No Way That Just Happened - Market Update April 28 - May 2, 2025

Yep, it’s a long one—record-breaking, even. Might need snacks and two sittings. Mark unread and circle back when you're ready.

This newsletter is 4,429 words, a 20-minute read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

🪙📉🫥Economy Shrinks

👷🏾♂️Jobs Jobs Jobs

↩️Amazon Backtracks

Company News

🪟Microsoft Earnings

🍎Apple Earnings

🛍️Amazon Earnings

Stats of the Week

💸$135 Billion saved by DOGE cost $160 Billion

🚢65% Drop in Cargo Shipping from China

💯139 Executive Orders in 100 Days

Looking Ahead

Papa Powell Speaks

300 S&P 500 Companies Report Earnings

Sports I Love

⚽Dr. Jekyll meet Mr. Hyde

Extras

🚘🤖Toyota partners with Waymo for Self-Driving Future

Markets

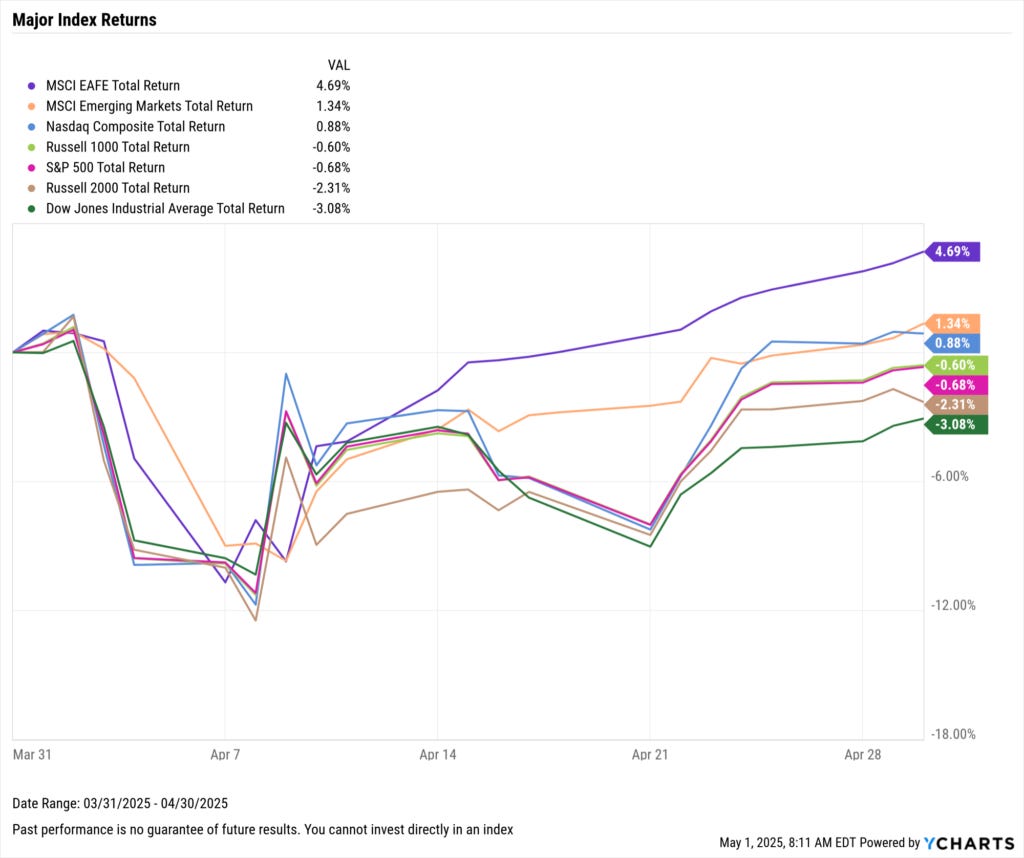

I gotta say, I am shooketh by the markets. I’ve never seen a comeback like that. It was like watching LeBron come back from being down 3–1 to the Warriors. After crashing due to “Liberation Day,” the markets recovered strongly—rising for nine straight days to close April firmly in positive territory.

Does it make any sense to me?

Nope—not even a little bit. The tariffs are still in effect. They've only been delayed by Trump, with some exemptions for specific industries and items. Tariffs remain a negative for the economy, and businesses must find ways to adapt. However, investors believe the outlook is much better than it was three weeks ago.

Again, it makes no sense! But this is exactly why I don’t invest or make financial decisions based on what I feel. I’m like a robot when it comes to that—automated, with everything running in the background without me having to do anything. In the short term, the stock market can swing wildly. But over the long run, it tends to move in one direction.

Hope you all are still on the ride.

Year-to-Date Returns

Tale of the Tape

Economy

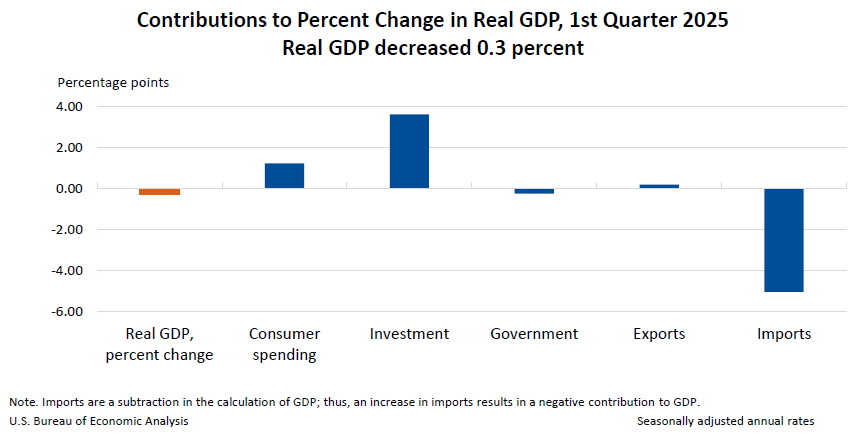

GDP put in numbers what you've all been feeling since Trump took office. The economy is getting worse.

🔢By The Numbers: On Wednesday, the Commerce Department released official GDP numbers for the first quarter of 2025.

The economy declined 0.3%. It was far worse than the 0.4% increase economists had forecasted.

To put things in context, GDP in the fourth quarter of 2024 increased by 2.4%

💬In Their Words: Senior Economist at UBS, Brian Rose explained, "We are not overly concerned about the negative GDP print. After all, the economy expanded 2.5% in 2022 as a whole despite the decline in Q1 2022. What is more concerning is the potential impact of tariffs, which is likely to cause a more substantial economic slowdown in the second half of 2025"

White House trade advisor, Peter Navarro, called the GDP decline, "The best negative print I have ever seen in my life.”

🤔What Happened: We all know what happened. We've been talking about it for the last three months: TARIFFS. Although they hadn’t been implemented yet when the GDP numbers were recorded, their impact was already being felt. Consumers and businesses did their best ant impression—importing a ton of goods before the tariffs took effect. As a result, imports in Q1 jumped by 41%.

The equation of GDP is Consumer Spending + Investments (Business Spending) + Government Spending - Net Exports (Exports - Imports).

Oh, and by the way—inflation ain’t gone yet. The PCE, the Fed’s preferred inflation gauge, showed a 3.6% increase in Q1 of 2025. That’s significantly higher than the 2.4% recorded in Q4 of 2024, and well above the Fed’s 2% target. This makes the Fed’s job even harder, especially with the labor market starting to falter at the same time. It’s putting our beloved Papa Powell between a boulder and a cliff.

😠Takeaway: Typically, I despise when people attribute either all the blame or all the credit to one person. Rarely is one individual solely responsible for things going well—or poorly—in the economy. Countless factors shape the conditions we live in, and no president controls all of them.

However, this presidency feels different from anything I’ve experienced in my lifetime. The usual rules I’ve come to expect about how an economy functions have been broken. The challenges we’re facing aren’t the result of a global crisis like a pandemic or a systemic financial meltdown.

Nope. This time, the problems are self-inflicted—caused by one administration choosing to go against the grain without fully thinking through the consequences… or, dare I say, even caring about them.

🫙My Take: One of the ironclad rules of Trump is to never admit defeat, even when you’ve lost. Always double down. If we’re waiting for the better angels to take over and for things to change, we’ll be waiting our entire lives. All signs point to one result: a very high likelihood that we’re heading into a recession of our own making.

My advice remains the same as always: protect yourself. Build that emergency fund. Keep your resume up to date. Stay in touch with recruiters. Take care of your personal finances. I don’t know if we’ll enter a recession, but I’d rather be ready than scramble to get ready in the midst of chaos.

👷🏾♂️Jobs Jobs Jobs

🔢By The Numbers: The effects of the tariffs are showing some effects in the labor market.

Job Openings fall to a 6-month low. Job Openings declined by 288,000 jobs to 7.19 million job openings in March from 7.5 million in February.

However, layoffs declined by 1%. This tells us that businesses are not making any big investments and hiring, but they are also not letting people go. Things are static at the moment.

The quit rate (measuring the number of people who leave jobs willingly) also dropped by 2%. Showing people do not feel confident in the labor market to leave a job and try to find another job.

ADP private payroll numbers were pretty abysmal

62,000 were added by private employers in April. Economists expected 125,000. It is a huge decline from the 147,000 jobs added in March.

Wage growth also slowed marginally. Increasing by 4.5% versus 4.6% in March.

It is in line with the JOLTS survey results of companies deciding to take a complete pause on hiring.

Nonfarm payrolls released on Friday gave the markets and the Fed a massive sigh of relief.

177,000 jobs were added in April, greater than the 133,000 expected.

The unemployment rate remained unchanged at 4.2%.

However, the thing to pay attention to in the report is the previous monthly revisions. That gives a clearer picture of what is happening with a complete set. BLS says in the report, "Monthly revisions result from additional reports received from

businesses and government agencies."February jobs were revised down by 15,000 jobs from 117,000 to 102,000

March was revised down by 43,000 jobs from 228,000 to 185,000

😕😖Confused: So, how do we put all this information together? The way I have always understood ADP is that it shows the reactions of businesses (especially small businesses) in real time to changes in the economy, while nonfarm payrolls tend to be a bit slower because of the larger breadth of data.

In basic terms, it means the nonfarm payrolls tend to be slower and backward-looking. Where ADP is a bit more forward looking.

The JOLTS survey is more of a leading indicator because if job openings are declining, it means it will get harder to find a job.

It also means businesses are scared to make investments.

If people are choosing not to leave their jobs, it means the economy is in a scary place, and people are not confident.

💬In Their Words: To put the job market in a word, it would be FROZEN. ADP chief economist, Nela Richardson, said it best in the report, "Unease is the word of the day. Employers are trying to reconcile policy and consumer uncertainty with a run of mostly positive economic data. It can be difficult to make hiring decisions in such an environment."

2️⃣Takeaway: Two things can be true at the same time. Things have been good, but things are looking scary when we look ahead. As Head of Investment Strategy at JPMorgan Wealth Management Elyse Ausenbaugh put it, “April may have been the last month when we didn’t see the aggregate impact of trade war 2.0, DOGE job cuts, and tight immigration policy—but look closely enough and there are hints, like the slight decline in manufacturing payrolls and another drop in federal government jobs.”

The economy has remained resilient, but can it continue with the pressures it faces? We will see as the dagger of the trade war remains hanging over our heads.

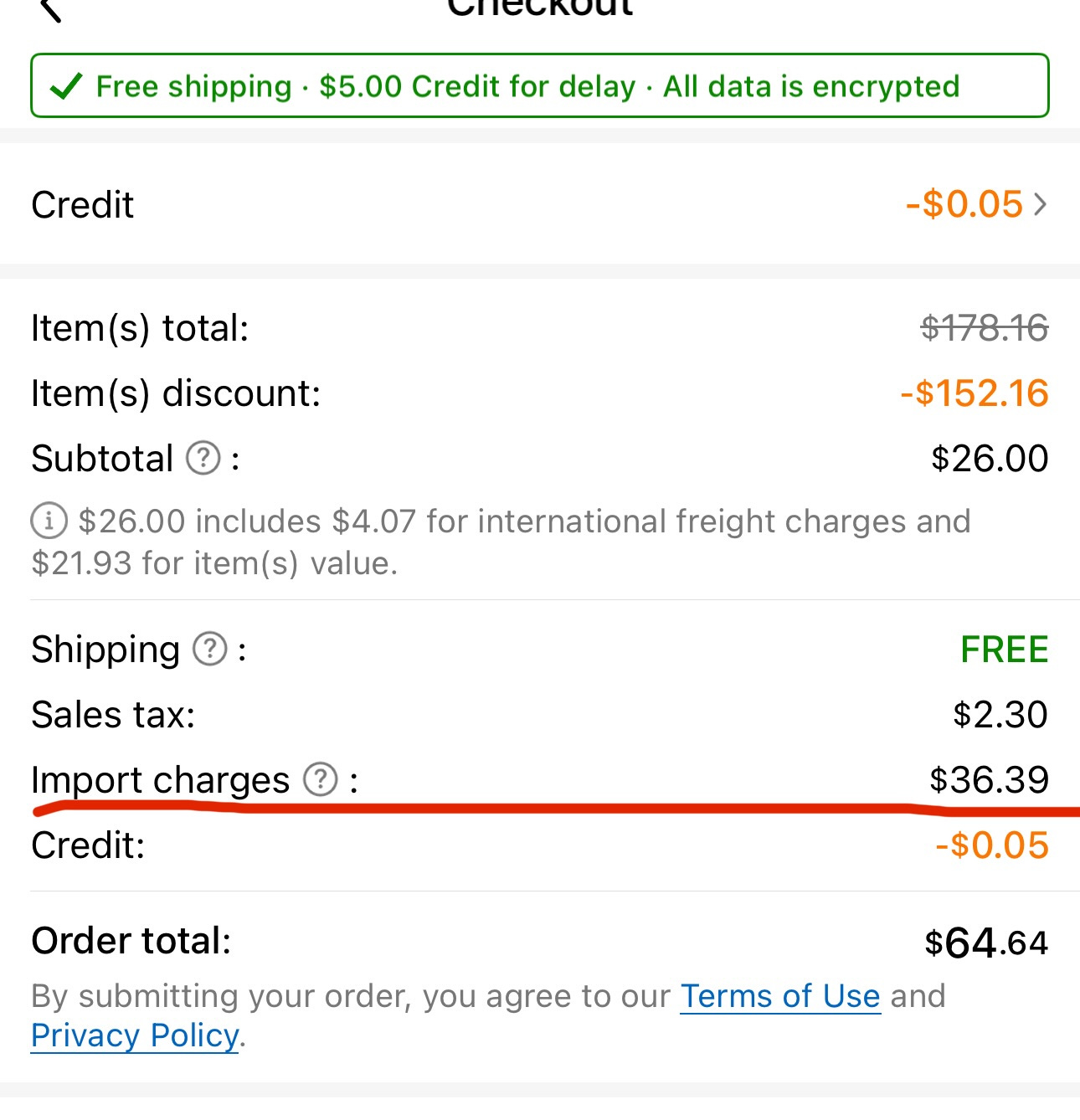

On Tuesday, Punchbowl News reported that Amazon was going to start showing the cost of tariffs right next to each item's total listed price.

❓Why: Amazon did not want to shoulder the blame for why prices were going up. It would have directed the blame to where the problem was coming from. Amazon is not alone in the idea of showing off tariff-induced cost increases:

Temu & Shein are showing the tariff surcharge with every purchase you make.

Jolie Skin Co., a showerhead company, will show a "Trump Liberation Tariff" at checkout.

Creston, an electronics manufacturer, will show a 12% charge at checkout to show the increase due to the tariffs

💢Outcome: The Trump administration lashed out, calling it a "hostile and political act". Trump called Bezos and told him to fix things immediately. Bezos did as his master commanded and killed the idea.

Takeaway: Businesses are worried about price increases and want to show customers that the increased prices are not their fault. The tune from businesses will be very different from Covid times when they kept saying, "we have pricing power."

💪🏾My Take: Large Retailers are more scared of Trump's autocratic tendency than of their customers not spending. Never thought I would see the day that money did not drive decisions for these money-loving executives. Guess you just gotta have someone willing to weaponize the government for them to make different choices.

Companies

Microsoft's report gave the market confidence that the mega investment in AI is here to stay, and it is still driving revenue growth.

📈Stock Move After Earnings: The Stock ripped 9% after earnings. It provided strong guidance for the future, which gave investors a lot more confidence to invest.

🔢By The Numbers: Revenues increased by 13% from last year to $70 billion. It was driven largely by an increase in Microsoft's Cloud and AI business.

Azure Cloud and AI increased revenue by 33%, far exceeding all analyst expectation and far stronger than Google Cloud's growth and AWS' growth.

The Intelligent Cloud business now makes $26 billion per quarter, an increase of 22% from last year

General Cloud services increased revenue by 20% to $42 Billion.

All other segments of the business brought in $13 Billion, an increase of 13% from last year.

Capex increased from last year by 53% to $16 Billion as Microsoft continues to double down on AI Infrastructure investment

💬In Their Words: Last quarter, Microsoft told investors that things would not be so great this quarter, but this quarter, they sang a different tune.

CEO Satya Nadella said on the call, "When it comes to cloud migrations, we saw accelerating demand, with customers in every industry... expanding their footprints on Azure. And we remain the cloud of choice for customers' mission-critical... workloads..."

In Layman's terms: We the best and we know it! All of y'all on the call are either using copilot at work right now or will be using it sometime today. We ain't worried 'bout nothing.

👀What to Watch: Microsoft is executing on all sides. However, a few things might hamper their growth moving forward.

How much will the tariffs increase their cost as they continue investing heavily in their AI buildout?

Can they catch up to the demand for their AI services, or will the demand go elsewhere as competition grows in the space?

Now that OpenAI is no longer directly tied to Microsoft, what will that extra competition mean for Microsoft?

👍🏾My Take: This was an excellent quarter for Microsoft. I am very pleased to keep holding onto my tiny shares.

Extra: An interesting tidbit from the earnings call. CFO Amy Hood was asked about LinkedIn, and she said, "LinkedIn’s Talent Solutions offering for recruiters continues to be impacted by weakness in the hiring market.”

This is another anecdote that, although the headline job numbers look great. There is more to the iceberg under the water.

Of all big tech companies, Apple has the most to lose due to the tariffs. Tim Cook was clear about this on the earnings call.

📉Stock Move After Earnings: The Stock fell 4% with Apple telling investors it has no idea what might happen in the future. As Tim Cook said, “because I’m not sure what will happen with tariffs.”

🔢By The Numbers: Revenues increased by 5% to $95 Billion. The best Q1 ever for Apple. However, analysts believe a lot of the sales are due to consumers rushing to buy things before the tariffs went into effect.

Profits increased 4% from last year to $24.8 Billion.

iPhone revenues stayed at $46 Billion

Mac and iPad revenues increased by 10% and 14% to $8 Billion and $6 Billion, respectively.

Services increased revenues by 11% to $26 Billion. This portion of the business now brings in $100 Billion annually. INSANE!

Apple expects tariffs to cost it $900 million this quarter.

Apple is moving all its iPhone manufacturing to India and Vietnam by the end of next year.

Apple announced an additional $110 Billion share buyback and increased its dividend by 4%

💬In Their Words: Tim Cook said on the call, “We will manage the company the way we always have with thoughtful and deliberate decisions, with a focus on investing for the long term and with dedication to innovation and the possibilities it creates. As we look ahead, we remain confident.”

Takeaway: Apple is the first company to completely change its business due to the tariffs. They announced that production of the iPhones will be moving completely out of China to India and Vietnam because they have lower tariffs than China. Apple had been slowly moving its production out of China, but is accelerating things in response to the tariffs. However, Apple has no intention of bringing its manufacturing back to the US.

👀What to Watch: How will China react to Apple moving its manufacturing out of the country?

Revenues in China continue to fall (-$1 Billion in Q1). How (can) will Apple compete with the likes of Huawei, which seems to be taking market share from Apple?

Like with Google, Apple also faces a lot of legal challenges. It lost a court case back in 2021 that forced it to reduce its app store fees. However, Apple did not comply with the rulings of the case. Well, the judge issued an investigation into Apple, which could lead to even more changes to Apple's business models. Also forced Apple to change its policies immediately and implement the changes in the way the judge chooses.

Will Apple ever launch the full version of its "Apple" Intelligence?

Can Apple still grow, or is it now like Coke? The only revenue it will make from now on is from people replacing their phones rather than new sales to new customers.

🫤My Take: Apple is facing a lot of challenges right now, and growth is no longer there. Apple is now a consumer staple and no longer a growth tech company. It is fully mature. This is why I reduced my stake in Apple to invest in growth-focused businesses like ASML. However, I still hold onto a small portion of it.

🛍️Amazon*

Similar to Apple, Amazon faces a lot of hurdles due to the tariffs, as a large number of its sellers get their products from China. But unlike Apple, its most profitable business (AWS) is not directly linked to physical products.

📉Stock Move After Earnings: The Stock fell 2% due to lower future revenue expectations because of the unknown impact of the tariffs. But also, due to the slow growth of AEWS

🔢By The Numbers: Revenues increased by 9% to $155 Billion, far above the $143 Billion expected. However, like with Apple, the belief is that a lot of those sales were due to consumers pulling future expenses forward to avoid tariffs.

Profits increased by 64% from last year to $17.1 Billion

AWS increased revenues by 17% to $29.3 Billion, less than expected

Operating income increased to $11.5 Billion

Advertising increased 19% from last year to $13.92 Billion.

💬In Their Words: CEO Andy Jassy said on the call, “It’s hard to tell what’s going to happen with tariffs right now. It’s hard to tell where they’re going to settle and when they’re going to settle.”

Takeaway: Most questions on the call were on the effects of tariffs on the business and what Amazon will do to adjust to the higher cost of business. The focus on tariffs is because Amazon makes about 30% of its revenues from Third-Party sellers, and a large number of those sellers are either based in China or get their products from China. However, Jassy said he expects that Amazon could be stronger in the uncertain environment of the tariffs, as it can offer lower prices.

For right now, things are great, but that could change tomorrow.

👀What to Watch: Effects of tariffs on the retail business and the advertising business that have grown massively to become a core part of the profits generated for the company every quarter.

Amazon's massive CapEx spending. They spent another $25 Billion in Q1 and expect to spend $100 Billion in the pursuit of AI infrastructure.

Amazon is spending an additional $4 Billion to expand its delivery network into small towns across America, creating 100,000 jobs in the process. Filling in the gap that UPS might be creating (announced layoffs of 20,000 people).

👍🏾My Take: Things are okay right now, but Amazon is facing pressure from both competition—namely Azure and Google Cloud—and from tariffs impacting its retail business. That said, I believe Amazon is well-positioned to benefit from the tailwinds of AI. Its continued investment in logistics will also help it keep taking market share from UPS and FedEx.

That’s why I chose to invest more when the stock dropped during the tariff chaos. Amazon is currently my third-largest single stock position, behind Google and CrowdStrike (around $5,000).

Explaining Obscure Financial Terms

GDP: Gross Domestic Product measures all the activity within an economy. Great way to see if things are improving or declining. It's not perfect by any stretch, but it is a great place to start.

de minimis exemption is a law that allows shipments bound to the US under $800 to enter without tariffs or taxes. This is why when you are at the airport, you have all those "duty-free" banners everywhere. It became a massive legal loophole that allowed companies like Temu & Shien to ship cheap packages stateside without tariffs. Trump recently removed that exemption for these companies. I am in favor of the exemption being removed.

Stats of the Week

It is estimated that DOGE has cost taxpayers $135 billion with its chaotic disruption of the federal government. DOGE was supposed to help save the government over $2 trillion, and estimates it saved $160 billion. However, any savings are pointless if to save money you spend even more money.

My Take: The whole DOGE experiment was a complete waste of time. But one thing I am grateful to Elon and DOGE for is showing the public that the US government is pretty damn efficient and highly devoid of fraud. I mean, any company would accept that with a $6 trillion annual budget, $160 billion was wasteful. That is 2.67% of the budget that is wasteful. It is pretty amazing.

However, I do believe there can be better spending within the budget that requires a scalpel to remove things, not a chainsaw.

🚢65%

In the 3 weeks since the tariffs were announced, cargo shipping from China to the US has plummeted 65% according to Flexport, a global logistics company. Ocean freighters cancelled 80 trips from China to the US in April. That is 60% more cancellations than during the COVID pandemic, and we shut down the economy during COVID.

💬In Their Words: Apollo chief economist Torsten Slock called the current economic period, "The Voluntary Reset Recession." He said there is a 90% probability that the US will enter a recession before the year ends. He expects:

BY the middle of May, most shipments from China will stop because no one knows if the tariffs are on or off. Even with the 90-day pause.

By the end of May, trucking demand will come to a complete halt, leading to layoffs in trucking and retail in early June and companies filing for bankruptcies.

Denial: While every company is talking about disruptions that are coming, the administration is in denial about the effects that the tariffs are having. Treasury Secretary Scott Bessent said at a White House briefing on Tuesday, "I wouldn't think that we would have supply chain shocks. I think retailers have managed their inventory in front of this."

🪙My Take: Back-to-school shopping in the summer will be the first time consumers feel the pain of the tariffs. There will be fewer options for school supplies, and the options available will cost more.

Even if the tariffs are completely taken off, we face the same issues we had during COVID-19. The world's logistics business is not something you can just start back up at will.

In Trump's first 100 days in office, he has signed more executive orders (by a wide margin) than any other president in U.S. history. However, those executive orders have led to more than 200 lawsuits against the administration because most of them have overstepped executive powers. Or they are just illegal.

Takeaway: This is a strategy from the Project 2025 document that was circulated before the elections. The idea is to flood the zone and distract everyone from the big things that the administration is truly after. It is to stretch every organization to thin that they cannot fully react to the bigger issues. By the time they react, it is too late, and you can do whatever you want.

It is also to test how far they can push the limits of the system before they get a reaction. I have to say it is a very ingenious way to go about things. But it only works if you have someone willing to throw the world into chaos and make the lives of the people they govern miserable. This administration certainly does not care. It was elected to do exactly this.

Looking Ahead

Economy

Next week is all about Papa Powell and the Fed. The May FOMC meeting kicks off tomorrow, and Jerome will speak to reporters on Wednesday following the Fed’s interest rate decision. The general expectation is that rates will be held steady, given that the latest PCE data showed inflation remains somewhat elevated and the job market is still holding strong.

However, Jerome is under increasing political pressure, especially as President Trump ramps up his attacks and calls for rate cuts.

👀 What to Watch

Over 300 companies in the S&P 500 report earnings this week.

Sports I Love

⚽Why I have no Faith in Man U

On Thursday, Man U looked like world beaters. They dominated Athletic Club in the Europa League semi-final, taking the game to them with confidence and control. For once, they looked like a well-oiled machine—playing in sync, everyone on the same page, everything clicking.

They almost had me believing again.

Then Sunday happened.

The game started with Man U taking the lead and looking sharp—like they had finally turned a corner. But, as we’ve sadly come to expect, it all unraveled the moment Brentford applied a bit of pressure. This team folds faster than tissue paper—if everything isn't perfectly aligned, it collapses almost instantly. It’s honestly a sad sight.

At this point, I just want the season to be over.

Maybe they can do something in the Europa League, but I doubt it.

Not This Year

Madrid started strong—dare I say dominant—in the first half, but then they pulled a very Man U move and stopped playing in the second. Celta took full advantage and nearly stole the match. It's the kind of game Madrid simply can’t afford to lose if they still have any hope of winning La Liga, though let’s be real—that hope is hanging by a thread with Barcelona looking like a full-blown juggernaut right now.

There are just four games left in the season, including one against Barcelona. Madrid has to win every single match from here on out to have any shot at stealing the title. But based on how they’re playing right now? Yeah… that’s just not happening. So, I’m officially writing off this season. It hurts, but it is what it is.

Extras

On Wednesday, Toyota announced a preliminary partnership with Waymo to build a new platform for autonomous vehicles. This is massive for both companies.

In Their Words: Waymo said in a statement, "In parallel, the companies will explore how to leverage Waymo's autonomous technology and Toyota's vehicle expertise to enhance next-generation personally owned vehicles."

Takeaway: Toyota has the manufacturing expertise to produce over 10 million cars every year. Waymo has the autonomous technology—and they’ve already proven it works, with real people using the service today. Combining the two means that, in a short time, we could see hundreds—if not thousands—of these vehicles on the roads. This partnership will significantly accelerate Waymo’s ability to expand its fleet into more cities and countries.

My Take: We’re stepping into the age of autonomous vehicles. I was ready—so ready—to use this piece to call out Tesla’s lag in self-driving tech. But something held me back. Maybe it’s caution. Maybe it’s fear. Or maybe it’s the haunting truth that Tesla, like a stubborn protagonist, always seems to rise just when the story looks like it’s over.

*I am a tiny shareholder in this company.