This newsletter is words a min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

❄Inflation Cooled off in April

💻Major Shortage in AI

Company News

Nvidia Larger Than Apple?

Stats of the Week

2.95 Million Travelers per day during Memorial Weekend

$16 Trillion in Economic Growth Lost

7.7% decline in house sales

75% of All New Amex Cards Opened by Gen-Z

Looking Ahead

Jobs Jobs Jobs

Dollar Tree Earnings

Sports I Love

HALA MADRID!

Boston Celtics vs Dallas Mavericks

Extras

File Your Taxes for Free Next Year

Markets

Despite a terrible last two weeks for the Stock Market, May has been a wonderful month for your portfolio. The S&P 500 finished the month up 5%, the Nasdaq finished up 7%, and Granddaddy Dow ended the month up 2%. Will the good times continue for the rest of the year? I have no idea, but I know I will be here for the entire ride.

YTD Returns

Tale of the Tape

Economy

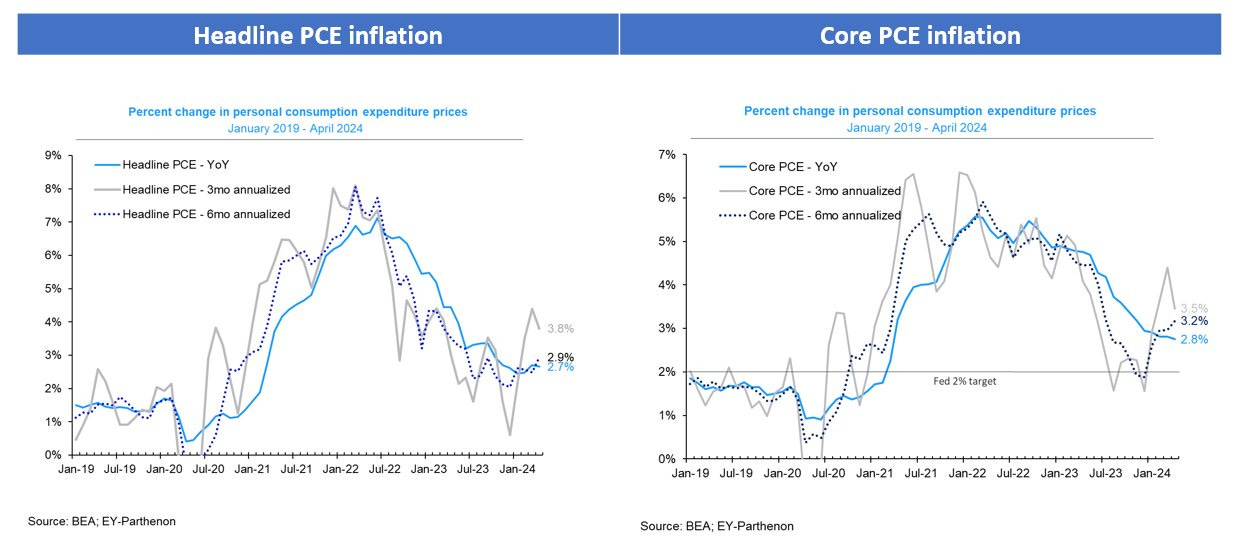

What you are hearing is a collective sound of release from investors and the Fed after PCE inflation showed that inflation continued cooling in April.

🔎Details: The Personal Consumption Expenditure Price Index (PCE) is the Federal Reserve's preferred measurement of inflation. It showed inflation slowed down in April with prices increasing by only 0.2% versus 0.3% in March. Although it feels like we are splitting hairs, every tiny bit matters for investors in the hopes of the Fed cutting rates anytime soon.

Year-over-year, PCE increased by only 3.5% much lower than the 4.4% it was in March.

😓The Bad News: Consumers are not doing well. The PCE gives a direct look into how consumers are spending their money and it shows consumers are not.

Spending dropped by 0.1% in April, and in March spending increased by 0.4%.

Consumers are pulling back rapidly as they feel more and more impacted by the increased rate environment.

The savings rate continued to deteriorate. Falling to an all-time low of 3.6%.

🫵🏾My Takeaway: The law of economics is holding. Supply and Demand is everything. Inflation is falling because WE, the consumers, are choosing not to buy. We have finally said ENOUGH IS ENOUGH. Up until this point, people were willing to spend their dollars on anything and everything. It seems reality is finally hitting most people in the face.

Multiple retailers from Walmart to Target to Amazon have announced price reductions for the rest of the year to woo back consumers.

Intriguing Chart

Inflation cooling but my pockets still HURT!

A little-known discussion around the prominence of AI is all the shortages the industry faces from normal things. Top AI companies are running into a shortfall much sooner and faster than expected.

🔎Details: Old-fashioned limitations are keeping the future fashioned technology at bay. Electricity, Computer Chips, Data, Talent, and Computing Power are in far more shortage than you would expect.

Generative AI Data Centers require much more energy than the typical storage data center because of the amount of cooling needed for the chips being used

Tech companies are running out of available Data to train their AI models to become more human-like

There are not many engineers who understand Artificial Intelligence which limits the number of people who can be hired to immediately be useful to companies

🤑Takeaway: This means it will take Manhattan Project-level investment (what the atomic bomb project was called) to build out the necessary resources for AI to keep growing. There are a handful of companies that can make these investments. This means there will be less competition in the space. The winner takes most economy is in full effect. Big Tech Companies are becoming nation-states. Investments that only governments could make are becoming table stakes for some of these businesses.

👨🏾⚖️My Takeaway: However, the government can use this opportunity to build out the economy to solve systemic problems it has allowed to fester for so long.

It can create training programs that will help folks get new types of jobs.

It can provide funds for small start-ups to enable competition and also create an ecosystem for innovation outside of large tech companies.

It can ensure easier immigration policies so more talented people come to the US and spend in the US.

It can reduce the cost of education so more students go for higher learning programs to be a part of the new economy.

It can pass laws to protect the public from the greed of man

We are still early enough in the AI growth cycle to be able to implement a lot of these things. However, the government moves very slowly. It is unlikely anything will change until there are bigger problems. From an investing point of view, this shows there are more than one way to make money from the AI hype cycle.

Companies

🤨🧐Nvidia Larger Than Apple

In the last week, Nvidia has added the market cap of Costco and Disney Combined to its market cap. It is now larger than Google, Amazon, and Facebook. If it keeps flying, it will be larger than Microsoft and Apple. Like what?

👀What to Watch: We have seen this movie before. It is called Cisco from the 90s. Yes, I am calling this a bubble. If you bought Cisco stock at the height of the tech hype, you are still down more than 20%. Nvidia's valuation is beginning to include almost impossible expectations for this company to grow to be larger than Microsoft, Google, Apple, Meta, and Amazon combined.

However, the problem with a bubble is it can go for much longer than you think as John Maynard Keynes once said, "Markets can remain irrational longer than you can remain solvent."

I am not touching this stock with a 10-mile stick. I will neither buy nor bet against it. Congratulations to all those who are making and have made a ton of money from this company. I envy you.

Stats of the Week

The number of people that were screened at airports on the Friday (May 24) before Memorial Day. It is the busiest travel day since the TSA was founded in 2001. Seems travel has become the default for most people today. The 10 busiest days of travel have all been over the last 2 years. The pandemic changed the way we view life.

😒😮💨Irony: As we spend more and more on travel, Americans still report feeling worried about their financial position. I don't get it but then again like I wrote in my last Money Mentality post, What We Say is NOT What We DO!

It is expected for Thanksgiving to be even busier.

👴🏾🧑🏾🦳$16 Trillion

According to a study by the Black Economic Alliance Foundation, addressing many of the issues that cause economic inequality for a Black person in the United States could lead to an economic boom worth $1 Trillion. The study comes at a time when every DEI initiative that was started in 2020 following the murder of George Floyd and Amad Arbury, is being attacked and canceled.

According to the study, $16 trillion has been lost from the US Economy over the last 20 years due to these inequities. This means that US GDP last year could have been $43 Trillion rather than the $27 Trillion it was.

🏘️7.7%

What is supposed to be the busiest time for home sales has turned into the worst home sale season in 4 years. According to the US Pending Home Sales Index, Home Sales declined by 8% last month and show a trend to continue declining. As mortgage rates remain above 7%, fewer people are inclined to make purchases.

However, unlike most things, home sales are a hyper-localized feature of the economy. Some pockets are experiencing sales growth but on a general scale, no one wants to buy a house. I hope to see home prices falling as demand falls and also just more houses being built. The best housing market right now is Austin, Texas because they are building A TON of new housing there. This is helping push down prices and cause more sales to happen.

💳75%

According to the Wall Street Journal, 75% of all new American Express credit cards opened last year were opened by Gen Z. With the $695 card being the most common card amongst the new card holders.

Like I said, WE OUTSIDE!

Looking Ahead

Jobs Week

With the end of another month means refreshing economic data. Starting with the nonfarm jobs payroll that will be released on Friday. 175,000 jobs were added in April and unemployment remained below 4%.

👀What to Watch: The Federal Reserve will be meeting next week, a weakening labor market might force the Fed to reconsider its stance on no rate cuts. However, I highly doubt that will happen unless the job report is exceptionally bad which is VERY UNLIKELY to be the case.

Company/Earnings

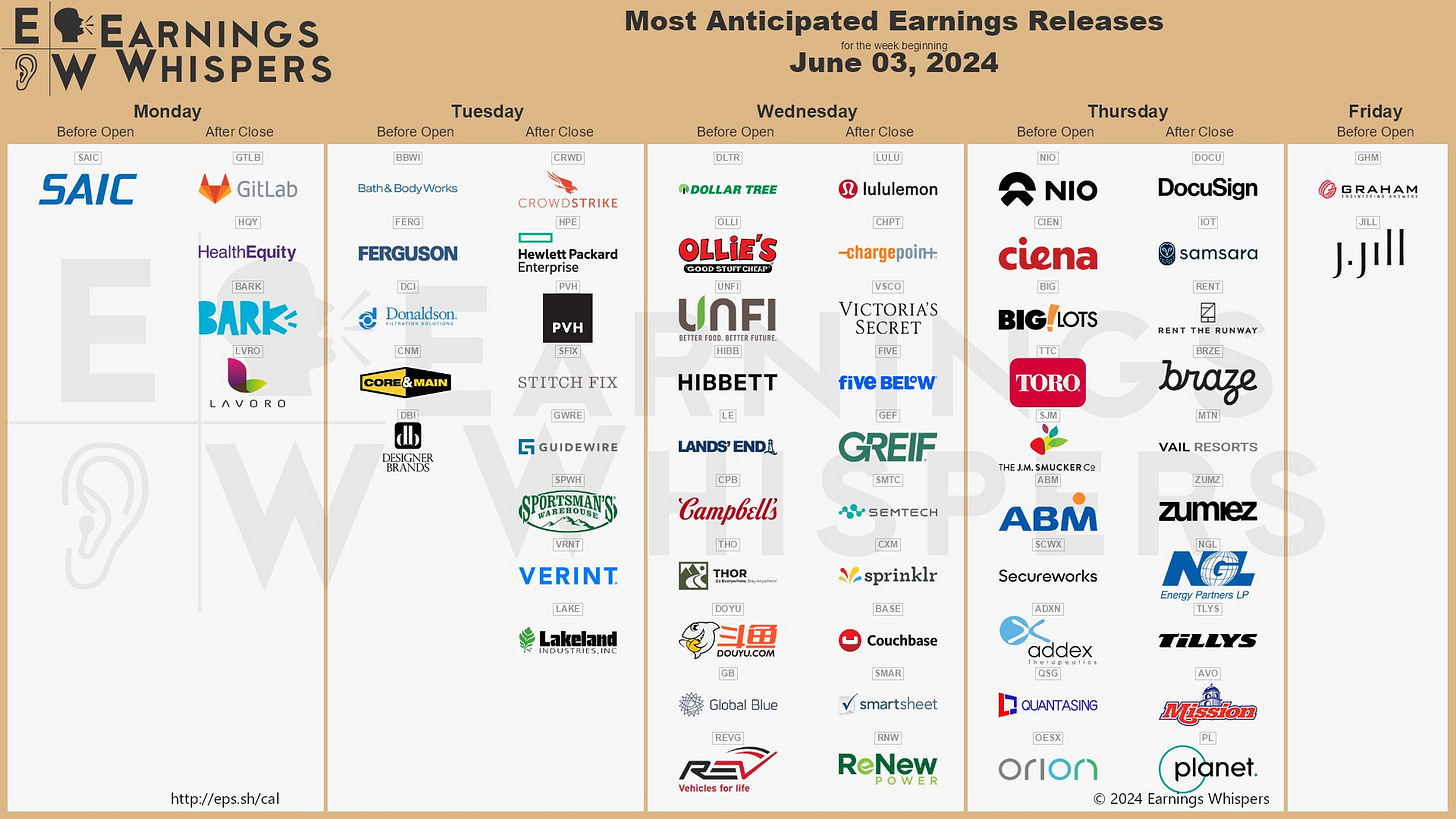

Dollar Tree

I typically don't care about The Tree of Dollars but with other retailers announcing price cuts. It'll be interesting to see if Dollar Tree is benefiting from consumers cutting back on spending.

👀 What to Watch: Dollar Tree has struggled over the last year as consumers have been willing to spend on “premium” products. If revenues are growing it means there is a substantial shift in consumer spending.

Lululemon will also be reporting earnings, it will be nice to compare their sales figures with other retailers that have reported such as GAP & Abercrombie. Lulu is a high-end retailer compared to those two.

Sports I Love

HALA MADRID!!

Dortmund did their best, but Madrid is Madrid! Once they got into the flow of the game it was OVER!!

Extras

To the dismay of TurboTax, H&R Block, and Tax preparers around the US, the IRS announced on Thursday that its Direct File free online tax filing program is here to stay. Except this time, it will be open to all 50 states and Washinton D.C.

140,000 people were able to participate in its limited launch earlier this year, it is estimated that it saved those individuals $5.6 million in tax preparation fees. This is according to the IRS.

In Their Words: Taxpayers Protection Alliance spokesperson Kara Zupkus said in a statement, "[Direct File will] radically increase the IRS's authority and scope [and] have devastating consequences. This is a solution in search of a problem ... The only result here will be more delays and less money in the pocketbooks of hard-working Americans."

What She Means: YOU MESSING WITH MY MONEY!!