed to act sooner rather than later.

👀 What to Watch

More Heavy Weights take the stage this week:

Microsoft reports on Tuesday: questions will center on profits from the heavy investment Microsoft has made into OpenAI.

Also is Cloud revenues still growing at double digits?

Facebook reports on Wednesday: I have no idea what questions will be asked here. I think they will have a marvelous quarter using Google as a proxy.

Also, expect a lot of pushback on Zuch’s desire to invest more for a VR world.

Apple and Amazon report on Thursday.

Apple has been riding a high since it revealed its AI prowess in June which cemented the need for more iPhones in the future.

Q2 tends to be a slower month for device sales of the company. Questions will be around the expectations for sales in Q3 after iPhone 16 is announced.

If Apple does not provide strong guidance for the rest of the year, the stock will recede. However, Apple tends never to share guidance anyway so……

Amazon cloud competition from Google and Microsoft with no real AI competition.

How successful was Prime Day? Estimated amount is $14 Billion

Is this a good sign for the rest of the year?

Other questions will be around Amazon’s rumored investmen in retailers (Saks-Neiman Marcus).

Even More Companies Reporting This Week:

Sports I Love

Warner Bros told Amazon and the NBA,

The NBA replied

A previous announcement said Amazon, ESPN, and NBC have agreed to a new TV rights broadcast deal with the NBA worth about $7 Billion/year. However, one thing no one paid attention to at the time was the fact that Warner Bros (owners' of TNT) has something called a "matching rights provision" in their current contract with the NBA. This means that WBD has the right to match a bid from any TV broadcaster.

The Current Agreement is broken into 3 parts:

Package A - ESPN will pay $2.8 Billion/year for the Finals and weeknight games. Same what they currently own.

Package B - NBC will pay $2.6 Billion/year for the All-Star Game and weeknight games. Currently owned by TNT, so Tuesday and Thursday night games will be on NBC.

Package C - Amazon will pay $1.8 Billion/year and get a conference final series every other year.

😱The Intrigue: Well on Tuesday, Warner Bros exercised their “matching rights provision”. They wanted the Amazon TV package.

The NBA saw the note from WBD and dismissed it faster than a used napkin.

However, by ignoring Warner Bros the NBA opened itself for a lawsuit.

💑Takeaway: WBD is like the guy who had a great woman but decided there was more fish in the sea and they could do better. He forgot a good woman is a VERY HARD THING to find in these streets. So now he regrets it and she has an even better man (Amazon), but he wants to get into a fight for her. She DON’T WANT YOU! Move on!

*I am a tiny shareholder in this company.