This newsletter is 2,410 words, an 11 min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include their responses in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

🧊Inflation Cools ... For Now

😨Consumers Are Scared

Stats of The Week

📉 Tesla Stock Down 53% and I love it

🏫 50% Staff Cut to Department of Education

✂️ 73 Million People Might Lose Social Security Benefits

🥷🏾 $12.5 Billion Lost to Scammers

Looking Ahead

👴🏾Papa Speaks

Sports I Love

⚽ Real Survive

🕛 A Dead Clock was Right

Extras

Trump Dictator Streak

Bags Do Not Fly Free

Markets

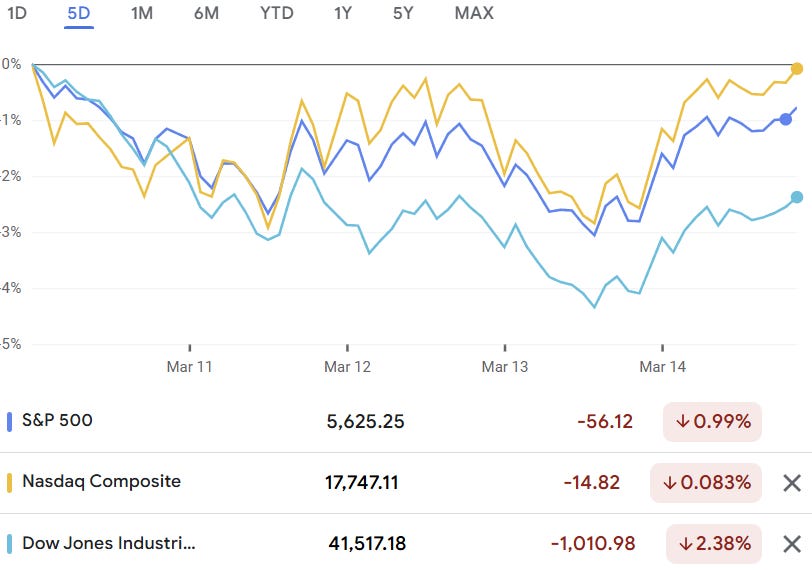

Over the last 6 months, Wall Street has celebrated the Trump re-election. After Trump was elected, the S&P 500 rose 8%, and the Nasdaq rose ~11%. The markets celebrated what they believed would be 4 years of massive regulation rollback and more tax cuts for businesses. They believed Trump's tariff threats were just that, threats, and he would not implement any of them. They believed Trump would not attack US allies and that he was just posturing.

Well, enter March 2025, and reality is beginning to dawn on investors that Trump 2.0 is not Trump 1.0. He has a completely different agenda and does not care too much about the stock market. In the last month, more than $5 trillion has been wiped out from the market. Since making new all-time highs at the end of February, the S&P 500 is down almost 9%. The Nasdaq is officially in a correction, it is down almost 13%.

My mom always told me, "When people tell you who they are, BELIEVE THEM!"

Reality is finally hitting businesses and investors in the face. I hope they wake up and pick up a machete to kill the snake they let into the hen house before all the hens die. In this euphemism, the hen house is the government, the snake is the Trump administration, and the hens are the economy of the United States and the tax revenue of the government.

Returns

Tale of the Tape

Economy

🔎Details: Investors breathed a sigh of relief on Wednesday after CPI was released by the BLS and showed February inflation increased by only 2.8% from last year. Economists had expected inflation to be 2.9% and much better than January's 3% inflation number.

Core CPI increased from last year by 3.1% vs 3.3% in January

Both are a good sign for the consumer market as a whole. However, February inflation numbers did not include any of the tariffs that have either gone into effect or are about to do so.

💬In Their Words: Kevin Gordon, senior investment strategist at Charles Schwab, said, “A lot of this inflation data does not incorporate what is to come and what already has happened for tariffs. The vagaries and uncertainties associated with policy are still a much stronger force in the market than anything CPI-related or in terms of one data point.”

🔢By The Numbers: Shelter, aka housing, continues to be a large driver of inflation increases. It increased year over year by 4.2% and 0.3% month over month. It accounted for half of the index increases.

Gas dropped 1% month over month

Airline prices dropped 4% month over month

Food prices increased 0.2% month over month

Eggs prices increased 10% (bird flu effects still active but receding).

My Take: Things are good on the surface, but there are avenues of pain for consumers. Walmart's CEO recently said, "You can see that the money runs out before the month is gone. You can see that people are buying smaller pack sizes at the end of the month."

Even Dollar General, who typically loves times of high inflation or high pain for consumers, is not bragging right now. Its CEO said on earnings last week, "Many of our customers report that [they] only have enough money for basic essentials, with some noting that they have had to sacrifice even on the necessities."

Consumer Sentiment tanks to levels not seen since inflation was at its most painful in 2022.

🔎Details: The Consumer Sentiment Index is an indication of how consumers feel about the economy. It was one of the first indexes (indices?) I shared religiously when I began this newsletter. But over the last two years, it morphed from an informative piece of data about the economy to partisan BS.

Explain: From 2023 to 2024, the Consumer Sentiment Index told us nothing about the state of people's finances but rather what their political party was. If the person was a republican, it was skewed towards the economy being horrible, and if the person was a democrat, it was sunshine and rainbows. Because of this, I stopped referencing it. That is why I haven't used it in the newsletter in a while.

↪️The Return: But it seems pain is the one thing that we can all mostly agree on. The University of Michigan tweaked the questions to weed out the partisan BS. But more importantly, chaos tends to scare everyone, even if the chaos is from the guy you are rooting for. No one likes to be negatively surprised.

😨Bottom line: Consumers are scared. The combination of tariffs, federal workers being fired, government agencies being shut down, rumors of cuts to major government programs like Medicare, Medicaid, and social security, and a president that seems aligned with a dictator is getting people scared.

This is causing people to pull back on spending because they cannot plan for the future. They are reporting less optimism about the future and the need to de-risk their life. For an economy like the US that depends on consumer spending, that is never good news.

🤡My Take: Richard P. Feynman said it best: "The first principle is that you must not fool yourself, and you are the easiest person to fool."

Stats of the Week

Tesla stock is down more than 53% since December, losing more than $800 billion in market cap. Tesla has been the worst performer in the S&P 500 so far this year. As Elon continues to antagonize the world, the world is reacting to his antics by choosing not to buy Teslas anymore. Last year, Tesla's sales declined in the US by 7% and worldwide by 1%. EV sales worldwide were up 25% last year. Some people have unfortunately decided to take out their anger by destroying random Teslas and Tesla dealerships.

😏My Take: I kinda love this. Seeing Tesla stock continue falling day after day and reports of Tesla sales declining gives me a weird joy. Elon has inflicted pain on a lot of people with DOGE, and having some of that pain go his way is cathartic. I do know one or two months do not make a trend, and things can change rather quickly. But it just makes me happy to see this.

🗒️Sidenote: It is not illegal to boycott a brand, as Donald Trump has been saying. It is the one way we can push back on companies that have most of the power.

The Department of Education laid off 50% of its entire staff, 1,315 staffers. Linda McMahon took a victory lap when making the announcement saying this was the first step to shutting down the Department of Education.

My Take: The Executive branch of government does not have the power to shut down any government agency created through the power of Congress. It's a little something we love to call, Checks and Balances.

✂️73 million

The number of Americans who depend on Social Security benefits may now be getting none of those benefits as Elon and DOGE begin dismantling the Social Security Administration.

🔢By The Numbers: Of those 73 million, 90% of those 65 or older depend on Social Security to survive post-retirement.

The Agency has announced it will be laying off 7,000 employees, about 12% of the staff.

6 of the 10 regional offices will be closed.

On average, it takes almost a year before most people hear back from Social Security on submitted claims.

My Take: If you thought, well, at least we have online services, and that will make up for the major changes. Well, you would be thinking logically and not chaotically. One of the departments being shut down is the department that is working on moving many of the Social Security services online.

Again, this has nothing to do with getting meaningful results for the public. All of these decisions feel like they are for show to a select group of people. Or worse, they are designed to create a gap that can only be filled by a "friend of the president."

According to the Federal Trade Commission, 2024 was a great year to be a scammer. $12.5 Billion was lost to various scams in 2024. An increase of 25% from 2023, which was the previous record-breaking year.

In Between: The FTC says this number is probably understating the actual hit. Most people do not report when they have been scammed because of shame. It could be closer to $30 Billion.

🪙My Take: We are living in the Golden Age of Fraud. The internet has made everything easier and has made this especially easy to do. It is no longer random strange people, it is now especially from people we ought to trust like the President of the United States (see Trump and Malania meme coins). Plus, the new administration's direction of firing everyone, even people you need (see news of the FTC having to delay a trial because it did not have enough workers), places the burden heavily on you. Here are a few steps to take:

Freeze your credit

Do not pay for anything over the phone. Go directly to the actual website, you know.

The government will never call you for unpaid taxes. It is typically a letter,r not a phone call

Check the sender of all emails to you

Block spam texts.

Do not give anyone your credit information

Stop chasing poop coins

Always remember, if someone is trying to rush you to do something as quickly as possible. Ask yourself, WHY? If it sounds too good to be true, IT IS!

Looking Ahead

👴🏾Papa Speaks

The only thing investors care about is hearing the soothing voice of a calm, rationally minded Jerome Powell to ease their pain from the chaos of President Trump.

On Wednesday, Papa Powell will speak to reporters after the Federal Reserve holds its monthly Federal Open Market Committee (FOMC) meeting. He will announce the Fed's decision on interest rates, the expectation is for rates to remain the same. He will also answer questions about what the Fed is thinking about now that tariffs have been officially activated (or not activated, as it could have changed since I released this) by the President.

👀 What to Watch

No company I care about is reporting earnings. Gotta wait till May to care about earnings again. But here are the companies reporting this week:

Sports I Love

Survived

Real Madrid did the Real Madrid thing and survived against Athletico Madrid in the Champions League Round of 16. They did not play a good game at all. Honestly, Athleti should probably have won, but as always, Real just has a knack for winning Champion's League games.

They move on to face Arsenal, which will be a great matchup. One that Real could easily lose if they are not focused.

🕛A Dead Clock is Right

Even a dead clock is right twice a day. Man United won their Round of 16 Europa League match. I was pleasantly surprised by the victory. However, I refuse to believe that this team is turning things around. They still suck in a pleathora of ways. So I will not allow my heart to get sucked back into the mess.

Extras

A federal judge on Monday blocked the Trump administration's attempt to deport a student involved with pro-Palestinian protests. The student has a green card and is in the US legally. Donald Trump posted on his social media platform,

Following my previously signed Executive Orders, ICE proudly apprehended and detained Mahmoud Khalil, a Radical Foreign Pro-Hamas Student on the campus of Columbia University. This is the first arrest of many to come. We know there are more students at Columbia and other Universities across the Country who have engaged in pro-terrorist, anti-Semitic, anti-American activity, and the Trump Administration will not tolerate it. Many are not students, they are paid agitators. We will find, apprehend, and deport these terrorist sympathizers from our country — never to return again. If you support terrorism, including the slaughtering of innocent men, women, and children, your presence is contrary to our national and foreign policy interests, and you are not welcome here. We expect every one of America’s Colleges and Universities to comply.

Sorry, President Trump, but you do not get to eject people from the US who you disagree with. This is a republic, not a dictatorship. Free speech is part of the system.

Southwest Airlines just announced that they are cancelling their famous Bags Fly Free policy. It will now only be available for their high-status and business select flyers.

In Their Words: Southwest CEO Bob Jordan said, "[The changes] will help us return to the levels of profitability we all expect, and to support our collective long-term success."

My Take: I disagree with the CEO; these changes are not going to make Southwest that much more profitable. Southwest now has nothing that makes it stand out from every other airline. It is as expensive as Delta, American, and United but comes with none of the perks.

These changes are pushed only because of an investment firm called Elliott Management. Which took 5 seats on the board of Southwest after the company's stock fell massively.

The Worse: Even Spirit Airlines is celebrating Southwest changing its policy. The CEO said, "I think it's going to be painful for a little bit as they find their footing, and we're going to take advantage of that."

Yeah, it's a bad day for Southwest for sure!

*I am a tiny shareholder in this company.