This newsletter is 1,786 words a 12-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

Empty

Company News

📺Netflix Flexes Again

Stats of the Week

🤖$500 Billion AI investment

🏪$600,000 to work at Walmart

🏠4 million homes sold

Looking Ahead

🥊Papa Powell vs Trump

👩🏾💻Big Tech Report Earnings

Sports I Love

⚽Man U

🏈Superbowl is Set

Extras

🫨🤬Ending Birthright Citizenship

Markets

With the return of Trump to the white house, is the return of chaos to the government. Trump does not care for due process. He prefers to do things his way and will push every government body to the edge. This leads to panic and chaos.

We have seen this show before and it will be a replica of the first, probably even more chaotic. With that understanding, here is my advice.

Advice #1: PROTECT YOUR PEACE!

I for one, will be reducing my news intake by skipping the over-analysis of everything he does and speaks. Most of which will be entirely useless and misleading. I will write this newsletter to inform you on big market themes. However, I will do my best to avoid and ignore the chaos. I will find the important factors and share those.

Advice number 2: READ HISTORY

Mark Twain said, “History Doesn't Repeat Itself, but It Often Rhymes”. Trump is not the first president to do some of the things he is doing. Therefore, for us to better understand what could happen we should not only read the news (even this newsletter). It is to read history and learn from it. Two presidents that seem to have the greatest similarities to Trump is President William McKinley, the 25th President. He was just as excited about tariffs and had a lot of the same protectionist/racist/hateful tendencies. Trump is also very similar to Nixon in his transactional way of wielding power and his willingness to pressure governmental bodies that should have autonomy like the Federal Reserve. I advise we read about these presidents' terms and that could provide insights into what the future may hold.

Returns

Back to All-Time Highs

Tale of the Tape

Economy

President Trump's first week in office sucked out all the air in the room for any other economic news item to be reported on.

Companies

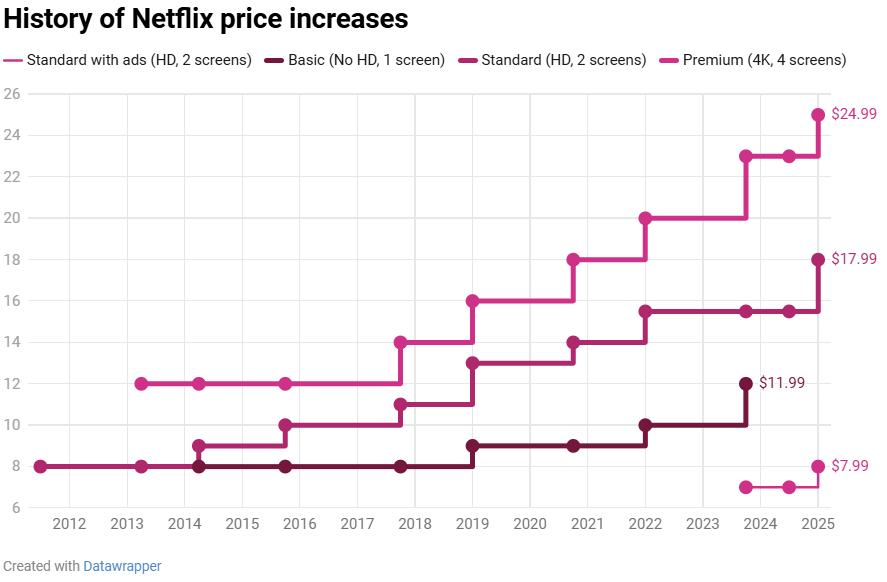

Live events charged Netflix's subscriber growth. Providing all the coverage Netflix needs to raise prices, AGAIN! It hasn't even been two years since they last raised prices.

💬In Their Words: The Letter to Shareholders said, “As we continue to invest in programming and deliver more value for our members, we will occasionally ask our members to pay a little more so that we can re-invest to further improve Netflix.”

They also took shots at other streamers, “We’re fortunate that we don’t have distractions like managing declining linear networks and, with our focus and continued investment, we have good and improving product/market fit around the world.”

🔢By The Numbers: Netflix added 41 million subscribers last year (18.9 million in Q4) bringing their total subscribers to 301.6 million. The cheapest ad-supported tier is working magic for the company. It accounted for 55% of the subscriber growth in the 4th quarter.

Revenue grew by 16% from last year to $10.25 Billion

Profit grew by 87% from last year to $1.87 Billion

📈Stock Move After Earnings: The stock flew 14% after reporting.

👀What to Watch: Netflix increased its full-year guidance for 2025 by $500 million. A sign that they expect 2025 to be a great year for the company. This company is not stopping at the moment. The only question is how much pricing power they have. When will Netflix hit the limit where people are no longer willing to pay for it? Right now, the value proposition still exists. It will be interesting to pay attention to when that value proposition no longer exists.

As a Netflix subscriber, I am not canceling my subscription but it is starting to annoy me.

Stats of the Week

President Trump announced a private sector investment of $500 Billion into AI advancement and growth. CEOs of OpenAI, Oracle, and Softbank were all present for the announcement.

🔎Details: The joint venture will be called Stargate. The investment will be over the next 4 years with $100 Billion being used immediately. It will begin with data centers in several states. It is estimated to create 100,000 jobs. Microsoft, Arm, and NVIDIA are also part of the venture.

🫤My Takeaway: Crazy when $500 Billion creates only 100,000 jobs. If you want job creation, data centers ain't it. But they do create a whole lot of revenues for those who benefit from them, think energy or chip manufacturing or the software created on top of the AI things. Just a note in case any government official happens to read my newsletter. Then again you probably already know that.

Walmart increased the pay for its regional store managers to range between $420,000 to $600,000 including bonuses and stock rewards.

🔢By The Numbers: Salary will increase from $130,000 to $160,000

Stock grant increase from $75,000 to $100,000

Bonus will increase from 90% of salary to 100% of salary

Takeaway: Walmart is going against the recent trend from most companies to cut pay and middle manager positions. Walmart sees its managers as key to continued success.

The total number of homes sold in 2024, is a 0.7% decline from 2023. Even worse was existing home sales fell to 1995 levels when the population was 23% smaller.

🤔Why?: High interest rates and low inventory. Mortgage rates have remained relatively high at about 6-7%. Plus, home prices have continued to rise. Now sitting at a median of $407,500 an increase of 4.7% from 2023.

The only way to counter those prices is an increase in supply. Unfortunately, that is not happening. Only 1.63 million homes were built last year. According to Zillow, the US is short 4.5 million homes.

Looking Ahead

🥊FOMC Meeting This Week

We get interest rate decisions from the Fed but that will be the boring part of the press conference on Wednesday.

😄The Excitement: It will be the first time we hear from Papa Powell since President Trump took office. It will be interesting to hear his comments and thoughts on a few things Trump said at the Davos World Economic Forum last week.

Particularly Trump saying, "I think I know interest rates much better than they do, and I think I know it certainly much better than the one who's primarily in charge of making that decision. If I disagree, I will let it be known."

Takeaway: Expect a lot of threats from Trump to fire Powell. Because as the economy stands right now there is no reason for the Fed to cut interest rates with the strength of the labor market and inflation at a great place. Trump wants low rates.

My Takeaway: Trump is going to be extremely disappointed because as we saw for a majority of last year. The Fed does not control interest rates. They control the Fed Funds rate, but bond investors determine the 10-year treasury yield which is the standard for most rates to be based. Hence why mortgage rates are still high even though the Fed cut rates all of last year.

I think Trump loves smokescreens and tosses blame. Jerome makes a perfect person to point the finger at.

👩🏾💻Big Earnings Week Ahead

This week truly kicks off the earnings barrage with 41% of companies within the S&P 500 reporting.

👀 What to Watch

Microsoft and Facebook aka Meta report on Wednesday

Biggest Questions investors have for these two companies

How much are you spending on your AI investment?

Is it increasing or decreasing?

Are you making any money from AI yet?

I expect both to report 15%+ revenue growth and 50%+ growth in capital expenditure cost

Which will freak out investors and might provide buying opportunities.

Tesla and ASML also report on Wednesday

It almost doesn't even matter what the earnings say for Tesla. With Elon as the "First Buddy", it is expected that things will go well for the company with future regulatory decisions.

I expect 20%+ revenue growth for my newest holding, ASML. Which will be super annoying because the stock ran away before I could buy my fill of the stock.

Apple and Intel report on Thursday

The biggest question for Apple is around the continued decline of iPhone sales

This company is no longer a growth company and seems to be more of a consumer staple company.

More in line with the likes of Walmart than in line with Microsoft.

Revenue growth will be in the low single-digits

The biggest question for Intel is how they are progressing in their turnaround

I expect more pain from Intel this week.

All investors are hoping for is a slower pace to declining revenues.

The Rest of the Field

Sports I Love

😮🫢Man U WON A Match

OMG! OMG! Man U finally won a game. I did not expect it at all. The way the match was going, I thought they would likely end the game with a draw than a win. However, for the first time since I don’t know when they put up a fight and found a way to win. Even more importantly, they did not give the game away at the end of the match. Even though they tried to, they were about to survive.

🏈Superbowl Is Set A Rematch

Kansas City Chiefs vs Philadelphia Eagles

You probably didn’t notice that the picture I used is from 2023.

Extras

Trump signed an executive order on Monday to end birthright citizenship in the US. A right that is specifically guarded by the 14th Amendment.

According to Trump, people like me (immigrants) are "poisoning the blood of our country". He would make my future kids and so many of my friends' children non-citizens. Even though we all went through all the proper processes.

It is highly unlikely the executive order will survive. However, it shows the character of our new president. Ain't even been in the office 24 hours, already chaos has returned.

My goal is to not allow the orange man's whims to get under my skin. Might mean less news consumption. Because I MUST PROTECT MY PEACE!

*I am a tiny shareholder in this company.