This newsletter is 4,044 words a 19-min read

Last week was jam-packed with news as essentially every company that we care about reported earnings. This post is insanely long. I say skip around and read about the companies you care about using the Summary of Topics. Because of the amount of news from last week and this week, I won't be releasing the weekly Money Mentality for the next two Wednesdays. Have a wonderful week. Thank you all so much for reading.

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Company News

🚘Tesla Q1 earnings (Not good)

♾Facebook stellar earnings but investors are not happy

Explaining CapEx

👑Microsoft is King

⚰Google back from the grave

⏰TikTok Countdown until ban

Stats of the Week

🚼3.6 Million new babies in 2023

💰3.2% savings rate in US

☕67% of people are coffee drinkers

📺30 million subscribers

👩🏾💻1 in 5 workers have an NDA

Looking Ahead

↕FOMC Meeting on Interest Rate

📊More Companies report earnings: Apple, Amazon, AMD

Sports I Love

⚽Man U does the Man U

🏀📺NBA TV Rights

🏀NBA playoffs

Extras

👴🏾Empty Nest Coaches

Markets

With so many companies reporting last week, the stock market was all over the place for most of the week. Thankfully your favorite Big Tech companies came out and showed out. They ensured the market closed the week on a high note. This was the best week for the Stock Market since November. This was despite fears that inflation is once again accelerating which means no rate cuts and GDP for Q1 showed slower growth than expected.

Tale of the Tape

Companies

🚘Tesla

Elon Musk must be the greatest salesman of all time because I cannot believe what he just pulled off during the earnings call. Everything for the company is going in the wrong direction. Yet, he got investors to buy into his story.

🔎Details: Revenue and Profits for Tesla fell sharply in the first quarter of this year. However, Elon Musk "promised" investors that Tesla is speeding up the development of cheaper versions of their vehicles.

Gross margins continue to decline as Tesla reduces prices to drive up demand.

Production disruptions in Germany due to arson hampered its ability to meet demand.

High-interest rates continue to suppress demand.

Electric Vehicle demand is down across the board.

🔢By The Numbers: Revenue was $25.17 Billion in the quarter, a decline of 9% from Q1 2023.

Profits were $1.13 Billion in the quarter, a massive decline of 55% from the same quarter last year.

Free Cash Flow declined rapidly in the quarter to a loss of $2.53 Billion.

🔢In Their Words: Tesla told shareholders, "We have updated our future vehicle line-up to accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025."

📉Stock Move After Earnings: After hours the stock shockingly ripped 13%.

Takeaway: What are we in 2nd Grade? I have never seen investors so readily accept a pinky promise about a business. Elon has investors of the Tesla by the balls. Everyone wants to believe in his genius so much that no one is willing to challenge his stance. I can understand why. Every time you have bet against the company, Elon has found a way to pull a rabbit out of a hat repeatedly.

The good news is Tesla has essentially no debt ($25 Billion in cash and $5 Billion in debt). As Peter Lynch says, "It's very hard to go bankrupt when you don't have any debt."

👀What to Watch: Will there be a sub $25,000 Tesla at the end of next year? Can Tesla reaccelerate growth and demand for their cars despite the headwinds of interest rates? Can Tesla compete against hybrids are the general public has less interest in EVs due to infrastructure needs? Can Elon Musk continue selling a dream to investors?

My Takeaway: There are so many questions about Tesla. I will stay away from this stock. There is too much emotion tied into the stock and it is far too hard for me to understand. I love following the story of the company because I love the drama but as of now, I have no interest in owning shares in the company. I have in the past and made a tiny bit of money. But no more.

♾️Facebook, the company that wants to be known as Meta

Facebook dropped earnings on Wednesday evening and for some reason, investors were not pleased.

🔎Details: Just as Meta did when it tried to build the "Metaverse", Zuck is back to his ambitious spending ways. He told investors on the call that Meta will be spending billions of dollars to invest in what is believed to be the next technological revolution, Artificial Intelligence.

Capital expenditures for 2024 will increase to $40 Billion from an estimated $30 billion last quarter.

This is also not a one-time investment, Zuck said he sees these investments continuing for years.

Explaining Obscure Financial Terms

Capital Expenditures aka CapEx are funds used by a company to acquire, upgrade, and maintain physical assets such as property plants, buildings, technology, or equipment. In simple terms, it is an investment a company makes for a future benefit. CapEx is spent from the Free Cash Flow of a business after all other costs are taken care of. It can be anything from:

Replacing/Upgrading a piece of needed equipment in a plant.

Buying a truck to enable faster delivery of goods.

Buying a laptop for workers.

Investing in the metaverse with the hopes that it will become a profitable new business venture.

Pros/Cons: As you would expect, investing can take two routes. Either your investment turns into amazing profits for the business or shareholders are forced to watch money that could have been in their hands sent up in flames.

Investors have a love-hate relation with CapEx spending, especially with companies like Facebook (a mature business)

They have been waiting patiently for years as the business has been growing and funding a lot of the growth with their dollars. They want to finally enjoy the fruits of the business.

If mature businesses continue investing heavily into new "possible" businesses in hopes to continue growing rapidly. Investors are not always happy.

Investors would prefer for mature businesses to return those dollars to shareholders in the form of dividends or share buybacks.

This can be counter to the goals of the company's management team.

There is only so much Free Cash Flow to go around.

🔢By The Numbers: Every financial metric reported was great.

Daily Active Users increased by 7% from last year.

Revenue increased by 37% from last year to $36 Billion.

Profits more than doubled from last year to $12 Billion.

Free Cash Flow Margin increased by 10% from last year.

Essentially Facebook prints cash

It has $58 Billion in cash and only $18 Billion in debt. It could pay its debt with a Free Cash Flow of 2 Quarters.

📉Stock Move After Earnings: Investors were not pleased AT ALL. The stock dropped 19% following the call. Zuck knew the sell-off was coming.

He said during the call, “I think it’s worth calling that out, that we’ve historically seen a lot of volatility in our stock during this phase of our product playbook where we’re investing in scaling a new product but aren’t yet monetizing it,”

💬In Their Words: Zuck said on the earnings call, “Historically, investing to build these new scaled experiences in our apps has been a very good long-term investment for us and for investors who stuck with us and the initial signs are quite positive here too. But building a leading AI will also be a larger undertaking than the other experiences we’ve added to our apps and this is likely going to take several years.”

👀What to Watch: Facebook is giving investors De Ja Vu. In 2021, Zuck said the same thing when he decided the company's new direction was all about the Metaverse. Well, that did not play out as he had hoped, and billions of dollars were essentially lit on fire in his pursuit of a virtual reality. Zuck pushing heavily into Artificial Intelligence is giving investors flashbacks. The question is whether or not Zuch can make this one a reality.

Facebook has a large advantage with the amount of data it has. It is trying to use that advantage to create a dominance in the race to dominate AI.

Unfortunately, it is competing against Microsoft & Google who are just as well capitalized and incentivized to dominate the space.

Takeaway: Will investors learn? We just went through this exact situation in 2022. Meta still has strong cash flows. Yes, it is investing heavily for the future but that makes sense seeing that there is a land grab of opportunity. Investors are being far too shortsighted and too focused on wanting share buybacks and more dividends.

Last time, I watched and predicted that Meta would explode because of their cash flow but chose not to invest for my "principles". This time I will watch and if the stock tumbles to crazy levels as investors get more displeased with the market as a whole, I will be buying heavily into the company (DO NOT COPY ME, heavily for me is not as much money as you might think). There is a huge likelihood I could be wrong but that is the interesting part of playing the game.

👑 Microsoft*, King of Companies

King Mikey is firmly holding control as the #1 company in the world by market capitalization. Never have we seen a company that is this large continue growing at such an impossible rate.

🔢By the Numbers: Microsoft is growing like a company that has been around for a few years not one worth $3 trillion.

Revenues grew 17% from last year to $61 Billion. This is faster than the 12% growth last year

How a two-decade-old company is accelerating growth is mind-boggling

This was mainly driven by Cloud growth which accelerated 31% due to businesses investing in AI.

GitHub (Microsoft acquisition) is beginning to bear fruit for the company as it is powering CoPilot which is an AI coding assistant that everyone says is amazing.

Profits increased by 35% to $21 Billion compared to $18 billion last year

This company is printing money

💬In Their Words: CFO of Microsoft, Amy Hood, said, "Currently, near-term AI demand is a bit higher than our available capacity."

Meaning there is plenty of room to grow and more CapEx investments will be made

CapEx increased by $14 Billion in the quarter and will continue rising for the foreseeable future

📈Stock Move After Earnings: The stock was up 5% after the call and kept rising to close out the week. This was counter to Meta who made a very similar announcement about increased CapEx.

👀What to Watch: Can AI growth continue? There's currently massive excitement with AI but are businesses seeing useful results from buying these services? It'll be interesting to see if Microsoft can continue driving meaningful results from its massive investment in AI.

Cloud is now and forever going to be the backbone of the business. Can Microsoft maintain its dominance in the space? Will Google or Amazon push its position?

Unlike Meta, Microsoft is already showing results for its investments in AI and investors are excited about that. The question is how long will investors be okay with Microsoft spending tens of billions of dollars on CapEx before they start questioning management on the excess spending?

Overall Microsoft is in a great place. Its investment in Cloud Computing is positioning it very well for future profitability. As a shareholder, I'm very excited about the future. Which I owned more of the stock.

⚰Google*, Company You Forgot

For the last few years, Google has been a laggard. It has not performed nearly as well as the other big tech companies. However, that changed last Thursday when they reminded everyone who they were.

🔎Details: After, ChatGPT was released in 2022. Everyone kept saying Google is dead. Then Google repeatedly fumbled the release of its own Generative AI chatbots. However, everyone forgot you don't have to be early to win and that the field is wide open right now. Also, they forgot that Google is still a CASH COW with its ad business that is still growing.

🔢By the Numbers: Every aspect of Google's Business grew. Like Microsoft, we have never seen anything like this. These companies are breaking the eternal models of investing that say Trees don't grow to the sky.

Revenues grew by 15% from last year to $80 Billion

Propelled by a 20% growth in YouTube Revenues and a 29% growth in Cloud Revenues.

Combined these two businesses will be bringing in over $100 Billion by the end of the year

Profits increased by 57% to $24 Billion

INSANE!!

Like Meta this company has no debt essentially

$107 Billion in cash and $13 in debt

💬In Their Words: CEO Sundar Pichai said, "Our leadership in AI research and infrastructure, and our global product footprint, position us well for the next wave of AI innovation."

In Layman's Words: Y'all must have forgotten who we are!!

📈Stock Move After Earnings: Google like Meta announced a dividend and a massive share buyback cause they have too much money sitting. This was very pleasing to investors. The stock dipped 15%.

👀What to Watch: YouTube's continued ability to monetize will be very important for the ad business growth. How can Google better monetize YouTube shorts which is (unfortunately) becoming a bigger attention grabber for the platform?

Can Google maintain its lean headcount as it invests heavily in AI? Will its fear of investor pushback for headcount increase cost it the opportunity to gain key market share in the Cloud business?

Overall things are looking great. As a shareholder, I am very pleased. Google is my second largest single stock holding. It might be the first five-figure holder for me.

⏰TikTok Countdown

The TikTok ban is about to be official.

🔎Details: Last Wednesday, President Biden signed a new bill into law that gives ByteDance about 9 months to either sell TikTok to a US-approved buyer.

After years of the possibility of this happening, it seems TikTok finally ticked off enough law officials to ensure the app disappears.

Reality: The countdown is more like years rather than months. TikTok is not going anywhere without a fight. As CEO Shou Chew said in a video, "Rest assured, we aren't going anywhere."

TikTok is launching every legal challenge that it can launch against the law.

Users of the platform are filing various lawsuits arguing that the forced sale is an infringement of First Amendment rights of Free Speech.

TikTok ain't cheap, this company is worth tens if not hundreds of billions of dollars. There are very few companies or people that can buy the company.

China is also not about to allow their internet darling to be bought by anyone. Because it considers the TikTok algorithm far too precious for anyone to have.

Adding another complexity to the potential sale.

🤷🏾♀️Takeaway: Expect no major changes for a few changes as this makes its way through various courts.

🚩My Biased Takeaway: TikTok in a capitalist society should be able to do business as they please as long as they abide by the rules of the nation, they do business in. This is the true crux of the issue, TikTok has proven that they have not abided by the necessary laws of the US. Especially with its management of its user's data. Then again, the same can be said for any of the various American companies as well.

TikTok is getting swept up in a retaliation move from the US after years of believing China would become American. China does not allow most American businesses in the country unless they abide by very strict rules. Example: Apple regularly has to take apps down to appease the Chinese government. Google, Facebook, Instagram, etc. are not allowed in China so the push is why should TikTok be allowed in the US.

The final straw is the realization that even China does not allow TikTok in its nation. They have a different version of the app.

Then you have the national security threat. As much as we may ignore it, it is real. Information is power and if you can persuade people one way or another, YOU WIN. I'm not saying this is happening, but I am saying every other major power has done exactly this including and especially the United States.

Stats of the Week

According to the CDC, only 3.6 million babies were born in the US last year. I say only because they aren't a good thing. It is the fewest number of births since 1979. The fertility rate in the US is now 1.62, which is below the number you need to keep the population constant. This is the lowest fertility rate since the 1930s when the world was tied up in World Wars. As much as people may say this is good for overpopulation, it's not. You need younger people for productivity an aging population is not good for any economy.

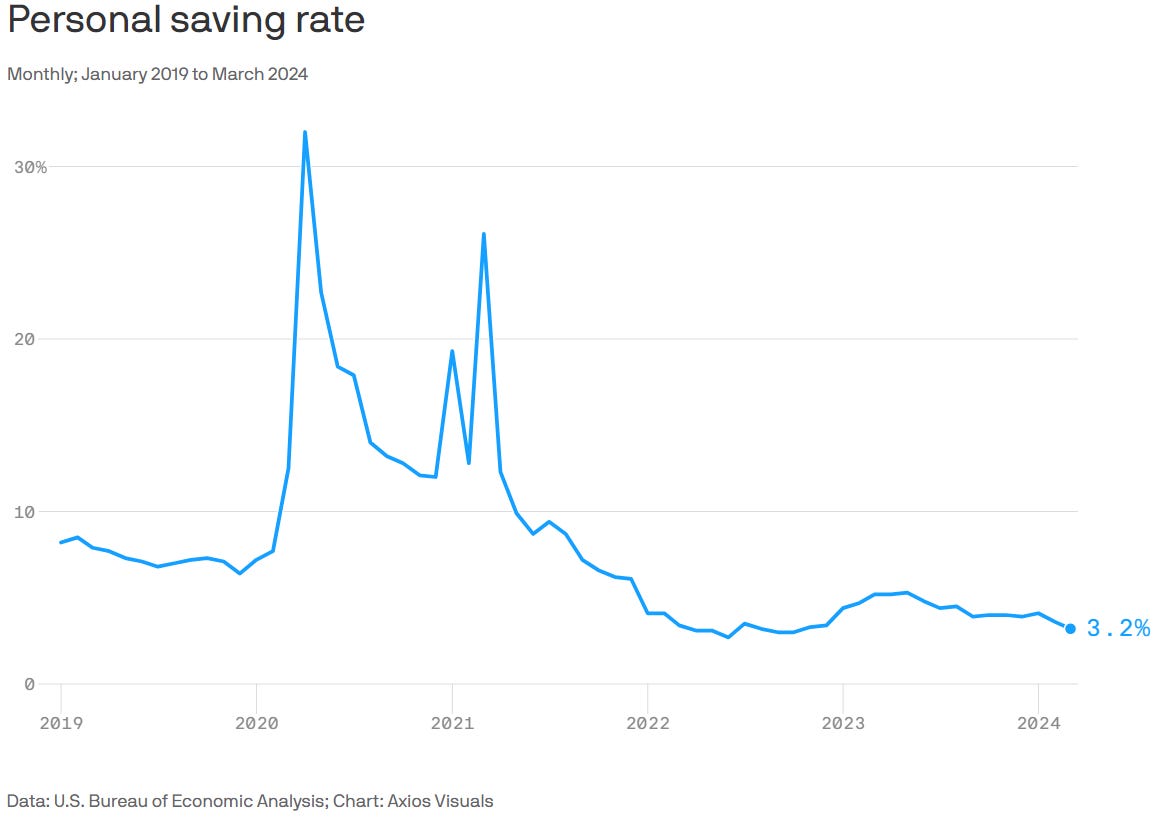

💰3.2%

According to the US Bureau of Economic Analysis, the US savings rate continues to decline as we choose to spend a greater share of our income. In February, the savings rate was 3.6% but in March was 3.2%. In dollar terms, personal saving was $671 billion in March, compared to $739 billion in February.

Combined with this, we are taking on much more debt to fund our lives. USBEA pointed out an increase in interest payment spending, eating out, and recreational activities aka fun.

US Consumers will choose to spend over saving every time.

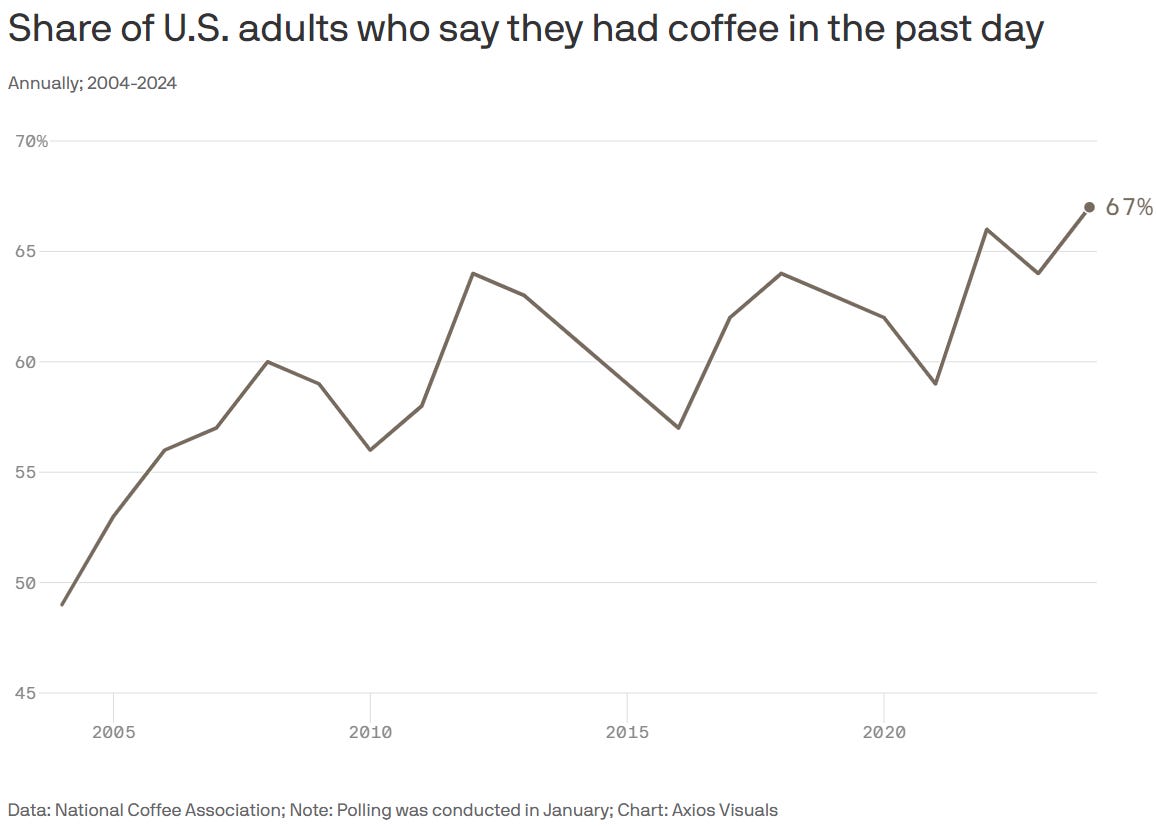

The percentage of people in the US that drink coffee today, according to the National Coffee Association (can't believe this is a real organization). This is a 20-year high and growing.

Three Questions for y'all: I hate coffee and don't understand people who drink it. So help me understand all you crazy people.

Why do you like coffee?

How do you drink your coffee?

What kind of coffee do you drink?

If you drink Frappuccino or any of these liquid ice cream in a cup. I'm judging your "love" for coffee. That's just a sugar addiction.

According to Antenna (a subscription research firm), 30 million subscribers canceled three or more subscriptions in the last two years. However, a third resubscribed in about 6 months but then canceled shortly afterward. Folks are getting wise in the way they subscribe to services.

Rather than always having an ongoing subscription, people are choosing to switch between a plethora of services. Only subscribing when there is a show good enough for their attention and then setting Calendar reminders to cancel before they are charged for another month.

Netflix seems to be the only streamer that has evaded the trend but even they have noticed a similar trend.

👩🏾🏭👩🏾💻1 in 5 Workers

According to the Federal Trade Commission (FTC), 1 in 5 workers in the United States are affected in some way by a noncompete contract. Ironically, it is not the C-Suite executives that you would expect to have these. Most noncompete contracts are for low-wage workers and those in healthcare.

The FTC voted last week to ban noncompete contracts for essentially all workers across the United States. The FTC expects this rule will increase business formation by 2.7% which will result in 8,500 new businesses created every year. FTC also estimates that there will be an increase in wages because businesses have to be more competitive to keep workers within the industry.

Takeaway: This is wonderful news for workers everywhere. Even if you do not directly have a noncompete contract, your company might have one with other organizations in its industry to ensure workers cannot jump ship for better opportunities within the same industry.

Unfortunately, it will be years before this law is fully instituted (if it is instituted). It will face a barrage of legal hurdles as corporations do not like the rule AT ALL.

Looking Ahead

Economy

On Tuesday and Wednesday, The Federal Reserve will meet to determine what to do with interest rates. It is expected that the Feds will leave rates unchanged. Investors will be listening to Jerome’s press conference on Wednesday afternoon for a signal of what to expect for future rates decision.

👀 What to Watch: I believe Papa Powell will continue banging on the same drum of “paying attention to the data”. The economy is in a pretty good place there is no reason for the Fed to cut interest rates.

Company/Earnings

Continuation of a heavy earnings season. More Heavy Hitters will be releasing earnings this week:

Amazon will be releasing earnings on Tuesday evening. With Microsoft and Google showing explosive cloud earnings, the expectation is for AWS to have similar results.

Apple will be releasing earnings on Thursday evening. Apple is facing a lot of headwinds as sales have slowed down dramatically in China, which accounts for about 20% of total sales. Investors will listen for details of what will come next for the fruit giant.

👀 What to Watch: Berkshire Hathaway will host its annual shareholders’ meeting on Saturday. This will be the first meeting since the passing of Charlie Munger.

Other Companies Reporting

Sports I Love

Nothing New Here

Man U is like that girl who is always around you, always laughing at your jokes (even the trash ones), always touching you. However, the moment you say you like her and ask her out. She goes, "What gave you the idea that she might like you." 😮💨

The point is United is a TEASE. Every time you think oh they might win this game. They give the game away!

NBA Playoffs

Playoffs are going strong and the Nuggets are showing why they are the defending World Champions. Jokic is proving HE IS THAT DUDE!

Bucks are sucking without Giannis dominating the paint. They likely lose the series against the Pacers. They have struggled all year with defense and that remains the case. Doc Rivers was brought in for playoffs and so far, I see no usefulness from him. Hoping I'm wrong but it's not looking like it.

As many have been predicting for years, tech companies are making a bigger claim on sporting rights. Amazon and YouTube have already taken stakes in the NFL TV rights from DirecTV and FOX. Now they want the NBA.

YouTubeTV already has a deal with the NBA as a sponsor but they want a more direct relationship with the leagues. On Friday, Amazon revealed they had a deal with the NBA to be one of the main streaming hubs for NBA games starting in 2025.

Extras

Yeah, it's a thing. Apparently, as parents are far more involved in their children's lives, there is a huge emotional toll when they start leaving home. To help families deal with their new lives not centered on a tiny human, a new type of life coach has entered the picture, the "Empty Nest" Coach.

Feels like we have life coaches for everything. I have no qualms with it. We need coaching to go through things we have never experienced. However, it does show just how individualized our culture is.

The more we are siloed unto ourselves, the more we have to pay to cope with life events that were done in community with others. I fall into the same traps, I love my individuality and not having to need or depend on others. However, I have a need that can only be fulfilled by other people. We are not made to be self-sufficient. We are made to be dependent. I hate that feeling of being needy, but I believe the earlier I accept it. The earlier I will live a much fuller life.

I implore everyone to be needy. Freedom is found in vulnerability. Just know who to be needy and vulnerable with.

*I am a tiny shareholder in this company.