This post is 874 words, a 5-minute read. Enjoy!

To kick off 2025, I decided to do something different. Rather than do the typical personal finance thing of sharing tips and tricks of how THIS WILL FINALLY BE THE YEAR for you to accomplish all your financial goals. I decided to share some stats I learned about in 2024. Some of these stats are designed to be shocking and provide perspective. The hope is that this provides some hope and faith that things are not so bad and can be better.

Other stats are just interesting numbers (at least interesting to me).

I hope you enjoy these numbers and use them in random conversations to sound smart to your friends, coworkers, and family. My only ask is you share this newsletter.

2024 was a wonderful year writing for you. Here is to an even better 2025! But for real share the newsletter.

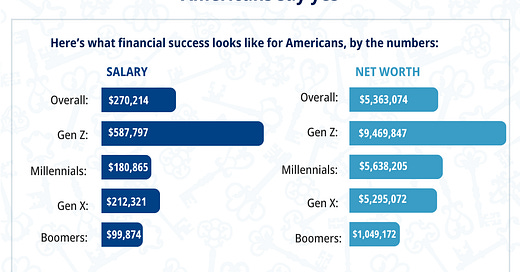

According to a study by Empower, Generation Z believes to be financially successful you need to earn at least $587,000 PER YEAR!

You must also have a net worth of at least $10 MILLION!

Compare those numbers to median income in 2023, which was $80,610.

The median net worth was $192,900.

This explains the nihilistic tendencies of Gen Z.

I believe social media has completely ruined us and ruined our perspective on REALITY!!

The expectation of a decent life has completely blown apart. I put out this thread a while ago and I believe it holds to be true.

Follow me on threads: @byKelechIwuaba

According to the Treasury Department, The Real (meaning adjusted for inflation) Median Net Worth for people ages 25-39 years old is $80,500 as of 2022. It is the highest in over 5 decades.

In 2010, the median net worth of those in the same age group was $23,750

The Pandemic helped turbocharge a lot of people's wealth with stimulus checks and all asset classes ripping.

Even with that being true, Millennials and Gen Z are the most anxiety-filled generation, especially around money.

This goes to show that more money does not mean you will feel better automatically.

Guess it makes sense why we think we need way more money to be "successful".

There are good reasons for why most do not feel good:

Net Worth may be up but that is not the same as cash flow and things have gotten much more expensive

Job Market is unstable and much harder to break into

There is much more isolation and less community with most young people saying they have no close friends

Plus, other things that weigh on the psyche: from regular shootings to wars to climate change

However; there are reasons to be optimistic though

There is more access to different forms of education than ever before

More opportunities to work in different ways

Cheaper access to goods and experiences

More information about money and finances.

Unfortunately, right now pessimism is completely engulfing our collective psyche. But I implore those of you in my generation to seek to find the bright spot. Things already SUCK might as well look for a good way to push forward.

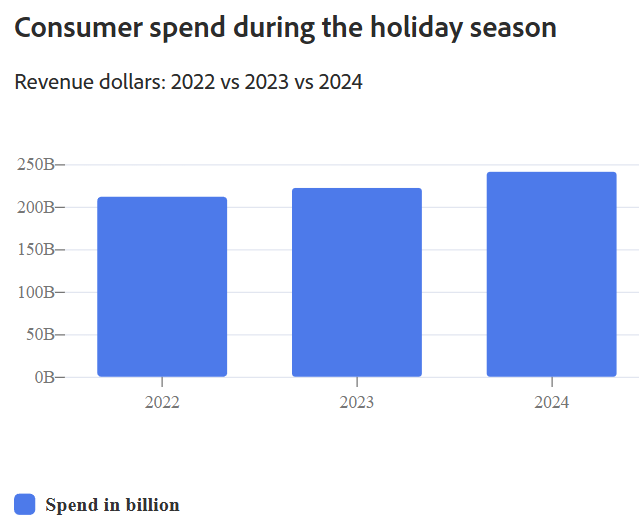

From Nov. 1 - Dec. 31, $241.4 Billion was spent on holiday shopping online.

An 8.7% increase from 2023.

On Black Friday alone, almost $12 Billion was spent.

$131.5 Billion was spent using mobile devices (your phone ain't your friend)

The conversion rate is double for laptop users meaning we are more intentional with our shopping on laptops and more frivolous on our phones.

$18.2 Billion was spent using Buy Now Pay Later services (people gonna be paying for last year this year)

Bible sales increased by 22% from 2022 to 2023. In the same period, book sales only increased by 1%.

14 million Bibles were sold in 2023

11 million Bibles were sold in the first 10 months of 2024.

There are two explanations for this sudden rise in Bible sales:

Anxiety is at an all-time high, especially for Gen Z. They, like every generation before, are seeking a lasting peace that transcends understanding.

According to Pew Research, a large number of the sales have gone to new believers or at least people testing things out for themselves.

People are looking for a better alternative to all the "self-care" that is always being shared on social but never provides the depth everyone seeks.

This is the explanation I want to believe.

My more skeptical side sees a different explanation. Marketers have discovered how marketable the Bible is. Using social media trends.

Mark Bertrand, the founder of Bible-design site Lectio, told Morning Brew something similar, "I'd like to say there is a craving for knowledge of scripture, but a lot of smart people are thinking about Bible marketing and catering to every whim for Bible study."

There are over 8 million TikTok videos with people sharing them buying their Bibles. With most of these videos having hundreds of thousands of views.

Regardless of the reason, I am here for it!! I believe the Bible is the greatest book ever. It is still the greatest story ever told, it is filled with more wisdom than any other book. It has the greatest message to man and the only hope that I hold onto.

I hope everyone who buys a Bible, opens it up and sees the Hope that I have found!!

According to research by the Institute of Health Metrics and Evaluation, the US is on pace to fall from 49th in global life expectancy rank (which ain't great) to 66th in 2050.

The US spends the most on healthcare in the world but has some of the worst outcomes.

More is spent on treatments than symptoms than on upstream issues

The US has the highest cases of chronic illnesses.

The US allows more unhealthy substances in foods than any other developed nations

If you don’t have health you don’t have anything. How is your health?

Fidelity announced that there are 544,000 401(k) millionaires on their platform. A 10% increase from last year.

Fidelity has 24 million participant accounts from various companies

The average overall balance is $132,300

The average millionaire balance is $1.616 million Up from $1.595 million last year.

The average savings rate of participants was 15%.

9.4% from employees and 4.7% from employers matching.

This is a solid savings rate

Unfortunately, most 401(k) participants have balances lower than $1 million.

The average overall balance is $132,300 an increase of just 4%.

(yes, a lot of those are small accounts from folks who just began their career)

Fidelity said it has noticed a trend since the pandemic of those with lower balances cashing out their accounts.

Never giving compounding a chance to work in their favor.

PLEASE LEAVE YOUR 401(k) ALONE

The S&P 500 has returned 242% in the last 10 years and 618% in the last 20 years.

Meaning: $1000 invested in 2015 would be worth $3,425 today

$1000 invested in 2005 would be worth $7,175 today

Takeaway: Stay invested. Do not measure your progress from day-to-day changes or even year-to-year changes. Measure your progress over decades because that is what matters when it comes to investing.

According to RIABiz, 25% of all 401(k) plans have been abandoned by account holders. That is about $1.65 Trillion in assets that are forgotten and abandoned.

That ain't you right?

*insert slide 65

Standing in line is the way to make getting food an experience. According to a study by the Coefficient Capital:

60% of Gen Z have stood in line for more than 30 minutes to buy a specific food item

48% of Millennials have done the same

When asked if it was worth it, 92% of people said they would.

When followed up with the question why?

One answer reigns supreme, INSTAGRAM🤮

$95

FOR WATER

See HOPE!

Thanks for reading! Until next time

God bless

GENEROSITY>greed

✌🏾