Labor Market Appears Calm But - Market Update July 1-5, 2024

Beneath the surface tells a different story

This newsletter is 1,298 words a 5-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

Slowing Labor Market

Stats of the Week

6 Day Work Week Gets Introduced

$1 Billion in Ticket Sales by Inside Out 2

Looking Ahead

Earnings Season Begins

Inflation Report for June

Sports I Love

Celtics Selling Out

Extras

Supreme Court Head Scratching Decisions

Markets

While we took the last few days off to watch fire works and throw meat on an open flame. The Stock Market kept going up and to the right. The S&P hit new record highs last week and the Nasdaq continues to fly with the hype of AI. The Dow however, continues to struggle to keep up with its younger index brothers. It is continually dragged down by stocks like Salesforce, Boeing, and Intel.

Tale of the Tape

Economy

The labor market is growing at a much slower rate than everyone thought. Employers have hit the brakes hard on hiring and more people are applying for unemployment.

🔎Details: On Friday, the nonfarm payrolls for June were released by the Bureau of Labor Statistics. The report stated that the economy added 206,000 jobs. However, the unemployment rate broke the 4% ceiling for the first time since November of 2021. It was 4.1% in June.

Labor force participation continues to rise which is why unemployment is also rising. It now sits at 84% for people between 25-54 years old.

ADP reported only 150,000 private sector jobs added

Government and Healthcare continue to be the heaviest sectors for job additions in the economy.

🔢By The Numbers: The monthly payrolls number is not my main concern anymore. This number might get the headlines and attention. But the more important number is the revisions for the previous months.

April and May jobs numbers were revised down by a combined 111,000 jobs. Essentially cutting the total jobs added in those months in half

This brought the average monthly job gains down from 269,000 jobs/month to 177,000—a massive and unexpected decline.

This signals that the economy has been in a much worse situation than it showed on the surface.

🙂Not All Bad: There was some good news in the report. Wages increased in June by 0.3% bringing the average for the year up 3.9%.

💬In Their Words: Indeed, economist Nick Bunker said, "Today's report shows the temperature of the labor market is still pleasant, but if current trends continue the weather could get uncomfortably cold."

Takeaway: This might be the push that forces the Fed to begin cutting rates. The CME Fedwatch tool (which I typically ignore) currently estimates there is a 75% chance that the Fed will cut interest rates once by September. I tend to agree.

The labor market has been the driving factor for the Fed refusal to cut rates as the market appeared calm from the surface. But as anyone who has been searching for a new job could tell you, there are sharks, crocodiles, and other deadly sea creatures lurking beneath the calm waters. June's jobs numbers were the crocodile eyes peering over the surface.

Stats of the Week

👩🏾🏭6 Day Work Week

Greece passed a law that increased the official work hours from 40 hours per week to 48 hours per week. The Greek government says it is to address a labor shortage. Labor Unions say that is absolutely BS. Greece is coming out of a terrible decade after its implosion during the financial crisis. It wants to keep the momentum up. However, the Greeks are already known for working A TON of hours. They even work more hours than US and Japan, the two cultures known for their workaholism.

🤬Takeaway: Just like eating too quickly causes you to throw up. Trying to force your advantage can easily backfire. Hardly ever is overworking people the answer to drive more growth. At best you get subpar returns, it is better to learn from the US and what happened in that past when businesses worked people to the bone. The reason we have a 40-hour work week in the first place. But I guess if the 6 days a week schedule works in China, it could work elsewhere 🤷🏾♂️.

Pixar is back on top.

Inside Out 2 is the first movie since Barbie to make $1 Billion in global box office sales and it is still rising rapidly. It is the fastest animated movie to make $1 Billion in history.

Looking Ahead

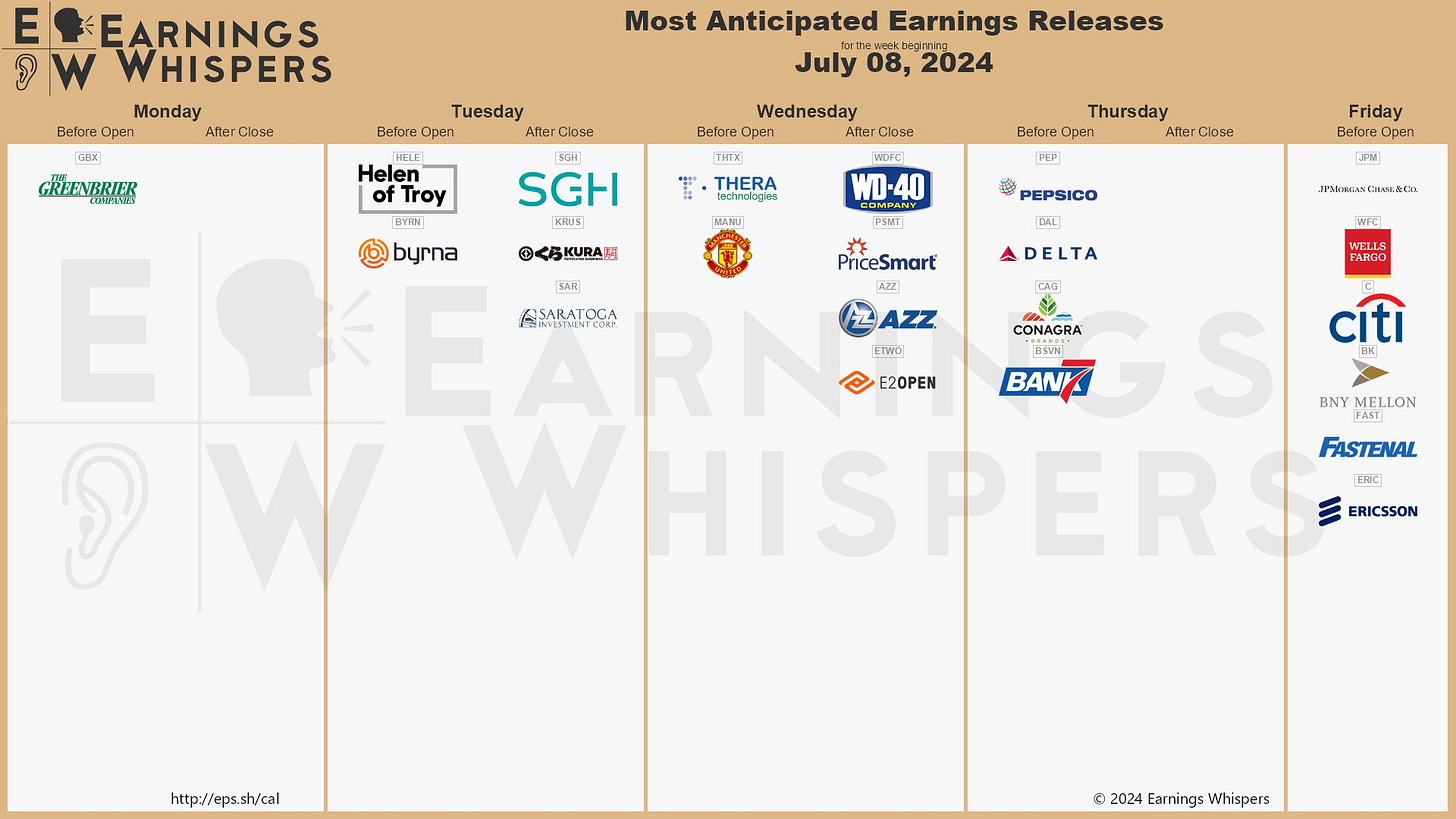

📉Earnings Reports Roll IN

Friday kicks of a new earnings season. As always, the banks are up first with JPMorgan, Wells Fargo, and Citigroup stepping up to the plate with their Q2 numbers. There will be a heavy focus on how interest rates are helping and hurting their bottom lines. Especially with commercial real estate in a dire situation.

I will also to be watching for consumer spending information. As we continue see consumers pulling back on spending and companies reducing prices, it will be interesting to see what areas are seeing the highest pull back in spending. However, it will be the week after when Bank of America gives great insight into the consumer.

👀 What to Watch: Inflation

On Friday, we get Consumer Price Index numbers for June. After seeing the jobs report for this week, the inflation report will play heavy roll into the thought process of the Federal Reserve's decision to cut. Also be good to see if consumer spending pull back continues to force prices downward.

Sports I Love

🏀Celtics Sell Out

The Owners of the Boston Celtics are looking to take some profits after winning the NBA championship this year. It is expected to make the Celtics the most expensive sale in NBA history. According to Sportico, the Celtics are currently worth $5.1 Billion. The team was bought in 2002 for $360 million by a group of investors.

Talk about a return on investment. That is 14 times the original investment. Far more than the 4x the S&P 500 has returned in the same timeframe.

Extras

I do not understand how or why the Supreme Court are landing on the decisions they have landed on in the last few weeks. It feels like the Supreme Court is finding ways to embolden more business overreach and removing the ability of the government to actually hold businesses accountable.

Repealing the Chevron Deference basically makes it so that any lawsuit against a business can ignore expertise or how to define really technical things like health, environment, technology, etc. and force a trial by jury

Essentially the supreme court is stating that every case must essentially have a law that is attached to it.

We have the most dysfunctional Congress in the history of the United States, they do not pass laws and now you want every single possible move of government to be a law?!

The ruling in favor of Donald Trump essentially turns presidents to kings who cannot be held accountable for the actions they take while in the seat as a president.

This is an exaggeration, but it does show the chaos the supreme court has invited into that branch of government

Case after case what is supposed to be the government branch that puts a check on politics, has folded to a specific ideology. We no longer have a balanced Supreme Court but one that serves a very specific part of the country. How this plays out over the long run will be interesting to see.