🦃Happy Thanksgiving - Market Update Nov. 18-22, 2024

Thankful for each person choosing to read this newsletter.

This newsletter is 2,013 words a 10-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Company News

💻Google To Sell Chrome?

📟Nvidia: The Mover of Markets

🛒Walmart: A Forgotten Giant

Stats of the Week

✈️80 Million Travelers during Thanksgiving

🏦4.2% of US Citizens are unbanked

🥊108 Million People Watched An Old Man Fight

🧑🏾🏭65% of Workers Feel Stuck

🍌$6.2 Million for a Banana?

Looking Ahead

🍗The Itis

Sports I Love

😑Man U: New Coach Same Terribleness

😀Real Madrid Wins Again

😅Ravens Play Tonight

Extras

Industries Threatened by Trump’s Mass Deportations

Markets

After you read this newsletter, ignore all things business, politics, stocks, etc. Find a way to completely envelope yourself in the love of those you love and who love you. Watch some movies, some sporting events with your loved ones. Everything else pales in comparison to that.

Oh and Definitely engorge yourself in all the food you can find. Calories don't count until December 1.

Tale of the Tape

Companies

The Department of Justice (DOJ) has finally announced its recommendation for the antitrust lawsuit Google lost earlier this year. DOJ officials said they will be asking the judge to force Google to sell off its Chrome browser.

🤔Wait, What? Earlier this year, Google lost its antitrust lawsuit against the DOJ and was found guilty of being an illegal monopoly. After the court case, the DOJ was asked to make recommendations on what they believe to be the best way to address the monopoly. Historically, this has turned out to be a simple fine for most companies. However, everyone is tired of these large tech companies, and they want to take a pound of flesh.

The DOJ is taking a major step by asking for Google to be broken up by selling Chrome. The DOJ believes that Chrome is the head of the spear to challenge the Google monopoly. If they can force Google to let Chrome go, then they can attack the Google Search monopoly.

🔢By The Numbers: As of right now, Chrome Browser has a 67% market share of worldwide users.

Safari is a faraway second with 18% market share.

It is estimated that Chrome would be worth over $20 Billion if sold today.

⏳Takeaway: The DOJ isn't messing around. This is the first time in over a decade that a ruling like this could profoundly affect a company as large as Google. The last similar case involved Microsoft, which was nearly forced to separate its Windows business from its Office business. However, they settled by agreeing not to make Edge the default browser, ironically paving the way for Chrome to rise.

But there's a long road ahead before anything is decided. The judge won't rule on this case until August 2025, and Google will likely appeal the decision. Nothing will happen quickly in this case.

My Takeaway: I'm not sure Chrome is that valuable to any buyer. Chrome is crucial to Google because it serves as a gateway to everything else Google does. For any other buyer, it wouldn't offer the same benefits. As John Gruber puts it, "It's like saying I have to sell my left foot. It's very valuable to me, but of no value to anyone on its own."

It's also hard to see how the DOJ will separate Chrome from Google. Chrome is Google, and Google is Chrome; there are no clear lines of demarcation between the two. Maybe I'm just too used to the idea of Chrome being Google. It will be interesting to see how this plays out.

Also, I am biased because I am a Google shareholder, so...

Nvidia reported earnings on Wednesday, and it was as good as expected. Which means it was not good enough for investors.

🔢By The Numbers: There was nothing Nvidia reported that was bad. Everything reported was great. Actually no, the numbers were amazing. They beat every expectation that investors had for the company

Revenues increased by 94% to $35 Billion from $18 Billion last year.

Profits more than doubled to $19 Billion from $9 Billion last year.

Gross margin increased to 74%!! Meaning for every $1 Nvidia sells it keeps 70cents.

Apple's margins are 45% and that business does more than $100 Billion in profit every year.

Imagine where Nvidia can be with continued growth!

The biggest announcement was from Jense Huang on the call saying, he expects growth to continue. Closing out Q4 with $37 Billion in revenue.

📉 Market Move After Earnings: Typically, this section focuses on the stock itself. However, this particular stock has the ability to move the entire market because it shapes investor sentiment. Therefore, the market reactions need to be shared. You would expect that with all the great news, the stock market and Nvidia stock would be soaring, right? WRONG?!

Nvidia shares fell 2%

The Nasdaq finished the day down 0.1%

The S&P 500 finished the day flat

Takeaway: Investor expectations have become completely disconnected from reality. Investors expect Nvidia to continue growing at over 200% per quarter, which is impossible. The larger the number, the slower the growth—this is the law of large numbers. However, Nvidia has been bid up to such levels that only that kind of growth can justify its current valuation.

Aswath Damodaran, my favorite investing thinker, said it best: “(The after-hours move) tells you how much the expectations game on Nvidia has been ramped up. They don’t just have to beat analyst estimates; they have to beat them by 10%.”

👀 What to Watch: All questions revolve around Nvidia's valuation. Can it grow into its valuation before investors lose patience? Or before companies stop their arms race for AI chips?

Nvidia also faces an uncertain future under the regulatory regime of the new Trump administration. Trump has threatened to roll back major parts of the CHIPS Act, which provided significant funding to companies like Intel and TSMC that manufacture Nvidia chips.

Walmart was once seen as the bellwether for shoppers. With so much retail moving online, Walmart has lost its market moving power. However, it still plays a very important factor in retail sentiment.

📈Stock Move After Earnings: The Stock increased by 4% after reporting earnings and hit a new all-time high.

🔢By The Numbers: Walmart reported great numbers and shared that holiday shopping has been wonderful so far.

Revenues increased by 5.5% to $169.6 Billion

Profits increased by 8% to $6.7 Billion

E-commerce increased by 22% (which is a major avenue for future growth of Walmart)

Same store sales increased by 5.5%

Walmart advertising unit grew by 26%

Never knew Walmart did advertising but makes sense because it has online sales.

🗨️In Their Words: Walmart CFO John David Rainey said it best, "We had a really strong quarter."

Takeaway: Walmart said it has seen a big increase in households that make over $100,000 shopping in its stores. This means that the inflation pressures have pushed many families to swap luxury for necessity. This plays into the hands of Walmart as a low-cost provider.

👀What to Watch: Recessionary fears drove consumers to Walmart but those fears are beginning to abate as people realize the economy is in a great place.

The question is how will Walmart weather that change in the future?

Also, how will Trump's proposed tariffs affect sales if enacted?

Stats of the Week

According to AAA, 80 million people are expected to travel for Thanksgiving this week. This is an all-time high in holiday travelers. It's expected for Christmas traveling to be even higher.

I will be one of those travels. I wish everyone a safe and tranquil journey.

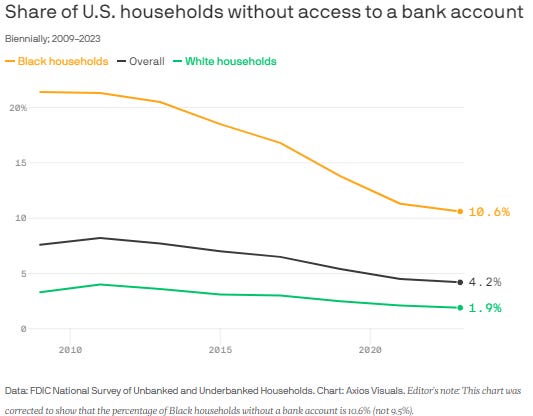

🏦4.2%

According to the Federal Deposit Insurance Corporation (FDIC), the share of unbanked households in the US is 4.2%, a dramatic decrease over the last decade. Black households have been a key driver in reducing this number.

In 2010, more than 20% of Black households were unbanked. Today, about 9.5% of Black households are unbanked.

This is great news because banking provides access to many benefits. It makes paying bills easier, eliminates the need to pay to cash your paycheck, and avoids exorbitant fees for everyday transactions. Most importantly, your money is protected by the FDIC.

However, there is still work to be done. Big banks continue to charge high fees for accounts, causing low-income families to remain outside the protections of banks. Fortunately, many new banking options offer fee-free services, opening the doors for more of the population to access banking benefits.

The number of people who watched the Tyson vs Jake Paul fight on Netflix. It is the most viewed live streamed event in history. This was a good test run for Netflix because they will stream two NFL Christmas games this year.

The bad news is Netflix had over 500,000 outage reports during the stream with users reporting issues throughout the fight. Last year, more than 200 million people watched the Superbowl at the same time. Can Netflix survive during that massive traffic event?

According to a survey by Glassdoor, 65% of professional workers feel stuck in their current roles. After four years of rapid job switching and record highs in job quits, job turnover has declined rapidly. In September, there were 7.4 million job openings, a decline of 1.9 million job openings in 2023.

Takeaway: Employers have regained complete control over the workforce. They no longer feel the need to hoard or compete fiercely for talent. In fact, they now demand more for less because, with the labor market no longer tight, they can generally get the workers they need at any time. This is evident in the significant decline in remote and hybrid positions listed. Additionally, companies like Amazon and Starbucks are forcing workers back to the office and are willing to cut those who do not comply.

My Takeaway: I'm not the biggest fan of surveys. I wonder how much of the discontent is real versus a reality check for workers. Over the last four years, workers were switching roles and receiving significant pay bumps, which incentivized even more job switching. Some of these job switches involved people not fully learning their new roles, and now reality is setting in.

However, the workers most affected by this are new graduates. It is much harder for them to break into the workforce.

A banana duct-taped to a wall sold for $6.2 million.

Looking Ahead

Sports I Love

😑Man U: New Coach Same Terribleness

There is no reason Man U is tying Ipswich Town. But I guess that is the wrong statement because Man U is just as bad as Ipswich.

😀Real Madrid Wins Again

Real Madrid is looking more like themselves after winning back-to-back games. However, the big test will be on Wednesday when Madrid plays Liverpool, who has been on an incredible run beating every single team that they have faced. Wednesday is when we will know who the real Real Madrid is!

I’m afraid we will get the Madrid we have gotten in other Champions League matches cause even in this game, Mbappe was still not that good.

😅Ravens Play Tonight

Extras

Industries threatened by Trump's Mass Deportation

There are so many BS narratives about immigrants stealing jobs. But the reality is companies and consumers benefit heavily from these immigrants. Both from their labor but also from their taxes. It is incredibly shortsighted to forcefully deport this massive part of our labor force. Also, deportation will be insanely expensive!

I do not expect companies or state governments to go along with the deportation plans because we they know the benefits both undocumented and documented immigrants provide.

*I am a tiny shareholder in this company.