Goodbye High Yield Savings Account - Market Update Dec. 2-6, 2024

This newsletter is 1,693 words a 8-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

⚒️Final Labor Report of 2024

Company News

🤖AI or Nothing

♟️Amazon Chess Move

🏆Salesforce Shows Champion

Stats of the Week

🍿$221 Million Spent on Moana 2

🛍️$10.8 Billion spent on Black Friday

✈️3.1 Million Flew for the Holidays

✝️22% increase in Bible sales

🌊95% Chance of Flooding

Looking Ahead

🎈Final Inflation Report

Sports I Love

⚽Same Old, Same Old

Markets

Last week’s newsletter? Not my finest moment. I reread it and thought, "Bro, where were you?" The Thanksgiving Fog hit hard! But after a week of snapping back to reality, we’re back on track.

While I was indulging in all the deliciousness that comes with family time, the stock market was pulling off an Olympic Champion performance, smashing record highs. My big question: "How long can this party last?" At least we’ve got the “Santa Claus Rally” to look forward to. Will it happen? Who knows. But it’s been a stellar year for investments!

Year-To-Date Returns

Tale of the Tape

Economy

⚒️Final Labor Report of 2024

😓Bleak View From ADP Private Payrolls

On Wednesday, ADP released its monthly private payrolls report. In November, 146,000 jobs were added—decent growth but less than October's 184,000 and below the expected 163,000 jobs.

Education and Health Services: Added 50,000 positions

Construction: Added 30,000 positions

Transportation and Utilities: Added 28,000 positions

↗️Wage Growth: Increased by 4.8%, meaning wages are now outpacing inflation by a solid margin.

💬In Their Words: Nela Richardson, ADP's chief economist, told CNBC, “While overall growth for the month was healthy, industry performance was mixed.”

In Kelechi's Words: The report was aight at best.

🌹Nonfarm Payrolls Paint a Rosier Picture

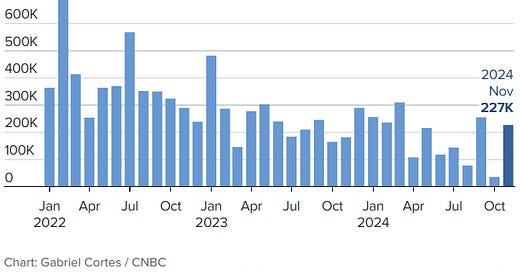

On Friday, the BLS nonfarm payrolls report showed a more optimistic outlook. November saw 227,000 jobs added, surpassing the expected 214,000.

🔢By The Numbers:

Upward Revisions for Previous Months

September: Revised up from 223,000 to 255,000 jobs

October: Revised up from 12,000 to 36,000 jobs (impacted by hurricanes and strikes)

Unemployment Rate: Remained at 4.2%

Labor Force Participation: Steady at 62.5%

Healthcare Services: Added 54,000 jobs

Leisure and Hospitality: Added 53,000 jobs (holiday season effect)

Government Employment: Added 33,000 jobs

Oddly, retail lost 28,000 jobs—unexpected for the holiday shopping season.

💹Wages: Increased by 4%

Takeaway: Ellen Zentner, chief economic strategist at Morgan Stanley, summed it up: “The economy continues to produce a healthy amount of job and income gains, but a further increase in the unemployment rate tempers some of the shine in the labor market and gives the Fed what it needs to cut rates in December.”

In Kelechi's Words: The Fed can cut rates again in December. In expectation of this, stocks rose and treasuries fell.

My Takeaway: Say goodbye to 4%+ savings accounts 😭. It was good while it lasted.

Negative Kelechi Enters Chat

Sorry, I can't help myself. There was one negative item of note in the jobs report. Although the unemployment rate remains historically low, in November, 193,000 people left the labor market. Compared to October, there are 355,000 fewer people employed. Weekly claims have been rising over the year, now averaging over 200,000/week. Earlier in the year, it was closer to 150,000/week.

This points to the difficulty people are facing in finding jobs. While massive layoffs may not be happening, finding a job has become exponentially harder in the last year, leading many to walk away from the labor market.

Companies

🌟 AI or NOTHING

Amazon and Salesforce, two once-overlooked giants, are making waves again with their stocks. Both companies recently showcased how they’re embedding AI across their systems.

♟️Amazon Plays Chess

🔎Details: At its re:Invent conference in Las Vegas, Amazon unveiled several AI-driven innovations leveraging its cloud dominance:

Nova foundation models: Think OpenAI's ChatGPT—but Amazon-style.

Project Rainier: A supercomputer training advanced models, with Anthropic as its first customer.

Trainium2 and 3 chips: Custom silicon enabling customers like Apple to build supercomputers.

Takeaway: Amazon is laser-focused on infrastructure, aiming to be the backbone of AI for enterprises. AWS CEO Matt Garman explained their strategy: "Everybody launched chatbots. We took a step back and said, 'What is the infrastructure and the platform that we think that our broad swath of millions of enterprises and startups are really going to want to build on?' We knew that cost and performance were going to be incredibly important there, and so five years ago, we started building our own custom silicon to support AI models"

My Takeaway: Amazon said, “We playing chess, not checkers.”

🏆Salesforce Shows Champion

Salesforce’s Q3 earnings were solid—good, but not Nvidia-level spectacular.

By The Numbers: Salesforce has a solid quarter. Revenues grew by 8% to $9.44 Billion.

Profit jumped 25% to $1.5 billion.

Gross margin hit 77% (impressive).

Free cash flow margin climbed to 19%.

Salesforce had reported similar numbers in other quarters but the stock was done as much as 30% at one point this year.

The Change: CEO Marc Benioff emphasized their new AI tool, AgentForce,

“We delivered another quarter of exceptional financial performance across revenue, margin, cash flow, and cRPO. Agentforce, our complete AI system for enterprises built into the Salesforce Platform, is at the heart of a groundbreaking transformation.”

His words ignited investor confidence.

📈Stock Move After Earnings: Shares surged 10% post-earnings.

Takeaway: You must have an AI offering and sell it to investors as to why it will help grow profits. It is the only thing investors care about at the moment.

👀What to Watch: How long will the AI excitement last?

Stats of the Week

Moana 2 broke the box office record for Thanksgiving weekend. Bringing in $221 Million! The previous record was Frozen 2's second week of release. Moana 2 added $165 million internationally.

Takeaway: Disney is SO BACK! Releasing banger after banger.

An estimated $10.8 Billion was spent on Black Friday according to Adobe Analytics, an 11% increase from last year. During the Thanksgiving holiday (Thanksgiving Eve to Cyber Monday), about $29 Billion was spent online.

$100 Million was spent on TikTok Shop during Black Friday.

💪🏾Takeaway: The American Superpower remains POWERFUL!

If you traveled back to your place of living last Sunday, you were among 3.1 million other people. This set the record for the busiest day for TSA.

✝️22%

Bible sales increased by 22% from 2022 to 2023. In the same period, book sales only increased by 1%. 14 million Bibles were sold in 2023. 11 million Bibles were sold in the first 10 months of 2024.

🤔But Why?: There are two explanations for this sudden rise in Bible sales:

Anxiety is at an all-time high, especially for Gen Z. They, like every generation before, are seeking a lasting peace that transcends understanding.

According to Pew Research, a large number of the sales have gone to new believers or at least people testing things out for themselves.

People are looking for a better alternative to all the "self-care" that is always being shared on social but never provides the depth everyone seeks.

This is the explanation I want to believe.

My more skeptical side sees a different explanation. Marketers have discovered how marketable the Bible is. Using social media trends.

Mark Bertrand, the founder of Bible-design site Lectio, told Morning Brew something similar, "I'd like to say there is a craving for knowledge of scripture, but a lot of smart people are thinking about Bible marketing and catering to every whim for Bible study."

There are over 8 million TikTok videos with people sharing them buying their Bibles. With most of these videos having hundreds of thousands of views.

🥳🙌🏾My Takeaway: Regardless of the reason, I am here for it!! I believe the Bible is the greatest book ever. It is still the greatest story ever told, it is filled with more wisdom than any other book. It has the greatest message to man and the only hope that I hold onto. I hope everyone who buys a Bible, opens it up and sees the Hope that I have found!!

🌊95%

The most expensive real estate in the US is a house (More like a palace. The thing has 24 bathrooms) in Naples, Florida worth an estimated $295 million. It has a 95% chance of flooding in the next 30 years and a 68% chance in the next 15 years. Even with that understanding, someone will buy this property for the amount being asked.

Looking Ahead

Economy

The final labor inflation report of the year will be released this week. CPI (Consumer Price Index) will be released on Wednesday and PPI (Producer Price Index) on Thursday. It will be the last economic report the Federal Reserve will have before deciding on rates on December 17.

👀 What to Watch: Retail Week

Sports I Love

⚽Same Old Same Old

The more things change, the more they stay the same.

Just as I start believing, United reminds me why I should never believe what my eyes see. This team has these movements where you think, "WOW, they are good!" But then they just revert to their typical garbage play. They make all kinds of unconscionable mistakes.

In this game, United gave a goal in the first minute of the game from a corner. Then they settle into the game and seem to be in total control. Then the second half begins and AGAIN they make another mistake and give up a goal. Less than 5 minutes later, you can feel the team start panicking and they give up ANOTHER GOAL.

Even with a new coach, the spirit of the team is the same. These players do not have the heart to face adversity during a match. At the first sign of difficulty, they fall apart!

*I am a tiny shareholder in this company.