This newsletter is 1,817 words, a 9-min read

Reply to this email with your thoughts about any of the topics discussed. I love hearing back from readers and will include those in a new section of the newsletter.

Welcome back to the Rambling Mind Newsletter. This is your Market Update.

Summary of Topics:

Economic News

😕😖Rate Cut Expected, Future of US Economy Unclear

Stats of the Week

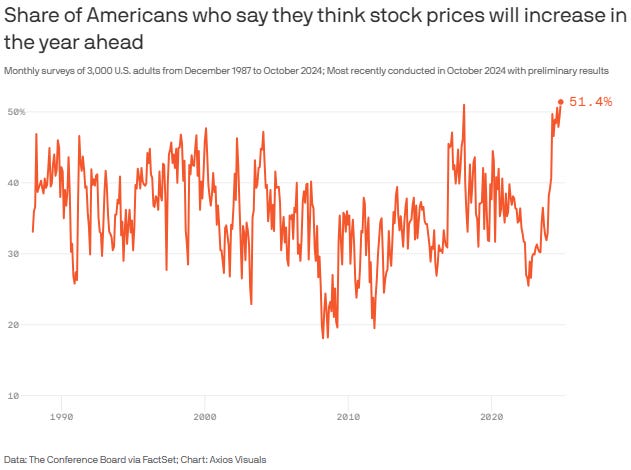

🐂51.4% Bullish on Stocks

🎁$1,778 on Gifts

🏫$2,480 Cost of a College

🧔🏾♂️👩🏾🦱38 Years Old New Age of First-Time Home Buyers

Looking Ahead

🎈New conversation on Inflation

🪄Disney Earnings

Sports I Love

🦅Ravens Survive

⚽Real Madrid Sink & Rise

😲Man U Surprise - They won a game

Extras

Intel Out, Nvidia In - Dow Jones Index Update

Markets

I am not happy with the election results. As many of you know, I am not a fan of Donald Trump and do not believe he is fit to be president. However, he won, and now he is our president. It pains me to refer to him as such, but that is the reality. The only consolation is that the stock market had a relief rally to finish the week. While I am not thrilled that the market is excited about another Trump presidency, it makes sense. During his first term, Trump focused on less regulation and lower taxes for businesses and the wealthy. Investors are expecting more of the same.

Investors should be careful what they wish for. If Trump follows through on his promises, we can expect a lot of uncertainty ahead. This is due to the types of people he appoints to major positions such as the Federal Trade Commission (FTC) Chair, Federal Reserve Chair, Securities and Exchange Commission (SEC) Chair, Federal Communications Commission (FCC) Chair, Consumer Financial Protection Bureau (CFPB) Chair, Environmental Protection Agency (EPA) head, and many others.

Each of these government agencies plays a significant role in our daily lives and the public markets.

During Trump’s last term, the CFPB was essentially neutered, becoming very business-friendly while consumers were often disadvantaged. The current CFPB has many rules set to be enacted, such as restrictions on companies using your data as they please. However, with a Trump presidency, these rules are likely dead on arrival. Even recent FTC rules aimed at making it easier to cancel subscriptions may never be implemented.

Ultimately, the only thing we can do with any elected official is pray and manage our personal finances. So, I will continue to invest passively, maintain an emergency fund, stay out of debt, and find ways to increase my income.

Tale of the Tape

Economy

Rate Cut Expected, Future Unclear

Election Results changed the vibe of the meeting.

🔍Details: The Fed cut rates on by 0.25%. This was well expected from economists leading into the meeting. However, after the elections there were bigger questions being asked. Most questions surrounded how Jerome expects to deal with the second Trump presidency.

First being around Trump's desire to have a say over monetary policy. In the first Trump presidency, Jerome was a constant target of Trump's rage. Trump regularly called Powell a bigger enemy to the US than Xi Jinping, blaming him for anything that went wrong or off script.

Trump stated during his campaigns that the president should be able to have a say in what the Federal Reserve Chair does.

Not a great idea, see Turkey, Argentina, Cuba etc. for countries where the "President" had a say over monetary policy.

Second questions surrounded Trump's stated plans for tariffs on everything as his "economic plan".

This plan would be heavily inflationary. According to the National Retail Federation, if Trump imposed these tariffs, it would cost US consumers $46-$78 Billion/year.

🗨️In His Words: Jerome responded to questions like any of us would, "We don't know what the timing and substance of any policy changes will be. We therefore don't know what the effects on the economy would be. We don't guess. We don't speculate. And we don't assume."

Kelechi's Interpretation: Bruh, I don't know. That ish just happened yesterday! The heck you expect me to say.

Jerome was also asked if he would step down if Trump asked him to. His response is one that we all need to learn to embrace more often, “NO.”

Takeaway: No one knows what the next four years hold. All we can do is wait and see how things play out.

Stats of the Week

According to a recent survey of 3,000 by Conference Board, 51% of Americans are bullish on stocks for the next year. This is the highest reading in the survey's history (first ever was in 1987).

⚠️Takeaway: Remember the wise words of Buffett, "Be fearful when others are greedy." This does not mean you should pull out all your investments. Rather be mindful of the investments you make.

I will continue investing passively into my 401(k) and IRA but I will be much more cautious in buying any stocks. I'm gonna prep my cash for a potential big buy.

According to Deloitte, the average shopper will spend $1,778 in December. Between gifts, decor, and travel the costs of the holiday is HIGH.

Takeaway: Check out The Joint Account for all the hidden costs of Holiday Season.

The net cost of tuition and fees for an in-state freshman attending a public four-year university next year will be $2,480! That is down from $4,140 in 2014/15. This is according to research done by College Board.

College is BECOMING CHEAPER?

Now that price does factor in grants students can get and does not include living expenses etc. However, it is great news to see that colleges are being forced to lower prices as less people are applying to go to college.

But even with all the excitement, don't get it twisted. College is still too damn expensive when everything else is factored into the cost. I just want to highlight progress being made forcefully on these universities.

The media age of first-time homebuyers is 38 Years Old, according to a report from the National Association of Realtors. It is the highest age of a first-time buyer in history of the US. Last year, it was 35 years old. The ability to purchase a house is becoming something only those with years in the labor market can afford to do.

According to the NAR report, first time buyers are 24% of the market. The lowest ever recorded.

Looking Ahead

Reprieve Week

This week is gonna be very low on economic news but there are two key indicators to watch for: inflation and retail sales.

Consumer Price Index aka CPI aka Inflation Number will be released on Wednesday. Once the key data point that stopped us in our track, is now a footnote event. From all signs, inflation has dissipated from its high levels of 2023 and has normalized.

👀 What to Watch: Rather than discussing the numbers, there will be discussion about what the new Trump era policy could reignite inflation in the near future.

Retail Sales Data will be released on Friday by the Census Bureau. Despite the fear of higher prices driving consumers away, repeatedly consumers have shown a resiliency and a willingness to spend through it all.

👀 What to Watch: Holiday season approaches. There is an expectation for retail sales to be stronger than it has been recently as people front loaded the holiday shopping season.

Earnings

Not much to see here. More than 90% of companies in the S&P 500 have reported earnings. The most interesting companies set to report this week are Disney*, Spotify, Shopify, and Home Depot.

Disney is in a very interesting spot. The stock has been beaten down by investors in the last two years. Bob Iger returned to turn the ship around for a second time. So, the drama is real in this business.

Questions Disney faces: Are subscribers growing or shrinking?

Netflix continues to report higher levels of subscriptions. Is Disney able to do the same? Even HBO Max is growing after months of stagnancy.

How have the parks business rebounded after a slowish summer period?

What is the timeline to expect a successor to Iger?

Sports I Love

🏈Ravens Survive Against The Bengals

Ravens somehow snatched victory from the jaws of defeat against the Bengals last Thursday. The Bengals in my opinion should have won that game. The Ravens were very sloppy and could do nothing against Joe Burrow and Ja'Marr Chase. Burrow had over 400 yards passing and 4 touchdowns and Chase had over 250 yards receiving and 3 touchdowns. It was insane just how insync those two players were.

But somehow Lamar and the Ravens survived because of two timely mistakes by the Bengals and one lucky break for the Ravens. There are two ways I can view this win:

The way every media person will view it. Ravens just find ways to win football games. They have the mentality to do whatever it takes to win.

The Ravens are lucky!

I tend to lean to the second viewpoint. You cannot keep getting away with these lucky breaks and expect to get those same breaks when things get REAL in the playoffs. We have seen that the last two years. Maybe this year will be different, but the Defense has to be world's better. The offense has to be more clinical with the ball.

However, things are looking great for the Ravens so far.

⚽Real Madrid

This year is not looking great for Madrid.

They lost to AC Milan during mid-week champions league match. And it was a BAD LOSS! They never looked like they had a chance during the game. Then one of their best defender's Éder Militão, suffered a torn ACL. This is the second in two years. Needless to say, things look bleak for Los Blancos.

But on the weekend, they seemed to right the ship somewhat on Saturday. They laid the smackdown on Osasuna. It was pretty tense early in the game, but they quickly settled into the game and won easily.

😲Man U Surprise

I forgot that Man U actually has the ability to play well and win games. I would like to say this could be a sign of things to come. Unfortunately, my heart is too damaged to have anything positive to say about this team.

Extras

The Grandpa Index, The Dow Jones, added Nvidia to the Index and removed Intel. Out with the Old, In with the New. Kinda did it late though.

Also, Sherwin Williams replaced Dow, Inc.

*I am a tiny shareholder in this company.