Goodbye Mag-7 Hello BATMMAAN- Market Update Dec. 9-13, 2024

Trillionaires - Broadcom, Apple, Tesla, Microsoft, Meta, Amazon, Alphabet, Nvidia

This newsletter is 2,070 words a 9-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

😐Normal Inflation

Company News

👋🏾Goodbye Mag-7, Hello BATMMAAN

Stats of the Week

🎁$1 Million Donation to Trump

⛽$2.98

🫸🏾60% of Gen Z and 48% of Millennials Love Waiting in Line

📺$83/month for YoutubeTV

Looking Ahead

FOMC Meeting - Interest Rate Decision

PCE Inflation

Sports I Love

⚽The Pain of Enemy Feels SO GOOD

🏈Ravens Back From Bye

⚾Baseball Contracts Make No Sense

🏈College Football Playoffs Begin

Extras

🖥️Google Quantum Computer

Markets

The Trump Bump (😮💨 🤮) has been a real thing as sad as I am to admit it. The NASDAQ crossed 20,000 for the first time, as stocks have been on a tear ever since Trump won the Presidential election. You've probably noticed a nice return on your investments as the year is coming to an end. The market has chosen to ignore Trump's rhetoric about tariffs and believes it's a negotiation tactic more than an actual possible means of action. They think Trump will help deregulate and make business much easier.

How far can the rally go? No idea

But even as scared as I am valuations are stretched and things are a bit too exciting. I will remain invested and keep adding to my investment every time I get paid because my goals are 30 years out not 6 months out.

However, in my stock picking portfolio, I am raising cash ($40/month from paychecks) and looking over what positions I would sell to buy into my best stock ideas.

The point is I have a plan and I am not deviating from my plan because of an orange man. Hope you all are sticking to your plans and not changing things because of short-term excitement.

Happy Investing!

Last Week Returns

Tale of the Tape

Economy

Huh?!: Yes, it is a thing. Inflation is a key part of the economic system. However, in the last 4 years inflation has been anything but normal. The good news is it has normalized (shout-out supply chains going back to normal and high interest rates) and should no longer make people feel uncomfortable every time they go shopping for food.

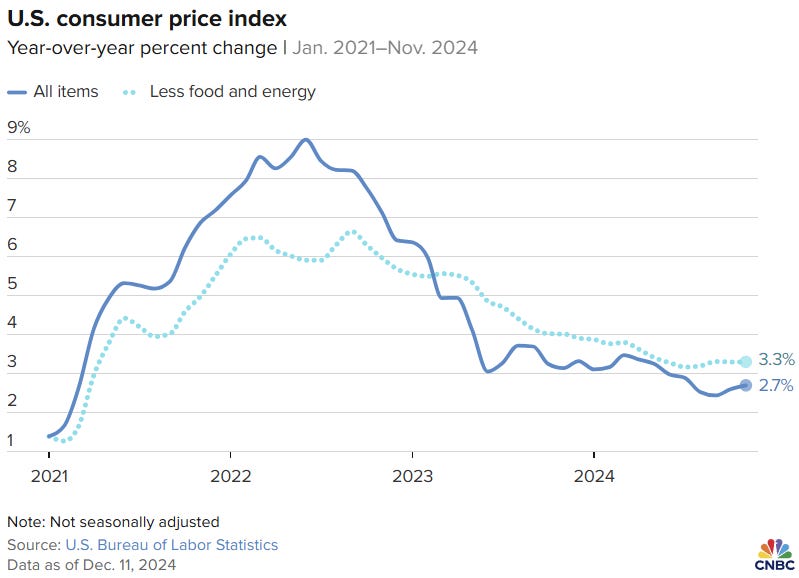

🔢By the Numbers: On Wednesday, one of the econ nerd's favorite websites the BLS released November inflation numbers.

Overall inflation for the last 12 months was 2.7%, a 0.1% increase from October

Month Over Month inflation increased by 0.3%

Core CPI was 3.3%

Month Over Month it increased by 0.3%

Housing remains a core driver of higher inflation, accounting for 40% of the increase in November

It increased 4.7% year over year.

Used cars increased by 2%

Food costs have remained relatively stable, rising 2.4% from last year.

😒Negative Kelechi: Yeah, all that sounds great BUT... The target number for inflation is 2%. Inflation ain't budging past 2.5%. Inflation has not fully normalized and could be reignited with any shock to the system i.e. tariffs.

💬In Their Words: Jerome Powell was asked about this last week. He said, "Growth is definitely stronger than we thought, and inflation is coming a little higher."

Takeaway: We are in a solid place as we close out the year. The Fed is still aiming to cut rates in December. However, there are some signs that things are heating up faster than preferred by our pocketbooks.

Companies

👋🏾Goodbye Mag-7 Hello BATMMAAN

Broadcom, a very important company that you have probably never heard of, surpassed $1 Trillion in market cap. Joining the vaunted Trillionaire class.

🔎Details: Broadcom is a semiconductor designer and manufacturer. It primarily designs and manufactures chips for wireless connectivity.

An example is the chip in your phone that allows you to connect to the Internet or connect to a mobile network is designed and manufactured by Broadcom.

They play a massive role in our mobile-connected world.

Over the last 5 years, they have shifted their offerings to focus more on data centers. Which means they are benefiting from you guessed it, the AI race.

🔢By the Numbers: Broadcom released earnings on Friday and it was spectacular.

Revenues increased 51% to $14 Billion (which was less than expected)

Profit increased 23% to $4.3 Billion

You might be asking, "How does revenues increase so much but not the profits?"

Great Question! The answer is heavy spending on capital investments to meet the AI needs of their customers. It would appear those investments are paying off.

AI revenue increased 220% in the quarter to $12 Billion

📈Stock Move After Earnings: Investors loved that growth number and the stock flew 23% on Friday alone. Joining the trillion dollar club.

👀What to Watch: How long can this AI hype continue sending companies stratospheric? Broadcom's valuation is insane:

Price to Earnings ratio: 195

Price to Sales ratio: 24

To help you understand how insane this is, Broadcom has gross margins of about 30%. About the same as Google but Google does over $200 Billion in revenue a year. Google's ratios are as follows:

Price to Earnings ratio: 25

Price to Sales ratio: 8

Now using these numbers doesn't mean much because when you factor in growth, Broadcom is growing over 50% per year and Google is at 15-20% per year. Investors will always pay more for growth. But the question to ask is how much is too much? The good news is Broadcom makes profits and has strong free cash flow. So it warrants a high valuation. I just worry about the broader market.

😬My Takeaway: There's so much froth in the market so be careful with your investing.

Stats of the Week

The following companies have donated $1 million to the Trump inauguration fund: Amazon, Google, Facebook, and OpenAI. Each of these companies' CEOs has also gone down to Trump's Mar-a-Lago to kiss the ring. Other company CEOs that have also made the pilgrimage include: Visa, MasterCard, Charles Schwab, and Goldman Sachs.

Takeaway: I don't think I've ever seen anything like this in a democratic country like the US. Where companies believe this man is so vindictive and so abusive with power that they believe they must curry his favor even before he has power.

😮My Takeaway: I worry about the future. This looks very kleptocratic to me.

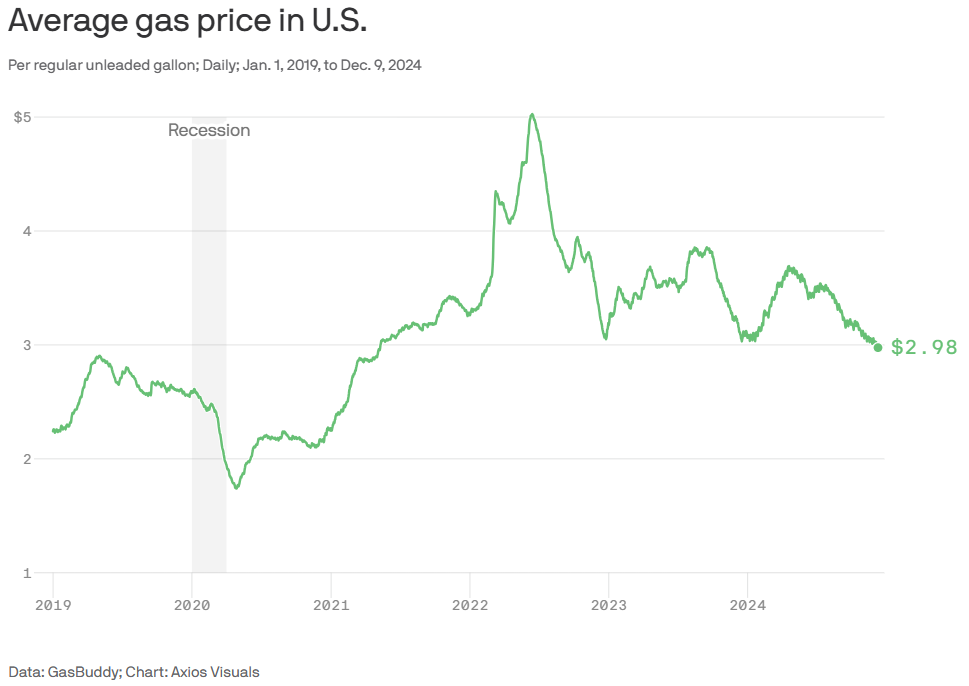

Gas prices fell below $3 for the first time since 2021 after the Covid pandemic causing prices to be negative. Gas prices are a key economic indicator for most people because those giant signs are seen everywhere. It is the one thing people track regularly to know if prices are rising or falling.

Standing in line is the way to make getting food an experience. According to a study by the Coefficient Capital:

60% of Gen Z have stood in line for more than 30 minutes to buy a specific food item

48% of Millennials have done the same

When asked if it was worth it, 92% of people said they would. I CALL CAP! When asked why? One answer reigns supreme, INSTAGRAM!

Ugh

📺$83

What's new will eventually become old. Perfect example YouTube TV which now costs $83/month. Which is about the same (if not more expensive) as regular cable. YouTube TV had pitched itself as a more friendly and cheaper alternative to cable and it was ... for a bit.

🤷🏾Takeaway: YouTube TV is pretty much cable except you have none of the benefits of being able to haggle about prices. When prices go up, you have to accept those increases. Unlike cable which needs you as a customer and would try to keep you, YouTube is backed by massive dollars of Google advertising.

My Takeaway: We have way more entertainment than ever. We have way more choice than ever. However, it is far more disconnected and segmented than ever. I guess the good news is we get to choose what we want and piecemeal things. The bad news is we get to choose what we want and piecemeal things.

Looking Ahead

Economy

The Federal Reserve will be holding its FOMC Meeting on Tuesday. Then on Wednesday, we will hear from Papa Powell on the interest rate decision. The expectation is for the Fed to end the year with another rate cut.

On Friday, the Fed’s preferred inflation measurement, the Personal Consumption Expenditure (PCE) will be released. We will know if inflation has taken a turn for the better or still staying stubbornly higher than preferred.

Sidenote: I also prefer the PCE because the PCE just includes a broader set of items that I believe represent more of our spending.

Company/Earnings

Sports I Love

Muahahahaha

I take back every bad thing I have ever said about Man U. I don't care how bad they are or how bad they will continue to be. I will continue to use this one victory to comfort myself. Did they play particularly well?

NOPE

Did they have a semblance of being a dominant team?

Not Really

But did they just add salt to the wounds of Man City and make my soul happy in ways that only God and my future wife should be able to make my soul pleased?!

HELL YES!!

Some things just mean more to me. Yes, Man U sucks more than a leech in a blood bag. But seeing Man City completely fall apart game after game after game. There is no better feeling.

Ravens Back From Bye

Nothing shocking here. The Giants suck. The upcoming games are massive if the Ravens want to control their destiny for a potential playoff run. But it won't be easy with big games against The Steelers, Texans, and Browns (who suck but Ravens lost to them earlier this season).

More importantly, Netflix will be televising games on Christmas Day. To steal NBA's Christmas Shine.

I still do not understand baseball contracts. Somehow the Mets just signed Juan Soto to the largest contract in the history of sports. To the note of $765 million over 15 years. This is a year after Shohei Ohtani signed a 10-year, $700 million contract.

Unlike Shohei, Juan is not deferring any parts of his contract. Shohei is deferring 97% of his contract until mostly the end. Shohei's contract makes no sense because a guaranteed dollar today is worth more than $2 tomorrow.

Takeaway: Baseball is where the money is for sports. Weirdly, it is also the most expensive sport for children to play.

Extras

A new frontier is slowly being realized in our computer-powered world. Google announced that its Willow quantum processor can solve processing errors much faster. This is important because solving errors has been the core challenge of quantum computers.

Unlike the computers of today that solve problems in a linear sequence (1 & 0).

Quantum computers solve problems by qubits (1, 0, and every combination in between).

The benefit means solving problems much faster. However, that also means errors scale up just as quickly.

Well, Google announced it would take 5 mins to solve a computation that would otherwise have taken 10 septillion years because its Willow processor was able to solve errors much faster.

In Their Words: Michael Newman a member of the Google Research team told Axios, "This is a really big deal for quantum error correction, and it's somewhere that we've been wanting to be for 20 years or so."

Takeaway: This might be the dawn of a new age, where so many of the big problems today could be solved in relatively short order.

Think of cancer cells, they mutate faster than we can analyze them.

A Quantum computer could analyze and then predict the possible mutations which can help to quickly kill off the cancer cells earlier and much faster.

The next step is seeing this being used in the real world. As Hartmut Beven, Google Quantum AI's founder said, "The next immediate challenge for us and the field is to demonstrate a first 'useful, beyond-classical' computation on today's quantum chips that is relevant to a real-world application."

*I am a tiny shareholder in this company.