This newsletter is 3,886 words an 18-min read

This is a long newsletter. You will need to open it in a web browser to read it all. There was just too much to cover this week.

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

🤔Labor Market Head Scratcher

⛓️💥Liberation Day or Suppression Day

🔏Privatization of Everything

Stats of the Week

↗️30% More Expensive

✈️10% = $2.1 Billion

Looking Ahead

Inflation

Earnings Season Begins

Sports I Love

⚽Back To Despair

Extras

🐧Tariff Hilarity

Trump Teases Third Term

Markets

This was not the start investors expected this year. Investors believed the new administration was ushering in a time of deregulation, which would be booming for businesses and the stock market.

We all got hit with the Uno Reverse. Rather than the healthy economy we closed 2024 with. We got a chaotic start to 2025. There was no clear direction on what the new administration actually wants to do.

The administration came in guns blazing. Enabling Elon and DOGE the freedom to shut down various federal agencies. Agencies that were not shut down had their labor force massively reduced. Leaving many agencies unable to do their jobs.

If that was not enough, then tariffs (more below) entered the chat. The tariff announcement wiped $5 trillion from the stock market in one day.

Combine all of these factors, and you get a stock market entering correction territory (losing 10% or more from its peak).

AND we still have 3 more quarters to go.

My advice to all investors remains the same: Keep Calm and Stay Invested. Do not make any drastic decisions when your emotions are all over the place. The best thing to do in these situations historically; has been to DO NOTHING and stick to your original plan.

Returns

Tale of the Tape

Economy

But in a positive way.

🔢By the Numbers: On Tuesday, we got the JOLTS (Jobs Opening and Labor Turnover Survey report). It showed that there were 7.5 million job openings. With employers removing 194,000 jobs. Not great.

But then on Wednesday, we got the ADP Private Payrolls Report, which showed employers added 155,000 jobs in March.

Plus, February job gains were revised upward to the tune of 84,000 jobs.

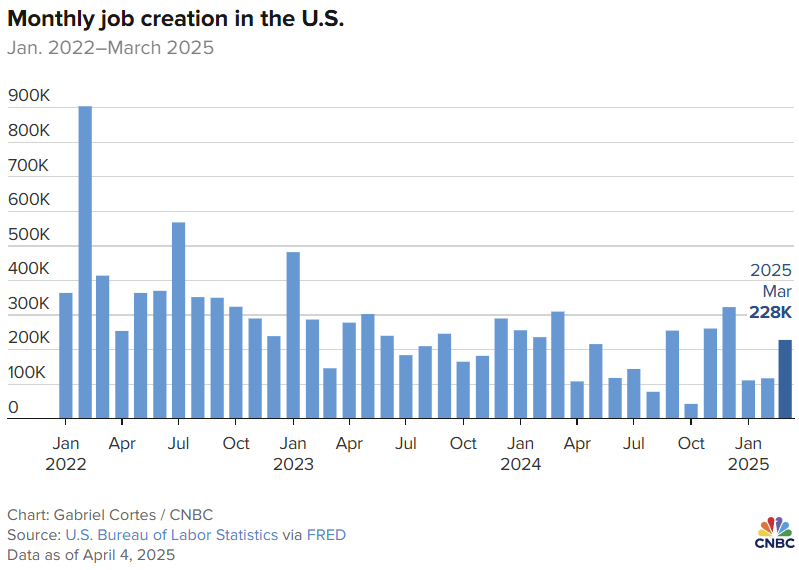

On Friday, we got the granddaddy, the nonfarm payrolls report from the Bureau of Labor Statistics. It showed 228,000 jobs were added in March, far higher than the 140,000 economists expected and the 117,000 jobs in February.

🤔The Head Scratcher: However, the unemployment rate increased from 4.1% to 4.2%. Which is still a great number, but is a weird diversion from the job numbers. Also, there were downward revisions from January and February from the nonfarm payrolls:

January's job numbers were revised down by 14,000 jobs, from 125,000 jobs added to 111,000

February's job numbers were also revised down by 34,000 jobs, from 151,000 jobs to 117,000.

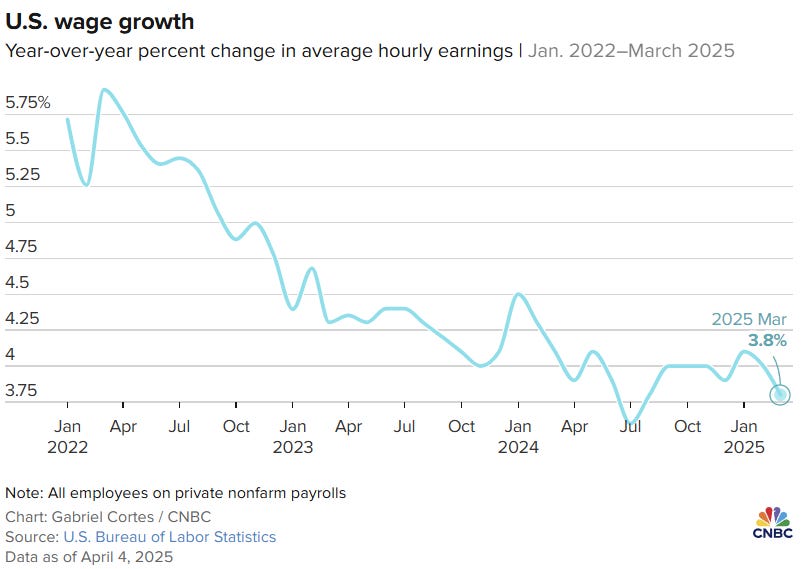

Also, wage growth is not growing but declining rapidly. In March, wages increased by only 0.3% from February and 3.8% from last year.

💬In Their Words: ADP chief economist Nela Richardson said, "Despite policy uncertainty and downbeat consumers, the bottom line is this: The March topline number was a good one for the economy and employers of all sizes, if not necessarily all sectors."

In Kelechi's Words: Employers are essentially Keeping Calm and Carrying on hiring .... For now.

Glen Smith, Chief Investment Officer at GDS Wealth Management, explained the situation very well, “While Friday’s jobs report showed that the economy is still adding jobs even with the tariff uncertainty and Federal job cuts, the data is backward looking and doesn’t say anything about how employers might fare over the coming months.”

🪙My Take: One question keeps ringing in my head: Will we continue having strong job gains, or was this a flash in the pan?

The labor market has been teetering. The tariffs could be the negative impact that pushes things over the edge. Let's hope that isn't the case.

⛓️💥Liberation Day or Suppression Day

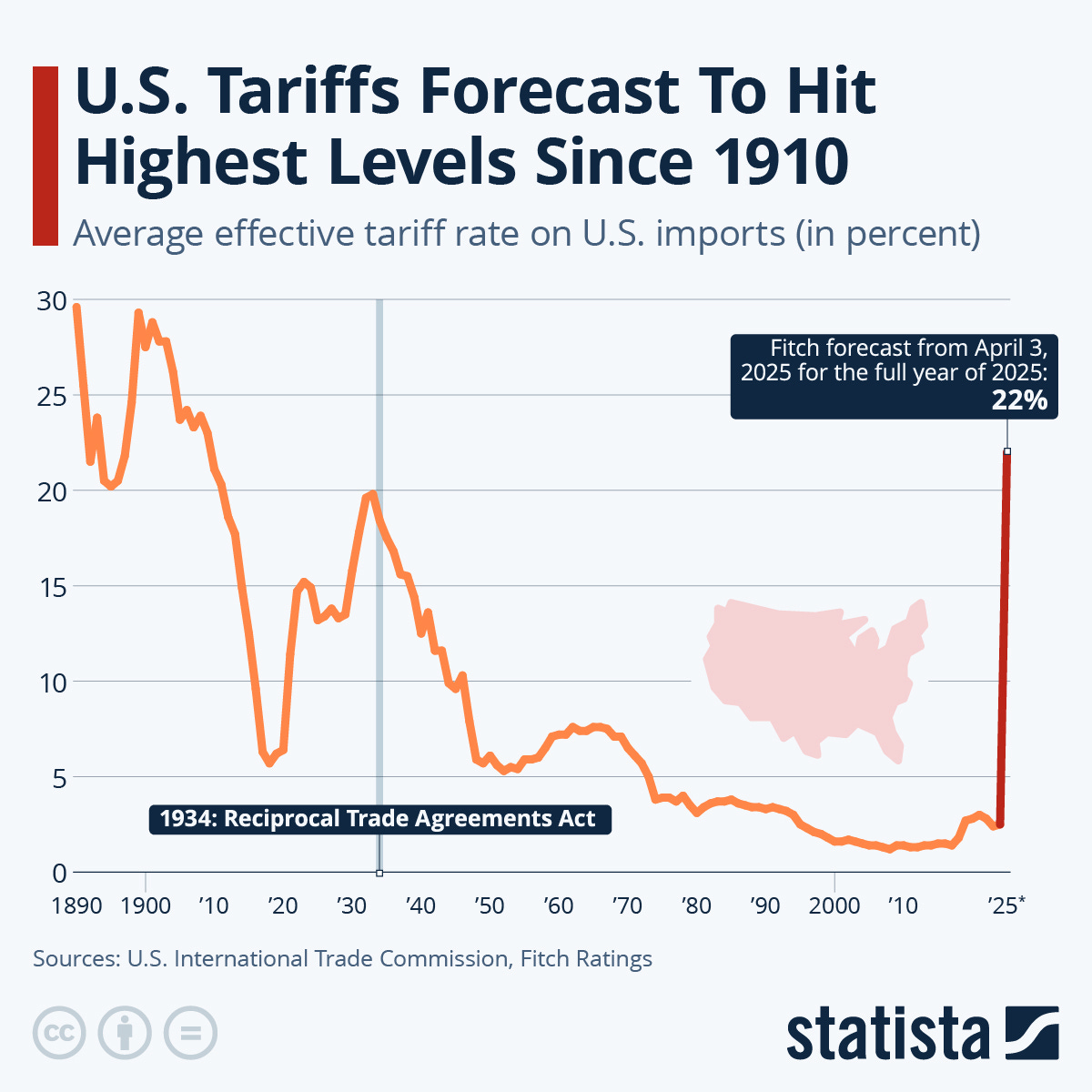

On Wednesday evening, Trump revealed his "reciprocal tariffs" on the entire world. He called the day, Liberation Day. I agree, he just liberated us from a good economy, cheap prices for goods, and having worldwide allies.

🔎Details: It's the end of the Free Trade World that has dominated the last two decades. Trump announced a baseline 10% tariff on all goods. Increasing the tariffs on some of America's allies:

China is subject to 34% tariffs (on top of the previous 20% tariffs already in place)

The EU is subject to 20% tariffs

Japan is subject to 24% tariffs

South Korea is subject to 20% tariffs

Vietnam is subject to 46% tariffs.

Taiwanese imports will face 32% tariffs.

Trump placed tariffs on basically every country in the world.

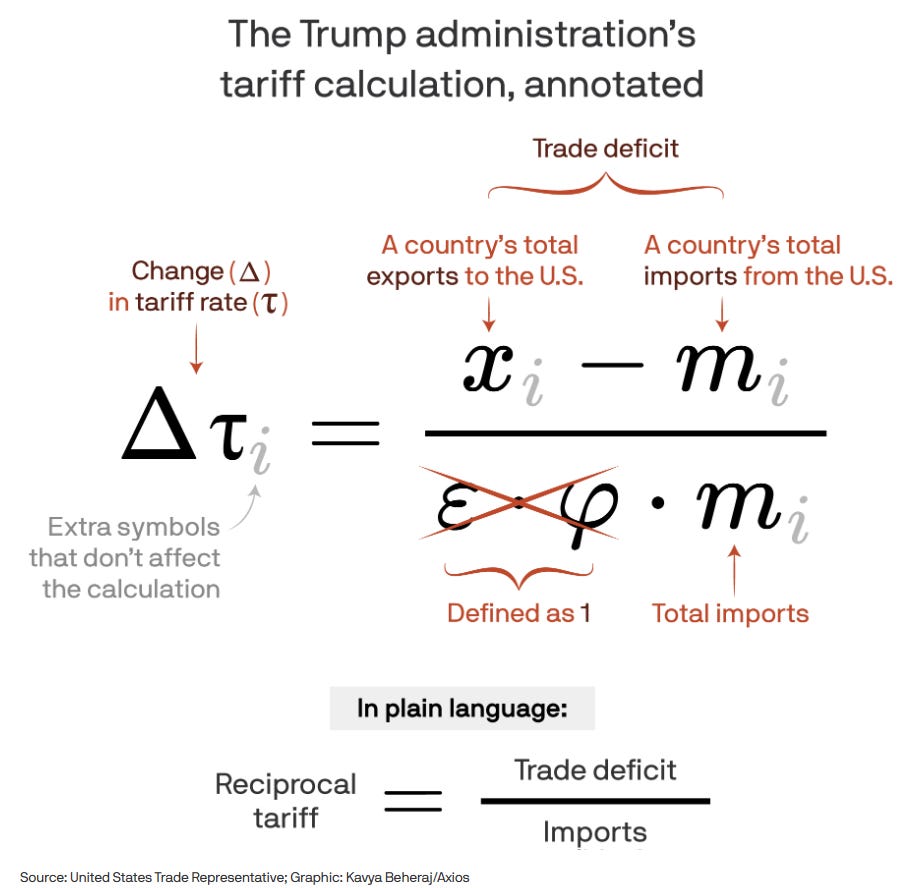

🪄❌Myth: The chart above has a column titled "Tariffs Charged to the U.S.A." That is a lie. The column shows the percentage of goods we import from other countries versus goods exported to those country. The equation would look something like this:

(Total exports to US - Total imports from US)/Total Imports = Tariffs?

It is a very simplistic way to look at the global economy.

The administration is saying, “How dare you make us buy more from you than you buy from us?” Except no one is forcing US citizens and businesses to do anything.

Plus, some nations cannot afford the things we are selling, or they do some things better than the US, or the US can't grow those things like tropical fruits.

It is like a child with 10 toys getting mad about the half toy another child has.

To play on the psychology of the public, the administration tried to sell it as a more complex calculation.

Bottom Line: Deception is REAL!

💬In His Words: Trump said during the event on Wednesday, "April 2, 2025, will forever be remembered as the day American industry was reborn, the day America's destiny was reclaimed, and the day that we began to make America wealthy again — gonna make it wealthy, good and wealthy."

Reality Check: US households are wealthier than they have ever been. Real US household net worth per capita is $496,000. It is the highest in the history of the US.

Caveat: it is not evenly distributed.

🏛️📜🕰️History Lesson: This is not the first time the US has tried using tariffs to "spur" domestic growth. A few examples:

Multiple presidents in the 1800s tried using tariffs, and they all had the same results. Terrible for everyone

The best example was William McKinley (who Trump loves and wants to emulate) imposed 50% tariffs on almost all goods. It quickly drew the ire of the world.

It didn't protect any of the industries it was supposed to help rather led to the destruction of many industries. It also pushed many nations to work together and avoid the US as much as possible.

None more prominent than Canada. At the time, McKinley wanted to make Canada a part of the United States.

Why does this story sound so familiar? 🤔

The tariffs backfired and strengthened Canada.

Ironically, at the end of McKinley’s presidency, he renounced the use of tariffs and wrote how he regretted ever implementing them. He repealed many of them before leaving office.

In 1930, Congress passed the Smoot-Hawley tariff. The goal of the tariff was to protect US farmers and manufacturers from foreign competitors. TL;DR it didn't work.

60% tariffs were placed on a wide assortment of goods. Other nations retaliated with tariffs of their own. Things quickly spiraled out of control

It was part of the reason the Great Depression was so bad because goods were so expensive to make up for any losses from domestic manufacturing.

In 2018, President Trump implemented tariffs on washing machines manufactured in China. China retaliated with tariffs on soybeans for US farmers

Today, we are still paying farmers a massive subsidy to make up for their losses due to the tariffs.

Also, your washing machine and dryer are still super expensive, and there are still not many manufacturers of these machines state side.

🔢By The Numbers: Manufacturers who these tariffs are supposed to help are already voicing concerns about parts that are imported that will be affected and warning of immediate price raises. The issue is that these tariffs are not going to help increase the workforce for manufacturing in the US. Most manufacturing jobs in the US are highly specialized and require fewer workers.

The manufacturing sector's GDP rose from $2.8 trillion to $3.1 trillion between 2020 and 2025.

However, the number of workers has remained at 12.75 million.

The biggest cohort of people that these tariffs will affect are the part of the economy that can least afford to pay these taxes. Yale Budget Lab estimated that the bottom 20% of income earners will see almost a 6% loss in disposable income.

It may seem small to you, but here's a breakdown:

The bottom 20% make about $28,000.

6% is about $1680/year.

It's about $140/month.

That is a lot of money for a family just getting by.

It can be the difference between having groceries for a month or going hungry.

Being able to put gas in the car, cover rent, etc.

👎🏾Takeaway: Tariffs being implemented by Trump are far broader and will have a deeper impact than the Smoot-Hawley tariff (remember it made the Great Depression worse). It also has no clear economic benefits. There is a place for tariffs, but they need to be targeted and executed with precision if they are to have the intended purpose.

Plus, these tariffs essentially hand the global equilibrium to China. As countries and companies look for the best alternative, China has the capacity and the ability to take on the role as the new preferred trade partner.

🪙My Take: I don't think these tariffs will get implemented the way Trump announced them (speaking hopefully). I think there will be caveats and exemptions all over the place. The problem will be the second-order effects. Companies and countries will find a way to avoid the US for trade because we are an untrustworthy partner that cannot be depended on.

Canadian Prime Minister Mark Carney said, "Our old relationship of steadily deepening integration with the United States is over. The 80-year period when the United States embraced the mantle of global economic leadership ... is over. While this is a tragedy, it is also the new reality."

Trust is like Oxygen, you don't know you have it until it is gone. The US might start choking soon.

⛔Negative Kelechi: I need this administration to stop trying to piss on us and tell us it's yellow Gatorade. The American public is not (that) DUMB. These are not reciprocal tariffs. For something to be reciprocal, it means something had to be done first. In this case, we have an administration that took the first shot, then got mad when others stood up for themselves like a bully.

Expect life to be a lot more expensive and, unfortunately, painful. My advice is as follows:

Accept the new reality.

Hug your loved ones and talk about the new reality we face.

Talk about how it might affect you and what you are afraid of.

Simplify your life.

Focus on what you can control

Ask the hard question:

What are the things that are important in your life?

What are the things that are not?

Say YES to the things you love and NO to the things you don't care about. This is how you find extra cash to use to save.

Know your numbers. Needs vs Wants vs Savings vs Debts

Use the 50 (needs)-25 (wants)-25 (savings/debts) Rule to have ranges for your spending

Create a financial plan

Delay large purchases, if you can. While beefing up your emergency reserves.

Keep Investing

Honestly, the advice is mainly for me. It is the only way that I don't allow my fear to control me. I have no idea what is ahead, but I am choosing my response now, not when things are even more chaotic.

Wishing you all the best!

One of the key aspects of Elon Musk's DOGE is not just reducing the size of the government but also privatizing the Federal government.

💬In His Words: Musk recently told a crowd at a tech conference, "We should privatize anything that can reasonably be privatized."

🕰️Background: Musk made his fortune from various private-public partnerships, both with Tesla and Space-X.

Tesla had multiple government contacts and grants from the Department of Energy and Transportation. Those contracts and grants enabled the company to take risks that private investors refused to take.

Space-X was funded by NASA to take all kinds of risks to build out its fleet. Then it became the contractor for NASA.

Both are great examples of when private and public partnerships work. Unfortunately, that is hardly the case in most situations when the private sector takes on a public service. Here are some examples that have turned out horribly:

Fannie Mae and Freddie Mac are the companies that the government partnered with to offer citizens of the United States fixed 30-year mortgages. Having a mortgage for that long at a fixed interest rate is unheard of anywhere else in the world. The government chose Freddie and Fannie to oversee the process of offering these loans.

That didn't work out that well leading up to the 2008 financial crisis. Freddie and Fannie got greedy and began taking leverage on top of the loans the government was backing. This played a massive role in why the financial crisis happened.

The government had to absorb both companies to save them from insolvency and causing even more issues for citizens. It is now a federal agency, not a private company.

Student loans are another public-private partnership that has failed citizens. The government works with multiple institutions, like Sallie Mae, to oversee the offering of student loans to students.

However, Sallie Mae and various other institutions got greedy and found ways to abuse citizens by keeping them in loops of payments for far longer than they needed to be.

They ensured that government workers like teachers, firefighters, and critical positions to everyday society, were supposed to have their loans forgiven after a period of time and consistent payment, could never get them forgiven.

It took the government stepping back in with lawsuits to force their hands, these were most of the loan forgiveness we saw during the Biden administration. All they did was enforce rules that were supposed to be implemented by private banking institutions.

🏛️Takeaway: I could provide more examples with public roads, waterworks, railroads, tolls, electricity, post office, etc. The reason why these situations don't work out well is the conflicting interests and incentives for public vs private entities.

A public service is focused on the public's interests. Ensuring it can serve all citizens, not just those who can afford its services. This means sometimes costs are not the priority. Example: the Post Office ensures that it can reach the furthest houses and most remote places in a city. FedEx, UPS, and Amazon rely on USPS for these things because it is not profitable for them to go that far.

A private company is focused on profits. It ensures that it can make its profit margin regardless of the situation. This sometimes comes at the cost of meeting the needs of a certain group of people. It also means they serve those who can afford their service first and foremost.

🪙My Take: Most public-private partnerships lead to higher costs and worse service. The private sector is not good at serving everyone as long as a profit motive is a driver. Efficiency in the private sector typically means cutting expenses to the bone and that usually leads to poor services. The government does not have a profit motive so can take risks and improve things.

Stats of the Week

💲30% More Expensive

I am not a fan of Milton Friedman, but he has the perfect quote on tariffs

"We call a tariff a protective measure. It does protect; it protects the consumer very well against one thing. It protects the consumer against low prices."

According to The Points Guy, a travel website, 10% fewer Canadians visiting the US will cost US businesses as much as $2.1 billion.

😤😡Why It Matters: Trump's continued rhetoric that Canada must become the 51st State and the tariffs he placed on Canada have turned Canadians into the biggest anti-US folks.

🔢By The Numbers: According to aviation data firm OAG, bookings for Canada-US flights between April and September are down more than 70%.

Airlines are also reducing the number of flights to Canada because they are seeing a massive reduction in reservations.

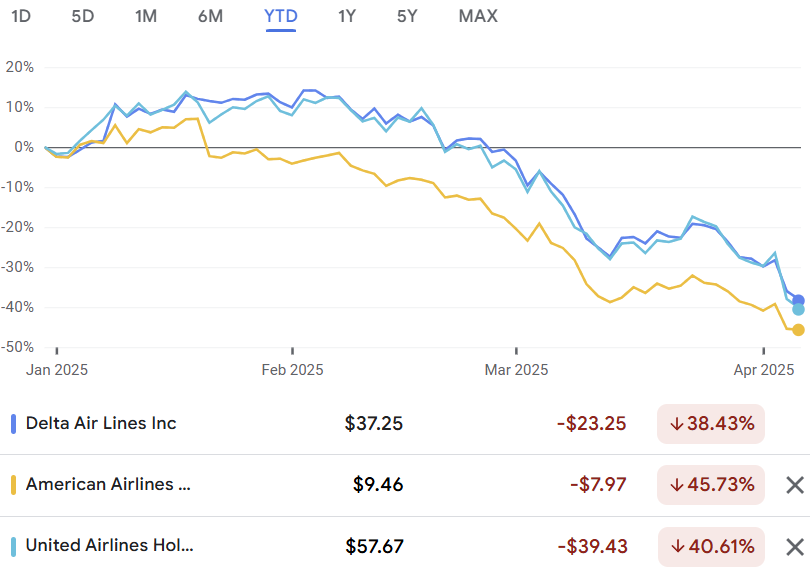

🎡Big Picture: We are already seeing the markets react to these changes after multiple airlines spoke about this in their last earnings.

🪙My Take: It is not just Canada trying to find a way to give the middle finger to the US. Airline executives have spoken to reduced travel from all over the world and mostly from nations that have been historically great for their business. There are many businesses and parts of the US that depend mightily on tourism. With the current administration's fights with allies, citizens of those countries are beginning to react and put their money where their hearts are.

Looking Ahead

Inflation Takes Center Stage

Last week was a lot to take in. I mean, this was probably my longest newsletter ever. Unfortunately, there is no reprieve for our weary souls this week.

Inflation takes center stage this week as the Consumer Price Index (CPI) will be released by the Bureau of Labor Statistics. It will be the final inflation print before we hear from Papa Powell and the Fed next week. With Trump's tariff now official, this will be a key report to inform the Fed on what action is needed moving forward.

👀 What to Watch

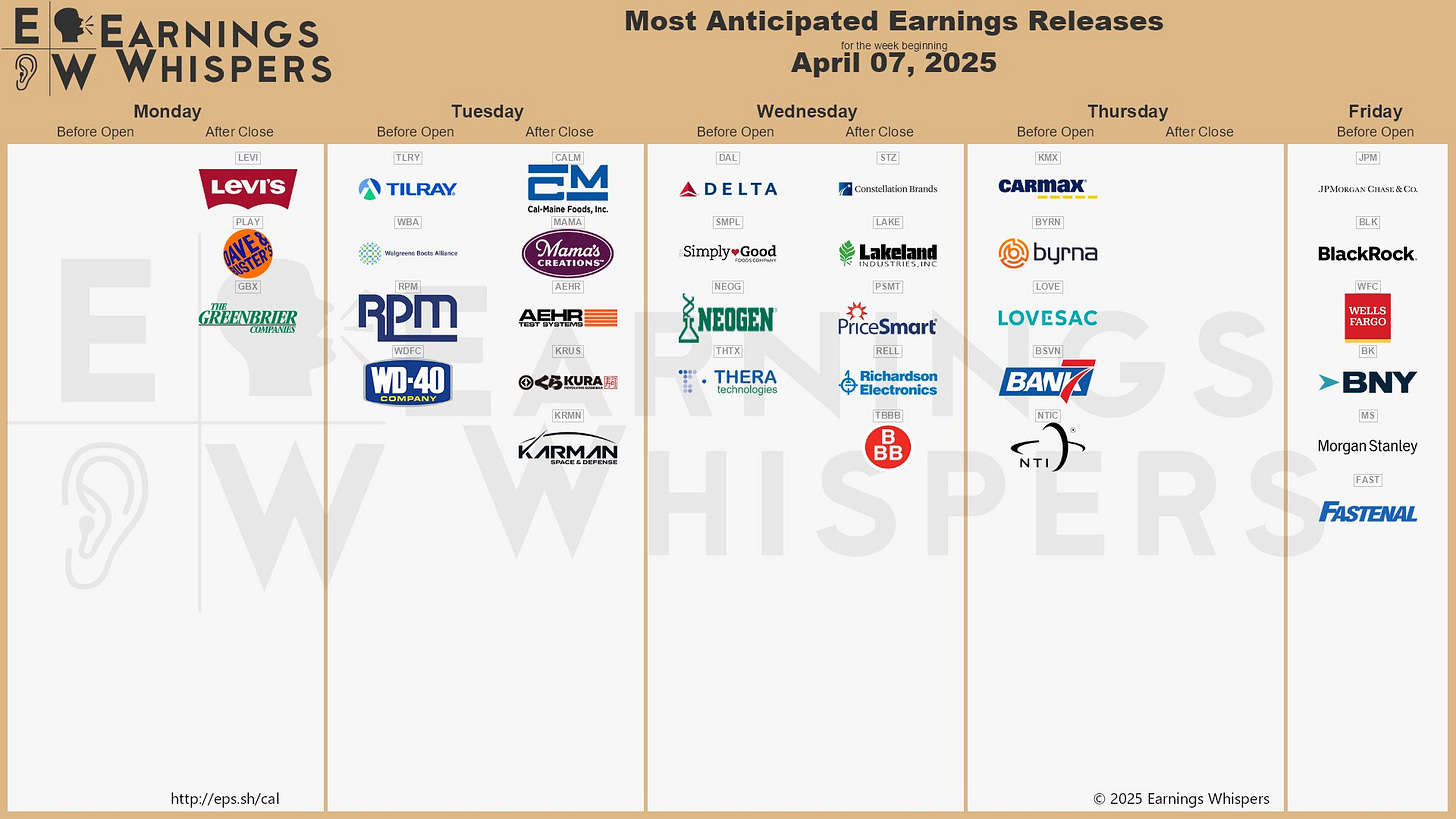

Now that Q1 is in the books, it means it is time for companies to report their Q1 earnings. As always, the banks kick things off.

JPMorgan Chase, Morgan Stanley, Wells Fargo, and BlackRock will report on Friday

Banks play a role in every aspect of the economy, so they can provide insight into the psychology of consumers, businesses, and investors. They can give us an idea of the conversations they have been having with their clients since the tariffs were announced. If bank executives hint at a pullback or that they are focused not on deploying capital but beefing up their cash reserves. That will be a major signal for the market because banks only beef up their reserves when they are afraid of a recession.

Other Companies Reporting

Sports I Love

⚽Back to Despair

I had two weeks of freedom from the disappointment known as Man United. Well, that is over.

The sadness and despair are back.

After the international break, Man U returned to Premier League action on Tuesday and did exactly what you expect, LOST!

Then on the weekend, they doubled down. This team is the epitome of mediocre. The worst part is realizing it is not the players because they leave the club and become integral parts of other teams.

Marcus Rashford at Aston Villa is scoring goals almost every game.

Anthony goes to Real Betis and scores more goals for them in 8 matches than he did in 2 seasons with Man U.

Scott McTominay goes to Napoli and is key to their title chase.

Jadon Sancho with Chelsea, helping turn their season around

Anthony Elanga with Nottingham Forest, key to them being top 4 and qualifying for the Champions League this season

This club is a garbage heap, and I have no idea what will change things for the club.

Extras - Trump Did What?!

I love this little excerpt from Brew Markets on the Trump Tariffs:

Like 179 other trading partners around the globe, the Heard and McDonald Islands were slapped with tariffs by President Trump late yesterday. There’s just one issue: Nobody lives on the Antarctic islands except for a couple hundred penguins.

According to White House documents, the uninhabited islands that can only be reached by a two-week sea voyage and have no imports or exports whatsoever have somehow been charging the US a tariff of 10%, and so will receive a 10% levy of their own.

Shocked to hear they’d been targeted by the US, the penguins who call the islands home couldn’t be reached for comment as they were too busy exchanging rocks as gifts and plotting retaliatory tariffs of their own.

Exhibit 180 of this tariff makes no sense.

People have whispered that Trump might want to "run" for a third term, but it was always a joke based on Trump's dictatorial ways. However, Trump, in only the way Trump does, confirmed the whispers and said it with his chest.

In His Words: Trump told NBC News, "No I'm not joking. I'm not joking. There are methods which you could do it. "I don't even want to talk about a third term now, because no matter how you look at it, you've got a long time to go. ... We have almost four years to go and that's a long time. But despite that, so many people are saying: You've got to run again."

Reality: The 22nd Amendment has put term limits on the President. So, unless two-thirds of Congress and three-quarters of the US states vote to abolish it, this is never going to happen.

My Take: This is another massively distracting issue. Trump is not getting a third term and all the discussion on this distracts from the big picture. The Big Picture is the Trump Administration and Republicans in Congress, are preparing for major tax cuts for corporations and ultra wealthy individuals. To pay for the tax cuts, they are cutting Medicaid, Medicare, and possibly Social Security as well.

The Big Picture is the overreach of power from this administration. The way it is systematically destroying core agencies that everyday people rely on. It is the additional hurdles it is adding for the common man to get access to the resources needed, and the removal of hurdles for businesses to abuse their customers.

When we focus on all the other nonsense that is spewed on a daily from this administration, we miss the big picture.

*I am a tiny shareholder in this company.