This newsletter is 1,606 words a 7-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

Inflation Finally Fell

Temp Trade Deal Reached

Company News

Walmart Says Things Are Not Great

Stats of the Week

$880 Billion Cut to Medicaid

30-80% Drug Price Cut

3 Name changes in 5 years

Looking Ahead

Retailer Earnings

Markets

Returns

Tale of the Tape

Economy

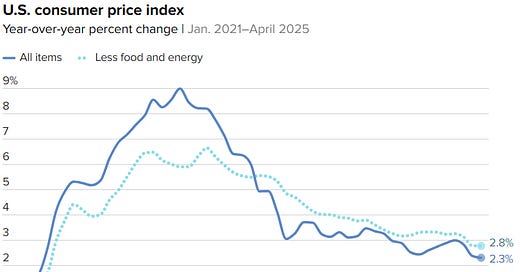

In a surprise to just about everyone, April’s inflation came in lower than expected.

🔢 By The Numbers: The Consumer Price Index (CPI)—which tracks a basket of goods to measure price changes—was released on Tuesday.

Prices rose 2.3% year-over-year and 0.2% from March, continuing the pre-tariff trend of cooling inflation.

Core CPI, which excludes the more volatile food and energy prices, rose 2.1% from last year.

💬 In Their Words: Robert Frick, corporate economist at Navy Federal Credit Union, told CNBC,

“Good news on inflation, and we need it given inflation shocks from tariffs are on their way. Non-tariffed goods are still in the pipeline, and perhaps some importers have absorbed their tariff costs for now.”

📉 Takeaway: This is the lowest inflation reading we’ve had in four years. It shows inflation was trending in line with the Federal Reserve’s 2% target. This should give the Fed more confidence that they l have a handle on the economy.

However, this report doesn’t reflect the impact of tariffs just yet. Many businesses are still working through pre-tariff inventory, which has helped avoid passing higher costs on to consumers—for now. That will start to shift in the coming months as new, tariffed inventory hits the shelves.

🧾 Personal Note: I’ve noticed prices creeping up on a few things I regularly buy. I’ve also been hearing more people mention extra fees showing up at checkout.

🤔 My Take: Patience would’ve paid off. Things were improving, but we couldn’t wait. Now we’ve got tariffs that will almost certainly push prices higher—and put us in a worse position than we were headed for.

🫱🏾🫲🏾Temp Deal Reached

Well, I was completely wrong.

Flash Back: Last week, I wrote:

For a deal to happen, both sides need to feel like they’re winning. Right now, neither side can walk away feeling like they've come out on top. Trump wants to claim victory and tell everyone how he "broke" China and made them bend to his will. China, on the other hand, needs to save face with its citizens and show that it didn’t cave to the "Big Bad US."

On Sunday, the Trump administration announced it had reached a temporary agreement with Chinese officials to lower tariffs for 90 days while both sides work toward a permanent trade deal.

U.S. tariffs on Chinese imports: Dropping from 145% → 30%

China’s tariffs on U.S. imports: Dropping from 125% → 10%

The Stock Market flew high on the news. Bond Yields dropped. The dollar strengthened.

💬In Their Words: Treasury Secretary Scott Bessent said in a statement, "We had very robust discussions, Both sides showed great respect to what was a very positive process."

Takeaway: While this is just a temporary agreement—and doesn’t give businesses the stability they need to plan—it does suggest there's a path forward for U.S.-China trade talks. But for any real progress, it seems the process needs to be less about headlines and more about diplomacy. Translation: Trump likely needs to step out of the spotlight.

This deal also highlights a major contradiction:

Despite all the tough talk, the administration’s big claims about tariffs reshaping the global economy aren’t holding up. One of the main negotiation points was China opening its markets more to U.S. companies—making it easier for American businesses to sell to Chinese consumers. That’s the exact opposite of the Trump narrative of bringing everything back to the U.S.

My Take: Make no proclamations when you have no idea what people are doing.

Companies

Walmart Says Things Not That Great

Stock Move After Earnings: The stock dropped 3% as the company signaled headwinds due to tariffs

🔢By The Numbers: Revenues increased 2.5% from last year to $161.5 billion. This was less than analysts expected.

Profits decreased by 1% to $4.49 billion from $5.1 billion last year.

Walmart's E-commerce increased sales by 21%

For the first time, it reported a profit. Driven by an increase in Walmart's advertising business from its acquisition of VIZIO

All store brands saw an increase in same-store sales:

Walmart U.S. same-store sales increased by 4.5%

Sam's Club increased by 6.7%

Walmart International increased by 7.8%

💬In Their Words: CFO John David told CNBC in an interview, “We’re wired for everyday low prices, but the magnitude of these increases is more than any retailer can absorb. It’s more than any supplier can absorb. And so I’m concerned that consumer is going to start seeing higher prices. You’ll begin to see that, likely towards the tail end of this month, and then certainly much more in June.”

Note, he said this after the tariff pause was announced.

About a third of all Walmart sales come from items from other parts of the world, particularly China, India, Vietnam, Mexico, and Canada.

Takeaway: Walmart has a huge advantage over other retailers, which is its broad variety. Because Walmart is both a grocery store and a general retailer, it can absorb price shocks. However, even Walmart is facing pricing pressures. We can see that in the fact that its profit is going in the opposite direction of the revenues, meaning the cost of business is going up.

👀What to Watch: How long will Walmart keep prices low to steal market share from competition? The CFO said on the call that Walmart plans to play offense by keeping prices below competitors.

Stats of the Week

The next time you hear a Republican lawmaker claim to care about the working class, keep this number in mind: $880 billion.

That’s how much the GOP-led Congress has proposed cutting from Medicaid, a program that supports millions of low-income Americans. And why? To help pay for more tax breaks for the wealthiest individuals and corporations.

It’s the reverse of Robin Hood: taking from those with the least to give to those with the most.

This isn’t just bad policy—it’s a clear signal of priorities.

So again, remember that number: $880 billion. Because actions speak louder than soundbites.

Details: The cuts would limit those who need Medicaid by increasing the work requirement. An indirect way to ensure more people cannot qualify for the resources they need.

On the other hand, it would increase the benefits from the 2017 tax cuts.

A permanent increase to the pass-through income for estate planning to be tax-free.

Temporary boost the standard deduction for middle-class folks for four years to $16,000 from $15,000 for single folks and $32,000 from $30,000 for married folks.

Only helps people who even make enough to get to this level of deductions.

It would raise the child tax credit from $2000 to $2500.

You have to make a certain amount to claim this credit. Most people never reach the threshold.

17 million children would be left out of this credit.

Plus a one-time credit does nothing for most families.

Takeaway: As always, Republicans framed it as we want to root out "abuse" in the system. Which is why they increased the requirements and cut the benefits.

Sidenote: This new budget plan by the Republican Congress will add an additional $5 trillion to the national debt.

There are a few things that the Trump administration does that I like. This is one of them.

On Sunday, the administration announced plans to slash drug costs by 30-80%.

In Their Words: Donald Trump told reporters, "The United States will pay the same price as the Nation that pays the lowest price anywhere in the World.”

Takeaway: This is another massive announcement from Trump that will lead to absolutely no change. You can see this from the stock reaction of the various drug manufacturers. When Trump announced his plans on Truth Social, their stocks dropped by at least 5%. When the executive order was signed the next day and details were released, their stocks rebounded, making up for all the previous day's losses.

My Take: The market is saying this to the Trump administration.

Expect a massive fight from the drug companies. They have pushed back on any effort to reduce costs in the US. The only significant change came last year from the Biden administration that allowed Medicare to negotiate prices.

The number of times Warner Bros has changed the name of its streaming platform in the last 5 years. It was dumb when Warner Bros. changed the name from HBO Max to Max. Getting rid of one of the most iconic brands. Seems they have learned their lesson as Netflix and Disney keep eating their lunch.

AAA expects about 45.1 million to travel over the Memorial Day Holiday. It will break a 20-year record of most travelers during the holiday weekend. However unlike previous years, about 40 million travelers will take a road trip rather than a flight.

Times are tough.

Looking Ahead

Company/Earnings

Various retailers report earnings and provide more insight into how tariffs are affecting their businesses and customers.