Work, Work, Work - Market Update June 3-7, 2024

Great News for the Labor Market Means Bad News For My Raise

This newsletter is 2,227 words an 11 min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

Weird Job Market: Data giving conflicting messages

Cash is KING thanks to higher rates

Company News

Stock Exchange in Texas?

Stats of the Week

$0 House Down Payment

Hottest 12 Months in History of History

Spotify raises prices

200 Years to Make same as your CEO’s salaries

Looking Ahead

Inflation & The Fed

Apple AI

Sports I Love

NBA TV Deal

Extras

Twitter = NSFW

Virtual Job

Markets

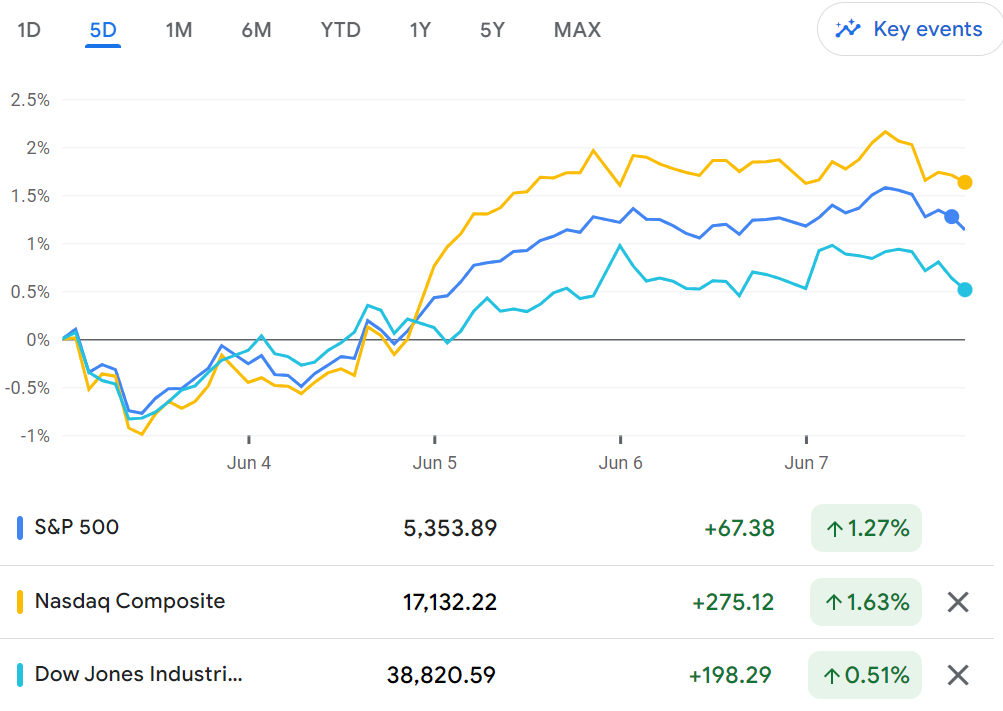

The economy is weird but the stock market keeps going up and hitting new all time highs. 🤷🏾♀️I don’t understand it either and I am starting to get pissed about it. As a young investor with decades to invest, I need cheap stock prices while I am building my wealth. Stocks can go up in 20 years when I need to sell down my portfolio to pay for life.

Tale of the Tape

Economy

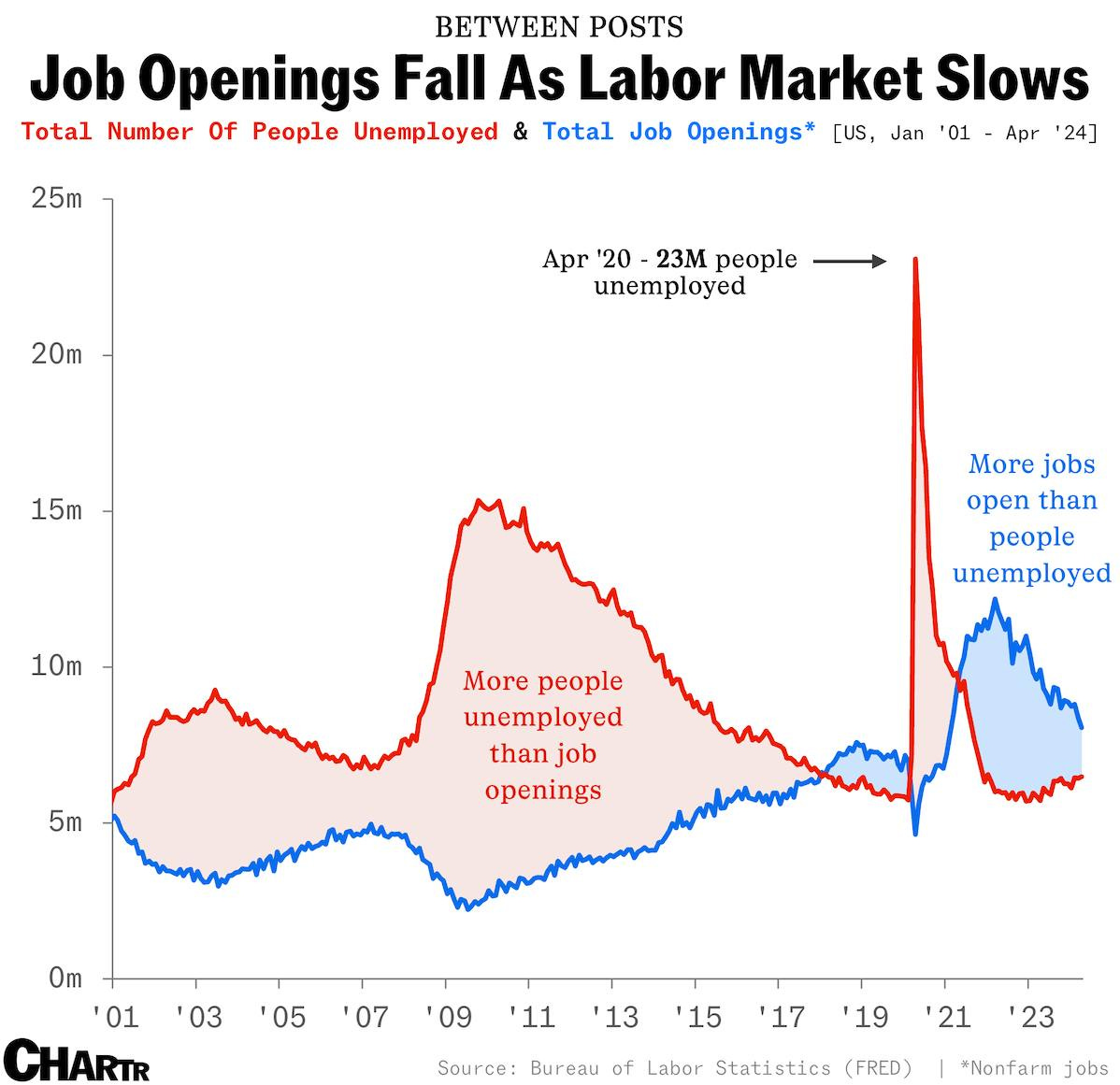

Jobs Market Coming Back to Earth

After about 2 years of a crazy hot job market, things are returning to a normal point. Great news for inflation, horrible news for me pushing my boss to give me another raise 😔😞

🔢By The Numbers: In April for every unemployed American, there were 1.24 Job Openings according to the JOLTS Survey from the Bureau of Labor Statistics.

This is the same level it was in October 2019. After reaching as high as 2 in early March 2022. It was much easier at that point to push for higher wages and job hop or hold multiple jobs.

ADP reported 152,000 jobs were added in May much lower than the expected 175,000 jobs.

Big slowdown from the 188,000 jobs added in April.

Manufacturing saw the biggest slowdown in jobs with 20,000 less jobs than last month.

💬In Their Words: ADP chief economist Nela Richardson had the perfect words on the state of the Job Market, "The labor market is solid, but we're monitoring notable pockets of weakness tied to both producers and consumers." She added, "When I talk to employers, their narrative has changed since last year. They are focused on productivity and getting the most out of their workforce, rather than recruiting the workforce they need for later."

🤔Weird Data: The nonfarm payrolls reported 272,000 far above the ADP jobs number and above the estimated 175,000 jobs expected by economists. At the same time unemployment increased above 4% breaking the historic streak of 27 months of unemployment below 4%. So what gives?

It's the way the data is captured. The nonfarm payroll is comprised of two surveys. One for businesses and one for households.

As we all know, people cannot be completely trusted with answering surveys properly. Also, these surveys are done on the phone and how many people still answer the phone.

These can cause irregularities in the data for nonfarm payrolls results. This is why these results are revised one month after.

April's payroll was revised down by 10,000 jobs.

📈Takeaway: The hot payrolls numbers makes it incredibly unlikely you see rate cuts this year by the Federal Reserve. However, the tighter labor market helps the Fed with helping right inflation as wages will be compressed.

My Takeaway: Economics is weird and beautiful. You can use data to paint a picture in basically anyway you want. However, it can also help you understand more of why things feel so weird around you.

Generally good financial practice says if you can get free money with almost no risk, you take that free money and run. That's what plenty of companies are doing

🔍Details: With interest rates remaining high, individuals and businesses are forgoing more risky investments and settling on earning free money by letting their money make more money for them.

The Federal Reserve has decided to leave rates above 5% which has propelled short term government bonds, Treasury bills, Money Market Accounts, and Savings Account to provide a very healthy risk-free return on excess cash.

💵Takeaway: Typically, it's advised to never have too much cash on hand because it's not doing anything for you and inflation is eating away at your spending power. However it's the opposite in the environment we are in and companies are double downing on the ability to earn so much free cash.

🤑My Takeaway: The Rich get RICHER! For those who are in a position to have excess cash this environment is a boon for them. They basically have to do nothing and their massive cash pile gets even larger without taking an investment risk. For everyone else, this environment SUCKS because it means you need to take out debt to fund anything and that adds crazy pressure to your life.

Cash in bad times provides security and protection. In good times, it provides flexibility and options. Never forget CASH IS KING! It should always be the first thing you get situated. Both having an emergency fund and an opportunity fund!

Companies

A new start up that is backed by BlackRock (the largest asset management firm) & Citadel (the world's largest electronic trading firm) wants to create a new stock exchange in Texas to compete with the Nasdaq and New York Stock Exchange.

🔎Details: The Texas Stock Exchange (TXSE) has raised about $120 million from various firms including BlackRock and Citadel. The CEO James Lee told the Wall Street Journal that they plan to register with the SEC as a viable exchange for trading and begin facilitating trades next year. He hopes to have its first company listed on the exchange by 2026.

⏲Background: Stock Exchanges facilitate the ability for us to buy and sell stocks. These are where companies make their shares publicly available.

There have been multiple exchanges in the history of the United States. However, most were either bought or went out of business.

Boston Stock Exchange, Chicago Stock Exchange, and Philadelphia Stock Exchange are now owned by either NYSE or Nasdaq.

Currently there are two other exchanges in the US: IEX and Cboe Global Markets but they have never been able to fully break up the duopoly between Nasdaq and NYSE.

Like with most things size matters, the bigger you are the easier it is to attract more businesses to be on your exchange.

Exchanges make their money based on trading volumes.

🔃What Changed?: Recently there has been a shift of businesses moving away from New York towards the south. Many companies have moved their headquarters out of New York to Florida and Texas because of its more business friendly environment. This opens up room possibly for a new player to disrupt the established giants. Texas recently formed a new Texas Business Court to challenge the Delaware Court of Chancery, which 90% of companies in the US are incorporated in.

TXSE also wants to use the current political climate to its advantage to lure potential clients away from the Big Apple. BlackRock and Citadel want more competition to pay the exchanges less than they have.

Takeaway: It is more telling that this company has only raised $120 million to form its exchange. Although, that is a lot of money it is much less than what is needed to start an exchange that will rival the size of NYSE or Nasdaq. Even with massive backers like BlackRock and Citadel, who regularly invest in new exchanges in hopes of disrupting the duopoly. It will be near impossible to disrupt an established process. Especially when you are not offering anything new or different. From the report all they seem to be offering is VIBES. That does not sell for financial products with high levels of regulation.

Some companies are fed up with the regulations of the New York and want to move to a friendlier CEO environment.

Stats of the Week

United Wholesale Mortgage, one of the largest home lenders in the US, is offering a zero-down mortgage. Meaning you do not have to pay the typically 3-20% down payment to buy a house. The way it works is you take out a typical mortgage for 97% of the home value and then you take on a second mortgage for the remaining 3%. To quality you must be making 80% of the median income of your area.

With the housing market out of the reach of most people due to high interest rates and even higher home prices, lenders are looking for ways to get people buying. Even if it means putting buyers in a very risky position.

Takeaway: If it sounds too good to be true, trust your instincts. The catch with the second mortgage is that it has to be paid back in one payment. Also, if you refinanced or sold the house, you must immediately pay that loan first. This turns a potential blessing into a curse if anything should happen and you need to move or get out of the house for any reason.

My Takeaway: This smells like NINJA loans of 2008. It may not be exactly the same but it basically is trying to find a way to target people who are already on the lower end of the wage spectrum. I DO NOT LIKE IT!

My advice for anyone who is tempted by these loans' is DON'T. The downside risk does not make up for the upside potential of home ownership.

May 2024 was the hottest May in the history of history. It continued the trend of the last 12 months of record setting heat. Which means it's no longer an outlier but just how we live now. Expect the world to get hotter as the day progresses.

🎧🎶$11.99

Spotify is raising prices next month to $11.99 for an individual plan, $16.99 for its duo plan and $19.99 for its family plan, up $1, $2 and $3, respectively. Last year they increased prices in July. Before you start screaming that you are canceling your subscription, YOU WON'T. Spotify has you buy the balls. It has the lowest subscriber churn of any subscription service at 2%. So please save your breath.

The irony is even with all the price increases Spotify still isn't profitable because most of the money it makes gets paid out to music publishers and to Google and Apple.

The number of years the median employee would have to work to make what the same as the CEO of his or her company made in one year. The irony is their pay is increasing much faster than inflation. The average CEO had a raise in 2023 of 12.6% versus the average working getting a raise of 4%.

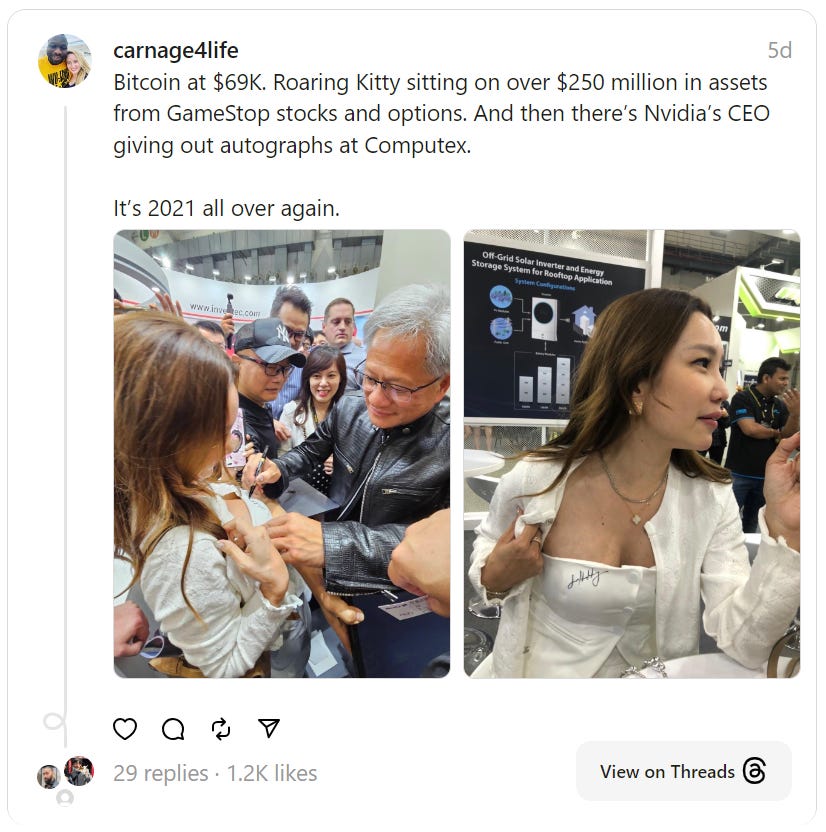

Nvidia is third company in the world to cross $3 trillion market cap. It is now worth more than Apple and likely to be worth more than Microsoft soon.

INSANE

Looking Ahead

Inflation & The Fed

It's gonna be quite a double whammy this week.

Before Papa Powell and his Fed Buddies announce interest rates on Wednesday, inflation data for the month of May will be released. That combined with the nonfarm payrolls of last week will drive everything Jerome says during his press conference.

Apple AI

Apple will be hosting its WWDC this week. It is expected for Apple to finally reveal it's version of an AI to the public. There has been rumors of Apple working with both Google and OpenAI this year. This wo

👀 What to Watch: Maybe after next week Siri will no longer SUCK. Unlikely but a man can dream. I'm not even an iPhone user.

Sports I Love

As the finals begins for the NBA, it took the opportunity to announce it's new mega TV deal with Amazon, ESPN, and NBC. The deal is worth $76 Billion, almost 3x it's previous TV deal. The intrigue with the deal is that the NBA is has seen declining viewership for the last three years but somehow was still able to command an insane premium. This shows the power of sports rights to streaming and TV companies.

👀What to Watch: The NFL is probably kicking itself for getting only $100 Billion for it's 2023 TV deal which looked really good at the time. However, it appears to have left at least $50-$100 Billion on the table. It's very likely that the NFL will try to find a way to get out of it's current deal earlier to negotiate a better package.

Extras

Twitter or X will now allow NSFW content on the platform. Which it was already allowing on the site. I advise anyone who has kids to treat twitter as a porn site.

I do not mean a remote job but an actual job where you work in virtual reality. Ikea is hiring employees to work within the stores in the virtual reality world of Roblox. You would do all the things a real-life Ikea worker would do. Stocking shelves, serving meatballs, and answering customer question.

*I am a tiny shareholder in this company.