Money Stats That Shook ME

I hope this makes you question everything you read or hear in the news.

This post is 919 words, a 5-minute read. Enjoy!

🫨The median American household has a net worth of $193k

They have $8k in checking/savings

54% of adults have 3 months of expenses saved.

Takeaway: Most people are not as broke as the media tends to portray things.

🤯92% of Americans can cover a $400 unexpected expense (which is counter to the popular 60% of people cannot cover a $400 stat that is thrown around. I am guilty of this).

However, 43% of low-income households have to use short term debt to weather the shock

🤔Why does the difference exist: According to JPMorganChase, "Recent surveys on the financial resilience of American households—how many live paycheck-to-paycheck and cannot cover emergency expenses—yield contradictory results. The contradiction likely stems from different treatment of cash savings versus disposable income and credit; there are few data sources that can simultaneously examine all these resources."

Essentially JP Morgan is saying people may not have a savings account with $400 sitting for an emergency. But they can adjust their spending in real time to make up for it.

Both statistics are true but view things from different lenses. One is focusing on the proactiveness of people financially. The other focuses on the ability of people to react to a bad situation.

😤My Takeaway: This helps me understand why most people can survive for so long and not realize the financial situation they are in. If you always move A to C then B to W, you won't feel a need to change because you can survive.

But who wants to just survive. This is the aspect that the report from JPMorgan ignores.

If you are surviving by the skin of your teeth, LIFE SUCKS! I want people to THRIVE not survive.

🤕41% of adults in the US live with medical Debt

Most people are not broke because of the flaunting we see on Instagram. Of course that plays a role. Most people are broke because they "made" the mistake of having the audacity to be sick or have a child break a bone. Or any other HUMAN ailment we all will suffer from at one point in our lives.

My Takeaway: Show grace. You have no idea what people have to deal with. I'm talking to myself on this one. I will still roast and judge you if you broke because you refuse to learn about money and just choose to overspend. Yes, it can be both.

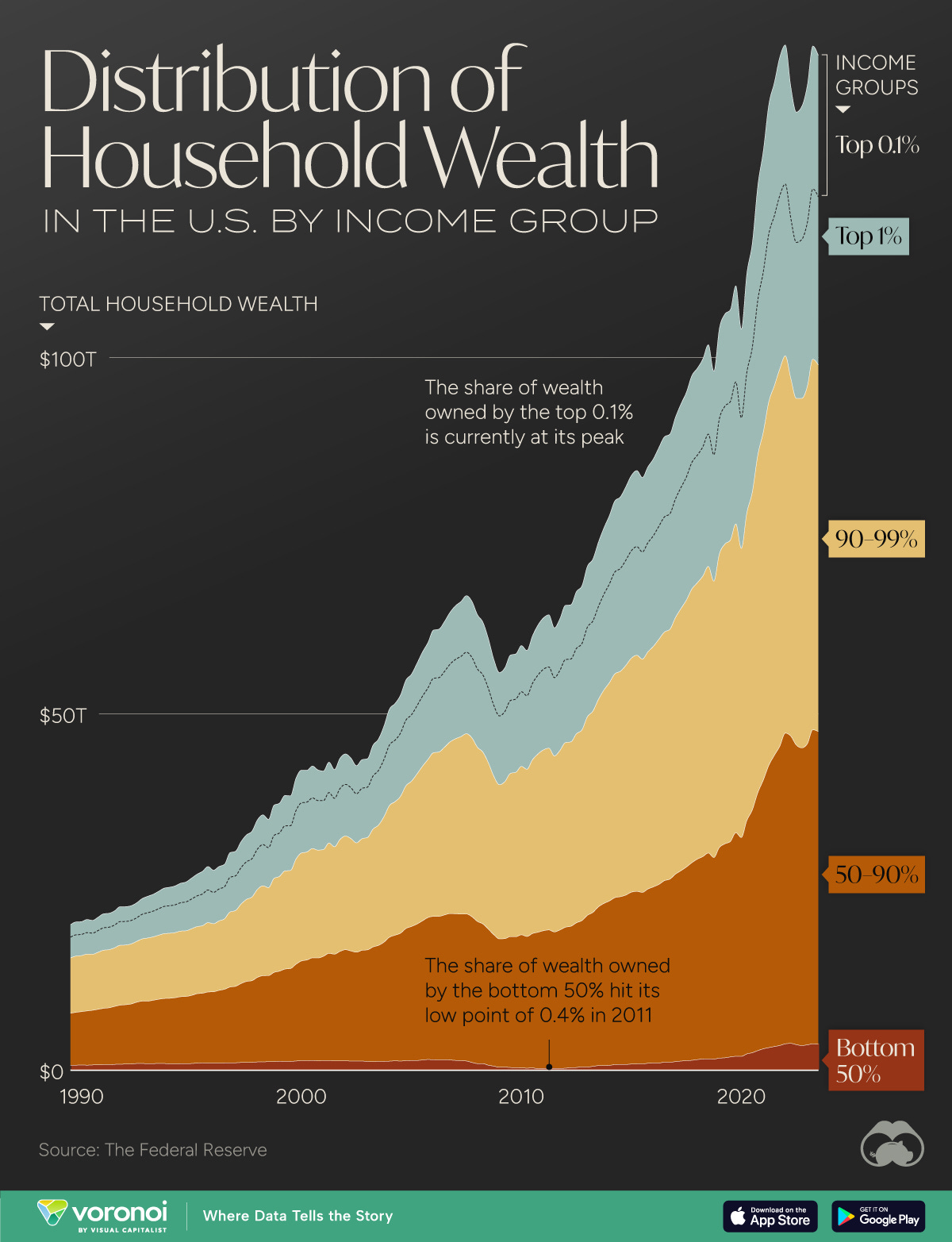

🤏🏾🤪The top 0.1% of the US own 14% and growing of the wealth in the US. The bottom 50% own 3% and shrinking.

Upward mobility is worse today than for the generation before us

The Opportunity Atlas - shows the best and worst neighborhoods for upward mobility

NOT where you would think.

0.1% of the population make $1 Million in household income. Most people believe it is closer to 20% of the population.

🗯️In His Words: Morgan Housel puts it best, "Your personal experiences with money make up maybe 0.000000001% of what's happened in the world, but maybe 80% of how you think the world works."

Same can be said for basically every other experience with our lives.

🙃Takeaway: If we cannot agree on facts, then we will always have an issue coming up with the right solution

This is why it is hard for me to believe polls.

Always assume your assumptions are probably wrong.

Use the words, "I don't know" Much more often.

💸For Every $1 placed on a sports bet, US household's investment decreases by $2.

As more people find the despair of online sports betting, less people are investing in good ole boring index funds.

🔢By The Numbers: The amount spent on sports betting has 14X'd since the Supreme Court legalized it in 2018

In January of 2019, $1.1 Billion was spent on sports betting

In January of 2024, $14 Billion was spent on sports betting

The paper linked above, found that in the 2 years following sports betting being legalized in a state, net investments fall by 14% and continues dropping.

🤦🏾Worst Part: The people who should definitely not bet, are the most likely to bet. The paper found that those in financially constrained situations placed the most bets. Losing the most amount of money, which in turn made their financial situation worse.

🗯️In His Words: Morgan Housel talked about this phenomenon in his book, Psychology of Money. He says, "No one is crazy, including you. But everyone justifies actions based on poor reasoning, including you."

A story to help you understand what he means, a story of an individual who chooses to buy lottery tickets (or make a bet) rather than investment those funds:

We live paycheck to paycheck and savings seems out of reach. Our prospects for much higher wages seem out of reach. We can’t afford nice vacations, new cars, health insurance, or homes in safe neighborhoods. We can’t put our kids through college without debt. Much of the stuff you Bloomberg/Collaborative Fund readers either have now, or have a good chance of getting, we don’t. Buying a lottery ticket is the only time in our lives we can hold a tangible dream of getting the good stuff that you already have and take for granted. We are paying for a dream, and you may not understand that because you are already living a dream. That’s why we buy more tickets than you do.

🫱🏾🫲🏾Takeaway: Show GRACE!

Recommendation Section

Morgan Housel in A Few Little Ideas And Short Stories. Provides awesome stories to help us understand the world and think better.

There are hidden costs in almost everything we choose to purchase. Doug and Heather Boneparth have a series covering many of them. I have loved learning and reading about them:

A new podcast I am loving is called 50Fires. It is by Carl Richards, a recovering Financial Planner and Advisor. He could help other people with their finances but had a difficult time talking about money with his wife and children. It has quickly become one of my most anticipated podcast to listen to every week.

Katie Gatti Tassin in The news that Makes Money Feel Worthless exposes the triviality of our constant pursuit of retirement enoughness when faced with a life changing diagnoses. She also pulls into question our so called free-market healthcare system that seems to help no one.

Jack Raines in The Cost of Apathy discusses how the modern world can rob us of our ability to live a fulfilling life because of the comforts that we have. He challenges us to choose a life path and TRULY LIVE.