Market Giveth & It Taketh - Market Update Nov. 11-15, 2024

This newsletter is 1441 words a 7-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from everyone.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

⤴Inflation Ticks Up

Company News

🎇Disney Earnings - Magic Returns

Stats of the Week

88% of US in Drought

28% of Christmas Shoppers Still Paying Off Last Year’s Christmas Debt

😒🙃$55.5 Billion - The Value of DogeCoin (SMH)

🏠26% of Young Folks get Family Money for Home

Looking Ahead

Nvidia Reports

Sports I Love

Ravens Hard Fought Victory

Markets

You would think based on all the excitement from the stock market last week that the market is going crazy. However, the market is in the same place as it was one month away. Ain’t that wild?

This is why we never get too high or too low with the daily gyrations of the market. We stay invested and We KEEP BUYING!

Tale of the Tape

Economy

⤴Inflation Ticks Up

October CPI was released last week, and it showed a slight uptick in inflation.

🔢By The Numbers: Overall CPI was 2.6% over the last 12 months. it was an increase from the 2.4% in September. Higher than economists expected but still in a very healthy place.

Core CPI (which excludes Food and Energy prices that can be volatile) was 3.3%.

Shelter continues to be a large driver of higher prices. It accounted for over half of inflationary price increases

It increased by 0.4% in the month and 4.9% from last year

Airlines were also making money last month with prices increasing 3.2%

😐Takeaway: Inflation is a nonstory and is no longer an issue for the economy. This is why the Fed continues to cut rates heading into the end of the year. Bond Yields are also falling as there is a higher expectation for the Fed to cut rates again in December. However, housing continues to be an issue for everyone.

💬In Their Words: Minneapolis Fed president Neel Kashkari said, "Housing inflation is the elephant in the room. We know mechanically [it] is going to take a couple of years for the new leases to work their way through. So far, I think our broad disinflation story is still on track."

Companies

📈Stock Move After Earnings: Stock was up almost 10% immediately following the earnings release but calmed down to 7% later in the day.

🔢By The Numbers: Revenues were $22.57 Billion, an increase of 6% from last year. Which is not the most impressive growth number. However, the beauty is in the path of the revenue growth.

Profits almost doubled from last year to $460 million from $264 million.

Disney's various streaming platforms (Disney+, Hulu, ESPN+) are growing fast and becoming profitable.

Profit for the streaming segment was $321 million for the quarter. Last year in the same quarter, Disney lost $387 million

Analysts had expected profits of only $200 million.

This is enabling Disney to slowing move away from its high margin TV packages.

Revenues for this part of the business fell 6% in the quarter and profit decreased 38%

The password crackdowns are helping increase subscription numbers similar to Netflix.

Disney+ subscribers increased by 4.4 million and is now 122.7 million

Hulu subscribers increased by 1 million and is now 52 million

The cheaper ad supported tier of Disney+ is helping increase the subscription number. Again, very similar to Netflix.

👀What to Watch: How much can Disney grow out its streaming business to make it as profitable as Netflix?

Disney says they expect to make $875 million in profit from the streaming business. A much faster growth rate than analysts expected.

Disney like Netflix plans to continue raising pricing to increase revenue and profits.

The other big question around Disney, Bob Iger's successor, has been somewhat answered.

Disney said they will announce the new CEO in early 2026.

🎞Takeaway: All the numbers are great to see but never forget the driver of everything for Disney. It is the shows and movies they create. 2024 was a blockbuster year for Disney movies. We had Inside Out 2 and Deadpool & Wolverine. These movies exploded and brought the excitement of Disney back.

💬In Their Words: Disney CFO, Hugh Johnson, said it best on the call, “If you think of the big initiatives we have invested, putting creativity back at the center of the company, and on top of that, we said we wanted to improve profitability and we are clearly doing that in a substantive way.”

If Disney can continue moving in this direction, then I believe this company has a bright future.

↪My Takeaway: My turnaround investment thesis might be playing out after all. But we shall see what is still to come.

Stats of the Week

🔥88%

According to the NOAA (National Oceanic and Atmospheric Administration), 88% of the US are facing abnormally dry conditions. It is the worse dry spell in over 25 years. The dry spell is causing wildfires not only on the West Coast but on the East Coast as well.

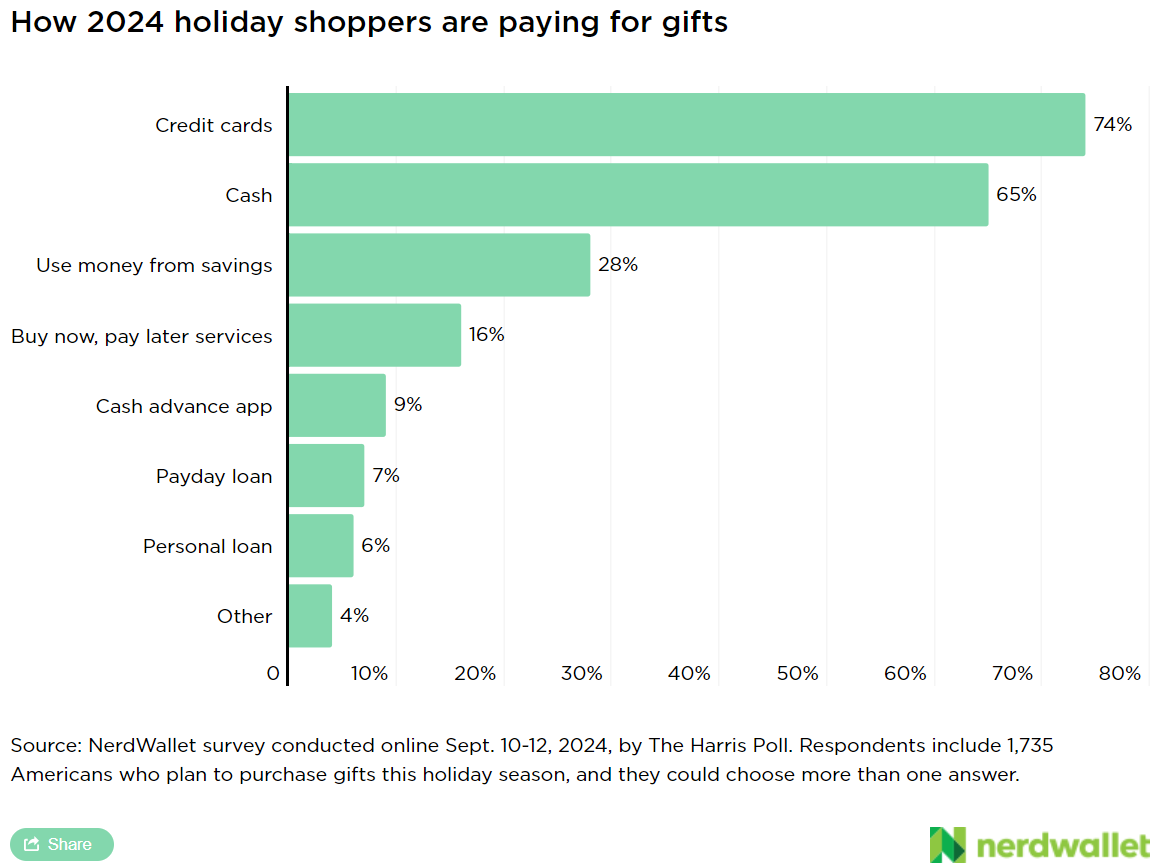

🎁28%

According to Need wallet, 28% of people who took debt to buy Christmas gifts are still paying it off as the new Christmas shopping season begins.

But you know we still gonna shop!

The market cap of Dogecoin. Oh you don't remember Dogecoin, it is the original memecoin from in 2020 when investing mania hit the US and everyone wanted a quick buck. That mania is returning. Seems investors are expecting a lot of crypto love from Trump moving forward.

Takeaway: it's like we don't learn. We just do the same things over and over again. We'll see how this plays out over the next few years. But I can pretty much tell you, it ain't gonna be pretty for A LOT of people.

My Takeaway: There will be volatility in the next years and maybe we can take advantage of it.

🏠26%

If the words "gift tax limit" mean nothing to you, you are part of the large population that does not come from wealth and probably cannot afford a house.

According to Redfin research, 26% of younger people buying homes used family money for down payments. This is an increase from 23% last year.

Takeaway: The gap between the haves and have not will only widen over time. However, just because you can’t buy a house does not mean that you cannot build wealth. Housing is not the only form of wealth. I would actually say that for most people renting is MUCH BETTER way to build wealth as long as you are investing.

My Takeaway: After my first home, my wife fiancé and I have decided we are going to rent when we move. We will probably rent for a while. Ain’t no need to punish ourselves with all the issues with owning a home. We can save and invest the difference while keeping our flexibility.

Looking Ahead

All Eyes on ME

What Nvidia is saying this week

Nvidia reports on Wednesday and it is the bell weather for all things AI. If there is a hint of slowed growth, expect the entire market to take a hit

Other notable companies reporting this week: Walmart, Lowe’s, and Target.

Its a pretty boring week for Economic Data

On Tuesday, data on housing starts (new homes being built) will be released

On Wednesday, existing home sales will be released

Sports I Love

Ravens

This game was a litmus test for the Ravens’ potential to make a deep playoff run. Ravens have lost to the Steelers the last three years in the same way each time. Each game came down to the last possession, it was no different in this game. The game came down to a 3 and 1 with 55 seconds left in the game. Ravens could not get the stop needed and Steelers walked away with the victory.

Takeaway: The Ravens are now 7-4, still very much a playoff team but not sure that they are a title contending team. These are the types of games they have to win in order to make it to the Super Bowl. But the Ravens are still doing a lot of the same things they did last year in the playoffs. They put themselves in bad situations with bad penalties, receivers are still not as dynamic as we need them to be, and Lamar still makes some knucklehead plays.

But saying all that, I STILL BELIEVE in this team. They just gotta get it together.

*I am a tiny shareholder in this company.