This newsletter is words a min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

🔻The Only Good News: Inflation Goes Down

🫢Why Trump Blinked

🫠No Plan from This Administration

Company News

⏸️Bank CEOs Say Everything is PAUSED

Stats of the Week

💸125% Tariff on China

🎞️$157 Million from Minecraft

Looking Ahead

Sports I Love

⚽🤬Oh They Stills Suck

⚽💔😭This Can't Be REAL.... Madrid

🏀NBA Playoffs Begin

Extras

🛍️We Shopping: The American Superpower

🍰I want This But I Shouldn't

Markets

One of my favorite quotes is from Morgan Housel: "Short Term Pessimist, Long Term Optimist." The general idea of the quote is that in the short-term+ things tend to suck but over the long run, things generally improve and get better. I love this quote because it perfectly encapsulates how to think about life, especially when things become scary and uncertain. Where we no longer feel great about our current state.

Right now, things are terrible after the Trump tariff announcement. No one knows what might happen next. The only thing we know so far is that it won't be great shortly as businesses and countries react to the tariffs. However, humans tend to be ever-progressing machines. We march toward always finding ways to make life better. The main thing is surviving the short term long enough to see the benefits of the long term.

In practical terms, it means:

Take care of your downside risk in the short term.

A good emergency fund if anything happens, you can survive until you get on the other side of things. (6-12 months of expenses)

Keep your resume polished and stay up to date with recruiters (you want to be remembered)

For the long term, look for opportunities.

If you are an entrepreneur, they say the best time to start a business is during chaos. Spot the path that is showing signs of customer needs

If you are an investor (should be everyone), do not stop investing. If you have extra cash, these are the times to increase investments.

As Felix Salmon of Axios put it, "Recessions are bad, but they're also inevitable, and the U.S. has had many of them. Over the long term, the American economy always seems to do pretty well."

Short Term Pessimist, Long Term Optimist

Returns

I'm surprised that markets rallied last week. I guess any sign of things going back to normal gets investors excited. In reality, things are not going back to "normal." I wrote that on Wednesday, and by Thursday, the market remembered that things were still really bad.

Tale of the Tape

Economy

🔻The Only Good News

Inflation is at its lowest levels since the 2020 pandemic.

🔢By The Numbers: CPI fell 0.1% from last month and rose only 2.4% from last year. This is less than the 2.8% inflation numbers in February.

Core CPI, which excludes volatile food and energy costs, rose 0.1% from last month and 2.8% from last year.

A few notable categories:

Energy prices fell 2.4% in March, led by a 6.3% decline in gas prices.

Unfortunately, food prices increased 0.4% in March, with both food at home and food away from home increasing by 0.5% and 0.4%, respectively.

Largely driven by egg prices increasing 5.9% and beef increasing 1.2%

Airline fares fell 5.3% in March following a 4% decline in February.

💬In Their Words: This is great news for Jerome Powell, at least for now. Tariffs were not active in March, so we are still benefiting from the Biden administration's policies. As EY Economist Lydia Boussour said today:

“While the March CPI report brought some encouraging news, the relief is likely to be short-lived as upcoming inflation reports will likely reflect some pass-through from recent steep tariff increases. Our modelling shows that if the universal 10% tariff on all trading partners and 125% tariff on China are maintained, US consumer price inflation could be 0.8 percentage points higher in 2025, with the inflationary impulse concentrated in the second quarter of the year.”

🫨Takeaway: Jerome is still very stuck in a hard place. The economy is teetering, and anything the Fed does could make the problem worse, especially when you have fiscal policy (Government spending) working actively against its progress. Ordinarily, if Trump had not gone Trump, the Fed would be cutting rates as inflation slows down, but that is not happening now with all the uncertainty in the air.

🫢Why Trump Blinked

🤔Explain: It is one thing for the stock market to crash. It is a much bigger deal when the bond markets begin to panic. In other words, Bond Vigilantes have entered the chat.

🕰️Background: The way companies and countries borrow money is not the way you or I borrow money. Companies or countries offer bonds to investors at certain interest rates. Investors tend to view bonds as a safe investment because they provide consistent income for a certain period. But like with any loan, your creditworthiness comes into play. If you are creditworthy, your interest rate is low. If not, you pay crazy high rates.

Of course, investors can buy or trade a bond depending on how confident they are about the country or the company.

The safest bonds in the world are the US treasuries. Because the US has never defaulted on a loan and always paid its debts, investors have an assurance that they will eventually get their money back. It is why the US has the lowest interest rates in the world on its bonds.

The main bond that is watched is called the 10-year treasury. It is also tied to the rates that we pay for car loans and mortgages. Making it extremely important to the US government, which has to regularly issue more bonds to roll over its debt.

⏳Timeline: On Tuesday, the Treasury opened the auction for the US 3-year bonds. It had very little demand. Typically, investors clamor for US bonds because of how safe they are. This sent the yield for all bonds flying to levels not seen since the 2008 Financial Crisis.

Shortly after this, we got the tariff delay announcement from Trump. Then the auction was able to be completed

🥷🏾Takeaway: The worst thing for any government is to either have to offer ridiculously high interest rates for its debt or not be able to sell its debt to raise funds for its nation, or keep rolling over its debts. If you cannot finance the government, it is game over. This is why bond investors are sometimes called "Bond Vigilantes" because they can force the hand of government officials to change their plans.

When bond yields begin to spike, investors are signaling two things:

We do not believe anything you are saying and do not trust you.

We believe the economy is about to go into a recession (see above 2008 recession).

Resulting in one outcome: WE WILL NOT INVEST IN YOUR NATION.

This move in bond yields got the attention of Trump with the quickness.

😵💫🫠🌀Lost in Chaos: Amid all the news of tariffs off and on, one important piece of news kinda slid away from headlines. On Thursday, the House passed the framework that will extend the 2017 tax cuts and create the framework to increase spending over in certain parts of the government. The bill is estimated to add $7 trillion to the national debt over the next 4 years.

For all the posturing, we've been hearing about reducing government spending. The reality is that the government will be even more in debt with this bill. The only difference is that it won't be to the benefit of most people because the government is also cutting social programs that help those in need.

These on-again, off-again tariffs just show that there is no strategy or plan from the most important office in the country. It is all just vibes.

💬In His Words: When asked by reporters how he will determine tariff exemptions, Trump said, "Instinctively, more than anything else. You almost can't take a pencil to paper. It's really more of an instinct, I think, than anything else."

😕😖Takeaway: Long-term plans cannot be made if everything is based on the feelings of one man. Who can change his mind at the snap of a finger. Trump and his lackies have said they want the US to be a manufacturing hub and for more investment to come to the US. As David Jacoby loves to say, "Your actions should match the outcome you want."

Right now, the actions of this administration make no sense in the outcome they keep saying they want. If the real desire is for more manufacturing, you need a few things happening simultaneously:

Investors have to trust that their capital is safe and that there will be no massive changes in a short period.

Administration is working against itself by constantly changing its mind and tune about what it is doing.

Plus, the administration’s autocratic tendencies do not help in attracting investment.

One of the benefits the US has had in the world of business is the Rule of Law, which this administration has gone after over and over again.

You need workers. Not just any workers, but low-wage workers who want these jobs (ignore that most of manufacturing is automated). Either US citizens who desire low wages or need a massive immigration to make up the shortfall.

The administration has gone on war path to not just deport illegal immigrants but to ensure the US does not feel welcome to legal immigration.

You need expertise from all over the world that wants to innovate in the US.

The attack against universities does not build confidence for people to want to come study in the US.

The cutting of funding to the best universities in the world for important breakthrough research is essentially cutting your hand off from being at the forefront of breakthroughs.

You need stable prices, aka no runaway inflation.

Implementation of tariffs ensures there will be inflation.

Don't antagonize the most important trade partners you have (Canada and Mexico) in completely pointless fights that push them to look for new trade partners.

You also want global partnership to look to you as the ultimate partner, and move away from the current world manufacturer (China)

The administration has done the opposite. It has alienated the US from the world and given ground for China to gobble up space and trust.

Eliminating USAID is dumb because it was a cheap way of buying goodwill and favor, and of keeping your enemies in check.

Provide subsidies to show the world you're serious about the change you're trying to make.

The administration did the opposite by eliminating the CHIPS Act and parts of the Inflation Reduction Act that were instituted in the Biden Administration. Both provided Biden and got manufacturers to make substantial investments in the US

Why was it eliminated? No idea

Right now, there is so much magical thinking happening in the Trump Administration. But when you do the math, it just ain't mathing.

🪙My Take: As my Pastor says, "Feelings are a great place to tell you where you are, but a horrible place to make decisions from."

And I love to say, "Feelings are not always reality. They are important to acknowledge, but do not need to be acted on."

In a role as the President of the United States, which holds more true than ever.

Companies

🏦JP Morgan Chase

Jamie Dimon, CEO of JP Morgan Chase, is a very important voice for the business community and for the markets at large. As the leader of the largest bank in the US, Jamie Dimon has access to information stretching every part of the US Economy. On Saturday, he wrote his annual shareholder letter. This one was more anticipated than past letters, as investors and business leaders wanted to hear what he had to say. It was nothing good.

"There are many uncertainties surrounding the new tariff policy: the potential retaliatory actions, including on services, by other countries, the effect on confidence, the impact on investments and capital flows, the effect on corporate profits and the possible effect on the U.S. dollar. The quicker this issue is resolved, the better because some of the negative effects increase cumulatively over time and would be hard to reverse. In the short run, I see this as one large additional straw on the camel's back."

Kelechi's Interpretation: I cannot say this directly because Trump is vindictive. But read between the lines, these tariffs are stupid. Yes, there are issues in some trade agreements with a specific country (looking at you, China). However, burning the house down to get rid of a spider is stupid. Plus, the economy is not where it was back in 2018 when Trump had his first flirt with tariffs. Things are a lot shakier.

📉Stock Move After Earnings: Typically, the focus would be on the financials of the companies, but right now, no one cares.

The Stock Market is a future discounting machine. It is looking for anyone to provide clarity on the cut situation and how it can be navigated.

The only response investors keep getting from the Big Banks is that there is too much uncertainty and a high likelihood that we are going into a recession because of the tariffs and trade war with China.

⏸️Takeaway: All Big Banks reported a major slowdown in their customers’ borrowing or making deals. They said businesses are hitting the pause button on everything.

👀What to Watch: Will any company provide future guidance? Even more important than last quarter’s financial result is this quarter and this year's earnings result. When it comes to the stock market, everything is about expectations of the future. Typically, these expectations are based on what the company says about its future.

I expect more companies to announce in their earnings that they will not be providing guidance for the foreseeable future. Similar to during the COVID pandemic. Businesses will probably be in a wait-and-see mode.

Stats of the Week

💸125%

Trump increased the tariff on China by 125% after Beijing instated an 84% tariff on US goods, but also announced a 90-day pause on the "Reciprocal Tariff". He also dropped most tariffs to a baseline of 10% on every other nation. Leading to a massive rally in the stock market.

🔢By The Numbers: The US imports about $600 billion worth of goods annually from China. Amazon has reportedly started cancelling orders with suppliers in China to avoid the tariffs. Meaning there is a possibility that for a while we will not be able to get some things that we are used to easily getting.

🪙My Take: I thought the market was a forward-looking indicator? The tariffs did not disappear, they are still hanging over heads like a guillotine. Just because Trump increased the distance the blade has to fall, it does not mean we are clear.

Plus, it ignores the secondary effects of the relationships with countries. Canada is already working with other nations to ensure it is not caught on the whims of one man. South Korea, Japan, and China are discussing having deeper trading ties because they do not trust the US as partners over the long run.

The point is that the market rally is masking the bigger issue and problems.

🫠✅Bottom Line: Once you instigate a war, it is hard to stop it.

Sunday Night Update: China increased its tariff to 125% after Trump increased the tariff to 145%.

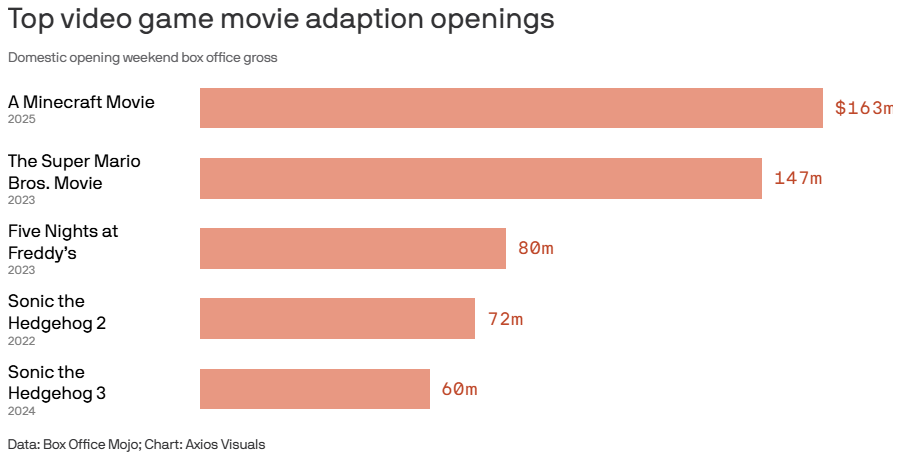

Minecraft Movie broke the record for the bestselling video game movie ever. Super Mario had just set the record in 2023.

🔢By The Numbers: The movie was estimated to make $90 million. But instead made $163 million in the US and $313 million in international sales.

Looking Ahead

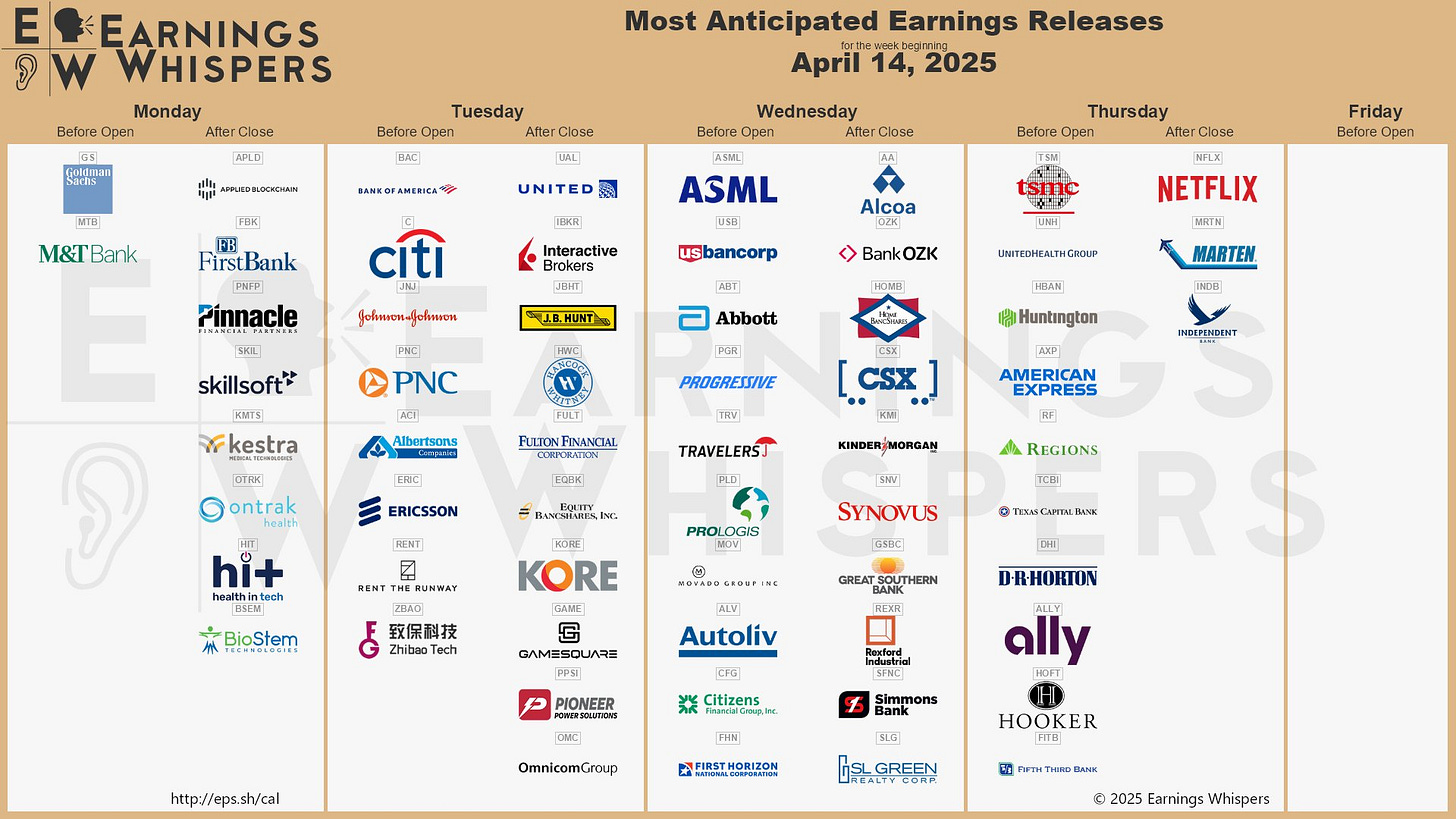

Company/Earnings

We take a break (hopefully) from heavy economic indicators this week. However, the quarterly earnings of companies will be flowing. We've got a lot of major companies reporting this week, each will give us a breakdown on their finances.

I expect most companies to have had a great Q1, but it won’t matter because their forecast will be cloudy. I expect most companies (if not all) will pull their guidance for the year ahead. Wall Street does not like this at all because it makes it harder to create expectations and remember that expectations are everything to investors.

The good news is that on Friday Markets will be closed for Good Friday. The day Christ died on the cross. You may wonder, “Why is it called Good Friday then?”

Because only through His Death and Sacrifice do we get the chance for an atonement for our sin and a chance to spend eternity with God.

👀 What to Watch

There is only one question on every investor’s mind: Tariffs.

How will these tariffs affect your business?

What are you doing to manage this new risk?

Are you pausing any capital expenses (read this as: will you hire fewer people)?

Companies I am Watching

*ASML: This is one of my newest holdings. ASML continues to be a key player in the growth of chips that are used in chip manufacturing.

My Question: Tariffs are probably not going to affect the company directly. However, what is ASML hearing from customers?

Are customers looking to delay orders?

If Tariffs do affect orders, will ASML pass on the increased cost to its customers?

Will that in turn slow demand?

Netflix: At this point, there is no real competition in streaming against Netflix. It has dominated the space fully. However, it has been more focused internationally for its continued growth.

My Question: Will there be any challenges with countries using Netflix as a way to fire back at the US? Software and Entertainment are the US's greatest exports.

Bank of America has more insight into consumer spending and saving trends than any other bank.

My Question: What are you noticing from consumers? Are they saving more or continuing to spend more to prepare for the tariffs?

What does Consumer Debt look like? Is it getting worse?

Others

Sports I Love

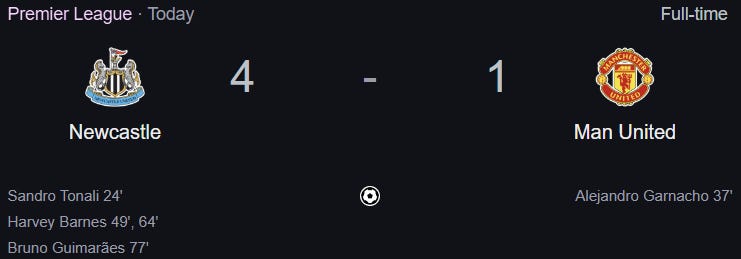

⚽🤬Oh They Stills Suck

This is just disgraceful.

That is all I have to say

⚽💔😭This Can't Be REAL.... Madrid

This is just disgusting!!

HOW MADRID HOW?!!

We looked like schoolboys against grown men. Madrid had a nice first half, but in the second half, they got completely outclassed. It started with Vini and Mbappe not taking chances that could have changed the game early. As the game progressed, they lost their defensive discipline.

We have the second leg on Wednesday, let’s hope they figure themselves out. This team has done it before. By before I mean last year against Man City, coming back from 4-1. So it is possible, but my goodness, they have a lot to figure out.

🏀NBA Playoffs Begin

After a WILD NBA Season, it is finally time to pay full attention to the NBA.

OKC looks very good but they feel too young to actually win it all. I do not trust Cleveland at all. I typically would go for the Bucks and they have been playing well the final 3 weeks of the season but my faith is very low. The Nuggets would have been a favorite, but they just fired their head coach and GM.

The Celtics right now are looking like the only team that has the completeness to win it all again. Which is annoying to say out loud. But is the truth.

Who do you think will win the title?

Extras

We are Shopping.

The Superpower of America is our ability to shop through any circumstance. We love buying stuff, and we especially love buying stuff during times of calamities like pandemics, hurricanes, etc. We use these times as an excuse to buy all kinds of stuff. We are at it once again.

By The Numbers: Post Trump tariffs, Americans are ramping up their spending on various items.

Instant coffee sales rose 21%

ketchup 18%

beer 3%

All compared to the previous week. Also, transaction size increased across a ton of big box retailers, including BJ’s, Costco, and Target. Folks are also making life-changing purchases as well like cars.

Takeaway: Consumer spending is key to a healthy economy. However, if these are just short-term pulled-up spending, it makes things worse later.

My Take: Never make a long-term decision based on short-term situations.

*I am a tiny shareholder in this company.