Scheduling note for the next two weeks. I will not be releasing a Market Update nor a Money Mentality.

This post is 1,327 words, a 6-minute read. Enjoy!

I am an Optimizer and a Worrier.

Which means I try to find the best way to make my money go the distance. And I also worry about the future ALL THE TIME.

Here's how this plays out for me.

I can literally spend all day in front of my computer running various compounding calculations and doing various n-1 simulations on my finances. Analyzing minute inconsequential changes on my finances and playing out how those decisions can turn into massive wins.

I spend even more time on my budgeting app (Monarch Money sign up for it here), categorizing my spending. Trying to decipher what bucket my plantain chip addiction should fall into (groceries or shopping?). Splitting my various transactions to fall very neatly into particular buckets.

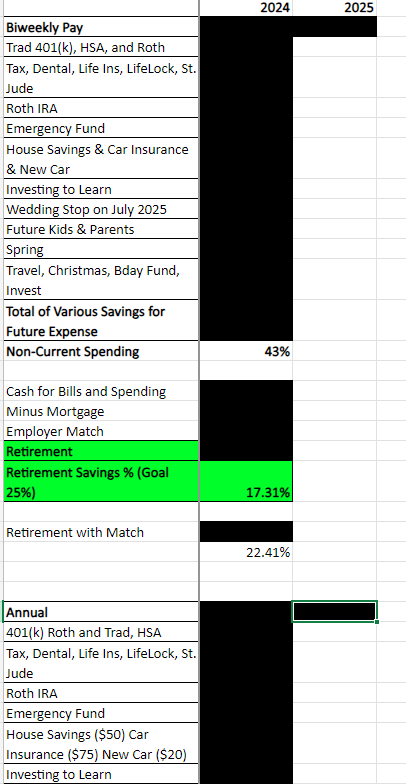

I literally got so bored during a meeting at work and created a spreadsheet to track my savings rate over time that will adjust for incremental raises and increased spending buckets.

Why do I do all this? Because I LOVE control, and it makes me feel like I am in control.

Saving, Investing, and Paying off debt to me are the best things you can do with money, in my mind. I will make whatever sacrifice to ensure I can do these things. Because they provide the best return for the cash I have. They are like a safety blanket for my life. The story that I tell myself is simply if I do these things then things will be fine. Plus, I have seen the benefits of doing them. I am currently enjoying the fruits of the seeds I planted when I got strict with doing these things.

It also happens that my favorite book in the Bible is Proverbs, which is known as the Book of Wisdom, and it has so much to say about money. And they all happen to be around saving, investing, staying away from debt.

Put all these things together and you get Kelechi seeing only three options when it comes to using money. Either paying off debt, saving it, or investing it.

However, all of this feeds into my other trait. My ability to eternally worry about the future and the various outcomes. Each outcome more negative than the last. I have a false belief that the other shoe can and will drop at any time. Therefore, I need to be ready for any and all situations.

This means spending money on anything I have deemed unnecessary (see above for what is necessary) or not needed is the worst decision I can make with money. Because the moment I spend the money, IT’S GONE! What if right after spending the money I need it for something important like an emergency?!

Here's the irony. As mentioned above Proverbs is my favorite book but I also love Ecclesiastes. When I read Ecclesiastes, one thing is very clear. Life is FUTILE. It is pointless and wasteful to spend so much time worrying about tomorrow. It speaks to the importance of enjoying the Gift of God, which is the present. I love the way Jesus speaks to this by teaching us how to pray in Matthew 6:11

Give us today our daily bread.

He expounds on this idea in the Sermon on the Mount. Jesus teaches the importance of taking not just the day as it comes but each moment as it comes.

The biggest irony is that as a Christian a big tenet of my faith is literally that, FAITH.

A belief to rest in the Peace and Promises of God the Father, who has never failed and won't start now. My Rabbi and Savior, Jesus, perfectly embodies how I am to balance both being wise and taking action but also Jesus always had a complete and total dependence on God.

I love to say "Being a Christian is a tight rope. I cannot be too far left or too far right." It is the same for me with my finances. Too far one way and I can easily miss the gift of the present or destroy the future. Sure, for a season it works well to go to one extreme but eventually it'll cause disfunction.

There's a sweet spot between planning for the future, doing the necessary things to ensure you can weather the storms of life, AND enjoying the fruits of your labor today.

I am still trying to figure out this balance for myself. But I think I have come to these conclusions of what it might look like:

ABSOLUTELY NO DEBT

Pay Cash for cars, vacations, and other big one-time consumption expenses

Mortgage type debts will be done with an understanding of what I can afford.

Always have an Emergency Fund to cover needed expenses.

3 months of emergency fund as a single dude.

6 months as a married man.

12 months as a family man.

Consistent income increases in a career field I love.

Compounding is a hell of a thing.

4-6% annual raises make a world of difference

Invest at least 20% of income.

Would love to get to 25% or more

REST and Have Fun

Spend Money on Things I love

Visit Siblings

Sporting Events and Concerts

Travel with my wife.

Beach relaxing trips

Know when to walk away from work

This life is too short to be stressed over Shareholder profits.

Does not mean I need to have millions.

Just need to be in a place where investments can keep compounding without added dollars.

GIVE

As Jim O'Shaughnessy says, “Money is like manure; if you pile it up, it stinks to high heaven, but if you spread it around, it does a lot of good."

Generosity is ALWAYS greater than greed.

I am blessed to be a blessing.

I share all of this, so you know my bias in talking about money.

I have no tolerance for debt. Some might say I am allergic to it.

I do not believe you can passively pay debt off

I love investing more than spending money.

Talking about compounding is a love language to me.

I am risk averse.

I realize my style is not for everyone. It's not even for my fiancée (love you, Sweet Lips). Y'all get to hear from me once a week. She has to hear my ramblings daily!

I also share because I selfishly want to know if I'm the only one who is this weird or if we all have our versions of the same feelings. If you feel comfortable, please share. Leave a comment or respond this email.

Remember Generosity>greed

God Bless You

✌🏾

Recommendation Section

Morgan Housel in A Few Little Ideas And Short Stories. Provides awesome stories to help us understand the world and think better.

There are hidden costs in almost everything we choose to purchase. Doug and Heather Boneparth have a series covering many of them. I have loved learning and reading about them:

A new podcast I am loving is called 50Fires. It is by Carl Richards, a recovering Financial Planner and Advisor. He could help other people with their finances but had a difficult time talking about money with his wife and children. It has quickly become one of my most anticipated podcast to listen to every week.

Katie Gatti Tassin in The news that Makes Money Feel Worthless exposes the triviality of our constant pursuit of retirement enoughness when faced with a life changing diagnoses. She also pulls into question our so called free-market healthcare system that seems to help no one.

Jack Raines in The Cost of Apathy discusses how the modern world can rob us of our ability to live a fulfilling life because of the comforts that we have. He challenges us to choose a life path and TRULY LIVE.