This newsletter is words a min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include their responses in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

💳Deficit Will Only Get Worse

Company News

🌐Nvidia’s World

Stats of the Week

👴🏻$26.8 Billion Taxes Paid

🍎$500 Billion Invested In US (not exactly new)

✂️108,551 Federal Layoffs/Departures

🤔40% of DOGE claims save no money for the government

🛍️50% of Spending is from Top 10% of US Households

Looking Ahead

February Job Numbers

Sports I Love

🤬💢NONE

Extras

Student Loan Returns

Markets

Sometimes, I get way too emotional and carried away when people bring up certain things. For example, with the return of the crypto craze, there have been so many people jumping into all manner of poop-coins, and it pains me to no end. I try to explain the dangers of jumping into these things, which is to no avail. Then I get riled up because I am like, "why can't they just understand that I am right, and I am trying to help them? Or why can't they understand that I know what's better for them?"

Recently, I have been catching my thoughts and saying to myself, "Is that what I really sound like? Who do I think I am? God?"

Yes. Yes, it is how I sound.

I know a lot of us feel the same way about a plethora of topics. We have inside knowledge from our life experiences. We share those experiences because we don't want others to go through the same thing. However, when we believe that we know better than those individuals and try to force our thoughts on them. We ensure they will never listen to any of the things we share, no matter how valuable it may be.

So now I have a new strategy: Let Them and Let Me.

Rather than chasing after people or trying to explain why what they are doing is not the best choice. I will choose to LET THEM. And then LET ME keep sharing good information in this newsletter because eventually, the information will be needed.

It is also how I will approach this political moment. Rather than triggering myself by mulling over what is happening, how insane everything is, and how people need to wake up to the madness. I am choosing to let it go and allow things to play out. Ain't like I got any control over it anyway.

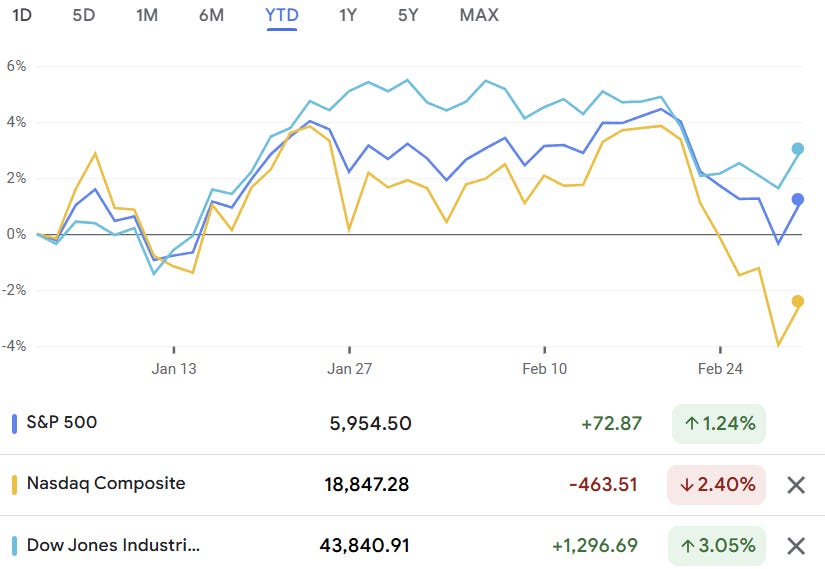

Year-To-Date Returns

Tale of the Tape

Economy

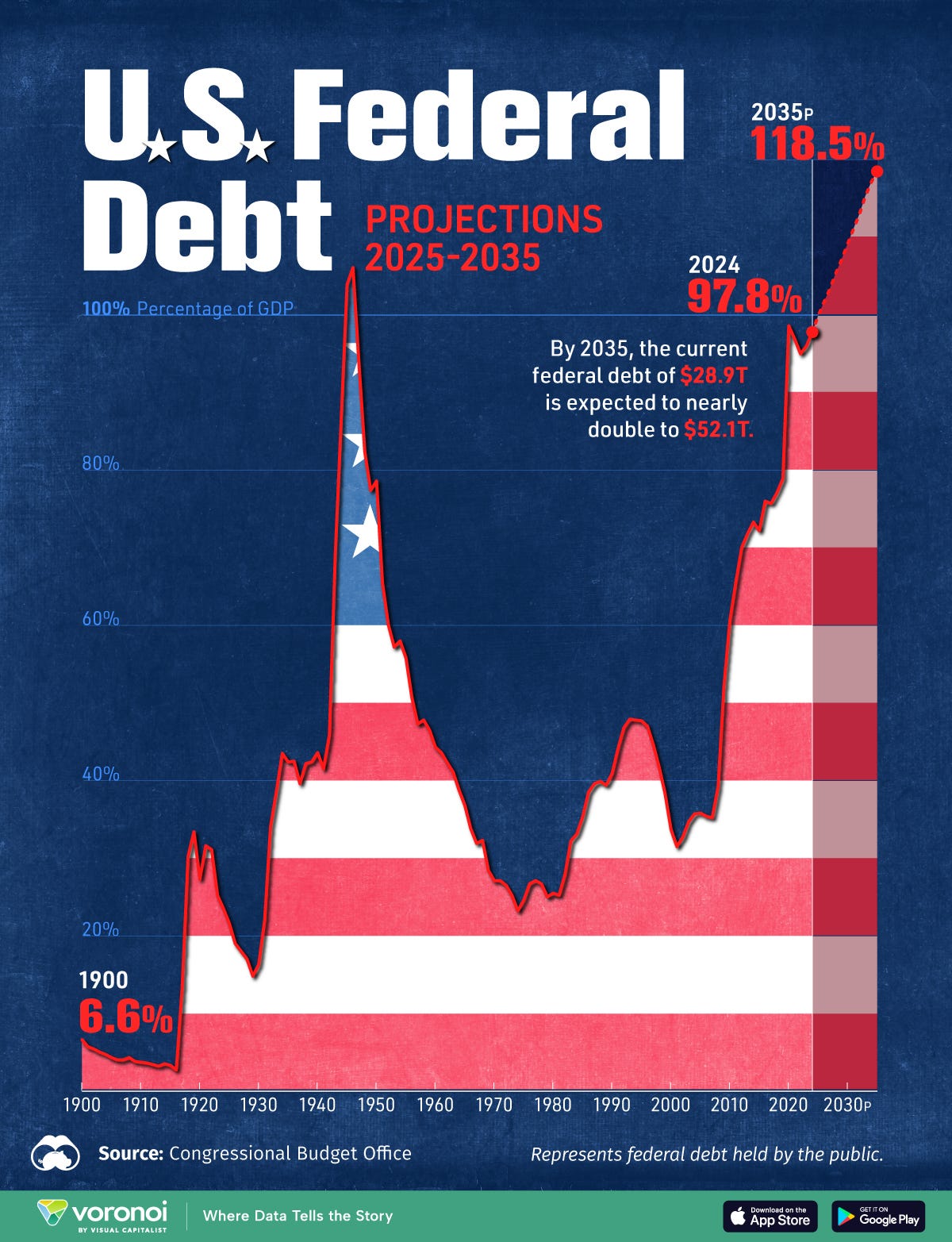

💳The Deficit Will Only Get Worse

When politicians agree on something, you know we have a problem.

🤔What Is It: Three hard truths that are always danced around:

The US government has a spending problem

The US government has a tax problem, both too much and too little (depending on the individual)

The US government has a massive debt problem

Politicians can agree on these three issues. But what is their response to the problem? In unison, MAKE IT WORSE!

👎🏾Takeaway: I don't care who you voted for; every administration has made things worse. Bush, Obama, Trump, Biden, and again Trump, have all had a hand in the situation we are in. They might have had good reasons for the decisions they made, but it does not change the reality that we are in a bad place as a nation financially.

💬In His Words: I love the way, Jim VandeHei & Mike Allen explain this in a recent column they wrote for Axios, "Washington is not a city of math thinking. It's too inconvenient to apply common-sense arithmetic. Instead, you get wonky "dynamic scoring," "budget windows" and "future growth." The solution is always in a future that never comes.

Our favorite new D.C. math: Republicans are backing word and math fog called "current-policy baseline," which allows them to "score" lower taxes as costing nothing. Why? Because they're just extending expiring tax cuts. Make sense? That's the magic of D.C. math."

🤷🏾♂️My Take: This is so American. We are people who spend our future today. Debt is always available and always freely flowing. We all have a belief that we just need to hit our big payday, and we can wipe away all our debts. It is why we have a hard time changing some key laws that could benefit our present life state because we believe that one day it will be us that is benefitting from the broken system.

As Ramit Sethi says, "To live a Rich life, first we have to be brutally honest with ourselves."

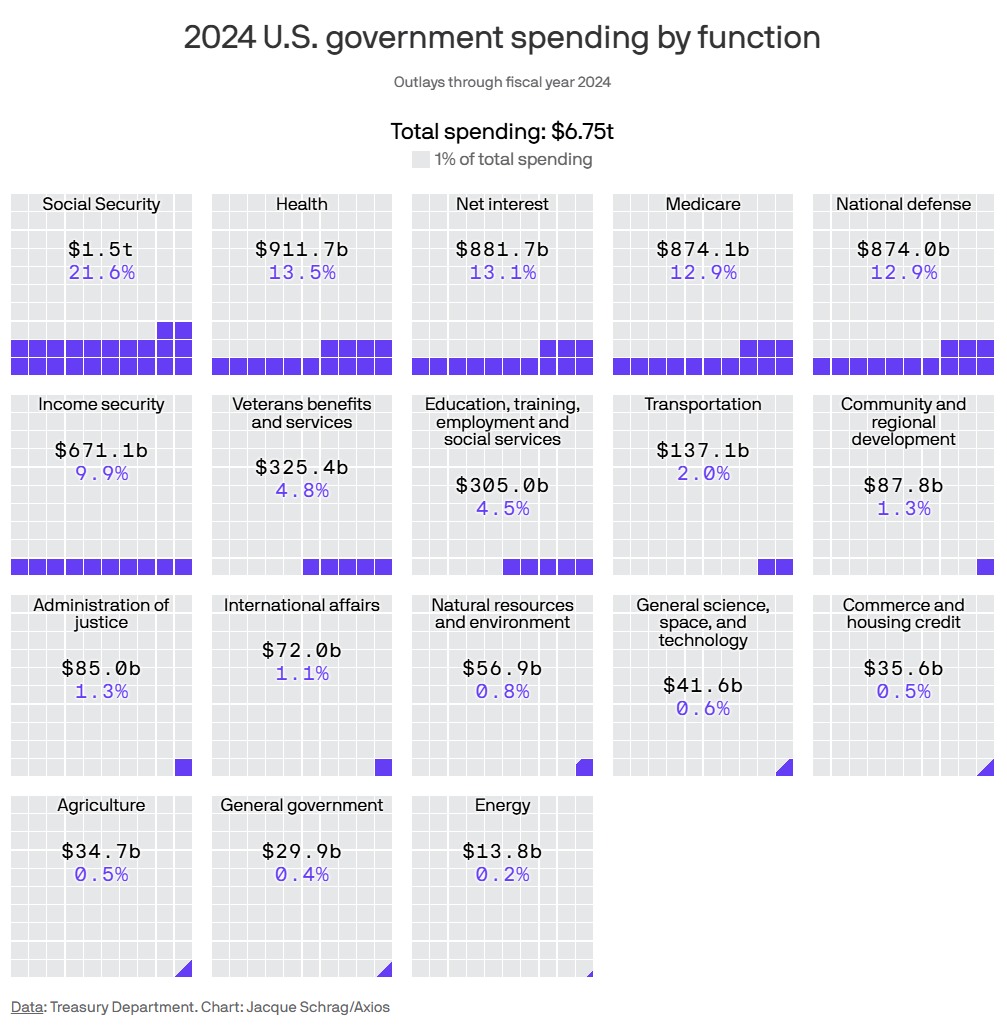

‼️Brutal Truth: From Axios, "The IRS collects around $5 trillion in annual taxes from over 200 million taxpayers. [The US government spends around $7 Trillion/year]. The difference between what we spend and what we take in = our annual deficit. Total annual deficits rolled together over time = total debt ($36.2 trillion today)."

Cutting taxes has never and will never have a trickle-down effect that helps the economy grow or benefit everyone.

Tariffs ain't the solution.

Hard decisions have to be made about some of our social programs, as much as it pains me to admit this.

Removing some tax loopholes and increasing taxes are necessary to increase and close the deficit gap.

If we truly want change, we have to be honest about the problems and the real solutions. But that's hard. As Jim VandeHei said, "Washington is a city of magical thinking." I would expound that to the whole of the United States of America. We are a country of dreamers; otherwise, life is just too painful. But that is the thing, this is also why the USA is still the one place where anything is almost possible. The key word being almost.

Companies

Takeaway: As goes Nvidia, so goes the entire stock market. AI is all the craze, and Nvidia is key to the entire AI run at the moment. When Nvidia catches a cold, the market gets pneumonia. Even when Nvidia is doing well (as it did this quarter), it is taken as "not good enough" and sent tumbling back to earth.

📉Stock Move After Earnings: The Stock initially rose 2% but quickly erased those gains and declined 8%.

🔢By The Numbers: Revenues grew 78% from last year to $39.3 billion. This exceeded analysts' expectations of $38 billion for the quarter.

Profits grew 80% to $22.1 billion, also beating analysts' expectations of $19 billion.

First of all, can we all just marvel at the insane gross margin (71%) Nvidia has? For every dollar that Nvidia makes, it keeps 70 cents.

Think about Walmart last week with a margin of 3%. Hence, this is why Nvidia makes way less revenue than Walmart but has a larger market cap.

Tip: Profits and Free Cash Flow matter more than anything else for a business. Revenue is cool, but it is just the starting point.

💬In Their Words: Nvidia CEO Jensen Huang said, "Demand for Blackwell is amazing as reasoning AI adds another scaling law — increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter."

Blackwell is the newest chip architecture for Nvidia. If demand is slow for this chip, it would have been a horrible sign.

👀What to Watch: How much longer can Nvidia, the stock, keep running? The company is doing great. Yes, its growth rate is slowing down, but that makes sense as the comparison set is getting larger and larger. However, the stock has so much expectation baked into it, making it harder for it to surpass or even meet those expectations.

There are also the growing competitors (Google, Amazon, Microsoft, Meta, etc) who are tired of relying on Nvidia. And there is a fear of the demand not turning into actual profits for the companies buying Nvidia chips, which might mean less revenue.

It will be interesting to watch this play out this year.

Stats of the Week

The amount Berkshire Hathaway paid in taxes in 2024. Warren Buffett, in his annual shareholder letter, bragged about paying the most taxes for a business in the history of the U.S.

💬In His Words: Warren Buffett wrote, "[Berkshire Hathaway] paid far more in corporate income tax than the U.S. government had ever received from any company – even the American tech titans that commanded market values in the trillions.

Huge numbers can be hard to visualize. Let me recast the $26.8 billion that we paid last year.

If Berkshire had sent the Treasury a $1 million check every 20 minutes throughout all of 2024 – visualize 366 days and nights because 2024 was a leap year – we still would have owed the federal government a significant sum at year-end. Indeed, it would be well into January before the Treasury would tell us that we could take a short breather, get some sleep, and prepare for our 2025 tax payments."

My Take: I love how he closed things out. He wrote, "So thank you, Uncle Sam. Someday, your nieces and nephews at Berkshire hope to send you even larger payments than we did in 2024. Spend it wisely. Take care of the many who, for no fault of their own, get the short straws in life. They deserve better. And never forget that we need you to maintain a stable currency and that result requires both wisdom and vigilance on your part."

This letter is required reading for all financial nerds. It is an old man who has seen more lifetimes and crises than any of us can imagine, reminding the young ones of what this game is all about.

Apple announced on Monday that it will be "investing" $500 billion in the US over the next 4 years.

💬In Their Words: Tim Cook said of the announcement, “We are bullish on the future of American innovation, and we’re proud to build on our long-standing U.S. investments with this $500 billion commitment to our country’s future. From doubling our Advanced Manufacturing Fund to building advanced technology in Texas, we’re thrilled to expand our support for American manufacturing. And we’ll keep working with people and companies across this country to help write an extraordinary new chapter in the history of American innovation.”

My Take: Pay attention to the use of the word "American". This is Tim Cook playing chess. During Trump's first term, Cook was able to find a way to get Apple products exempt from all Chinese tariffs that were put in place. This announcement is Cook doing the same thing. This announcement is to stroke the ego of Trump and give him something he can say he was able to do. In reality, Apple was probably going to do a lot of these things anyway. We can tell this because of how vague and almost empty the announcement was. Cook is simply finding a way to act in the best interest of his shareholders.

In Other News: Like Costco, Delta, and JP Morgan, Apple recently reaffirmed its DEI programs and goals. Going against the current business climate where there have been pressures from the Trump administration to do away with DEI programs within companies. Amazon, Meta, Walmart, Target, Lowe's, Google, and McDonald's are some companies that have reversed their DEI policies.

Since the Trump administration took over, there have been 108,551 Layoffs/Departures. This number is expected to continue growing as Musk and his merry band of DOGE folks continue their rampage through the Federal government.

😲Why It Matters: It is estimated that for every 1 Federal worker, 2 contractors support some of the work being done either directly or indirectly. This means that over 300,000 people have lost their jobs since the Trump administration took office.

Takeaway: Prepare for a horrible jobs report in April, when most people will show up in the unemployment numbers. That should be the first shock that the stock market reacts.

My Take: It is not just the federal government going layoff happy. We have seen many tech companies announce layoffs. On Monday, Starbucks announced an 1100-person layoff. Joann's Fabrics is going out of business, and 20,000 people are losing their jobs. The current economic climate looks dark.

I would caution everyone to have that emergency fund in place. Even if it is not fully funded. HAVE SOMETHING. Things are just making me very uncomfortable right now.

🤔40%

According to the Associated Press, 40% of the contracts that DOGE canceled to save the government money saved nothing. Because those contracts were already paid out for services that had already been competed.

My Take: I'm sure there's been a lot of savings. Too bad we won't know what's real because of all the posturing. Charles Tiefer, a retired University of Baltimore law professor and expert on government contracting law, put it best: “It’s like confiscating used ammunition after it’s been shot when there’s nothing left in it. It doesn’t accomplish any policy objective.”

🛍️50%

If you have ever felt that some people are just different from you, you are correct. According to Moody's Analytics, 49.7% of all spending in 2024 came from the top 10% of households in the US. These households make an annual income of $250,000+.

⁉️Why It Matters?: This shows the US's heavy reliance on wealthy households. It is estimated that these households now account for almost 33% of the US GDP; remember, 67% of US GDP comes from consumer spending. This can explain why the numbers show things are great in the economy, but reality can be so different for yourself and those around you. It shows the disconnect in our economy. The gap between the haves and the have-nots is widening at an astronomical pace.

Businesses, of course, respond to this situation. This is why you have been the premiumification of everything. Where there is no longer just one price for things but rather a tiered approach to everything. If you have more money, you get better things and services. If you don't, you get trash. It is the Disney Park effect, where some families with extra money can afford to pay more than $3000/person to have better access, and those who don't get a terrible experience.

Big Picture: The more businesses cater to the rich, the less services and goods are provided to everyone else. An economy that only focuses on the wealthy is never healthy.

Looking Ahead

👀 What to Watch

February Job Numbers

It is estimated that for every 1 government worker that is laid off, it equals another 2 contractors being let go. If those numbers are true, that means around 300,000 people lost their jobs over the last month.

On Wednesday, we get ADP nonfarm payrolls

On Thursday, we get weekly initial jobless claims (can be a leading indicator of people filing for unemployment

On Friday, we get nonfarm payrolls from the Bureau of Labor Statistics

Companies

Sports I Love

This section is empty because I currently have no sports team I love. All my teams are currently sucking so therefore they do not deserve my love.

Extras

If you have student loans, please make sure you are constantly keeping an eye on the payments and making payments. Lots of people are seeing their credit scores take massive hits (almost 100-point drop) because all the pandemic-era relief on federal loans ended in October. The 90-day clock of when you have to make a payment before your credit takes a hit just ended this month.

I know many people signed up for the SAVE Plan, which should have suspended payment while the case goes through the courts. However, there are reports that some loan servicers are ignoring the application. So please go check on your student loans. I would say to report any errors you see from your loan servicer to the CFPB, but the Trump administration just gutted the agency and has been actively trying to weaken it.

*I am a tiny shareholder in this company.