Money Stats That 😲🤯 ME Volume 2

I hope this makes you question everything you read or hear in the news.

This post is 874 words, a 5-minute read. Enjoy!

😲Missing the 10 best days in the market cuts your return in Half

This is why Time in the market is better than timing the market

This is especially important in case you are freaking out over the political climate. Do not make any drastic decisions. Stay the course!

Nearly 1 in Every 10 Homes (actually 8.5%) in the US is worth $1 Million

Nope, it is not you. Houses are just that expensive.

It is time for us to redefine the purposes of homes in our lives. I for one do not want the desire for a house to get in the way of living a full life.

How much people think they need to be Financially comfortable.

Once upon a time, we had Keeping up with the Joneses who lived down the block. Now we have social media, so we have Keeping Up with the Kardashians.

We know too much about what other people have in their bank accounts and it ain’t helpful for us.

Maybe it is just me and I am projecting.

Only 15% of Gen Z are saving for retirement and only 20% save at all, according to a survey from Bank of America.

Here I thought Gen Z were better at saving than the rest of us. 😔😓

The Good news is most of them are still in their 20s, so they are living it up and have plenty of time to make the changes.

However, for all you grown folks reading this post. Start talking with those young-ins around you.

One conversation could change their entire life.

Oh and don’t give them a book, they won’t read it. Share a podcast, a YouTube video, or a TikTok page.

Maybe still Add the book as a bonus.

Wage Distribution for select jobs

Wanna make a good income? Get a career that has a wide wage distribution.

Why? Because it means there is room to grow and more income to be made as you progress in your career.

401(k) was created in 1978 and IRA in 1974

They were created originally to help rich executives escape taxes

The Roth IRA was added in 1997

It was not originally meant to help the common man

It is still relatively new. So have grace that your parents did not teach you about it. They barely understood it themselves.

The experiment of defined contribution plans (401k) vs defined benefit plans (pensions) has proven that defined benefits protected and sponsored by the government might be the best solution.

401k benefits far too small a minority of people.

Still mad that Roth IRA has a lower limit but it makes sense why.

But I guess Social Security is supposed to be the defined benefit plan for everyone.

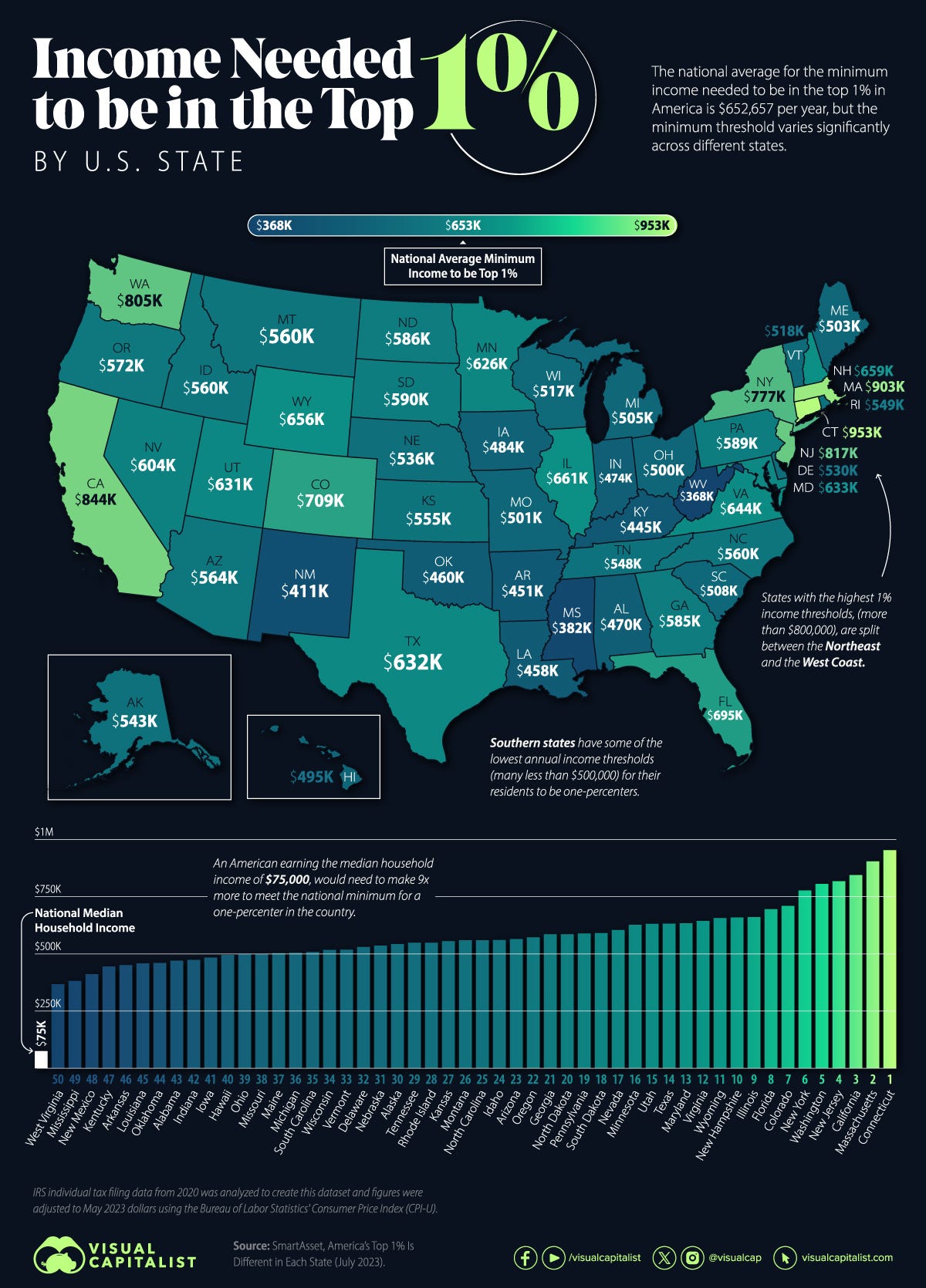

1% income earners in the US depends on where you live.

Location, Location, LOCATION!

Live in one place and feel like a king. Live somewhere else and feel like a pauper.

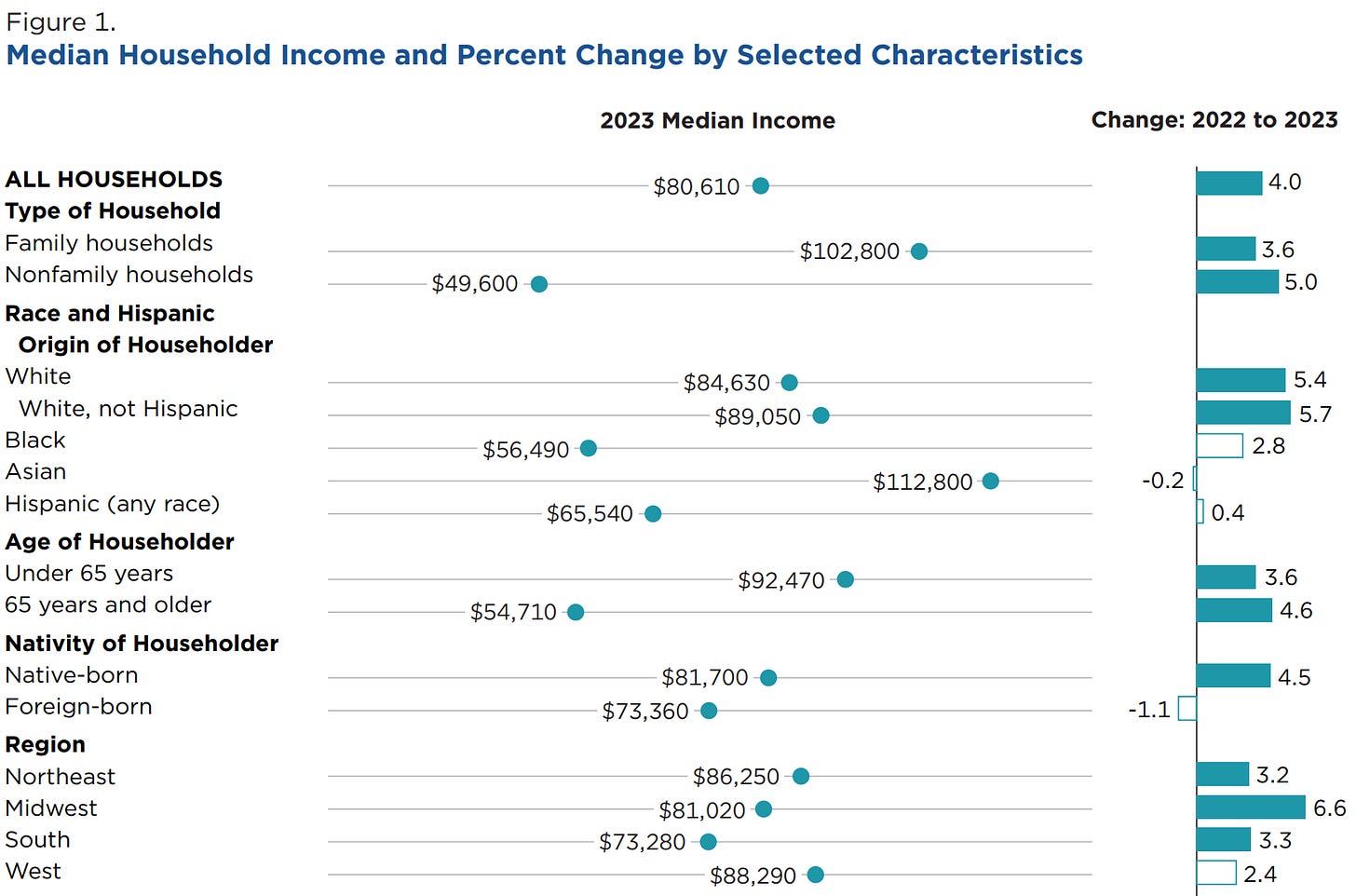

Median income in US is $80,610

I thought it was $65,000.

However, because of inflation most of us still feel like we don’t make that much.

Professor Scott Galloway likes to say, “When we get a raise we believe it is because of our hard work and talent. When inflation goes up we blame the government.”

In reality, for your wages to increase, we also need inflation.

Not all your blessings are your fault.

Debt stats

I received this brief while I was at FinCon from National Debt Relief.

Almost everyone around us is struggling with some form of debt; however, most of us believe we are alone in the problem because of how people try to appear okay.

We need to make conversations about debt and money normalized so people know they are not alone.

But then again in the US, debt is so normalized that we do not even see it as a problem in most cases.

Finance is complicated so here is a picture of 40 Finance Terms with explanations

In-state freshmen at public four-year colleges will pay a net tuition of just $2,480 next year, down from $4,140 in 2014-15

Why? Fewer people are applying, so colleges are finally dropping prices. While this cost includes grants and excludes living expenses, it’s still progress worth noting.

But let’s be real: college is still too expensive once you factor in everything else. Progress is great, but we’ve got a long way to go.

Recommendation Section

Johnathan Clements in Advice For The Kids, gives some of the best financial advice for us youngins in bite-sized form that I've ever seen

Morgan Housel in A Few Little Ideas And Short Stories. Provides awesome stories to help us understand the world and think better.

There are hidden costs in almost everything we choose to purchase. Doug and Heather Boneparth have a series covering many of them. The latest topic is on Holidays

A new podcast I am loving is called 50Fires. It is by Carl Richards, a recovering Financial Planner and Advisor. He could help other people with their finances but had a difficult time talking about money with his wife and children. It has quickly become one of my most anticipated podcasts to listen to every week.

![r/dataisbeautiful - [OC] The wage distribution for selected common jobs in the United States. r/dataisbeautiful - [OC] The wage distribution for selected common jobs in the United States.](https://substackcdn.com/image/fetch/$s_!BH6r!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F8cc919fe-a039-4ce9-afa7-2d6f7238414e_640x512.png)