Short Week, Short Newsletter - Market Update May 20-24, 2024

Late Newsletter cause Man U won something, and I had to celebrate

This newsletter is 985 words a 5 min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Stats of the Week

100 Applications

56% of People

12.6 Years

Looking Ahead

Inflation On The Mind

Sports I Love

I Fell Back In Love (My Toxic Relationship)

Champs De League Final

Markets

It is Memorial Day. The Market had the appropriate response for the day. It ticked slightly lower last week as we all take a moment to remember the sacrifices that were made for us to enjoy all the freedoms we have today.

Tale of the Tape

Stats of the Week

According to Glassdoor, new grads had to send out an average of 100 applications to be able to land a job. Compared to the previous two years, the labor market has gotten a lot tighter for new graduates as many companies pared down their hiring and did multiple rounds of layoffs.

🔢By The Numbers: According to the National Association of Colleges and Employers, entry level hiring is set to drop 5.8% when compared to 2023.

The decline is primarily driven by two industries: finance and tech.

Software engineering hiring has dropped 30% from pre-pandemic levels as tech focuses on hiring more tenured individuals with a focus on AI-related roles

Unfortunately, the advice given over the last decade was for everyone to go into software engineering because that is where the money is.

Now there are less jobs and a ton of people competing for those positions

According to Handshake, about 40% of new grad expect to either start off working part-time, freelance, or join the gig-economy after graduation with the expectation that it will take longer to get a full-time role

Many are opting for work in the leisure and hospitality industry. Which is the only industry that seems to always have a need for more employees.

💪🏾Takeaway: This is another sign that employers have all the power back. A couple years ago, new grads had so much leverage in the things they could demand from employers. The pendulum has completely switched back. Now employers have the mindset that everyone should be happy to just have a job.

🤔My Takeaway: The headline is misleading. Two industries do not make an entire economy. Tech and Finance maybe the "dream" industries because they pay so much. However, if you have the right major like software engineering there are a plethora of companies or government agencies that would love to hire you. They may not pay at the level of Google, Amazon, JP Morgan or fill in the blank large company but they provide a very good living.

My advice is cast your net WIDE. Try industries that you may not have imagined working for. Especially for those of you who have hard skills in finance, engineering, healthcare, etc. You are always in demand; you just might not work for a Facebook or for Deloitte. But might work for the US Treasury or an energy company.

The percentage of Americans that believe the US Economy is currently in a recession according to a poll by the Harris Poll.

🙃Reality: The economy is in a great place:

Unemployment is at decades low

Inflation has fallen dramatically over the last two years

Income increases are outpacing inflation gains

The Stock Market is at all-time highs

GDP keeps growing

😐Takeaway: Perception is Reality. Our minds are incredibly powerful things. Reality can say one thing, but we can effectively block out all information that counters our beliefs. When we feel we cannot live life the way we want, we tend to look for a way to explain away the situation.

🫨My Takeaway: We are living in the age of misinformation and lack of understanding. There is so much information being thrown in our face daily that it is hard to decipher what is what. Plus, news networks are no longer as helpful because they are driven to produce content that will lead to clicks rather than provide good information.

Take The Guardian Quiz to see how well you know the economy: Share you results in the comments.

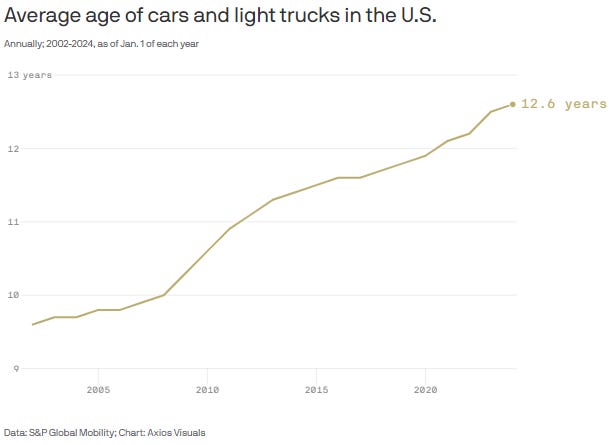

The average age of care in the US, according to data from S&P Global. As much as I yell about people taking on $1000/month car payments. There is a good amount of people who buy and keep their cars for a long time. Thankfully (although your grandpa and uncle might say otherwise) cars today are made much better than ever before. I will caveat that with the fact that these are cars from the 2010s which did not have all the electronics and sensors most modern cars have. It will be interesting to see how well these new vehicles cost overtime with all the various additional sensors in them.

Looking Ahead

Inflation

The Fed's preferred gauge of inflation, the Personal Consumption Expenditures (PCE) will be released on Friday. Unlike Consumer Price Index, which tracks changes in prices. The PCE tracks what consumers are spending on. It also includes personal income data to give a slightly better view on the effect of inflation on individual spending.

Investors are hoping for similar good news as there was for the April CPI. PCE in March was a bit elevated after declining to start of the year. The Fed has been very clear there is unlikely to be any changes with interest rates if inflation remains above their 2% target. In March, PCE was 2.7%. Investors are hoping things will be moving in the desired direction to hasten the Fed towards cutting rates.

Sports I Love

Back in love

Coach still needs to be fired BTW. Honestly EVERYONE NEEDS TO BE FIRED!!

Champs De League Final

Real Madrid do it one more time!