Usually, markets are compared to two animals:

Bears because when a bear attacks it claws downwards

Bulls because bulls use their horns and attack upwards

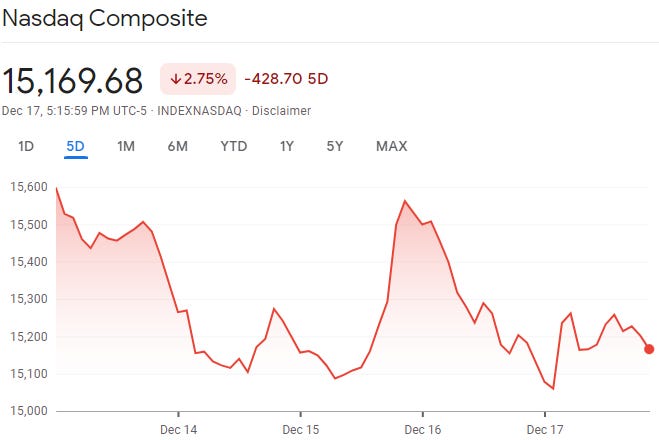

But the recent market has been neither of those. It has been more like a Kangaroo (I did not come up with this). The thing has been moving all over the place.

Last week was a great example of a Kangaroo market:

The market started the week in a downtrend. As there was uncertainty around tapering and tightening by Papa Powell and the Fed.

On Wednesday, Papa Powell does his press conference announces faster tapering and possible rate hikes in 2022. Markets RALLY HARD to close out Wednesday. Essentially wiping out all the losses of Monday and Tuesday.

Then Thursday and Friday, the markets digested the news and went down again.

This is why we do not make decisions based on how the market is moving. The market IS NOT always right. The market will overreact or underreact to whatever the pressing news of the day is. As I said in my podcast (Rambling Mind subscribe); as investors, we are future looking the things happening right now mean nothing when we have a 10, 20, 30, 40-year horizon with our investing. We focus on owning good businesses, paying attention to how the business is operating. For my index investors, we focus on owning a piece of the World Economy or the US Economy. As long as we are optimistic about what the future holds then there is nothing to worry about. Now if you are retiring that is a different situation.

If you are a person picking single stocks, we use the irrationality of the market to our advantage to buy Wonderful Businesses at Attractive Prices. The noise of the market should mean absolutely nothing to you when looking at the business. A great business should be able to withstand interest rate changes, inflation, government, etc.

But with all of that being said, from an economic outlook. The short term matters A LOT for our daily lives. The decisions by the Fed affect the dollars in our pockets. So we pay attention!

Tale of The Tape

The Fed announced last week, they will increase the speed of tapering because the economy is in a good place and inflation is getting a little too hot. From their policy statement:

Meaning tapering which was supposed to end in June of 2022 will end in March of 2022. This will give the Fed room to make adjustments with interest rates for the rest of 2022 to ensure they have control over inflation.

Meanwhile in Turkey, President Erdogan is showing an interesting way of dealing with inflation that goes against every basic idea of Economics we know. Inflation in Turkey hit 21% in November and the lira, the Turkish currency, has lost 40% of its value against the dollar in the last three months. What was the reaction from the president (who unlike the US has control over the central bank), he decided to cut interest rates by 50%. It will be interesting to see how this plays out. It is the perfect experiment to see if you can actually fight inflation by making money easier to access. My prediction: Things are gonna be very bad in Turkey, but what do I know.

Looking Ahead

My vacation begins.

Meaning lots of LAZYING about my Mom’s house. I am very much looking forward to it.

The market will also be having a bit of a break as it will be closed in observance of Christmas on Friday. But before then we will get Personal Consumption Expenditure (PCE). This is another version of inflation. This is the version of inflation that the Federal Reserve bases its policy decisions on.

Very short earnings week as no one wants to be anywhere near a work computer this week. However, Nike will be reporting earnings. As one of the largest manufacturers in the world, we can get a feel for supply chains and how they are adjusting to meet customer needs. It is expected that they will report a decline in revenue due to Covid-19 spikes in Vietnam and Indonesia.

Are Theaters Still A Thing?

The biggest thing to watch for is Spiderman: No Way Home numbers. It is expected that this movie should top the current pandemic weekend champion which is Venom: Let There be Carnage. Which brought in $90 million on its opener. Spiderman is expected to do close to $200 million. If the hype is anything to go on, it should easily smash through that number. However, covid cases are once again rising. Will people be willing to risk it and go see the movie? This will be a test for the survival of theaters.

Early Monday Morning Update: Spiderman: No Way Home brought in $253 million on its opening weekend. Becoming the third highest grossing movie EVER behind Avengers: Infinity War and Avengers: End Game.

Totally Unnecessary Man U Update

No update cause Man U caught the COVID! All games are postponed until Monday. So I guess we get another moral victory week.

Thank you for reading

I hope you all have A WONDERFUL week. This will be the last newsletter update for 2021 (unless I get restless). Thank you all so much for the support and for joining the Rambling Mind. It has been fun coming up with concepts and writing every single week. Here is to an even better 2022.

While I may not be writing, I have content that will be going out on various platforms. So Go subscribe to Rambling Mind Podcast for mid-week stock market updates. You can also catch me on TikTok, Instagram, and YouTube every day.

If you enjoyed the post, SHARE IT with one person you hate; one person you love, and one person you have no real strong feelings about.

If you hate this newsletter, please tell me why.

Either way for those who love or hate this newsletter. Please give me feedback on what you would like for me to cover or things to make it better.

Remember GENEROSITY > greed

God bless Each and Everyone of y’all

MERRY CHRISTMAS!

SEE Y’ALL in 2022!

✌🏾

-Kelechi