So Much Money - Market Update Oct. 28 - Nov. 1, 2024

Big Tech Companies reported MASSIVE numbers in their Q3 Earnings

This newsletter is 2,906 words a 14-min read.

It's a long one today, y'all know how it goes with Big Tech Earnings Weeks. Plus, it coincided with Labor Report Week.

Hope you enjoy it though

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

The Economy is Doing AMAZING

📈GDP Numbers for Q3

📉PCE Inflation

😕Job Numbers

Big Tech Earnings

😏Google is Still Google

🤑Microsoft is a Fluid Money Machine

🤨Meta Making Money But Spending It All

🤔Amazon The Forgotten Big Tech Company

🍎Apple Good and Boring

Stats of the Week

😱$15.9 Billion spent on The Election

Looking Ahead

🗳️Election

🏦FOMC Meeting

Sports I Love

😓⚽New Coach, Same Result

🦅🏈Back to Winning Ways

Markets

Big Tech earnings brought the volatility back into the markets. However, do not get shaken by the random gyrations of the market. Whenever you get stressed looking at a stock chart. Always remember to ZOOM OUT.

In other news, elections tomorrow…… Glad it will finally be over and done with. So tired of all the spam in my mailbox and these dumb ads! But hope everyone in the US eligible to vote does vote.

Year-To-Date Results

Tale of the Tape

Economy

📈The Economy is Doing AMAZING

If anyone tells you the US economy is in a bad place, they are one of two things:

Lying to you so they can sell you something. Avoid them because that person is a leech.

Ignorant and have no idea what is happening. In which case, avoid them because they are just as dangerous as the leech.

GDP: The Commerce Department released Gross Domestic Product (GDP) on Wednesday. It showed that the US Economy grew by 2.8% in the third quarter.

GDP is how we measure if the economy is growing or contracting. Anything over 2% is a very healthy economy. In Q2, GDP was 3% showing that the US economy is in a very good place right now.

The core growth of GDP can be traced back to you and me. Two-thirds of GDP is made up of consumer spending. If we do not spend, GDP contracts, and mostly people only spend when they feel good about their financial situations generally.

GDP growth was fueled by consumer spending which increased by 3.7%. This is against the backdrop of constant news about how badly consumers (aka citizens) are doing. Yet people are still spending.

Inflation: The Fed's preferred inflation measurement, the Personal Consumption Expenditures (PCE), showed inflation continued its decline. It was 2.1% for September, a 0.2% decrease from August. Right in line with the Fed's 2% inflation target.

Jobs Numbers: Last week, we got numbers on how the labor market has been doing. I expected the labor market to be somewhat hurting but that is not the case at all.

On Wednesday, ADP released the private payroll number. In October, 233,000 jobs were added by private employers.

The highest we have seen in almost 1.5 years.

On Friday, Nonfarm Payrolls showed the US economy only added 12,000 jobs. However, that number is very muddied by the strikes from Boeing and the two Hurricanes in the South.

However, the unemployment rate remained at 4.1%

👍🏾Takeaway: The economy is in a great spot right now. However, as the labor market continues to tighten up, employers are getting emboldened to lay down the law on employees. There have been more firings for seemingly small offenses. If y'all have a job maybe now is not the time to try to "work" from home so you can go to a concert.

Companies

😏Guess Google* is Still Google

By that I mean it is still a money-printing MACHINE!!

Background: Google stock has underperformed the S&P 500 over the last year. While its peers were making new all-time highs, Google has floundered. Due to certain perceived challenges, the company faces:

Dropping the ball on AI and letting OpenAI seemingly run away with it

Multiple antitrust lawsuits aimed at the company that might break it up

TikTok taking up space as a new search engine

Although all those problems are still real; it seems investors forgot how good this company is at generating revenue and turning those revenues into profits and free cash flow.

📈Stock Move After Earnings: The stock rose over 5% after the earnings report was released. Investors were very excited about Cloud revenue and income growth.

🔢By The Numbers: Revenues increased by 15% to $88 Billion. It is just insane that this company is on the precipice of making $100 Billion/Quarter. Only Amazon, Walmart, and Apple do this and with Amazon and Walmart their margins are tiny in comparison to the beast that is Google.

Profits increased by 37% to $26 Billion. This is a new record for Google.

YouTube revenue increased by 14% to $8.9 Billion.

The most important Cloud revenues grew 35% to $11.4 Billion

But Google is still spending heavily to ensure it stays on the bleeding edge of AI. Spent over $13 Billion in Capital expenditure last quarter, a 62% increase. Google plans to spend another $13 Billion this quarter. Unlike in Q2 when investors groaned and sent the stock down, this time they saw those profits from the cloud and sent the stock flying.

💬In Their Words: Google's new Chief Financial Officer, Anat Ashkenazi said on the call, “I plan to build on these efforts but also evaluate where we might be able to accelerate work and where we might need to pivot to free up capital for more attractive opportunities.”

Talk about music to investors' ears. Cutting costs and increasing profits.

😎Takeaway: Yes, there are problems facing Google and they have to figure out a few things with the business. But for right now, this company is still a cash-generating monster, and as the Great Investor Peter Lynch said, "It's very hard to go bankrupt when you don't have any debt."

👀What to Watch: Those threats I mentioned earlier are still very much front of mind for Google. The biggest one is the threat of being broken up by the FTC, which could be the option selected by the judge in the most recent antitrust lawsuit Google lost. This lawsuit could make Google hesitate in going all out against the competition.

But as of right now, it is great to be a Google investor.

🤑Microsoft is a Fluid Money Machine

This company only knows how to do one thing and that is make money. It is such a well-oiled machine. Even though the bar keeps getting raised, this company continues to fly over it.

📉Stock Move After Earnings: Stock went up 2% but later fell more than 5%. Due to the guidance Microsoft provided.

🔢By The Numbers: Revenues increased from last year by 16% to $65 Billion.

Profits increased from last year by 10% to almost $25 Billion.

Of all the Big Tech Companies, Microsoft is the most profitable. It is one of three companies to make more than $85 Billion in Profits per year. The other two are Apple and Berkshire Hathaway. The difference is Microsoft does not do nearly the same amount of in revenue of those two companies.

Azure Cloud which is the new profit driver for the company grew by 33% to $24 Billion.

Like Google Cloud, Azure Cloud is extremely important for Microsoft's Growth and Microsoft somehow has been able to continue growing this beast at an astronomical rate.

However, it is expensive to be this good. Microsoft like Google is investing HEAVILY in Artificial Intelligence. In the last quarter, it spent $20 Billion on capital expenditures and plans to spend about the same in the next quarter. Microsoft is on track to spend over $80 Billion this year alone. Investors did not like hearing that at all. Hence the stock fell after a great report.

🤑Takeaway: Right now, there are no real challenges this company faces. It has positioned itself to benefit from the AI race by partnering with and owning OpenAI. Its cloud infrastructure is much more extensive than one would have thought. Its software business although no longer the growth monster it once was, has allowed it to position itself to be the first ask for most companies with software needs.

👀What To Watch: Like Google, Microsoft also faces Antitrust lawsuits. It might not be able to move as freely as it has in the past.

How much longer can Cloud Growth continue at a 30% clip?

Will the AI investment ever pay dividends or is the investment Microsoft making going to form the groundwork for others to benefit from?

How will its other divisions continue to fair? I did not talk about gaming but that is becoming a major part of Microsoft's plans. Especially with its purchase of Activision Blizzard last year.

Meta Making Money But Spending It All

These companies just cannot be stopped.

📉Stock Move After Earnings: Stock fell 3% after earnings because, like Microsoft, investors were not happy with the continued and increased capital spending on AI and AR.

🔢By The Numbers: Facebook has a marvelous quarter. Revenues increased by 19% to $40 Billion.

Profit increased 35% 😱 to Almost $16 Billion. This shows that Zuck's "Year of Efficiency" is working wonders for the business.

However, that is where the positive news ends. Meta expects to spend almost $40 Billion on capital expenses as it follows the rest of Big Tech in making big leaps in Artificial Intelligence.

Plus, Facebook has continued its investment in Augmented Reality. Showcasing its Orion glasses that were pretty dope last month. However, they have spent over $58 Billion since 2020 on this pursuit and those investments are not slowing down anytime soon.

💬In His Words: Zuck told investors on the call, “Our AI investments continue to require serious infrastructure, and I expect to continue investing significantly there, too.”

😐Takeaway: AI is an arms race, and every big tech company has the money and the desire to be the dominant one in the space. These earnings serve as a siren call to every player in the industry that you better have a $100 Billion war chest, or you will not be able to compete

👀What to Watch: Investors are fed up but not that fed up. Facebook is still generating gobs of cash so it can spend heavily on AI while at the same time buying back shares and paying a dividend. The question investors have is when will we see a return on these massive investments?

Explaining Obscure Financial Terms

Share Buybacks: When a company buys its shares. This reduces the available shares and increases the percentage of ownership of the remaining shares. Which increases the share price.

Dividend: A portion of profit being paid out to shareholders. Companies do this as a sign of goodwill to investors.

🤔Amazon The Forgotten Big Tech Company

Unlike the other Big Tech Companies, Amazon does not have a direct play on Artificial Intelligence, so it has been relegated to the forgotten heap. Which is hard to say cause it has returned 40% this year. However, it is not talked about nearly as much as the other companies. Except when it is firing people or forcing them back into the office. But that does not mean this company is not a money-making machine.

📈Stock Move After Earnings: Stock ripped 6% after the release of earnings because investors were once again reminded of the greatness that is Amazon.

🔢By The Numbers: Revenues increased 19% to $158 Billion. It is just insane to think a company can make so much money in one quarter. Walmart is the only other company that makes more than $100 Billion in a quarter.

Profits increased by more than 50% to $15.3 Billion in the quarter. It is insane that they were able to increase it so much.

Advertising which continues to be a growing part of Amazon's revenue mix increased by 19% to $14 Billion. A key part of the increase in profit margin.

AWS Cloud services grew by only 19% in the quarter to $27 Billion which is much slower than Google and Microsoft, which both grew at 35% and 33% respectively.

But like Microsoft and Google, Amazon is spending big on AI services. Capex doubled from Q3 2023 to $22 Billion. Amazon is on pace to spend $70 Billion on Capex this year.

👀What to Watch: Is Amazon's market share being eaten away by Microsoft and Google? Amazon continues to have a very slow growth rate of Cloud, partly due to it already being the biggest player in the space. Amazon no longer has the category to itself; Google and Microsoft have proved to be very worthy challenges to AWS.

It will be interesting to see how long Amazon can keep its dominance. Microsoft is on the verge of matching Amazon's revenue from Cloud and Google won't be too far behind.

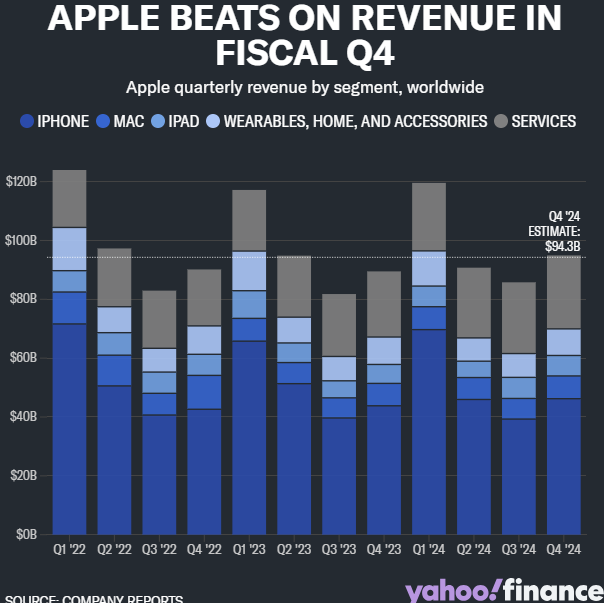

Apple is the old statesman of the group. They are not making any major investments or trying to push the boundaries with AI. The company is focused on sending money back to shareholders.

📉Stock Move After Earnings: Stock fell 2% after the earnings release.

🔢By The Numbers: Revenues grew 6% in the quarter. The weakest of all the Big Tech companies.

Profits were flat from last quarter coming in at $22.96 Billion

iPhone sales, which are the primary sales arm for Apple, increased by only 7%

It was dragged down by slow growth in China which had been a major profit center for Apple

Services which have the highest margin of any Apple product, increased by 10% to $24 Billion for Q3.

The number investors loved the most $29 Billion. The amount Apple spent buying back its stock. Which makes stock prices go higher.

😪Takeaway: Apple is now the old man who is doing the bare minimum. The company is not following the torrent of other big tech companies and spending heavily to go into AI. Unlike its Big Tech peers, Apple has only spent $10 Billion on Capex in the quarter. But has spent more than $105 Billion on share repurchases and dividends. This is a sign of an old company. Apple is more similar to the likes of Coke than to Google, Microsoft, Facebook, or Amazon.

👀What to Watch: Apple is no longer a growth company. It is not a value company. Apple has to show that it is still an innovative company to everyone. Now, Apple tends to do things its way and it might be doing that with AI. But its other tries with the Apple Vision and its failed car project, do not give most of us faith that it can do it.

Stats of the Week

Over $15 Billion has been spent on this Federal Election. The most (of course) in the history of any election. No other industrial country spends even a fraction of what we spend in the US on elections. IT IS INSANE!!

Takeaway: If anyone ever said money does not matter in Politics, just show them this number. Money is in everything freaking thing. In 2004 only 23 Americans donated $1 million, today that number is 408 Americans. 150 Billionaire families have spent $1.9 Billion on these elections. That is a 58% increase from 2020.

How did this happen? One Supreme Court case, Citizens United v Federal Election Commission.

Looking Ahead

Federal Election

Elections are tomorrow! If you have not voted, go vote! But most importantly, BE CIVIL to one another out in these streets. Regardless of who wins this election, I hope we are all in a financial position to be able to ignore the posturing from both parties. Rather we can use our resources for the change we want in our local communities.

FOMC Meeting

On Wednesday and Thursday, Jerome "Papa" Powell takes center stage. He will be announcing the Central Bank's decision on interest rates. The expectation is for there to be no cuts at this meeting.

Company/Earnings

Airbnb* is the only company reporting earnings this week that I care about. I will be listening to what the growth plan is for the company. I have noticed a major slowdown in bookings of my Airbnb, so I wonder if that is a consistent thing across Airbnb. This will be an interesting quarter for Airbnb because Bookings Holding reported last week, and they reported great earnings growth.

👀 What to Watch

Sports I Love

⚽🙃New Coach, Same Result

Man U finally fired Ten Hag, but as I expected, nothing has changed. The team still plays as badly as it did under Ten Hag. Maybe I am being unrealistic. The coach has not even had a training session with the team yet. But I do not think the problem with this team was just the coach. The issues run deep for this organization.

🏈🦅Ravens are BACK

After falling apart against the Browns in the final minutes of that game, the Ravens returned to winning ways against the Broncos. It was a very strong showing by the Ravens, they enforced their will against the Broncos and played the way we are used to them playing.

*I am a tiny shareholder in this company.