This newsletter is 1,741 words an 8-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

📉Inflation stabilizing

Company News

🏦Big Money Making Banks

Stats of the Week

🪀$1 Trillion Trade Surplus

👻18-22% of Job Postings are Not Real

🤑$2 Billion in unpaid interest

🫴🏾$500 Million Raised in less than 6 months

🏠7.09% Mortgage Rate

Looking Ahead

Heavy Earnings Week

Sports I Love

💔Hope Destroyers

😭Ravens Fumble The Win

Extras

🤢Our Greed is Too Much

Markets

The irony of today is not lost on me. We celebrate a great hero of American history. A man who put the needs of others above his own. A man who stood for something greater than his well-being and managed to galvanize not just his generation but countless generations after him to rethink how we view one another. A man who stood for unity and a better future for everyone. Of course, I am talking about Rev. Martin Luther King Jr., a man who spoke truth to power and compelled the world to listen, alongside a generation of people who recognized that the only way to change the world was through sacrifice for the greater good.

Today, however, we also inaugurate a new president who represents the antithesis of these ideals. A man who has repeatedly shown that the only person who matters to him is himself. A man willing to do anything as long as it is for his benefit, regardless of the harm caused to others in the aftermath of his decisions. He fosters division instead of encouraging us to see each other as human.

Okay, enough philosophy. Back to the news of the market. The market had a great week following the release of December’s CPI numbers (more on this below).

Returns

Tale of the Tape

Economy

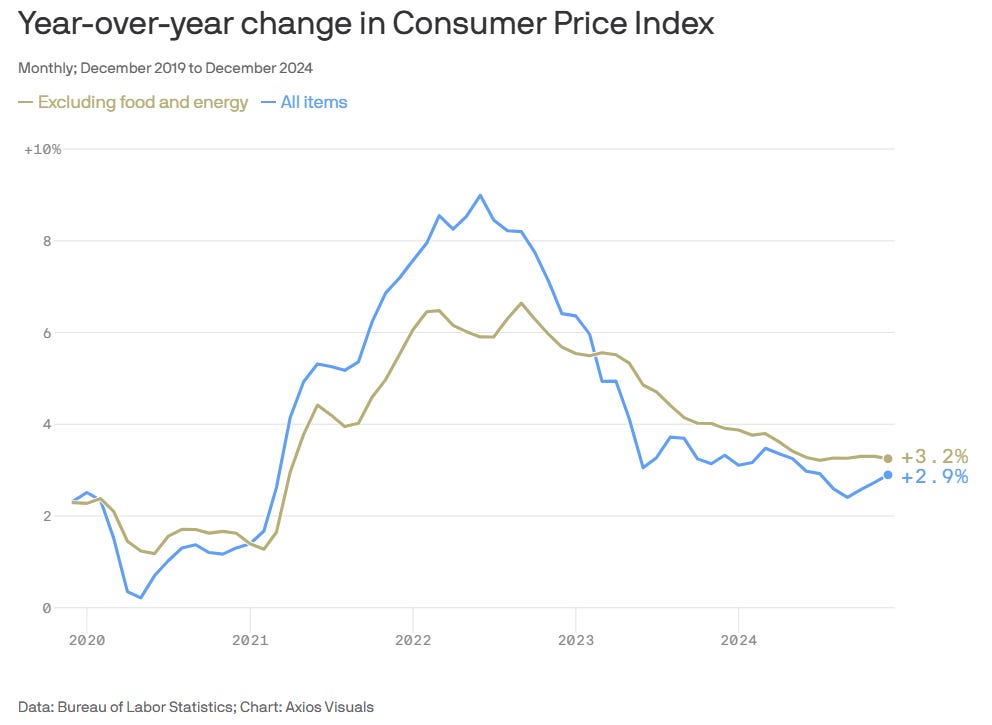

Good news for your pocket. Prices have generally stopped going up. CPI (Consumer Price Index) for December was 2.9%

🔎Details: CPI rose 0.4% from November. Energy was the driver of the increase; it accounted for 40% of the increase in December. Gas prices increased 4.4%.

However, Core CPI which removes food and energy prices, was 3.2% dropping from November's 3.3%.

Rising Month-Over-Month by only 0.2%.

🔢By The Numbers: Shelter prices which had been the key drivers of inflation for the last two years; are finally abating. It rose only by 0.3% month-over-month and 4.6% from a year ago. This was the smallest increase since January 2022. Other interesting numbers:

Food prices have continued to decline.

Month-Over-Month increase was 0.3% in December compared to 0.5% in November.

Food inflation is no longer a problem. However, prices will never go back to what you remember in 2018 or 2019.

Except for eggs which increased 3.2% accounting for most of the monthly price increase. This is because there is currently bird flu causing farmers to kill a ton of chickens. So, we can expect those prices to come back shortly. In November eggs increased 8.2%. We are on track.

Clothes prices increased by 0.1% month over month. But it is interesting the difference between men and women.

Women's shoes increased by 1.1% from November to December.

Men's shoes decreased by 3.2% from November to December.

💬In Their Words: Sung Won Sohn, a professor at Loyola Marymount University and chief economist at SS Economics, “The inflation rate is currently grappling with a ‘last mile’ problem, where progress in reducing price pressures has slowed. Key drivers of inflation, including gas, food, vehicles, and shelter, remain persistent challenges. However, there are signs of hope that long-term inflationary pressures may continue to ease, aided by moderating trends in critical sectors such as shelter and labor costs.”

Takeaway: After the report, the stock market breathed a sigh of relief. There had been fears that the Fed might be incentivized to raise rates with any sign of faster-than-preferred inflation. Plus, there is a sense that the Fed might want to pre-empt actions of the new Trump administration's plans for tariffs and mass deportations.

My Takeaway: Unless there are major missteps from the new administration. I believe this is the year of Disinflation. This means prices will not go back to what we knew in the past but it will no longer increase. Prices will hold steady.

Companies

🏦Big Banks Make Big Money

2024 was a great year for the Big Banks and they finished the year out with a BANG!

Takeaway: The economy is doing great. Each bank spoke to the strength of the consumer with increased spending with the use of debt. They also spoke to companies' willingness to make decisions on large investments, boosting their profits with dealmaking. However, some uncertainties lie ahead that could change all of that.

📈Stock Move After Earnings: JPMorgan rose after reporting earnings. Wells Fargo and Citigroup rose 6 after reporting earnings. Goldman Sachs rose 5% after earnings

🔢By The Numbers: JPMorgan reported revenue growth of 10% in Q4 to $43.74 Billion. Profits grew 50% to $14 Billion.

Goldman Sach reported revenue growth of 23% to $13.87 Billion. Profits doubled from the previous year to $4.1 Billion.

Wells Fargo reported $20 Billion in revenue, but profits grew 47% to $5.1 Billion.

Citibank reported a revenue increase of 12% to $19.58 Billion. Profits grew 40% from the previous year.

👀What to Watch: There is a lot of optimism about the new administration coming into office. The expectation is for even more dealmaking to take place in this year boosting bank profits by a higher rate. However, every bank CEO cautioned about the uncertainties that lie ahead such as:

Unknown regulatory environment

Unknown trade policies (read tariffs)

Unknown tax policies

Unknown energy direction

High geopolitical tensions could ignite a new world war.

Overall, things are great for the banks but change very quickly.

Stats of the Week

If it feels like everything you see or buy seems to have a "Made in China" tag on it. That is because it is made in China. Expose from China in December rose by 10.7%, growing China's trade surplus to $1 trillion.

According to hiring platform Greenhouse, 18-22% of job postings in 2024 were ghost job postings. This means companies never intended to fill those positions. Companies post these jobs to appear to be still growing.

Capital One was sued on Tuesday by the Consumer Financial Protection Bureau (CFPB) for cheating customers out of $2 Billion in interest payments from late 2019 to mid-2024.

How: Capital One offered two savings accounts to customers: 360 Savings and 360 Performance Savings. According to the CFPB lawsuit, Capital One marketed both accounts as providing the best savings rates. However, in reality, the 360 Performance Savings account paid, at times, up to 14 times more in interest.

In Their Words: The CFPB director Rohit Chopra said, “The CFPB is suing Capital One for cheating families out of billions of dollars on their savings accounts. Banks should not be baiting people with promises they can’t live up to.”

Capital One denied all claims and said, "We strongly disagree with their claims and will vigorously defend ourselves in court."

Takeaway: The CFPB is trying to get a ton done before the less CFPB-friendly Trump Administration takes over next week. At the end of December, CFPB also sued Zelle, and all the big banks associated with it for allowing fraud to take place on the platform.

According to a Trump adviser, the Trump campaign is on pace to raise over $500 million by summer. It is an insane amount of money for someone who cannot run again.

💬In Their Words: A Trump adviser told Axios, "It used to be $1 million was a big number. Now we're looking at some folks giving like $10 [million] or $20 million."

Takeaway: The money is coming from a variety of institutions from various industries. However, people from the crypto industry have given the most. They are hoping they can get Trump to finally legitimize the whole industry by making it a part of the US Federal Reserve. But all other industries are in on the action as well from

My Takeaway: As a Nigerian, this is no different from all the politicians that run that country. These are just a fancier form of bribes. Welcome to the world of Kleptocracy.

Mortgage rates continue going in the opposite direction of what home buyers would like. Rates have increased this month to 7.09%, an eight-month high.

Looking Ahead

All About Earnings

👀What To Watch

Netflix reports tomorrow evening. Netflix has been enjoying a period of complete domination in the streaming world. The key question will be how its entry into Live TV with the Christmas NFL games and WWE Raw on Monday nights has benefitted the company’s subscriber growth.

Sports I Love

Hope Destroyer

Man U is like the song "Hot n Cold" by Katy Perry. In one game, they look like world-beaters. In the next game, they look like bottom feeders.

In one week, they went from having a great comeback on the back of one of their youngest players; to looking like they forgot how to play the beautiful game.

I do not understand it at all. At times, they seem to be really changing their ways, but then that seems more like a mirage than reality. Then again, it might just be me. I am a thirsty fanboy in the middle of a desert who is looking for signs of water, aka life, in this team.

This team is a Hope Destroyer.

😭Ravens Fumble The Win

The game was right there. The Ravens had the chance to walk away with the victory. Although they were down for the entire game, they still had a chance to win it at the end. But they just were not ready for primetime. Mistake after mistake, drop after drop, fumble after fumble. The Ravens could have won but they just could not make the final play.

Extras

California is on fire and people are losing all they own but that doesn't stop our greed. Landlords in California are in some cases doubling rent prices to take advantage of the desperation of those looking for places to stay during this difficult time.

Not only is this immoral, it is also very illegal.

*I am a tiny shareholder in this company.