This newsletter is 2,898 words a 15-min read

Sorry for the length. Take plenty of water breaks from work, not the newsletter.

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update. This is a heavy news week.

Summary of Topics:

Economic News

🤷🏾♀️Rate Cut in September (Probably)

😨Rate Cut in September DEFINITELY

Company News

🍎👑Apple Earnings - The King Returns

😑Microsoft Earnings - Overreactions?

😎Meta - Swagged Out Zuch

🙄Amazon - Not Like The Rest

Stats of the Week

$205 Million made by Deadpool & Wolverine

$1.7 Billion Lost Crost Yield - Food

5.6 Billion AC Units

$1.77 Billion Cash You Gave to Starbucks for Nothing

Looking Ahead

Weekly Jobless Claims

Disney Earnings

Sports I Love

Olympic Paycheck

Extras

👶🏾Protect the Children

Markets

And just like that, we are in August. Is it just me or is time moving faster than I want? It feels like yesterday I was celebrating my birthday at the beginning of the month and now it's a new month. PLEASE SLOW DOWN THE DAYS!

In Stock News, the labor market has taken over the investor psyche. There have been points where the economy and the stock market were divergent but that no longer seems to be the case. Investors’ thoughts and feelings about the economy fueled the downward spiral we experienced last week in stocks.

Not a great way to start the month. But as we love to talk about, always remember to zoom out.

Year-To-Date Returns

Tale of the Tape

Economy

Jerome Powell donned his best purple tie and spoke to the economic press on Wednesday with some relatively good news. At least, news that got investors excited. He said there is a possibility that the Fed might and is thinking about maybe cutting in September.

💬In His Words: Papa Powell said during the press conference, "The broad sense of the committee is that the economy is moving closer to the point at which it will be appropriate to reduce our policy rate."

🔎Details: Minus all the caveats that someone in Jerome's position must give. This was the first FOMC press conference where Jerome indicated that interest rate cuts are on the table. After months of battling inflation and ensuring inflation has been completely beaten. The Fed is seemingly ready to claim victory and move on.

Also, the labor market (the second half of the Fed's mandate) is showing signs of weakness. Some believe this is due to the high-interest rate environment that disincentivized businesses from taking risks to expand operations. The labor market has been the pillar that allowed the Fed to keep rates high for so long. However, that pillar seems to be crumbling

🔢By The Numbers: Financial markets are predicting a 50-basis point cut in September (0.5% cut) and another 25-basis point (0.25%) cut before the year ends.

Treasury yields have been falling to reflect this reality. As of Wednesday, it sits at about 4% for the 10-year Treasury (yeah that changed very quickly keep reading).

Takeaway: This is great news for smaller businesses sensitive to the movement of interest rates. It is also great news for home buyers who have been unable to buy a house. It is still to be seen how much the rate cuts will help with affordability if prices remain high.

Friday after Jerome spoke and indicated a rate cut in September might happen. The nonfarm payroll job number was released and spooked the entire world. The numbers were so bad that the R-word was being used again.

Details: The Nonfarm Payrolls report showed the US economy only added 114,000 jobs. On the surface that is not bad until you realize the estimate was for the economy to add 185,000 jobs.

The unemployment rate jumped from 4.1% in June to 4.3%

June payroll number was revised down from 185,000 jobs to 179,000

After averaging 194,000 jobs per month over the last year. The job market has gotten tighter than John Cena wearing tights (it ain't pretty).

😱More Bad Numbers: On Wednesday ADP reported Private Payrolls and revealed what we all are feeling. There were only 122,000 added to the economy in July. Lowest amount since 2021 and far below the expected 150,000. There were much higher losses than at any point this year.

Last week, 249,000 people filed for unemployment. The highest number in over 11 months.

💬In Their Words: Becky Frankiewicz, president of the ManpowerGroup employment agency, told CNBC on Friday, “Temperatures might be hot around the country, but there’s no summer heatwave for the job market. With across-the-board cooling, we have lost most of the gains we saw from the first quarter of the year.”

Takeaway: As Nick Bunker of Indeed Hiring Lab wrote, "Yellow flags had started to pop up in the labor market data over the past few months, but now the flags are turning red."

The S&P 500 dropped 2.5% on Friday after the news was announced.

Treasury Yields fell from 4.5% to 3.82% (there goes my savings account).

Investors are worried about a possible Recession and want the Fed to cut faster. But as Jeffrey Roach, chief economist at LPL Financial told CNBC, “The latest snapshot of the labor market is consistent with a slowdown, not necessarily a recession.”

My Takeaway: It is not yet time to panic but these are warning shots for the Fed to take action. I see a 50-basis point cut in September and two more to close the year.

Oh, and an obligatory reminder to have an Emergency Fund.

Companies

🍎👑Apple - The King Returns

📈Stock Move After Earnings: Stock jumped after the reported 0.5%.

🔢By The Numbers: Apple made $85 Billion in the quarter. An increase of 5% from last year. Might seem like a small growth rate but when you make almost $100 Billion a quarter from selling hardware that people do not have to replace every year that is INSANE!

Profit increased 8% from last year to $21 Billion from $19 Billion.

iPhone revenue was a surprise bringing in $39 Billion in the quarter

iPad revenue was $7 Billion with Tim Cook stating that half of the iPad sales were to individuals who have never owned an iPad in the past

There is no such thing as perfection. Apple had a blemish in its earnings report. Sales in China continued to decline, falling 6% in Q2. The Chinese economy has not been in a great place this year. Lower-priced competitors like Huawei have used the period to steal market share from Apple.

💬In His Words: Tim Cook told CNBC, “What we’ve done is we’ve redeployed a lot of people on to AI that were working on other things. Certainly, embedded in our results this quarter is an increase year over year in the amount we’re spending for AI and Apple intelligence.”

Takeaway: Last year, the narrative surrounding Apple was that the end was beginning because sales were flat. Investors were very disappointed that Apple did not make any announcement about its AI play for the entire year.

However, Apple did what Apple does. Prove that once again it knows exactly what it is doing. With one announcement of Apple Intelligence in June, it completely blew the top off AI and showed a way that will force people to clamor for its future devices.

It is interesting to note that like Google, Tim Cook is indicating that Apple will be investing a ton of money into AI. However, unlike Google Apple is also giving a ton of cash to investors. Spending $32 Billion in the quarter on share repurchase and dividends.

📉Stock Move After Earnings: Stock Fell 7% after reporting on Tuesday evening. The Expectations for this company were just too high.

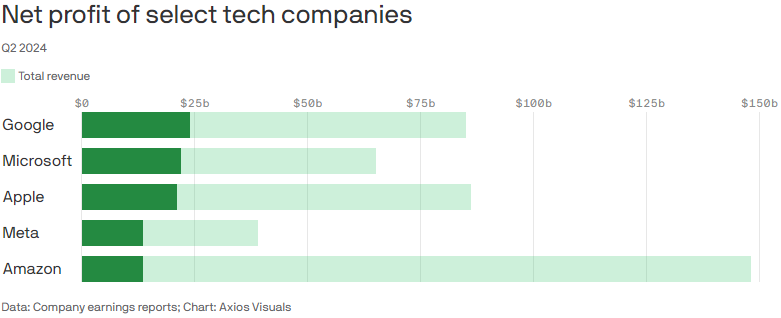

🔢By The Numbers: Everything looked good. Revenues increased 15% from last year to $64 Billion. Profits increased from 10% to 22%. Every single number Microsoft reported was positive. I mean look at that chart below.

However, there was one tiny flaw in their report. Microsoft reported Azure Cloud Services grew by "only 29%". Analysts expected 31% growth. This is the reason the stock fell.

👀What to Watch: The excitement over AI pushed so many Big Tech stocks to the edge so any blemish and investors are looking for reasons to bail. The question is when will Microsoft be able to make big profits from all its AI investments. It spent $19 Billion in Capex a 35% increase from the first quarter of this year and almost 78% from last year. Investors do not like continued massive investments. They want cash being returned to them.

My Takeaway: There is nothing to see here. It is business as normal for Microsoft. I see no reason to sell. Matter of fact if investors lose their minds and panic sell. I will take the opportunity to buy more.

😎Meta

The swagged-out Mark Zuckerberg is winning in all ways.

📈Stock Move After Earnings: Stock rose 6% on Wednesday. Which was surprising to me. You’ll see why below.

🔢By The Numbers: Revenues increased 22% from last year to $39 Billion.

Profit increased a whopping 73% to $13 Billion

💬In Her Words: CFO Susan Li told investors on the call, “[W]e expect infrastructure costs will be a significant driver of expense growth.”

In Layman's Terms: We ‘bout to spend this money!!

Meta estimates spending between $35-40 billion on capex this year.

👀What to Watch: On Thursday, Meta gave back most of the gains from the initial bump from the earnings. I was initially shocked that the stock did not get pummeled for the announcement that more investment in AI would be made. I guess the excitement from Papa Powell announcing possible rate cuts, was more important to investors.

📉Stock Move After Earnings: The Stock fell almost 7% after earnings were released.

🔢By The Numbers: Revenues grew just 5% from last year to $147 Billion (SO MUCH MONEY) even with the blowout sales of Prime Day in June. However, every other number looked great.

Profit doubled from last year to $13 Billion

Advertising revenue grew 20% to $12 Billion

AWS revenue grew 19% to $26 Billion

Third-Party seller revenue grew 12%

💬In Their Words: CFO Brian Olsavsky told investors on the call, “We did come in a little short on revenue growth in North America versus our internal estimates. What we’re seeing is really around ASP (Average Selling Price) and lower ASP in products selected by customers. They are continuing to be cautious in their spending and trading down to lower ASP products.”

Takeaway: Amazon unlike the other Big Tech companies is acutely exposed to the economy because, like Walmart, it is a seller of everything. When consumers begin cutting back, Amazon will feel it immediately on their top-line revenue which retail accounts for about 50% of. However, after cost-cutting measures, Amazon has ensured that it will continue making major profits.

👀What to Watch: The bigger issue with Amazon is the seemingly sluggish growth of AWS. Google and Microsoft grew revenues for their Cloud by 29% each. Google Cloud is much smaller than AWS. However, Microsoft Azure is about the same size as AWS and seems to be able to continue growing. AWS is the primary center for profit for Amazon if that story begins to fall apart, the stock will fall fast.

Two questions investors are asking about Amazon

Can Amazon hold its market share or is it shrinking?

What is Amazon's strength in AI?

Stats of the Week

Marvel Movies are so BACK! Deadpool & Wolverine brought in $205 million on the weekend of its release. It is the largest opening ever for an R-rated movie.

The amount projected to be lost in crop yield due to increasing temperatures. This summer is going down as the highest ever. Not only will this affect us from an electrical bill aspect, but it will also cost us in the grocery store.

Higher crop yield loss means higher prices are needed to make up for those losses. This means we will be seeing higher prices for fruits and vegetables this summer and probably moving into the future. So, Food prices that were finally on the decline will soon be going back up.

Just wonderful

Staying with the hot news. the International Energy Agency predicts that by 2050 we will have 5.6 billion AC units in buildings. It was 1.6 billion in 2018. Places that have never required AC now need multiple units to survive the heat.

Starbucks reported in the earnings report that they have almost $2 Billion in free cash from customers. How you ask? The unused gift card that people have in their wallets and purses. Starbucks uses that money as it sees fit to run its operations.

Looking Ahead

👀 What to Watch

This week will be very calm compared to the chaos we had last week (Famous last words). However, all eyes will be on the weekly jobless claims. If that number continues ticking higher, expect the market to ensue with even more panic. Investors have switched from paying attention to interest rates to paying attention to Monthly job numbers.

Disney* Reports

Disney is on Cloud 9 with the release of Inside Out 2 and Deadpool & Wolverine. Disney is proving that it still has its movie-making magic. I have a few questions as a tiny shareholder that I am hoping to get answers:

Are we finally seeing higher profits?

What is the succession plan for Iger?

Are parks still making good money? Especially in the critical summer months?

Sports I Love

Olympics

Extras

Last Tuesday, the Senate passed two bills aimed at changing the way minors used social platforms.

🔎Details: The Kids Online Safety Act (KOSA) and the Children and Teen's Online Privacy Protection Act (COPPA) because what is a bill without an acronym?

The bill aims to put the responsibility of protecting children online on social media platforms and not only parents. The main takeaways from the bills are:

Platforms restrict the ease of minors receiving messages from randoms

Platforms place restrictions for minors that encourage longer use of their app like autoplay (I love this one).

Eliminate the ability of companies to actively target advertising at minors

Allow parents to delete their children's info from any site.

Disagreement: Not everyone is in line with the bill. There has been pushback not just from social media companies, who of course like making money and parts of the bill will limit their ability to make as much money as they can. But also, from various privacy organizations and free speech advocates. They say the bill would give government officials too much power to accept things they like and things they do not like. They have a point because there have been a few officials who have stated they would use KOSA and COPPA for a very different cause. According to Morning Brew:

Republican Senator Marsha Blackburn from Tennessee believes the bill would “protect minor children from the transgender in this culture and that influence.”

The Heritage Foundation, the conservative think tank that is also behind Project 2025 (a project designed to change the way democracy works changing the US to an autocratic nation), has promised to use KOSA to limit online content about sexual and gender identity.

My Take: I worry about the way the bill could be used. But I want there to be more safeguards from the government FORCED unto these social media companies. These companies do not care about the children, they are incentivized to abuse the minds of children if it leads to more dollars in their pockets. They have shown this time and time again.

As much as I would love to say parental responsibility is where everything should land. Let's be honest, unless you are going to keep your kids under your watch 24/7 and they never have kids with families that do things differently. There will be times when your children will have access to things you do not want them to. So yes be the defender of your home and for your kids but we also need Societal Accountability in the form of laws on these businesses.

*I am a tiny shareholder in this company.