Incompetence - Market Update April 14-18, 2025

Hard to see a difference between evil and incompetence

This newsletter is 3,121 words 14-minute read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

🚨The Exemptions Begin

🇨🇳🧧China Retaliates

Company News

📺Netflix Wins

🖥️ASML Struggles

Stats of the Week

🤑$2600

💸$4700

✈️9%

💼❌3 in 1

Looking Ahead

Big Earnings: Tesla, Google, Intel, and Boeing

Sports I Love

⚽This Team is Frustrating

Extras

Harvard Takes A Stand

How Trump Exploits US Law

Markets

Hope everyone had a wonderful Easter Weekend. I know I did. I went on an awesome date with the wifey leading into the weekend. Then Friday went for a powerful Good Friday service, which got me crying and everything. On Saturday, went for an Easter service and got to see some awesome friends and watch some NBA playoffs. On Sunday, went for another Easter service (yes, we real churchy over here) and then hung out with my in-laws and ate myself into a coma.

So yeah, it was a wonderful weekend. This also means that editing this newsletter was kinda a last-minute effort. So I apologize for all typos or weird sentences. I promise you, it made sense in my head.

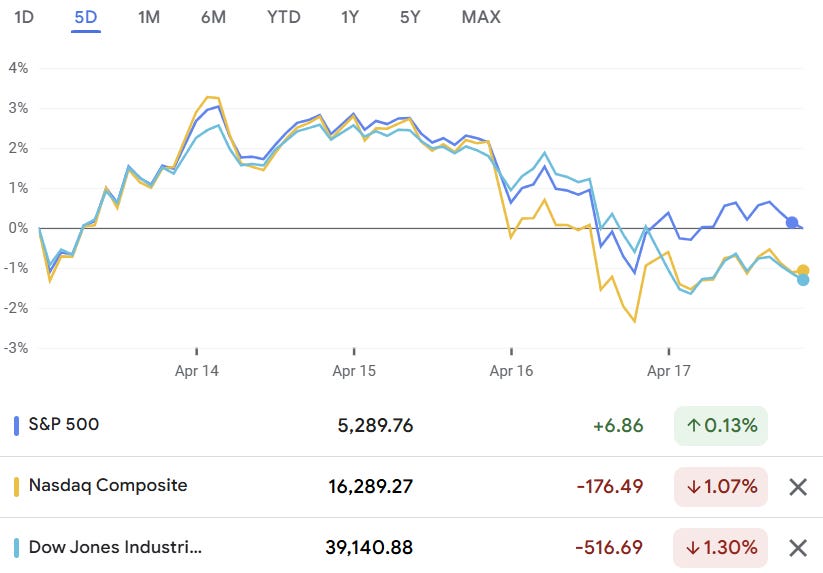

Returns

Tale of the Tape

Economy

🚨The Exemptions Begin

As I thought, these tariffs are gonna have all kinds of carve-outs and exceptions.

🔎Details: Over the weekend, the White House announced that it would be exempting phones, computers, and other electronics from the 125% tariffs placed on China. Then Monday, Trump told reporters he would be pausing the tariffs placed on automotive manufacturers.

🤔Why: You might be wondering, “Why the change of heart?” Well, Tim Cook did the Lord's work and was able to convince Trump that it would be a bad idea and Apple would "invest" in the US. Then Nvidia on Monday announced a similar idea, and Trump was able to claim victory. This led to the exceptions which the White House calls temporary.

❓How: Axios shared the general playbook of how tech companies are planning to goad Trump and get out of these tariffs, or at least get in his good graces to ensure he doesn’t obliterate their business:

Pick a crazy high investment number in the hundreds of billions of dollars, then hedge it by using terms like "up to" and "planned."

Roll together projects that were already in the pipeline with new spending plans to boost the final tally.

Be sure to credit Trump by name, or otherwise signal he made the deals possible, or just don't contradict him when he takes credit.

In a few months or years, feel free to change course or back out as needed.

👄Takeaway: Shout-out to Tim Apple for being the greatest sweet talker known to man. During Trump's first term, Tim Cook was able to get an exemption for Apple products from all Chinese tariffs. This time, he was able to do it not just for Apple but for all computers, phones, semiconductors, and other electronics.

Tim Cook is the deal maker Trump wishes he could be an inch of.

🪙My Take: Rolling the tariffs back is pointless because this proves the US is incompetent and has no idea what it's doing. It also shows that there is no rule of law, but rather, you just have to buy the favor of the president, and you get what you want. It does nothing good for the nation in the short term and guarantees every country will find a way to avoid the US as much as possible.

On Tuesday, China began halting the shipment of rare earth metals to the US in response to US tariffs.

🔎Details: Rare Earth Metals are extremely important for almost every piece of electronic device that we use daily. Everything from smartphones to LED lightbulbs to semiconductors to more advanced things like US military guided missiles.

Although they are called "rare-earth metals," they are actually not that rare to find but they are extremely difficult to mine and environmentally dangerous to process. China has made major investments to be the number 1 miner and producers of these metals.

🔢By The Numbers: China produces 90% of all rare earth metals and 90% of all rare earth magnets.

In 2020, the US pledged $439 million to build domestic supply chains, but that is not nearly enough money to get things moving.

🥊Takeaway: China is not playing with the US. China is meeting force with force. It also ordered its airlines to stop accepting deliveries for Boeing planes in another targeted blow to the US. The US may be the largest consumer of Chinese goods, but China has important materials that the US needs.

China has decided to challenge Trump to a game of UNCLE, and we will see who cries out for relief first. More than likely, it will not be China that does not have to worry about elections.

🪙My Take: This was all my initial reaction when the news was released. It was another apparent way the Trump administration was dropping the ball. But then, in my daily readings and listenings, I learned a new fact. In 2024, the US imported a total of $170 million in rare earth metals from China. Notice that the number is a million, not a billion. This is down from $186 million in 2023. The amount imported from China has declined every year since 2020.

In other words, this is not nearly as crazy a story as the headlines make it out to be. Yes, it is another disruption, but it is not the biggest disruption we face currently.

💡Lesson: This is a key lesson for me in paying attention to my biases. I do not like Trump, and I do not like his economic policies. So, it is easy for me to buy into every bad headline. But I have to be careful not to allow my bias to cloud my judgment. This is why I never invest based on how I feel (at least I try not to invest based on my feelings), cause it will lead me astray more times than not.

Other Tariff News: No one understands what the Trump administration wants in a deal to adjust the tariffs. EU trade officials could not make headway in negotiations with the US on tariffs.

Companies

Been a while since I've been able to focus on the bread and butter of this newsletter. Talking about companies making money.

When it comes to streaming companies, there is Netflix and then there is everyone else. It is not close at all. Netflix has taken over the space, and every other company is competing for third place cause we can't even say there is a second close winner.

📈Stock Move After Earnings: Netflix stock rose 2% as investors view it as a safe place to invest in the current market uncertainty.

🔢By The Numbers: Revenues increased year over year by 13% to $10.5 billion.

Profits increased by 24% to $2.9 billion.

Operating margin increased from 25% to 29%.

Free cash flow increased 24.5% to $2.66 billion.

💬In Their Words: Netflix CEO Greg Peters said on the call, “We also take some comfort that entertainment historically has been pretty resilient in tougher economic times. Netflix, specifically, also, has been generally quite resilient. We haven’t seen any major impacts during those tougher times, albeit over a much shorter history.”

🪙My Take: Netflix is not only a cash-guzzling machine but also becoming a haven for investing because it doesn't face any challenge from tariffs.

👀What to Watch: Can Netflix withstand a recessionary environment? Netflix has been able to raise prices almost every year since the pandemic without too much pushback from consumers. Can they keep doing this? Consumers are starting to pay a bit more attention to their finances and looking for areas to pull back spending.

🖥️ASML

Things were great, but are not looking great.

📈Stock Move After Earnings: The stock fell 5% after releasing earnings.

🔢By The Numbers: ASML reported revenues of €7.7 billion, a 45% increase from Q1 2024.

Profits increased 100% to €2.4 billion

Gross margins increased from 51% to 54%

😓Takeaway: Business is booming. Well, it was booming until tariffs entered the picture. ASML CEO Christophe Fouquet told investors during the earnings call, the tariffs are creating uncertainty for some of ASML's customers. The signs of uncertainty showed up on the booking for the next quarter. Analysts expected €4.89 billion but got €3.94 billion, hence the decline in the stock price.

👀What To Watch: How ASML navigates the tariffs being put in place by the Trump administration. How ASML struggles affect every other semiconductor manufacturer, particularly Nvidia.

Explaining Obscure Financial Terms

Net Bookings: the total value of new customer contracts signed in a period. It is a forward-looking metric that indicates a company's future revenue.

Stats of the Week

The average federal tax refund for 2025 is about $2,600 per the IRS. Here are a few ideas of what you could do with that refund:

Emergency Fund: This can be a great way to start this fund. Have at least enough to cover your highest insurance deductibles.

Pay Off High Debt: If you have credit card debt or other debts with interest rates greater than 8%. This can be a great way to take a nice chunk out of that debt.

Invest: A great way to start investing is to open a Roth IRA and invest a bit of money.

Other Savings: might be a great way to fund that vacation or honeymoon or car, or whatever you have planned

Enjoy: Spoil yourself a bit

According to estimates from Yale University's Budget Lab, the tariffs implemented by the Trump administration will cost the average household an extra $4700. This is higher than the initial $2700 estimated from the first wave of tariffs announced.

✈️9%

Tourism accounts for about 9% of US GDP, approximately $2 trillion annually. With the Trump's Administrations anti-world rhetoric, travelers are choosing to avoid the visiting the US as much as possible.

🔢By The Numbers: Travelers from Germany declined 28% in March, according to Tourism Economics.

💬In Their Words: Secretary of State Marco Rubio said on Saturday, "Visiting America is not an entitlement. It is a privilege extended to those who respect our laws and values. We expect — and the law requires — all visa holders to demonstrate their eligibility every day their visa is valid."

Takeaway: As Henry Harteveldt of Atmosphere Research Group said, "When you're traveling to another country, whether it's for a business trip or a personal trip, you want to have the assurance that you're going to be able to enter the country and be welcomed. The actions and words of the U.S. right now are not very welcoming to international visitors."

The US is becoming like authoritarian countries that people avoid. Not because they are bad or have terrible people, but because you do not know what to expect. Even when you do everything the right way, something could still make you persona non grata.

💼❌3 in 1

On Friday, Trump announced the replacement of the IRS commissioner, Gary Shapley. Ordinarily, this would not be a very noteworthy thing. Except this was the third change of the head of the IRS this week.

🕰️Timeline: On Wednesday, Melanie Krause announced she was leaving due to pressures from the White House. She announced Gary Shapley as her replacement.

Friday, Trump announced Deputy Treasury Secretary Michael Faulkender as Gary Shapley's replacement.

🤔Why: Shapley was Elon's pick for the role. But Treasury Secretary Scott Bessent is feuding with Elon didn't like it. So he pushed Trump for the replacement, and Trump obliged.

😵💫Takeaway: If this sounds like incompetence, TRUST YOUR INSTINCTS.

I find Bessent's words on the announcement hilarious: "Trust must be brought back to the IRS, and I am fully confident that Deputy Secretary Michael Faulkender is the right man for the moment."

Like my guy, you are the reason for the trust eroding. The constant changing of this administration does not instill trust. It does the exact opposite.

🪙My Take: I love this tweet from Larry Summers (former US Secretary of State)

Looking Ahead

Company/Earnings

Earnings Season continues this week with some big companies reporting. Each will provide a better picture of the effects of the tariffs on their business.

👀 What to Watch

Tesla reports on Tuesday.

It will be interesting to hear the story Elon weaves about why the continued declining sales of Tesla is not a big deal. Why should we focus on something other than the company's actual financials?

Capital One reports on Tuesday

Last week, Capital One was cleared to complete its acquisition of Discover. Expect plenty of discussions on the earnings and how the company will benefit from the acquisition.

Intel reports on Thursday

A new CEO has taken over, the third CEO in the last 2 years. The company has lost out on the AI race and continues losing revenues to AMD and Nvidia.

Investors will be interested in hearing what plans this new CEO has to turn the company around.

Investors will want to understand how the tariffs will help or hurt their business.

Google Reports on Thursday

Investors only care about one number from Google: capital expenditures. Will Google hold steady with its $75 billion investment in AI or will it adjust in the face of the new uncertainty brought on by the tariffs?

Sports I Love

The Word is FRUSTRATING!

This game was everything that I love and detest about Man United. The final scores makes it seem like it was a back and forth game but in reality, it was Man U doing what Man U does and almost pooping the bed.

Man U started the game HOT! They scored 2 goals in the first half and were completely in control of the game. Then the second half started, and it looked like everyone on Man U forgot that they were playing football. They were making all kinds of mistakes and lost control of the game. Lyon took advantage and scored two goals.

Extra time started, and Man U went full Man U. By that, I mean, they were worse than a freshly spread manure. Lyon were in complete control and scored 2 goals quickly. Sending me raging more than Hulk.

But then Man U did the thing that makes me love them. They woke up in the final 5 mins and turned on the magic they always had. In 2 minutes, they scored 2 goals to win the match. It was amazing and unbelievable.

Bottom Line: This team SUCKS! But these moments of brilliance keep me stuck. This is an abusive relationship, where Man U does just enough to keep me around and give me nostalgia about the past and what we once had. Even though I know fully well that the past is never gonna be again. But I hold on.

Pray for me.

After writing this on Saturday, Sunday, Man U reminded me exactly of their trashiness losing to Wolves.

I AM DONE WITH THIS TEAM!!

Extras

Details: The Trump Administration has targeted many universities under the guise of "fighting antisemitism". The Trump administration has threatened about 50 universities that federal funding will be pulled unless the administration can decide things like:

The teachers being hired

Requesting that certain professors be fired (typically anyone who spoke out against Trump or others in his circles)

Removing certain degrees from being offered

Rejecting all students from any nation that the Trump administration believes to be "hostile to American values"

Bottom Line: If it sounds like an authoritarian state, Trust Your Instincts.

Some Universities like Columbia have unfortunately complied with the demands of the administration

By The Numbers: These are the universities that have been specifically called out and targeted by the Trump administration, per the New York Times:

Brown University, which the Trump administration said stood to lose $510 million.

Columbia, which is hoping to regain about $400 million in canceled grants and contracts after it bowed to a list of demands from the federal government.

Cornell University, the target of a cut of at least $1 billion.

Harvard University, which has approximately $9 billion at stake. The government has sent the university a list of demands.

Northwestern, which Trump administration officials said would be stripped of $790 million.

The University of Pennsylvania, which saw $175 million in federal funding suspended because of its approach to a transgender athlete’s participation in 2022.

Princeton University, which said “dozens” of grants had been suspended. The White House indicated that $210 million was at risk.

Takeaway: This is another example of the Trump administration's power grab while destroying one of the key sources of opposition, American universities. Part of the Project 2025 was to eliminate the freedoms of higher education to freely question the authority of the government. It is something that those on the extreme right have hated for years and want to eliminate. The recent Gaza v Israel war was a good cover to implement any of the changes they have wanted to make.

In His Words: Harvard decided to fire back. On Monday, Harvard's president, Alan Garber, wrote:

The University will not surrender its independence or relinquish its constitutional rights.

The administration’s prescription goes beyond the power of the federal government. It violates Harvard’s First Amendment rights and exceeds the statutory limits of the government’s authority under Title VI. And it threatens our values as a private institution devoted to the pursuit, production, and dissemination of knowledge. No government—regardless of which party is in power—should dictate what private universities can teach, whom they can admit and hire, and which areas of study and inquiry they can pursue.

In response, the Trump administration paused $2.2 billion in funding to Harvard and threatened to remove Harvard's tax-exempt status.

This article from Axios explains how the Trump administration can bypass Congress (not that Congress would fight back) to do whatever it wants.

TL:DR: Trump has declared more "national emergencies" than any other president in the history of the US. These emergencies allows the executive arm of the government bypass the typical processes.

*I am a tiny shareholder in this company.