Inflation is DEAD - Market Update Aug 12-16, 2024

If anyone says otherwise, they are lying or selling you something. Either way, RUN!

This newsletter is 2,120 words a 10-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

Inflation is GONE

DUMB Policy Idea from Trump & Kamala

We Need Both The Walzes & Buffetts

Stats of the Week

Drug Prices Fall by 79% Shout-Out to the Fed

New Homes $3.50 Cheaper Than Existing Homes

$1 Billion R-Rate Movie

30.6 Million Daily Viewers During the Olympics

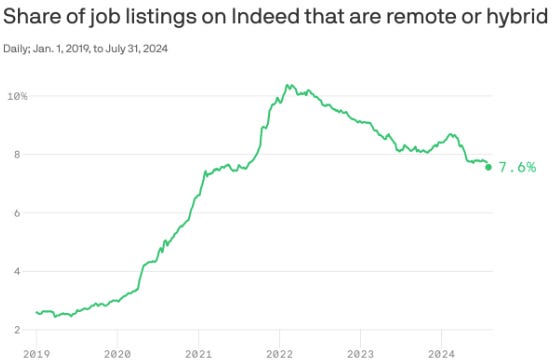

No More Remote or Hybrid Job Postings

Looking Ahead

Summer Camp for the Rich & Powerful

Sports I Love

My Heartbreak might be returning

Extras

Summerween

Markets

A recent report from FactSet showed that the companies within the S&P 500 are on track to report revenue growth of 5.2% for this quarter. This will be the highest growth rate of revenues within the S&P 500 since Q4 2022.

This is another reason we ignore the noise of the stock market. The Stock Market follows revenues and earnings. As long as those two things are moving in the right direction, we can safely ignore the noise and know things will be alright.

Tale of the Tape

Economy

The Federal Reserve must be having a pizza party right now because inflation dropped below 3% for the first time since 2021.

🔎Details: Prices in July rose only 2.9% from last year. It follows a string of lower CPI reports this year.

Month-over-month prices rose only 0.2%, the lowest so far.

Core CPI which excludes volatile food and gas prices rose 0.2% from June and 3.2% from last year

This is the slowest pace since April 2021.

🔢By The Numbers: Shelter cost which has been the driver of higher inflation has been steadily declining after peaking in March 2023 at 8.3%. It is now 5.1%.

Food prices last month rose only 0.1%

Fruits and veggies are down (Apples -14.5%, Frozen Fruits and Vegetables -1.7%, Potatoes -4.7%, Pasta -2.5%).

Meats are up (Bacon 8.5%, Pork Chops 7.3%, Hot Dogs 9.7%)

Vending Machine and candy up 5.4%

Drinks and Juices are up 19.2%

Takeaway: Buy healthy food and cook at home, it's cheaper.

Gas prices remained flat from June which is great considering during summer gas prices are usually high. Prices are down 2.2% from last year.

Used car prices are down 10% from last year.

💬In Their Words: Sung Won Sohn, professor of finance and economics at Loyola Marymount University and chief economist of SS Economics, told CNN in an interview, "Breaking the 3% barrier is a key psychological positive. It shows that inflation is not only trending down, but disinflation is on track. If you look at the future, it’s pretty clear that the inflation picture will continue to improve”

Explaining Obscure Financial Terms

Disinflation, according to Investopedia, is the temporary slowing of the pace of price inflation. Not to be confused with deflation, which no one wants.

Layman's terms: prices are increasing slower than they were before.

Takeaway: The war on inflation is over, anyone who tells you otherwise is trying to either sell you something or is lying to you. Regardless RUN FROM THEM! Stocks have been rallying since the release of inflation data last Wednesday.

The focus has shifted to the labor market. The Fed will definitely be cutting interest rates in September. The only question is how much?

💪🏾The American Superpower Remains Powerful

Unexpectedly Retail sales for July increased 1%. Economists expected an increase of 0.3%. It is the largest increase in retail sales since January of 2023.

🔢By The Numbers: Car buying was the main driver of higher spending in July. Sales rose over 3%.

Electronics increased 2%

Supermarkets increased 1%

Building materials increased 1%

💬In Their Words: Walmart CFO John David Rainey said on its earnings call, "Things have been remarkably consistent — I know everyone is looking for some pieces of information that maybe indicates further weakness with our members and our customers. We're not seeing it."

Takeaway: In June, retail sales declined 0.2% which fueled fears of a recession. But now those fears can be put on ice. Consumers are the backbone of the economy. As long as consumers are still spending, the economy remains fine. Also, consumers are switching from higher-end goods to discount goods.

My Takeaway: Our ability to spend in America is undefeated. The three inevitables of life: Death, Taxes, and Americans will buy stuff.

This is the dumbest economic policy that both presidential hopefuls are pushing.

🙅🏾♂️My Pushback: No one benefits except a very tiny group of people who work in high-end restaurants. Most tip workers do not make that much money and are already not subject to Federal Tax because they make so little.

It adds unnecessary complexity to an already complex system. I promise you that everyone who makes money on the 1099 form will find a way to report their income as tips, so they pay no taxes.

Anyone who makes money from bonuses, rental income, sales commissions, etc. will find a way to ensure they never pay taxes on that income. I know I would.

It makes the debt situation for the US worse because it reduces the amount of income that the government can make

It also incentivizes companies to push customers to pay for the product and pay a second time for worker’s wages.

😤Bottom Line: if you thought tip culture was already horrible. Just wait for the incentives this will create.

☁Takeaway: This is a smoke screen. Both candidates announced the policy in Las Vegas, Nevada. The highest concentration of tipped workers. In other words, this is one of those BS campaign promises for votes. Even though they know it will never happen.

Real Issue: If either candidate wants to help service workers, they need to increase the minimum wage of those workers. Still insane that a restaurant can pay a worker less than the Federal Minimum wage.

My Takeaway: It is just DUMB! Expect more dumb campaign promises as we get closer to election day.

PSA: It is almost time to apply for an Absentee ballot if you live in Georgia. It opens on August 19. The last day to request a ballot is October 25. Must be submitted by November 5th.

Walz need Buffett and Buffett needs Walz

Walz and Buffett are extremely different financially:

Walz owns no stocks. His entire financial security comes from dependence on the state for his income and pension. Showing to be happy neither a high income nor massive wealth is required.

Buffett is a billionaire. He has been pursuing money since he was a baby. He never has to rely on anyone for anything. From all signs, he is also happy.

However, for the US to work, we need both Walzes and Buffetts. A perfect economy will look like what Felix Salmon describes in Axios:

America's unique greatness emerges when the two appreciate what they owe each other, and when they support each other in their endeavors. That means politicians being business-friendly, while businesses and billionaires are happy to pay their fair share in taxes.

In other words, we realize what we owe to each other. As a human being who knows himself, expecting humans not to be selfish is a strong ask unfortunately.

Stats of the Week

The Biden administration announced the benefits of the Federal government finally being able to negotiate directly with drug manufacturers. Starting in 2026, some drug prices will be cut by as much as 79%.

Officials said if the new price tags were in place last year, it would have saved over $6 billion for the government and patients $1.5 Billion in out-of-pocket costs. The continued direct negotiation is estimated to save the government $100 Billion by 2031.

According to Zillow, New homes are $3.50 per square foot cheaper than existing homes.

🤔Reality: Both are still far more expensive than historical norms. But it might be showing signs of a market starting to roll over.

💬In Their Words: Zillow economist Orphe Divounguy told Axios, "Not only are cash-strapped buyers continually seeking out lower-cost options, but developers are changing what type and size of home they're producing to try and meet that need."

🧐Explanation: Builders are looking to sell homes in mass, they are paying attention to the needs of consumers. According to Zillow, lot sizes for new homes are shrinking. Builders want to meet new home buyers where they are. Over the last decade, builders got trigger-happy with building massive luxury-sized houses because they could charge more. Unfortunately, no one wants to buy those cause it is far too expensive.

Takeaway: The US is still short over 4.5 million homes as of 2022. We need more homes on the market. That is the only thing that will drive prices down. To do that, we might need smaller homes.

Deadpool & Wolverine crossed $1 Billion in total sales last weekend. It is the fastest R-rated movie to make $1 Billion. It is also the highest growing R-rated movie of all time. I still have not seen this thing. At this point, I will just wait for it to come on Disney+ or be available for rent on Amazon or YouTube.

NBC had an average of 30.6 million viewers every night watching the Olympics, an 82% increase from the Tokyo Olympics in 2021.

7.6%

According to Indeed, 7.6% of job listings are remote or hybrid. Down from its high of 10% in 2022. After the pandemic forced many companies to accept a remote world and the Great Resignation forced companies to acquiesce to worker desires to hire talent. Things have changed. Companies are pulling back from advertising remote or hybrid roles unless you are the CEO.

Looking Ahead

👀 What to Watch

Summer Camp for the Rich and Powerful

Jackson Hole Economic Symposium will be taking place next week. It is where all the ultra-rich and powerful get together and sing campfire songs, fish, play some capture the flag, and just have all around wholesome fun.

Okay, maybe not that exactly. Investopedia explains it as "an annual symposium, sponsored by the Federal Reserve Bank of Kansas City since 1978, and held in Jackson Hole, Wyo., since 1981. Every year, the symposium focuses on an important economic issue that faces world economies. Participants include prominent central bankers and finance ministers, as well as academic luminaries and leading financial market players from around the world."

Leaders from across the globe will meet and discuss the economics of their countries. Making it a very important fishing trip.

👁Big Focus: Jerome Powell will be speaking to the group. Expect him to put the ribbon in place for the cuts to be announced in September.

Company/Earnings

Sports I Love

Premier League Begins

Somehow I missed this in last week's newsletter, but the Premier League kicked off on Friday with Man United playing Fulham.

I was certain the season was beginning with Man U doing what they do best, breaking my heart. But to my surprise, they found a way to win. Now was it a convincing win? NOPE but at least, they won.

However, their play in the game gave me a lot of hope. They were able to control the game and break down the Fulham defense. Unfortunately, they could not finish AT ALL. They missed so many great chances in front of goal. The injury to Rasmus Hojlund is going to hurt them unless other players find their shooting boots.

Let's just hope this does not turn into another depression-induced season like last year. Cause I know, y'all definitely do not want to read about that every week.

Extras

Summerween

Word of the week, "summerween".

Background: Retailers have been slowly putting out Halloween décor earlier and earlier. I'm sure you have probably noticed a ton of Halloween merch at every store you visit. Stores started putting out items in June, in an effort to snag extra sales.

Why so early: Because they are trying to get more money in their pockets. Last year, people spent $12 Billion on Halloween. The hope is that putting items out earlier will lead to an overconsumption of the items (i.e. buying twice as much decoration than you actually need).

Bottom Line: Please do not fall for this, save your money, and bring out the decoration you bought last year. Replace what is broken and keep your money in your pocket.