The King Has Returned - Market Update June 10-14 2024

Apple reminded the World why it is the most valuable product ever created.

This newsletter is 1,715 words an 8-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

Inflation is cooling down

Company News

A.I. - Apple Intelligence

New Companies Added to S&P 500

Stats of the Week

26% increase in cost of home ownership

Looking Ahead

Stock Market Closed on Wednesday

Retail Sales Data

Sports I Love

Euros 2024

Copa America 2024

Markets

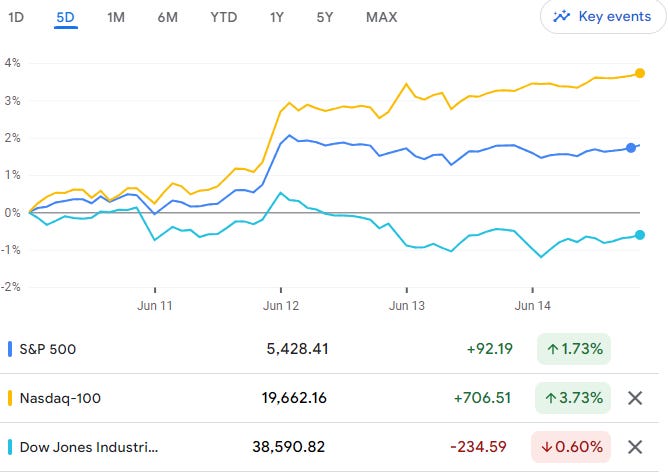

The Stock Market hitting new highs is becoming rather obnoxious. The market has zero chill, it is blazing to new all time highs basically every week. To be honest, I'm torn on how to feel about it. On one hand, my money is growing. On the other hand, I'm paying more and more to buy into the market. As an investing nerd, I want discounts so future me can get an even better return especially for single stocks. I wanna buy a ton today at a discount and enjoy the massive reward in the future. 😮💨😞😔

The only saving grace for me interest rates are high enough that my opportunity fund for buying single stocks is also growing. Would rather be buying stocks though! 🙄😞😮💨😒

Tale of the Tape

Economy

Unlike me in my car this summer after my AC went out 🥲😭, inflation is cooling down.

🔎Details: On Wednesday morning CPI was released. To the joy of consumers everywhere, it showed inflation stayed flat from in May. Although not declining, it also means prices are not rising.

Year over Year prices grew 3.3% versus 3.5% in April

Core CPI which excludes food and energy prices because of their wild swings, stayed flat year over year at 3.3%

Month over Month prices only increased by 0.2% lowest since 2021

🗨️In Their Words: Papa Powell told reporters on Wednesday after CPI release, "We’ll need to see more good data to bolster our confidence that inflation is moving sustainably toward 2%.”

Layman's Words: Y'all ain't listening. Inflation ain't 2% until that happens I ain't cutting rates!

😶🌫️Takeaway: Soft landing has been activated. The economy is still going strong and inflation is receding. It's everything the Federal Reserve could have dreamed of when they began increasing interest rates back in 2022. Yes, things are far more expensive than they were in 2020. About 20% more expensive but prices are no longer growing rapidly. Economist and Investors are beginning to position for the Fed to cut rates in September of this year.

My Takeaway: I see no reason why the Feds should cut rates. Yes, I would love for interest rates to come down for those buying a house. But the typical reason to cut interest rates is to spur on the economy. Right now the economy is in a good place.

Also, there is a second order effect most people don't think about with cutting rates. If rates are cut and people feel good about spending again and more importantly using debt to spend. Inflation will pick up again. So be mindful of what you ask for.

Your inflation rate is definitely different from the average of the nation. I love looking through the Inflation Chart to see what my personal inflation rate is like. Biggest factor me is Food, Restaurant, Gas, Energy, Car repairs, Electricity, and Airfare. My Inflation rate is 2.9% (it's a very crude calculation).

What's Yours?

Companies

Apple* did the most Apple thing. Take an existing technology rebrand it then sell it back to everyone as a brand-new technology.

🔍Details: Apple hosted its Worldwide Developer Conference last week. As expected, they finally announced their take on AI. The announcement was about as exciting as the Celtics playoff run. It was all very predictable. Here are a few of the announcements:

Siri might finally be useful with integration of Large Language Models

"AI" powered features for the Photos, Messaging, Notes, and Email

Genmojis (yeah, I have no idea either)

You can place app icons anywhere on the screen of the phone and customize app icons. Only took a decade for Apple to catch up

The iPhone finally has RCS Messaging which means iOS devices can send videos and photos to Android devices without issues

HALLELUJAH!!! (I no longer have to switch to an iPhone. Sorry Wifey)

Minor updates to WatchOS, VisionOS, and iPadOS.

📈Stock Move After Earnings: Apple stock fell 2% after the announcement. I believe this to be an overreaction because Apple said the AI features will be available only on its latest iPhones for free (unlike Samsung and Google) which will be a driver to sell more devices.

It was because the next day it exploded on Tuesday 7%

Then another 6% on Wednesday

Apple is again the largest company in the world

🔢By The Numbers: Apple's market cap increased by $312 Billion in two days. That increase was worth more than the value of OpenAI ($80 Billion), Elon Musk's xAI ($24 Billion), Amazon invested Anthropic ($18 Billion), and all other AI startups combined.

📢Takeaway: There was only one announcement made that mattered. Apple will be integrating ChatGPT natively unto the iPhone. This is essentially Apple admitting that it cannot keep up with the advancements that other companies are making with AI.

Historically Apple has had a "we will not be the first, but we will be the best" approach to any new tool or feature that was discovered or developed. With AI, that has essentially been a death sentence for the company. Unlike tools of the past where the creators can choose how and when to improve upon it. AI builds on itself. It is like OpenAI and Google have the Starman in Mario Kart and are running laps around Apple.

However, Apple has one thing none of the other AI companies have. TRUST! Apple's drive to be known as the Privacy company will be a tailwind in the new world of AI. Plus, with Apple's ability to take innovations to their fullest and most times best expressions. Simply put, they made AI useful to everyone not just the tech and media geeks. WWDC displayed that in an almost boring manner that will manner for more people than how OpenAI or Google have had splash announcements.

If it sounds as if I am talking out of both sides of my mouth. Trust your instincts. Wifey celebrate! Guess I am still open to possibly switching.

👀What to Watch: Satya Nadella, CEO of Microsoft, is an unbelievable mastermind. He has somehow managed to infiltrate the high walled garden of Apple. AND he did not have to pay a dime like Google to become the default search engine on iPhones (at least as far as we know).

Satya is the Smiling Conqueror. He has positioned Microsoft to be the company that everyone wants to work with. He has also found ways to ensure Microsoft benefits from any advancement from any company in AI either by pseudo-acquisition (Inflection AI) or by skillful purchase agreements (OpenAI). While at the same time avoiding the scrutiny of the FTC.

👑My Takeaway: THE KING HAS RETURNED!

CrowdStrike, GoDaddy, and KKR (a private equity firm) joined the S&P 500 index on Friday.

🔍Details: The S&P 500 is the default index used to represent all the United States stock market. Being added to the exclusive list is a big deal for any company, even though on the surface it may seem like it. However, not every large company is eligible to be in the index. There are three main criteria for companies to be added to the index:

Must be a US-based company

Must be profitable for a minimum of 4 consecutive quarters

Must be worth at least $12.7 Billion

Must have at least 50% of its shares available for trading

An example of a well-known company that is not on the index is Dell. The company is worth $93 Billion but could not qualify because of a rule that said companies with multiple share classes were not allowed in the index. That rule was recently removed, and Dell will probably be added soon.

📈Stock Move After Announcement: CrowdStrike rose 7% on the news, GoDaddy rose 2%, and KKR rose 12%.

📉Downside: If companies are being added it also means companies are being removed in order to keep the 500 total number intact (there is actually 505 companies but that is because Google, Facebook, and Berkshire Hathaway have multiple class shares listed). Rober Half, Comerica, and Illumina will be removed.

Stats of the Week

🏚️26%

According to a Bankrate study, the average costs of owning and maintaining a home increased by 26%. These are all the hidden costs that no one talks about when it comes to buying a home. It includes property taxes, insurance, maintenance costs, utility bills, and internet bills.

Bankrate found that the average homeowner pays $18,118 a year to afford a home. It was $14,428 in 2020.

Takeaway: Homeownership is like an iceberg. There is way more under the surface than what you can see. It costs a hell of a lot more than you think. Before you decide to buy a house, run a rent v buy calculations. I like the one from New York Times.

Looking Ahead

Juneteeth Closes Markets

Sports I Love

Almost the end of sports season for me. 🥹😭

NBA Finals

NBA Finals are almost over. This has been probably the most boring Finals I have ever watched. I cannot believe just how bad the Mavs were in the first 3 games. I believe Jaylen Brown will win the Finals MVP. He has been the best player on the court for the Celtics throughout the playoffs.

Euros 2024 began on Thursday.

Honestly, it is hard to care as I care about none of the countries in it. France are my favorites to win. Germany is looking good and so are Portugal and Spain. I have no hope in England.

COPA America 2024

Copa America kicks off on Thursday here in Atlanta. My favorites is Brazil mainly because I like Vini Jr.

*I am a tiny shareholder in this company.