My Investing Rules

I have put these guardrails in place to protect my peace and future. It might be helpful for you as well.

This post is 1,124 words, a 5-minute read. Enjoy!

🤐Don't Interrupt

"The first rule of compounding is to never interrupt it unnecessarily". - Charlie Munger

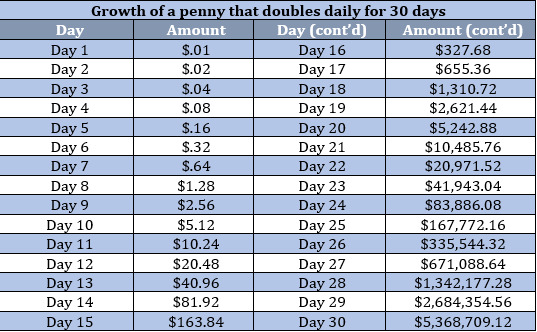

In my post, Everything to Know About Your Money Part 4 - Simple Path to Wealth, I used the example of a doubling penny. One thing I did not mention was to pay attention to when the penny takes off and becomes an insane amount of money. It was not until the 28th day that the penny beats choosing $1 million. If, for some reason, you had removed the penny from its magic box on the 15th day, you would only have $163.84. You had to wait the entire 30 days to see the full benefit of the penny.

This is what Charlie Munger is talking about. When you start investing, you can be tempted to remove the money because it does not seem like anything is happening in the beginning (or worse, it goes down like the markets are currently). It can feel like a waste of time. However, like with the penny, given enough time to allow compounding to do its thing, you get to reap the benefits. This is why I preach paying attention to the long term. Warren Buffett is not just great because he picked great stocks. Warren is great because of how long he was able to compound his money.

He has compounded his money for almost 80+ years. It was after turning 60 that things went ballistic. The goal with investing is not to make one great selection but rather to compound for a long time. Which leads to the next guardrail.

🫷🏾Don't Eff Around & Find Out

There is always going to be some hot new thing that makes people a ton of money in no time. We see it all the time, from new cryptocurrencies to hot stock picks to gambling to fill in the blank thing that just made someone else 10x their money. It is easy to get distracted by these things and even experience FOMO as others seem to be getting rich. But always remember as Proverbs 13:11 says, "Wealth gained hastily will dwindle, but whoever gathers little by little will increase it."

Why?

Because the person who makes a quick buck with no effort can easily believe it was their skill that got them that money. They will keep looking for the next big swing, leading to their demise. As Morgan Housel says, “Good investing isn’t necessarily about earning the highest returns, because the highest returns tend to be one-off hits that can’t be repeated. It’s about earning pretty good returns that you can stick with, and which can be repeated for the longest period of time.”

This is why I say Don't Eff Around & Find Out. Trust me, it is never worth it. I have been through my fair share of catastrophic losses from chasing high flyers. Leading to the next guardrail.

🥱Boring is Good

As Mohnish Pabrai says, “When you get excited by watching paint dry, then you are ready to build wealth.” Unless you are a finance nerd, good investing is very boring. For most of us, investing is simply automating a weekly, monthly, biweekly amount of money into our 401(k), Roth IRA, 403(b), TSP, HSA, 457, or Brokerage Account. That gets invested in a low-cost Target Date Index Fund.

Most of us will never think about our investments most days, maybe we check it quarterly when we get an email or letter statement updating us about the investment. And ironically, that is how it should be for a vast majority of people. Unlike most things in life, where we need to be an active participant with investing for great results, you need to be a passive participant. The less you do, the better the outcome.

For the finance nerds out there who get enjoyment from investing. The next guardrail is for you.

🤑Cashflow Rules Everything ‘Round Me

For those of us who believe we are good at picking stocks and selecting winners. This guardrail has helped me avoid disasters.

If you cannot read a 10K or 10Q to learn about a business. You are not investing; you are trading or, even worse, gambling. Trading is fine, but understand the difference. Investing is focused on the underlying business fundamentals. Trading is focused on the price of the stock and how it is moving and predicting what might happen next.

When researching a company, I am very focused on the cash flows of the business. As Warren Buffett said, “If you attempt to assess intrinsic value, it all relates to cash flows. The only reason for putting cash into any kind of an investment now is because you expect to take cash out.”

I am investing to eventually take money out of the business, either through share buybacks or dividends. The way I get money back out is only if the business is consistently generating free cash flow. This leads to my final guardrail

Short Term Pessimist Long Term Optimist

Morgan Housel said, “All good investing comes down to surviving an inevitable chain of short-term setbacks and disappointments in order to enjoy long-term progress and compounding."

This goes back to my first guardrail: Don't Interrupt. However, life tends to life so I have to survive today to see the benefits tomorrow. This is why it is so important to have downside protection, aka an emergency fund. If I do not have this in place, it becomes much easier at the first sign of an emergency to interrupt my compounding.

There is a common idea that Cash is Trash because inflation is slowly eating away at it. This is true; however, I love what Warren Buffett says about Cash: “Cash, though, is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent.”

There are too many things that can go wrong today. I have to take those risks into account when thinking about what money I invest and what I do not invest. This is why I do not invest money I need in the next 3-5 years; the juice is not worth the squeeze.

Extras

Max Out Roth IRA every year to get tax-free dollars.

Get company 401(k), 403(b), TSP match. Free money makes a ton of difference over the long run.

Diversification is my only free lunch with investing (domestic, international, bonds, etc.). This is the beauty of target date index funds

Hope this is helpful to you.

Generosity>greed

✌🏾

Recommendation Section

Ben Carlson in "Some Things I'm Thinking About", discusses the stuff that actually matters after losing his brother to cancer. Two of my favorite snippets are:

My lists are changing. The list of things I don’t care about is growing exponentially. There is a lot of bullshit in the world I’m more or less done caring about. The list of things I do care about is shrinking, but my feelings for the important things are growing stronger by the day.

Life is for living. Money is for spending.

Nick Maggiulli in "Never Root for a Recession" discusses the second order effects of a stock market crash. Typically, I am the guy who gets hyped about market crashes, but Nick presents a good case why this is never great for anyone especially for those of us who are just starting out our careers. Great quote:

The problem is that market crashes don’t exist independent of the economy. It’s like those people who want to buy a house but are waiting “until prices crash.” Do you think there exists a world where housing prices crash and everything else stays the same? No way. The same thing is true of financial crises in general. Such declines have higher-order effects that could create problems for you that you would never anticipate.

Jack Raines in "Russian Uber Drivers Are America's Leading Optimists", discusses the importance of giving ourselves a better perspective outside the bubble we live in every day. Especially those of us who have acquired a level of success in our life but yet feel inadequate because of what we are around. My favorite quote:

Young folks, who are, by any conceivable metric, crushing it, are walking anxiety disorders worried about not making enough money (despite making double the median household income in the US on their own), not having a nice enough apartment (ignoring the beauty of living within a 10-minute walk/drive of their friends), not progressing in their careers fast enough (despite the fact that they’re only a few years into their careers), and feeling like they just aren’t doing enough, despite being better off than virtually anyone, anywhere, at any other point in history.

Josh Brown in "Give it a minute", discusses the best way to approach most situations that seemingly make no sense.

Heather Boneparth in "Six Financial Red Flags You Can't Afford to Ignore" explains some of the biggest issues that affect the finances in relationships. Some of my favorites snippets:

Two forms of Never Enough: overspending and ever moving goal post of success. Great quote from the post "The issue this brings into relationships is that when nothing ever feels like enough, then eventually, no one ever feels like enough. Your partner starts to feel like they’re becoming one of your moving targets, and nothing they ever say or do will be, well, enough."

DON'T LIE: "Even the little white lies I hear about in my day-to-day life, they compound. Lying is a slippery slope. We convince ourselves certain conduct is acceptable, then we get more comfortable, and we go deeper and deeper. Our standards dive lower and lower."

Having no patience: "People find it hard to respect the timeline. And when they can’t respect the timeline, they end up taking on risks they really shouldn’t, or they shut down and miss out on opportunities altogether."

There are hidden costs in almost everything we choose to purchase. Doug and Heather Boneparth have a series covering many of them. The latest topic is on Tariffs

🎙️Podcasts Episode I love:

50Fires. It is by Carl Richards, a recovering Financial Planner and Advisor. He could help other people with their finances but had a difficult time talking about money with his wife and children. It has quickly become one of my most anticipated podcasts to listen to every week.

Money For Couples by Ramit Sethi. Ramit is no one new to the world of money and personal finance. In his podcast, he talks with couples about their finances and helps them better enjoy their money or better get aligned. This is very important podcast for me as I enter a new stage of life.